ICP Jumps 30% in a Week: What’s Fueling the Buzz and What Could Happen Next?

- ICP token surged 30% in 7 days amid whale accumulation and rising network adoption metrics. - Daily active addresses rose 35% while DEX volumes hit $843.5M, signaling growing decentralized computing utility. - Futures open interest reached $188M as retail optimism clashes with technical concerns below EMA-9 at $5.40. - Key resistance at $6.47 could trigger further gains if ICP sustains above $5.40, but leveraged positions pose correction risks.

On-Chain Activity: Whale Accumulation and Network Growth

Recent blockchain data points to growing confidence among major investors and institutions. Wallets with large

Network metrics further validate the rally. The number of daily active addresses on the ICP blockchain has

Investor Sentiment: Speculation and Retail Confidence

Analysis of investor mood reveals a blend of caution and optimism. Open interest in ICP futures has

Spot market data also shows encouraging accumulation. On November 18, 2025, ICP saw a

Retail trading patterns offer further clues. ICP’s decentralized exchange (DEX) volume hit $843.5 million during the week of November 18,

Technical Analysis and Resistance Levels

From a charting standpoint,

Nonetheless, there are still risks. If the price fails to stay above short-term averages and leveraged positions remain dominant, a sudden shift in sentiment could trigger sharp pullbacks. Traders should keep an eye on trading volumes and whale activity for further signals.

Looking Ahead

The next few weeks will be crucial in determining whether ICP’s recent gains are a brief spike or the beginning of a sustained uptrend. Strong on-chain activity and growing retail confidence provide a solid base, but technical resistance remains. If ICP can hold above $5.40 and attract steady inflows, the $6.47 resistance could serve as a springboard for further advances. On the other hand, dropping below $5 could revive bearish sentiment.

At present, the data points to a market in flux. Continued whale accumulation and rising DEX volumes suggest faith in ICP’s long-term prospects, while increased speculation highlights the dangers of excessive leverage. Investors should weigh these factors carefully, using technical markers as reference points and staying alert to broader market trends.

The Internet Computer (ICP) is currently showing several important technical signals that could indicate future price action. Market watchers are monitoring the RSI for signs of overbought or oversold conditions, while the MACD is hinting at possible crossovers that may signal either upward or downward momentum. Together with price movements relative to key averages and support or resistance levels, these indicators are crucial for forecasting ICP’s next steps.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP ETF Investments See $4 Billion Influx Amid Price Drop: Market Adjusts After Recent Surge

- Ripple's XRP ETFs see $128M inflows and regulatory approvals, but prices drop amid market correction. - XRPI and XRPR ETFs fall 8%, while XRPC ETF generates $58.5M in first-day trading, surpassing Solana's debut. - SEC approvals confirm XRP's commodity status, boosting institutional confidence as nine new XRP ETFs target $4B–$8B inflows. - Technical analysis shows XRP-USD above $2.00, with analysts projecting $2.50 by late 2025 if ETF AUM exceeds $8B.

San Francisco Hotel Promotions and Autonomous Taxis Indicate Economic Recovery

- San Francisco's hotel market shows recovery as Newbond and Conversant buy two iconic hotels for $408M, signaling investor confidence amid rising convention bookings. - Tech innovation accelerates with Amazon's Zoox launching free robotaxi trials, competing with Waymo and Tesla in autonomous vehicle testing. - Deutsche Bank raises capital via a 7.125% AT1 bond and revises ESG targets to include 900B€ in transition finance by 2030, reflecting industry decarbonization trends.

TWT's Revamped Tokenomics: Redefining Value for Holders and Ensuring Long-Term Project Viability

- TWT rebranded as Toncoin in 2025, shifting to gamified utility via Trust Premium, emphasizing user engagement and gas discounts. - A 2020 token burn reduced supply by 40%, but liquidity risks persist due to pre-burn circulation and centralized utility dependencies. - Lessons from TNSR's collapse highlight the need for decentralized use cases, as TWT's value relies on recurring incentives and cross-chain liquidity. - Analysts project TWT could reach $15 by 2030, contingent on sustained adoption and addres

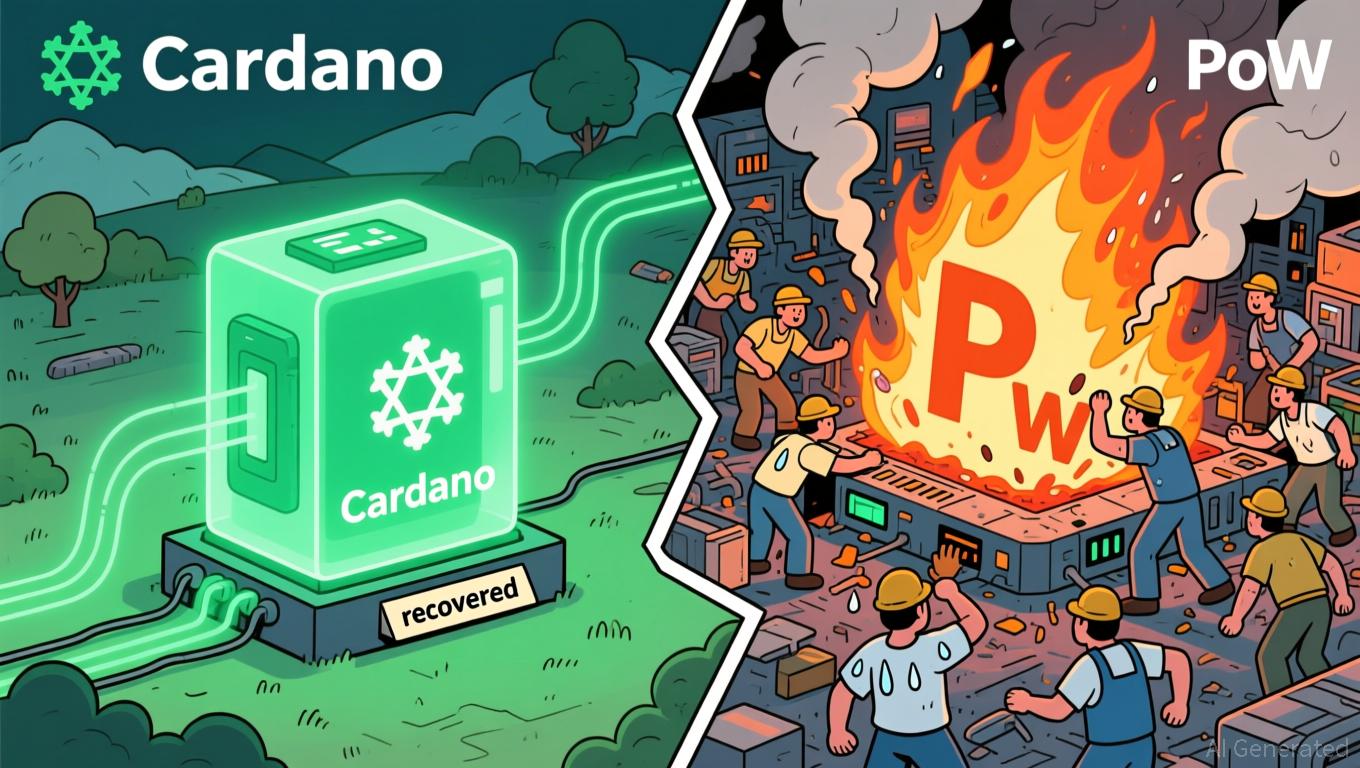

Cardano News Today: Blockchain Dispute: Should Those Responsible for Chain Splits Face Legal Action or Should Open-Source Creativity Be Safeguarded?

- Solana co-founder Anatoly Yakovenko praised Cardano's swift recovery from a November 2025 chain split, calling its resilience "pretty cool" despite a malicious transaction exploiting a deserialization bug. - Cardano's Ouroboros consensus model enabled rapid convergence without hard forks, preserving transaction throughput and avoiding fund losses through emergency node upgrades. - A public debate emerged between Yakovenko and Cardano founder Charles Hoskinson over legal accountability, with Hoskinson adv