Key Market Information Discrepancy on November 24th – A Must-Read! | Alpha Morning Report

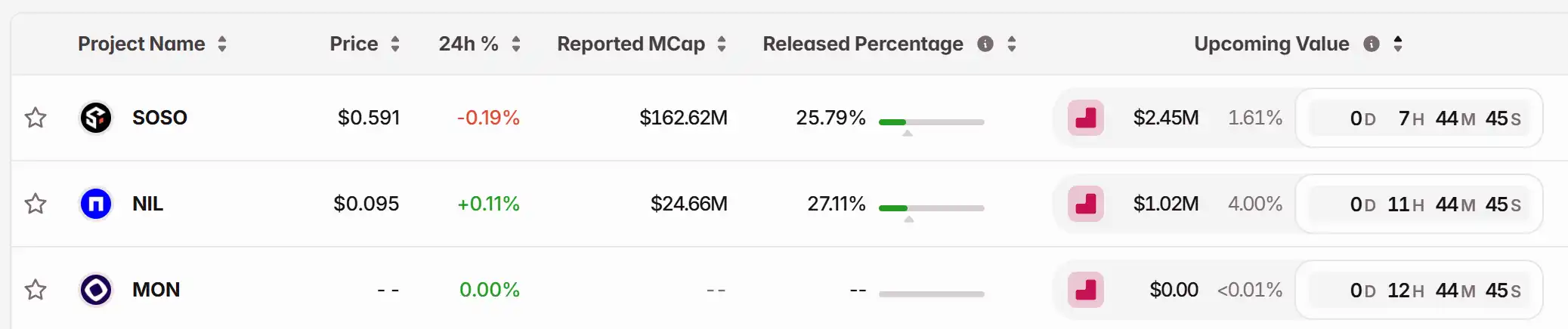

1. Top News: Bitcoin Surges Above $88,000 This Morning Before Retracing 2. Token Unlock: $SOSO, $NIL, $MON

Top News

1. Bitcoin Surges Above $88,000 This Morning Before Pulling Back

2. Federal Reserve Entering Quiet Period, Institutions Maintain December Rate Cut Expectation

3. Altcoins Recovering, PIPPIN Surges Over 148% in 24 Hours

4. TNSR Surges Over 80% in 24 Hours, Currently Trading at $0.1838

5. $213 Million Liquidated in the Past 24 Hours, Majority of Liquidations on Short Positions

Articles & Threads

1. "Crypto's Strongest Bulls and Bears Dialogue: Has the Four-Year Crypto Cycle Lost Its Edge?"

The 2025 crypto market is at a delicate inflection point: Bitcoin ETF approval, the intertwining of liquidity cycles and debt refinancing periods, AI hype diverting funds, traditional finance and tech giants accelerating blockchain adoption. In such a backdrop, the market structure exhibits anomalies, with a lack of buying interest in small-cap assets, underperformance of high-performance public chains like Solana, and investor sentiment swinging between extreme optimism and panic.

2. "What Have the Mainstream Perp DEXes Been Up To Lately?"

While the entire crypto market seems to be in another "bear market" phase, enthusiasm for new tracks has not diminished much. Especially in the derivatives track of Perp DEX, many traders and community users are focusing more on the high-frequency, structured, and gamified perpetual market. This is why yet-to-launch Perp DEXes can still produce impressive data in a downturn environment.

Market Data

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South Korea Implements Comprehensive Crypto AML Enforcement: Exchanges Subject to Standardized Sanctions

- South Korea's FIU is imposing uniform penalties on major crypto exchanges like Upbit and Bithumb for AML/KYC violations, starting with a 35.2 billion won fine on Dunamu. - A "first-in, first-out" enforcement timeline extends into 2026, with Korbit and GOPAX facing imminent sanctions while Bithumb's case delays due to order book inspections. - The crackdown reflects South Korea's global regulatory leadership, aligning with stricter AML compliance and a delayed 2027 crypto tax regime that heightens market

XRP News Today: XRP Faces a Pivotal Moment—ETF Excitement Clashes with Technical Skepticism

- XRP's price debate intensifies as spot ETFs attract $410M inflows but fail to push the token above $100, with analysts divided on their long-term impact. - Prominent analyst Moon argues $10+ targets require more than ETF demand, contrasting bullish claims about XRP's utility-driven $1,000 potential. - Ripple's $500M Swell 2025 funding and 11 approved XRP ETFs signal institutional confidence, though historical post-Swell declines persist. - Technical indicators show mixed signals: $2 support retests and p

Bitcoin News Update: Major Whale Places $87 Million 3x Leveraged Bet Opposing BTC Surge Amid Divided Market

- A Hyperliquid whale opened a $87.58M 3x BTC short, contrasting with bullish market trends and other traders' strategies. - Another 20x $131M short faces liquidation risk if BTC surpasses $111,770, while $343.89M in 24-hour liquidations highlight short-position vulnerability. - Technical indicators (RSI 66, 15/1 buy/sell signals) and institutional BTC purchases support upward momentum despite liquidity risks on Hyperliquid. - Diverging whale strategies and macro factors like Fed policy underscore crypto's

Ethereum News Update: Major Institutions View Ethereum as a Key Asset, Outpacing ETF Investments

- 68 publicly traded firms now hold 12.7 million ETH, surpassing all Ethereum spot ETFs' 11.3 million holdings as of July 2024. - Firms like Coinbase and Gemini lead corporate accumulation, while banks like Fidelity expand crypto custody services for institutional clients. - Analysts cite regulatory clarity and improved risk frameworks as drivers, with 72% of institutional investors boosting crypto allocations in 2024. - Critics warn of market manipulation risks as corporate holdings now control 54% of ins