6,202,753,441 Shiba Inu Longs Erased but Burn Rate Soars by 859%

As Shiba Inu loses some of its recent gains, more than 6.2 billion SHIB tied to long positions have been liquidated across the market.

Shiba Inu saw some relief yesterday after four straight days of losses between November 19 and 22. The meme coin broke its losing streak with a 4% rebound, climbing to $0.0000080 in the early hours of the day.

The recovery continued today, with SHIB briefly surging to around $0.000008133. However, the momentum was short-lived. As the broader crypto market turned bearish again, Shiba Inu erased its gains and slipped back below $0.000008.

Over 6 Billion SHIB in Long Positions Wiped Out

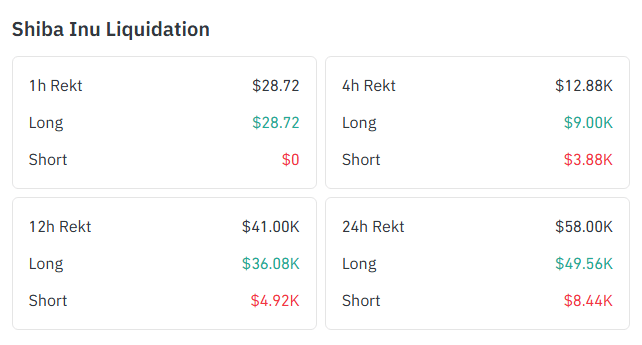

Long-position traders, those who bet on SHIB’s price rising, were hit the hardest by this sudden drop. Data from CoinGlass shows that approximately $41,000 worth of SHIB long positions were liquidated in the past 12 hours.

Meanwhile, liquidations have risen to about $58,000 over the past 24 hours. Long positions accounted for the vast majority of Shiba Inu liquidations, totaling $49,560, or 85.44%, of the total wipeout. Short positions, by contrast, amounted to $8,440.

At SHIB’s current price of $0.000007990, the long liquidations over the past day are equivalent to roughly 6,202,753,441 SHIB (6.2 billion), while the short liquidations translate to about 1.05 billion.

More Shiba Inu Liquidations Possible

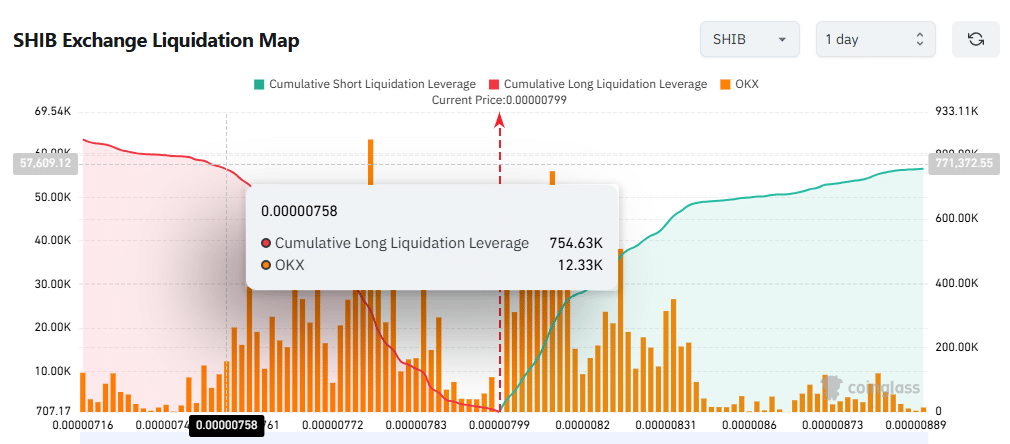

Despite Shiba Inu’s slight pullback earlier today, the asset still maintains a modest 24-hour gain of 0.97%. At its current price of $0.000007990, SHIB is up 5.39% from last week’s low of $0.000007581.

If it retests the $0.000007580 level, an estimated $754,630 worth of long positions would be liquidated, equivalent to roughly 99.55 billion at that price. Conversely, a potential upswing to $0.00000840 could trigger approximately $661,630 in short liquidations, representing around 78.76 billion SHIB at that price.

Daily Burn Rate Soars 859%

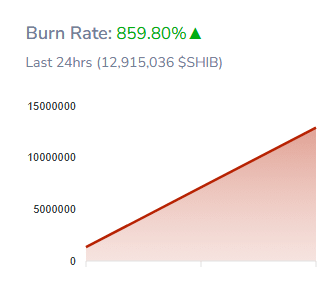

Meanwhile, Shiba Inu’s burn rate surged sharply over the past 24 hours, soaring by an impressive 859.60%. Despite this dramatic spike, the actual amount burned remained relatively modest, with just 12.91 million out of circulation.

The largest single burn during this period originated from the CEX.io crypto exchange, where a user transferred 9.5 million SHIB to the official burn address. Additional notable burns included transactions of 1.78 million, 1.52 million, and 1.27 million SHIB, contributing to the day’s overall total.

To date, approximately 410.753 trillion SHIB have been burned, leaving the total supply at around 589.24 trillion tokens.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Deutsche Bank Turns to Gold: Managing Risks Amid Dollar Volatility and Changes in Cryptocurrency

- Deutsche Bank re-enters gold trading to hedge market volatility, boosting trading assets via increased precious metals inventories. - Analysts highlight Carvana's logistics efficiency as a competitive edge, assigning a $395 price target despite cutting Asia-Pacific private credit teams. - Strategic reallocation focuses on mature European markets, contrasting with Asia's regulatory challenges and illiquidity in private credit. - Macro risks include potential Bitcoin ETF outflows and MSCI's crypto reclassi

Ethereum Updates Today: Unprecedented Profits and Regulatory Challenges Prompt Strategic Reassessment in the Crypto Industry

- BitMine Immersion reports record $13.39 FY25 EPS and becomes first major crypto firm to declare a $0.01/share dividend, while planning 2026 Ethereum staking via its "Made-in-America Validator Network." - Kraken Robotics posts $3. 3M Q3 net income with $330.7M total assets, driven by subsea battery production and marine services expansion amid macroeconomic uncertainties. - Grabar Law Office investigates Avantor , enCore Energy, and Fortrea Holdings for alleged securities fraud, including inflated earning

KITE's Initial Public Offering: Evaluating Whether SPAC Listings Reflect Genuine Value or Speculative Excitement

- Blockfusion's $450M SPAC merger with BACC highlights 2025's SPAC market resurgence, targeting AI infrastructure growth amid valuation debates. - The 6x 2028 EBITDA multiple appears conservative for AI data centers but hinges on securing long-term contracts with major tech players. - Past SPAC failures like Hyzon Motors and Kodiak AI underscore risks of speculative overvaluation in pre-revenue tech sectors despite strategic advantages. - Niagara Falls' low-cost energy and Tier 3 infrastructure position Bl

Visa Executives' Share Dealings: Standard Financial Actions, Not Indicators for the Market

- Visa executives conducted routine stock transactions in late 2025, exercising shares to cover tax liabilities and surrendering portions to offset costs. - Senior officers including CFO Chris Suh and Tullier Kelly Mahon executed trades under prearranged plans, aligning with standard insider financial management practices. - Analysts emphasize these moves reflect personal financial strategies rather than market signals, though transparency remains critical amid regulatory scrutiny of executive compensation