3 Token Unlocks to Watch in the Final Week of November 2025

The crypto market will welcome tokens worth more than $566 million in the final week of November 2025. Several major projects, including Hyperliquid (HYPE), Plasma (XPL), and Jupiter (JUP), will release significant new token supplies. These unlocks might lead to market volatility and influence price movements in the short term. Here’s a breakdown of what

The crypto market will welcome tokens worth more than $566 million in the final week of November 2025. Several major projects, including Hyperliquid (HYPE), Plasma (XPL), and Jupiter (JUP), will release significant new token supplies.

These unlocks might lead to market volatility and influence price movements in the short term. Here’s a breakdown of what to watch for each project.

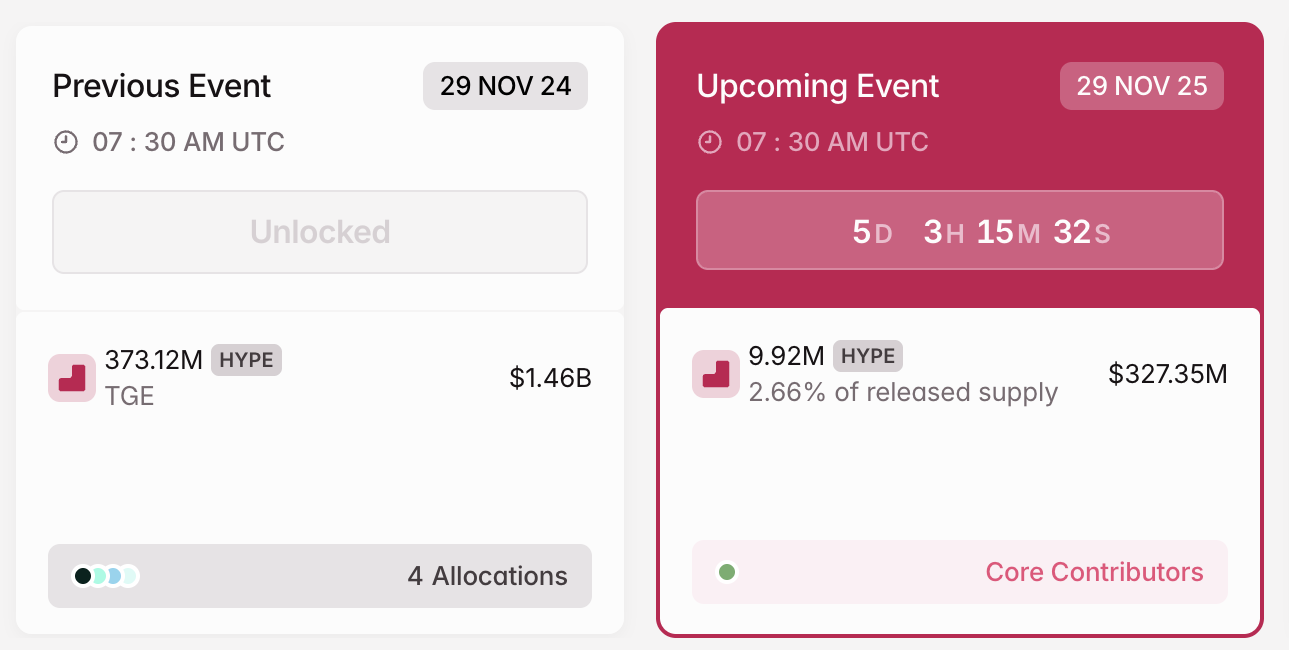

1. Hyperliquid (HYPE)

- Unlock Date: November 29

- Number of Tokens to be Unlocked: 9.92 million HYPE (0.992% of Total Supply)

- Current Circulating Supply: 270.77 million HYPE

- Total supply: 1 billion HYPE

Hyperliquid is a leading decentralized perpetual futures exchange built on its own Layer-1 blockchain. It offers high-performance trading with low latency, on-chain order books, and also sub-second transaction finality.

On November 29, the project will release 9.92 million tokens valued at approximately $327.35 million. This accounts for 2.66% of the current released supply.

HYPE Crypto Token Unlock in November. Source:

Tokenomist

HYPE Crypto Token Unlock in November. Source:

Tokenomist

Hyperliquid will distribute all the unlocked tokens among core contributors.

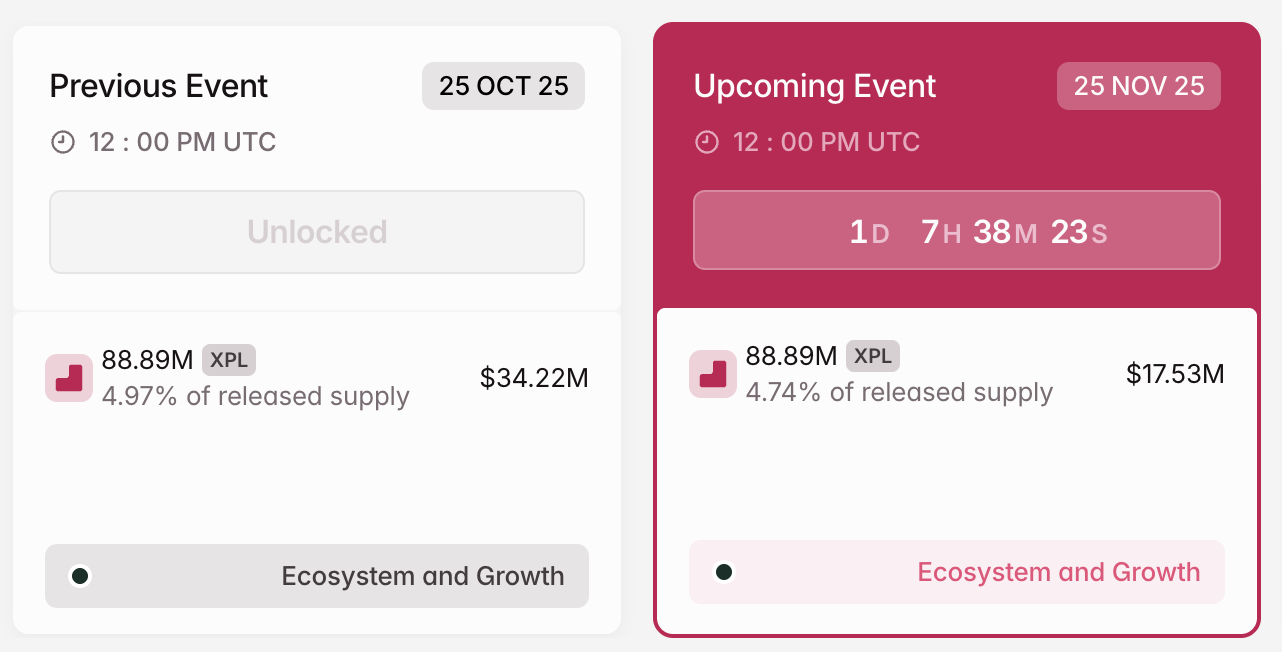

2. Plasma (XPL)

- Unlock Date: November 25

- Number of Tokens to be Unlocked: 88.89 million XPL (0.89% of Total Supply)

- Current Circulating Supply: 1.88 billion XPL

- Total supply: 10 billion XPL

Plasma is a Layer 1 blockchain platform built to enhance the efficiency and scalability of stablecoin transactions. It enables zero-fee USDT transfers, allows the use of custom gas tokens, supports confidential payments, and delivers the throughput required for global-scale adoption.

Plasma will unlock 88.89 million XPL on November 25. The tokens are worth $17.53 million. Moreover, they account for 4.74% of the current circulating supply.

XPL Crypto Token Unlock in November. Source:

Tokenomist

XPL Crypto Token Unlock in November. Source:

Tokenomist

The team will direct all of the 88.89 million XPL to the ecosystem and growth.

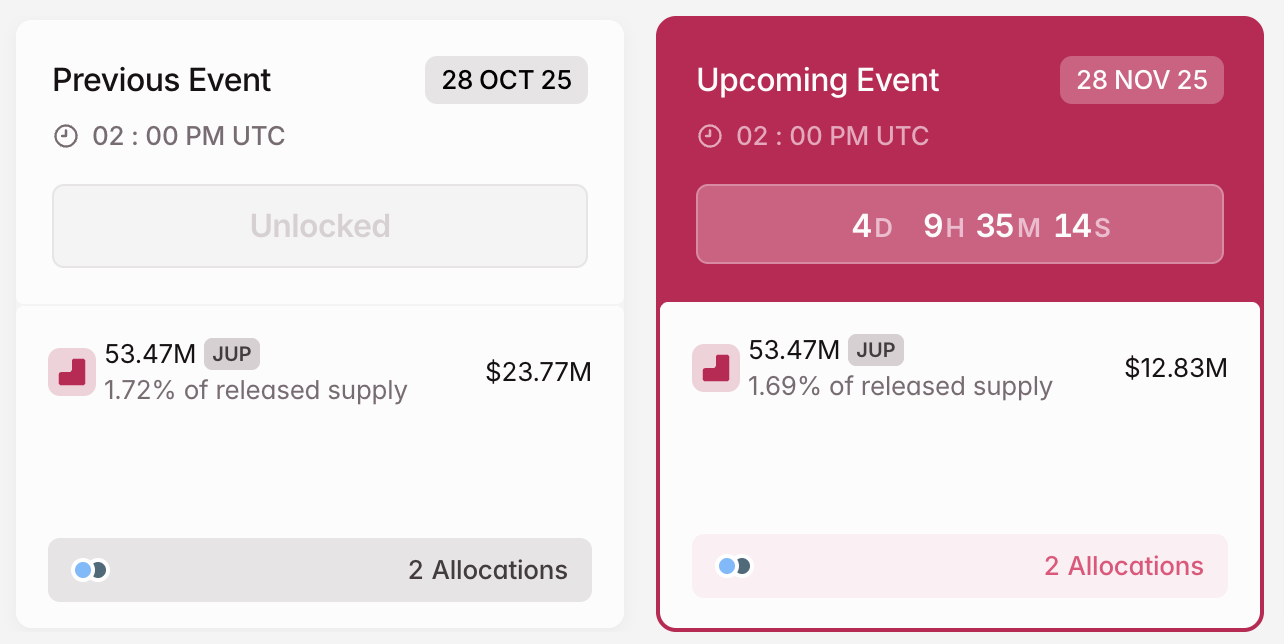

3. Jupiter (JUP)

- Unlock Date: November 28

- Number of Tokens to be Unlocked: 53.47 million JUP (0.53% of Total Supply)

- Current Circulating Supply: 3.2 billion JUP

- Total supply: 10 billion JUP

Jupiter is a decentralized liquidity aggregator on the Solana (SOL) blockchain. It optimizes trade routes across multiple decentralized exchanges (DEXs) to provide users with the best prices for token swaps with minimal slippage.

On November 28, Jupiter will unlock 53.47 million JUP tokens. The supply is worth approximately $12.83 million, representing 1.69% of its circulating supply. Furthermore, this unlock follows a monthly cliff vesting schedule.

JUP Crypto Token Unlock in November. Source:

Tokenomist

JUP Crypto Token Unlock in November. Source:

Tokenomist

Jupiter has allocated the tokens primarily to the team, who will get 38.89 million JUP. Furthermore, Mercurial stakeholders will receive 14.58 million JUP altcoins.

In addition to these, other prominent unlocks that investors can look out for in the final week of November include Artificial Superintelligence Alliance (FET), Aerodrome Finance (AERO), IOTA (IOTA), and various altcoins, contributing to the overall market-wide releases.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC drops 5.47% as large investor moves and ETF withdrawals contribute to market downturn

- Whale 0x5D2 holds a $106M 20x BTC short with $29.8M unrealized profit, adjusting take-profit to $67,000 amid falling prices. - A second whale adds $87.6M 3x BTC short, pushing Bitcoin below $92,000 liquidation threshold as bearish pressure intensifies. - U.S. Bitcoin ETFs see $3.5B November outflows, with BlackRock’s IBIT accounting for 63% of redemptions, accelerating BTC’s 21% monthly drop. - CEX outflows hit 29,194 BTC in seven days, while Binance gains 16,353 BTC inflow, signaling liquidity consolida

Bitcoin Slides Into Cleanup Phase Amid Trader Capitulation

Aave News Today: Transparent DeFi Protocols Drive Unprecedented Growth in Crypto Lending

- Galaxy Digital reports Q3 2025 crypto-collateralized lending surged to $73.59B, with DeFi lending up 54.84% to $40.99B. - DeFi now dominates 62.71% market share, driven by Tether's Plasma network ($3B in 5 weeks) and Aave's layer-2 expansion. - CeFi rebounded 37% to $24.37B but remains at 33.12% share, with Tether controlling 59.91% of tracked loans via Bitcoin/stablecoin collateral. - Market volatility intensified, with $19B in crypto futures liquidated in 24 hours, as protocols prioritize code-based co

Ethereum Updates: Bitcoin ETFs Plummet While Founder Increases Ethereum Holdings

- Bitcoin ETFs face $3.5B November outflows, worsening crypto market sell-offs as BlackRock's IBIT loses $2.2B. - BitMine Immersion founder Brandon Mintz expands Ethereum treasury to 3.63M ETH despite 28.7% price drop. - Leveraged ETH positions trigger partial liquidations, highlighting risks in volatile crypto markets. - Mintz's bullish Ethereum strategy contrasts with broader caution, emphasizing long-term staking potential. - Market duality emerges as ETF outflows persist alongside buybacks and asymmetr