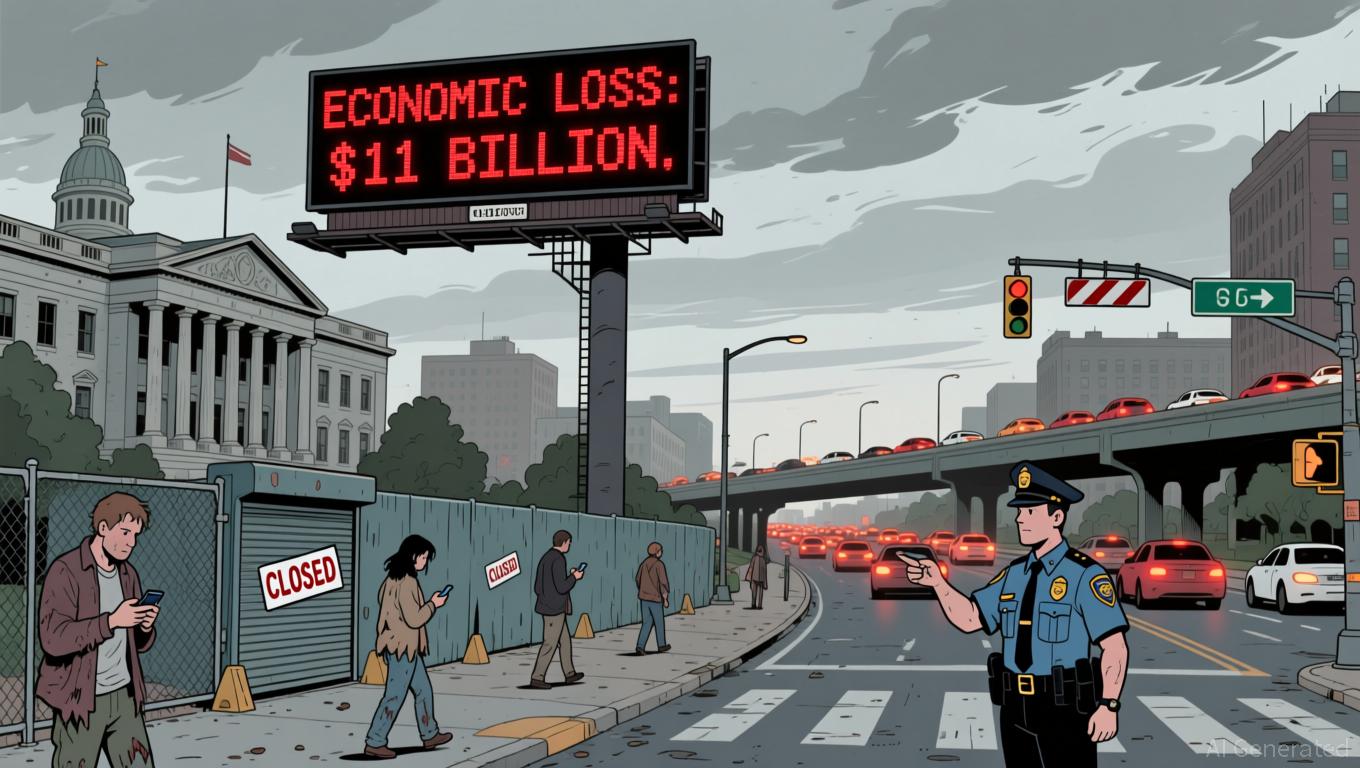

Political Stalemate Results in $11 Billion Loss, Highlighting Deep-Rooted Flaws in the System

- U.S. government shutdown in late 2025 caused $11B economic loss, disrupted critical data collection for CPI and employment reports. - Treasury Secretary Bessent highlighted recession risks in rate-sensitive sectors but emphasized services-driven inflation, not Trump trade policies. - "One Big, Beautiful Bill" tax cuts aim to boost incomes, with analysts projecting 0.4pp growth boost despite Fed rate constraints. - Shutdown intensified calls for congressional reform to end gridlock, as prediction markets

The United States experienced a government shutdown spanning 43 days at the end of 2025

The BLS

Despite these obstacles, the administration remains optimistic about the nation’s economic direction.

The economic consequences of the shutdown have strengthened demands for legislative change.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Animoca Connects Conventional Finance and Web3 Following UAE Authorization

- Animoca Brands secured in-principle approval from Abu Dhabi's FSRA to operate as a regulated fund manager in the UAE's ADGM digital asset hub. - The conditional approval enables the Web3 investor to establish a collective investment fund, aligning with its institutional-grade digital asset expansion strategy. - The move complements Animoca's $1B valuation reverse merger with Currenc Group , aiming to re-enter public markets after 2020's delisting. - ADGM's regulatory framework requires firms to meet capi

Bitcoin Updates: Bitcoin Jumps 60%—Sign of Market Evolution or Monoculture Danger?

- Bitcoin's market dominance nears 60% as altcoins lag amid regulatory pressures and shifting investor preferences toward stability. - U.S. investigations into Bitmain's mining hardware and proposed Bitcoin adoption policies highlight regulatory and institutional risks reshaping the sector. - Macroeconomic uncertainties and MSCI's crypto index exclusion plans intensify Bitcoin's appeal over altcoins, with critics warning of forced sell-offs. - While Bitcoin outperforms gold in appreciation potential, its v

Blockchain and AI Empowering SMEs to Compete Equally in International Trade

- Ant Group's Eric Jing proposed blockchain smart contracts and AI to address SME income distribution challenges at Singapore FinTech Festival 2025. - Blockchain infrastructure enables real-time, transparent revenue sharing among collaborative agents, with digital currency enhancing trustless transactions. - AI tools like Antom Copilot and EPOS360 streamline SME operations, while MAS partnerships through sandboxes advance blockchain-based trade solutions. - Projects like Guardian (tokenized money) and Path

Bitcoin Updates Today: Bitcoin Holds Firm While Investors Navigate Policy-Related Uncertainty

- Trump's 40% tariff exemption for Brazilian coffee/beef eases U.S.-Brazil trade tensions, stabilizing global commodity markets amid political clashes. - Lula's firm stance secures Brazil's agricultural exports, boosting domestic political standing while avoiding inflation spikes in U.S. food markets. - Bitcoin maintains stability at $82,000 despite Trump's tariff-driven volatility, reflecting investor confidence in decentralized assets as policy hedges. - Tariff exemptions highlight limits of U.S. economi