Zcash Rallies After Latest Relisting Announcement From Major Exchange

VanEck’s Jan van Eck argues that the rotation to Zcash reflects growing demand for privacy features that Bitcoin does not provide.

Zcash, the privacy-focused cryptocurrency, surged more than 12% to trade near $600 on Sunday after OKX announced it would relist the token.

The rally makes ZEC the top-performing asset among major cryptocurrencies in the last 24 hours, significantly outpacing Bitcoin, which has struggled to reclaim the $90,000 level.

Wall Street Divided on Zcash Impact on Bitcoin

On November 23, OKX announced that spot trading for the ZEC/USDT pair would resume at 12:00 UTC tomorrow.

OKX 将上线 ZEC (Zcash) 现货交易,现已开放充币,开盘时间11月24日晚20:00 (UTC+8),详见公告👇🏻

— OKX中文 (@okxchinese) November 23, 2025

While the exchange failed to provide additional reasons for its decision, the move marks a significant regulatory U-turn for the venue. It had previously delisted the asset in 2023, citing compliance risks.

Nonetheless, the decision can be linked to two significant factors, including ZEC’s strong outperformance of Bitcoin in recent months.

It also reflects a post-election regulatory thaw, as the new SEC leadership is emboldening platforms to re-integrate privacy protocols that were once considered radioactive.

Meanwhile, the resurgence of Zcash has ignited a philosophical clash on Wall Street regarding the future of digital privacy.

Eric Balchunas, Senior ETF Analyst at Bloomberg, cautioned that the sudden pivot to privacy coins could fragment the broader crypto narrative. He noted that this shift comes at a time when Bitcoin is trying to consolidate institutional support.

He argued that pushing a separate privacy layer risks “splitting the vote” of capital allocation when Bitcoin needs unified political and cultural backing to cement its status as a global reserve asset.

“Zcash has third-party candidate vibes, like Gary Johnson or Jill Stein. Seems like you’d better off folding in their ideas to the main party vs splitting the vote, which could have major consequences, especially in such a crucial time for BTC,” he said.

However, asset managers suggest that fundamental flaws in Bitcoin are driving the rotation.

Jan van Eck, CEO of global investment manager VanEck, pushed back against the “spoiler” characterization. He noted that veteran investors are treating Zcash as a necessary complement to Bitcoin rather than a competitor.

TLDR:The bitcoin bear market is being driven by the onchain reality of the halving cycle (bearish for 2026), quantum-breaking-encryption concerns and the better privacy of Zcash.

— Jan van Eck (@JanvanEck3) November 21, 2025

According to Van Eck, the current bear market in Bitcoin reflects “the on-chain reality” of surveillance risks. He argued that rising demand for confidentiality is driving capital toward Zcash’s encrypted ledger.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ALGO Falls 1.74% as 1-Month Results Remain Subdued

- Algorand (ALGO) dropped 1.74% on Nov 24, 2025, extending its 1-month decline to 20.35% amid sustained bearish sentiment. - The token’s annual price has fallen 57.76% from its peak, driven by macroeconomic volatility and uncertainty over potential interest rate cuts. - No ALGO-specific news or on-chain developments were reported, with price movements linked to broader economic factors and risk appetite shifts. - Analysts warn the bearish trend may persist unless major upgrades emerge, urging investors to

DOGE drops 53.85% over the past year after early dissolution of federal agency

- Trump's DOGE department, aimed at cutting federal spending, was disbanded early, with functions absorbed by OPM. - DOGE's aggressive cost-cutting, including $1.9B in canceled contracts, faced scrutiny over lack of transparency and legal concerns. - The DOGE cryptocurrency token fell 53.85% in a year, while Grayscale launched spot ETFs as the department dissolved. - Former DOGE staff now hold federal roles, but its legacy raises ongoing questions about executive authority in reform efforts.

YFI Value Increases by 1.18% During Market Fluctuations

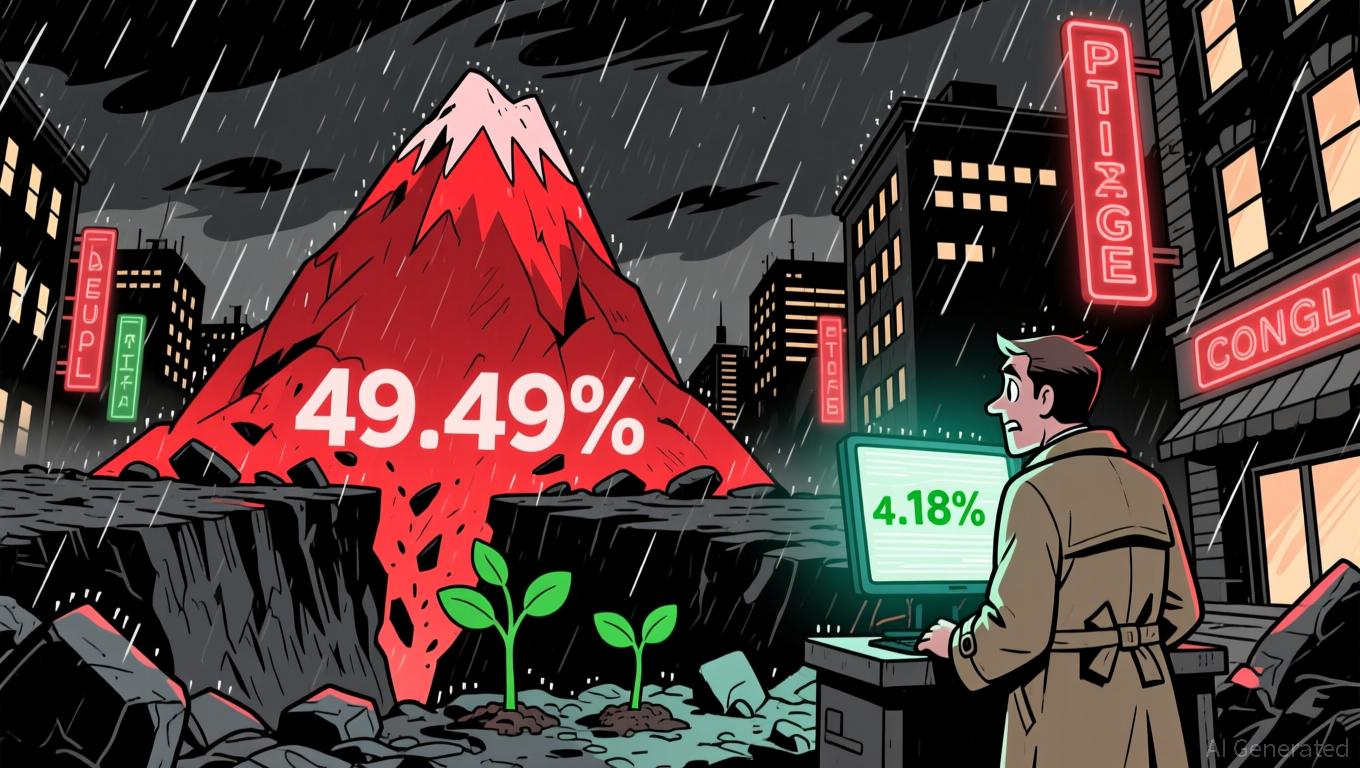

- YFI rose 1.18% in 24 hours to $4,036 but fell 49.49% annually, highlighting extreme volatility. - Short-term gains lack clear catalysts, with analysts noting broader market dynamics drive fluctuations. - Long-term bearish trends persist despite temporary rebounds, urging caution amid macroeconomic pressures.

Aave News Today: The Two Sides of DeFi: Aave's Expansion Increases Volatility Concerns

- Aave's AAVE token faces volatility risks near 0.57 support level, with whale accumulation and leveraged positions amplifying short-term instability. - A major Aave whale added 24,000 AAVE tokens (total 276,000) at $165 average cost, but remains vulnerable to repeat October 11 liquidation risks. - A $80M WBTC long position on Aave approaches $65,436 liquidation threshold, threatening forced selling and downward price pressure. - Tangem's Aave-integrated stablecoin yield feature highlights protocol's DeFi