Polish Crypto Analyst Apologizes After Bitcoin ‘Santa Rally’ Forecast Fails

Polish analyst Robert “El Profesor” Ruszała issued a rare public apology after Bitcoin broke his forecast within weeks. He published a detailed breakdown of the errors in his model, sparking debate among traders about transparency in crypto analysis.

A well-known Polish market analyst has publicly apologized after his latest Bitcoin outlook collapsed within weeks, sparking debate across social media.

Robert Ruszała, known online as El Profesor, admitted his plan was wrong and published a detailed breakdown explaining the mistakes behind his failed scenario.

Analyst Breaks Industry Norm by Owning His Error

Crypto commentators often highlight their wins and stay silent when predictions miss. Ruszała took the opposite approach.

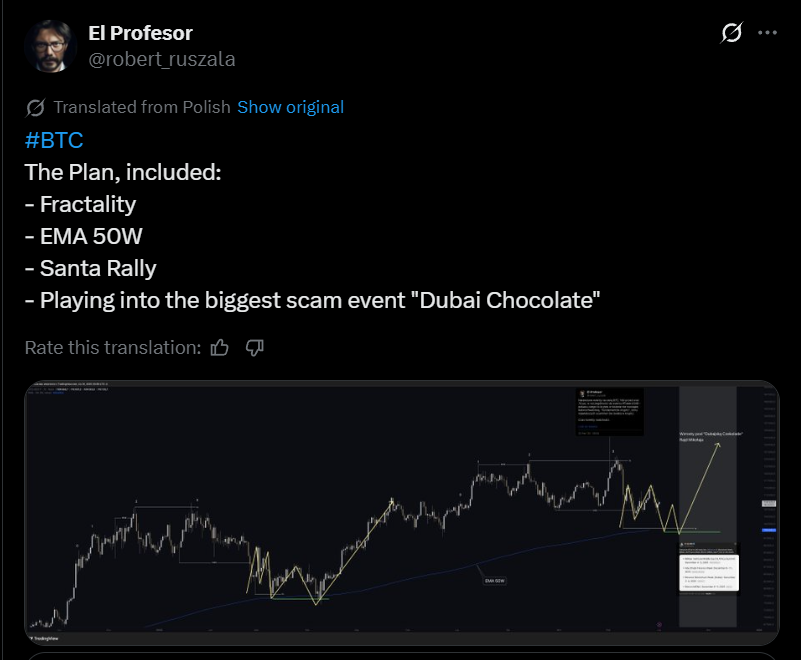

He originally released a forecast called “The Plan,” outlining a bullish path for Bitcoin based on market fractals, the 50-week EMA, and a seasonal move often described as the “Santa Rally.”

Original Post From the Analyst

Original Post From the Analyst

According to his model, Bitcoin was expected to hold its uptrend and provide opportunities to take long positions at specific technical levels.

Market Reversal Forces a Reassessment

However, it took the market only three weeks to dismiss that vision. Bitcoin dropped below key zones and invalidated the entire bullish structure.

On 21 November, Ruszała addressed the failed call directly, writing:“I failed… I’m sorry to everyone who followed this plan. I know where I made the mistake.”

He later explained that he always prepares two scenarios — bullish and bearish. The first one worked from roughly $116,000 down to $94,700. The deeper decline activated his bearish outlook.

He stressed that reacting to market changes matters more than sticking to a single direction.

What Went Wrong in “The Plan”

Ruszała then published a technical breakdown of the error. He pointed to several indicators that he ranked incorrectly in terms of probability.

That mis-ordering, he said, led him to misjudge Bitcoin’s potential movement.

The Analyst Later Explains Why His Prediction Failed

The Analyst Later Explains Why His Prediction Failed

The post did not spark major controversy, but it prompted discussion among traders. Several users praised him for his transparency, noting that few analysts publicly dissect their own mistakes.

His response highlights a broader reality in crypto markets: even well-constructed scenarios require constant revision, and the market can still surprise the most seasoned experts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Major Whale Places $87 Million 3x Leveraged Bet Opposing BTC Surge Amid Divided Market

- A Hyperliquid whale opened a $87.58M 3x BTC short, contrasting with bullish market trends and other traders' strategies. - Another 20x $131M short faces liquidation risk if BTC surpasses $111,770, while $343.89M in 24-hour liquidations highlight short-position vulnerability. - Technical indicators (RSI 66, 15/1 buy/sell signals) and institutional BTC purchases support upward momentum despite liquidity risks on Hyperliquid. - Diverging whale strategies and macro factors like Fed policy underscore crypto's

Ethereum News Update: Major Institutions View Ethereum as a Key Asset, Outpacing ETF Investments

- 68 publicly traded firms now hold 12.7 million ETH, surpassing all Ethereum spot ETFs' 11.3 million holdings as of July 2024. - Firms like Coinbase and Gemini lead corporate accumulation, while banks like Fidelity expand crypto custody services for institutional clients. - Analysts cite regulatory clarity and improved risk frameworks as drivers, with 72% of institutional investors boosting crypto allocations in 2024. - Critics warn of market manipulation risks as corporate holdings now control 54% of ins

Breet's Enhancement Addresses Africa's Cryptocurrency Instability and Delayed Transactions

- Breet 3.0 Pro Max upgrades Africa's OTC crypto platform with USD wallets, instant transfers, and flat fees to combat volatility and slow settlements. - Key features include stable dollar holdings, peer-to-peer transfers bypassing banks , and automated issue resolution to reduce transaction friction. - Business tools now offer multi-currency templates, VIP tiers for high-volume traders, and security dashboards tracking account activity. - The update addresses Africa's crypto challenges by stabilizing purc

DeFi's Automation Shortfall Addressed: Orbs Introduces dSLTP to Achieve CeFi-Grade Risk Control

- Orbs launches dSLTP, a decentralized stop-loss/take-profit protocol for DEXs, bridging CeFi automation with DeFi. - The protocol automates risk management via on-chain orders, reducing real-time monitoring needs during volatility. - Built on Orbs' Layer-3 infrastructure, it enhances DEX functionality with CeFi-grade tools while maintaining decentralization. - This innovation addresses DeFi's automation gap, potentially driving DEX adoption and institutional-grade on-chain trading.