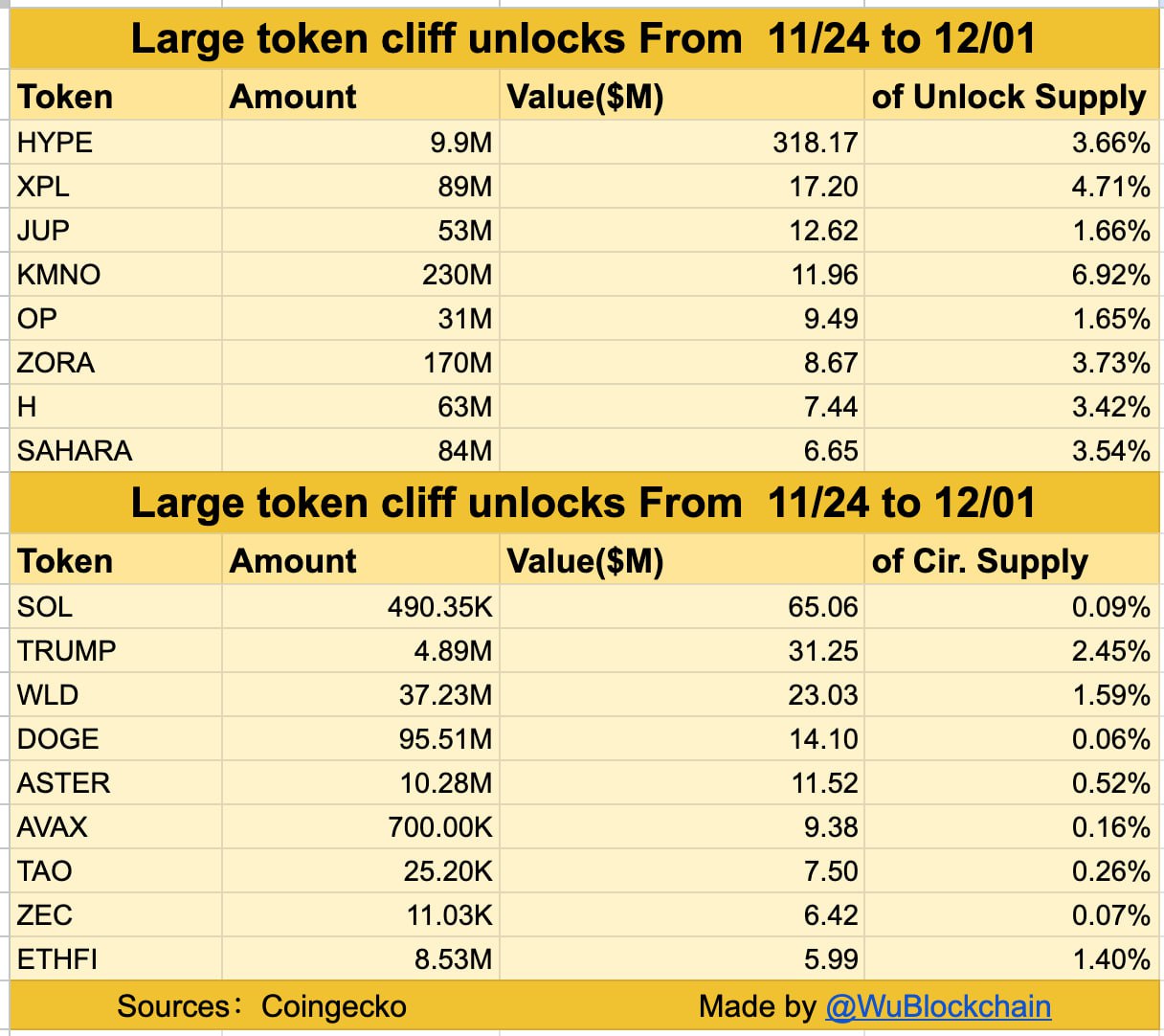

The cryptocurrency market is poised for significant movements as coin unlocks worth over $566 million are scheduled in the coming week. According to data compiled by Wu Blockchain from CoinGecko, these substantial single-event unlocks, each valued above $5 million, will impact cryptocurrencies such as HYPE, XPL, JUP, KMNO, OP, ZORA, H, and SAHARA. Moreover, daily linear unlocks exceeding $1 million will take place for coins including SOL, TRUMP, WLD, DOGE , ASTER, AVAX, TAO, ZEC, and ETHFI.

Single-Event Unlocks Stir Market Tensions

Investors are closely monitoring the sizeable coin unlocks anticipated to capture headlines this week. Single-event unlocks in projects like HYPE, XPL, JUP, and KMNO are expected to cross the $5 million threshold, raising concerns over potential supply pressure on the market. These unlocks, particularly in JUP and OP, known for their expansive investor base, could lead to significant price fluctuations in the short term.

In relatively newer projects such as ZORA, H, and SAHARA, these unlocks might trigger profit-taking by early investors. This could cause a temporary spike in project liquidity and reshape the trading balance that dictates market direction. Historical cases have shown that similar large-scale unlocks occasionally result in short-lived price drops, a pattern investors are mindful of.

Linear Unlocks Surpass $566 Million Threshold

Leading altcoins like SOL, TRUMP, WLD, DOGE, ASTER, AVAX, TAO, ZEC, and ETHFI will experience linear unlocks, with daily volumes exceeding $1 million. This category accounts for a significant portion of the total unlocks. Although the gradual release structure of linear unlocks means their price impact is more muted, the overall amount exceeding $566 million presents a psychological hurdle for investors.

Particularly in high-volume altcoins like SOL and AVAX, these unlocks are expected to influence short-term dynamics in DeFi and liquidity pools. Analysts suggest that the increased coin supply and subsequent sell-offs might play a pivotal role in determining the market’s overall trend. The market’s ability to absorb this influx will be a key factor in dictating the volatility path in the coming week.