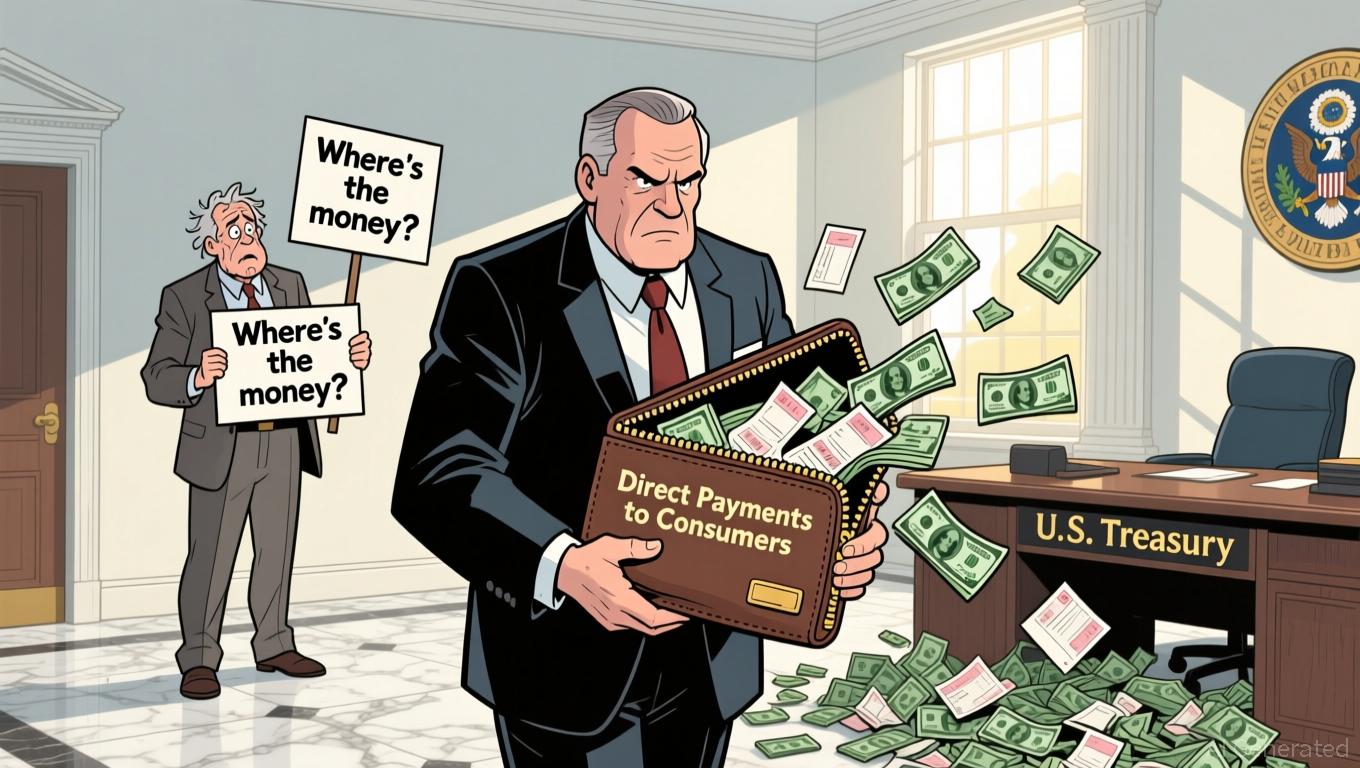

Trump’s Proposal for Direct Payments Threatens ACA Subsidy Stability Amid Ongoing Dispute

- Trump administration proposes direct consumer payments to replace ACA subsidies, aiming to cut healthcare costs by bypassing insurers . - Plan faces criticism for risking ACA marketplace stability and premium hikes, as GOP lawmakers balance Trump's stance with public affordability concerns. - Treasury Secretary Bessent defends "noninflationary growth" via tax cuts, while healthcare stocks show mixed performance amid sector-specific challenges. - Political standoff intensifies with Jan. 30 deadline loomin

Treasury Secretary Scott Bessent revealed on November 23 that the Trump administration is developing a strategy to lower health-care expenses in the U.S., with further information anticipated this week. This initiative arises as political tensions mount over the looming expiration of enhanced Affordable Care Act (ACA) subsidies at the end of the year, a change that could result in higher premiums for millions. "There will be an announcement about this in the coming week," Bessent stated during NBC's Meet the Press,

President Trump has repeatedly rejected legislative attempts to extend ACA subsidies, which Democrats maintain are essential for keeping coverage affordable.

Bessent also discussed broader economic challenges,

The current political and economic environment remains tense.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South Korea Implements Comprehensive Crypto AML Enforcement: Exchanges Subject to Standardized Sanctions

- South Korea's FIU is imposing uniform penalties on major crypto exchanges like Upbit and Bithumb for AML/KYC violations, starting with a 35.2 billion won fine on Dunamu. - A "first-in, first-out" enforcement timeline extends into 2026, with Korbit and GOPAX facing imminent sanctions while Bithumb's case delays due to order book inspections. - The crackdown reflects South Korea's global regulatory leadership, aligning with stricter AML compliance and a delayed 2027 crypto tax regime that heightens market

XRP News Today: XRP Faces a Pivotal Moment—ETF Excitement Clashes with Technical Skepticism

- XRP's price debate intensifies as spot ETFs attract $410M inflows but fail to push the token above $100, with analysts divided on their long-term impact. - Prominent analyst Moon argues $10+ targets require more than ETF demand, contrasting bullish claims about XRP's utility-driven $1,000 potential. - Ripple's $500M Swell 2025 funding and 11 approved XRP ETFs signal institutional confidence, though historical post-Swell declines persist. - Technical indicators show mixed signals: $2 support retests and p

Bitcoin News Update: Major Whale Places $87 Million 3x Leveraged Bet Opposing BTC Surge Amid Divided Market

- A Hyperliquid whale opened a $87.58M 3x BTC short, contrasting with bullish market trends and other traders' strategies. - Another 20x $131M short faces liquidation risk if BTC surpasses $111,770, while $343.89M in 24-hour liquidations highlight short-position vulnerability. - Technical indicators (RSI 66, 15/1 buy/sell signals) and institutional BTC purchases support upward momentum despite liquidity risks on Hyperliquid. - Diverging whale strategies and macro factors like Fed policy underscore crypto's

Ethereum News Update: Major Institutions View Ethereum as a Key Asset, Outpacing ETF Investments

- 68 publicly traded firms now hold 12.7 million ETH, surpassing all Ethereum spot ETFs' 11.3 million holdings as of July 2024. - Firms like Coinbase and Gemini lead corporate accumulation, while banks like Fidelity expand crypto custody services for institutional clients. - Analysts cite regulatory clarity and improved risk frameworks as drivers, with 72% of institutional investors boosting crypto allocations in 2024. - Critics warn of market manipulation risks as corporate holdings now control 54% of ins