Solana Drop Hits Forward Industries With $668M Unrealized Loss

Forward Industries, the largest institutional holder of Solana with more than 1.1% of the total supply, currently faces unrealized losses of $668 million. SOL’s price drop has left nearly 80% of its circulating supply underwater, highlighting significant risks for Digital Asset Treasury companies. This sharp reversal underscores the mounting pressure on institutional crypto strategies amid

Forward Industries, the largest institutional holder of Solana with more than 1.1% of the total supply, currently faces unrealized losses of $668 million. SOL’s price drop has left nearly 80% of its circulating supply underwater, highlighting significant risks for Digital Asset Treasury companies.

This sharp reversal underscores the mounting pressure on institutional crypto strategies amid worsening market conditions.

Forward Industries’ Massive SOL Position Faces Heavy Losses

Forward Industries (NASDAQ: FWDI) holds 6,910,568 SOL, totaling roughly 1.124% of Solana’s circulating supply. CoinGecko data shows the company’s SOL treasury is now worth $917.42 million, down from a $1.59 billion acquisition cost. Its average purchase price of $230 per SOL has resulted in an unrealized loss of $668.73 million, or 42.2%.

The company initiated its Solana treasury strategy in September 2025. According to an official BusinessWire release, Forward Industries initially bought 6,822,000 SOL at around $232 per token, for a total investment of $1.58 billion. Its holdings have grown slightly, with the latest disclosure on November 15, 2025, confirming 6,910,568 SOL in its treasury.

Source: BeInCrypto

Source: BeInCrypto

The company’s stock price has dropped alongside its crypto assets, falling from a high of $40 to $8.17. Billions in shareholder value have been erased. Today, Forward Industries’ market capitalization is $706.38 million—less than the value of its SOL holdings.

SOL Market Structure Reveals Widespread Pain

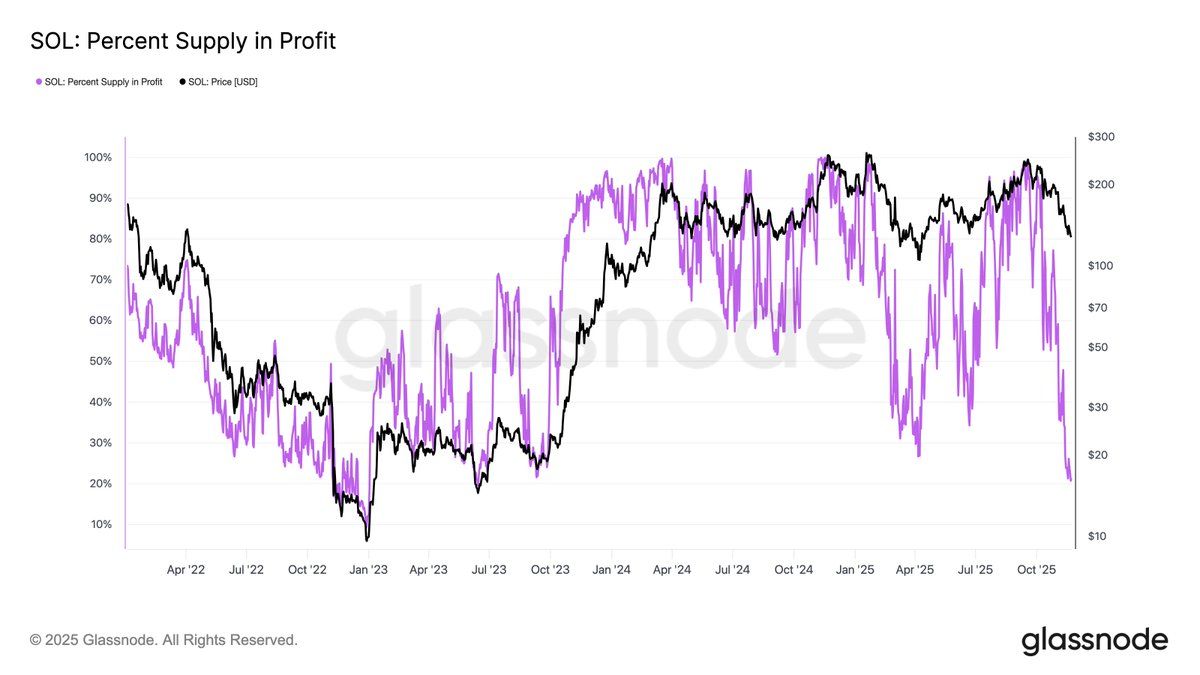

These losses are part of a larger market decline. Glassnode data reveals that about 79.6% of SOL’s circulating supply—approximately 478.5 million tokens—is now held at a loss at a price of $126.9. This figure underscores how top-heavy the market had become before the current downturn.

At $126.9, about 79.6% of Solana’s circulating supply (r~478.5M SOL) is now in loss, underscoring how top-heavy the market structure had become before the recent contraction.📉

— glassnode (@glassnode) November 23, 2025

Many investors and institutions joined the SOL rally in late 2024 and early 2025. Solana’s all-time high was $263.2 in November 2024, according to Oak Research, with a 41.4% gain that month. However, the token has since retraced by more than 50% from its peak.

This turn comes despite Solana showing strong fundamentals. In November 2024, Solana overtook Ethereum in monthly fee revenue for the first time, with fees rising 171% to about $200.69 million. The total value locked increased by 73% to $11.4 billion, making Solana the world’s second-largest blockchain by TVL.

The percent of SOL supply in profit plunges as the price contracts from its highs. Source: Glassnode

The percent of SOL supply in profit plunges as the price contracts from its highs. Source: Glassnode

Portfolio Movement Sparks Speculation

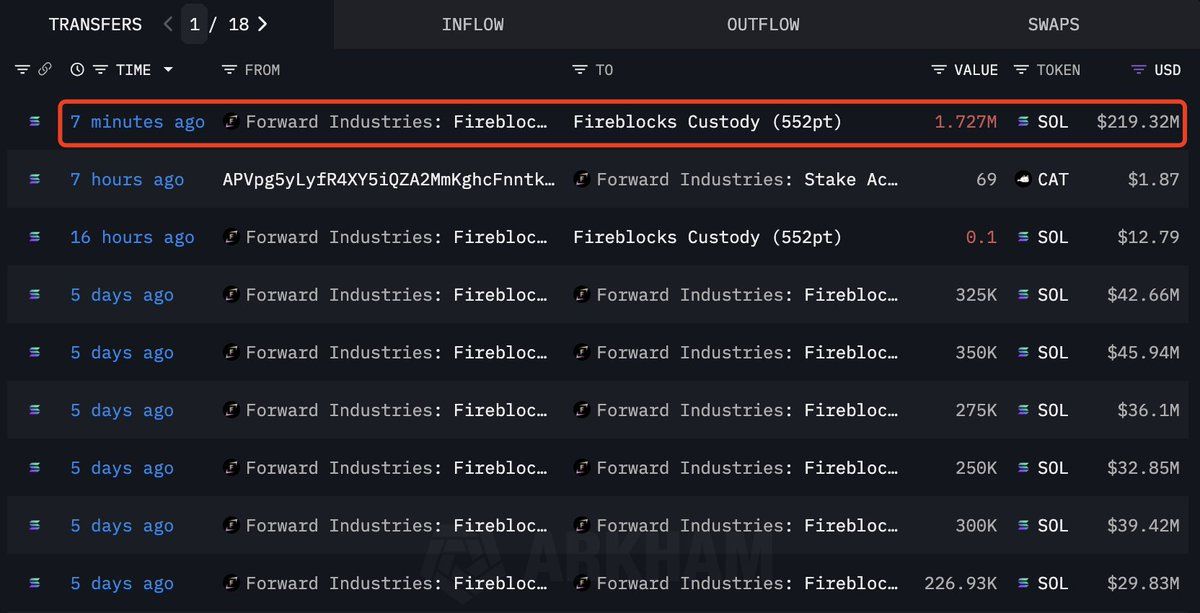

Recent blockchain activity has raised questions about Forward Industries’ approach. The company executed a significant Solana transaction, transferring 1.727 million SOL, valued at around $219.32 million, to the wallet address 552ptg. However, these funds soon returned to the company’s staking account, suggesting no sell-off occurred.

Market watchers saw this as portfolio restructuring, not capitulation. The company continues to stake its SOL, generating yield while retaining its position. Although it added 38,968 SOL last month, Forward Industries has not significantly changed its treasury strategy.

Forward Industries’ 1.727M SOL transfer to custody wallet showing portfolio management activity. BeInCrypto

Forward Industries’ 1.727M SOL transfer to custody wallet showing portfolio management activity. BeInCrypto

Forward Industries’ situation differs sharply from other Digital Asset Treasury companies. Market data shows Strategy’s 649,870 BTC, purchased at an average of $74,433, has an unrealized profit of $6.15 billion—a gain of 12.72%. Meanwhile, Bitmine’s 3,559,879 ETH, bought at roughly $4,010 each, carries an unrealized loss of $4.52 billion, or 31.67%.

This divergence highlights the volatility Digital Asset Treasury companies can face. Galaxy research indicates that DATCOs hold over $100 billion in digital assets, with bitcoin-focused companies holding $93 billion and ETH-focused firms over $4 billion. On the other hand, however, these companies can amplify volatility due to their significant, sometimes leveraged, exposures.

Market Dynamics and Future Outlook

Open interest in Solana futures has stabilized around 8 million contracts after periods of volatility. This suggests a consolidation phase. When open interest is steady and prices are falling, it often signals lower conviction and possible liquidations. As a result, traders appear cautious, awaiting potential catalysts for a rebound.

Forward Industries, led by Chairman Kyle Samani and based in the United States, remains committed to its Solana treasury strategy despite heavy losses. The company’s future hinges on Solana’s ability to recover and establish new support.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DOGE drops by 0.22% as Government Efficiency Agency Faces Dissolution

- The Trump-era DOGE agency, dissolved 8 months early in Nov 2025, aimed to cut $2 trillion in federal spending but struggled with coordination and lacked legislative framework. - Despite Elon Musk's involvement and $335M in reported savings, DOGE's erratic operations and internal disputes led to its absorption into the Office of Personnel Management. - Legal challenges persist as former USAID staff seek transparency, while supporters argue its efficiency principles remain active despite the abrupt shutdow

LUNA Drops 0.27% as Stablecoin Market Cap Continues to Fall

- LUNA fell 0.27% in 24 hours to $0.0733, showing a 82.3% annual decline amid broader bearish trends. - Stablecoin market cap dropped to $3028.37B (-0.33% weekly), marking its largest monthly decline since 2022's LUNA collapse. - Analysts link LUNA's struggles to waning investor trust in algorithmic stablecoins and heightened regulatory scrutiny. - Market shifts favor fully collateralized stablecoins, pressuring complex mechanisms like LUNA's hybrid model.

ZEC rose by 0.18% on November 25 as a result of short-selling fluctuations and portfolio rebalancing

- ZEC rose 0.18% on Nov 25 despite a 20.61% weekly decline, surging 825.18% annually amid volatile short-position liquidations. - A top short trader lost $2.78M after 31 liquidations as BTC/SOL prices spiked, reducing their BTC short exposure by 47%. - The "Top ZEC Short" opened a $3.48M MON short at $0.032, while the largest MON long faces liquidation at $0.0248. - Market dynamics highlight ZEC's role as a short-term confidence barometer, with institutional short-covering rallies under bearish pressure.

Bitcoin Updates: Senate Deadlock Over CLARITY Act Triggers Volatility in Crypto Markets

- Bitcoin fell below $82,000, losing $1 trillion in value due to macroeconomic risks and stalled U.S. crypto regulation (CLARITY Act). - Federal Reserve's delayed rate cuts and political gridlock over CLARITY Act deepened uncertainty, eroding market confidence. - Firms introduced leveraged tools and AI staking to navigate volatility, highlighting sector resilience amid leverage risks. - Deutsche Bank warned Bitcoin's 46% Nasdaq correlation weakens its value proposition, while political crypto advocacy grow