A 300% Spike in Selling Pressure Could Threaten the Ethereum Price Bounce

Ethereum price bounced almost 10% from this week’s lows near $2,600, and the price is up about 1% today. The move looks positive, but the recovery may not last. Two major bearish signals have emerged simultaneously. Together, they threaten to end the bounce before it grows. Holder Selling Surges 300% as a Death Cross Forms

Ethereum price bounced almost 10% from this week’s lows near $2,600, and the price is up about 1% today. The move looks positive, but the recovery may not last.

Two major bearish signals have emerged simultaneously. Together, they threaten to end the bounce before it grows.

Holder Selling Surges 300% as a Death Cross Forms

Two connected signals now point to deeper weakness.

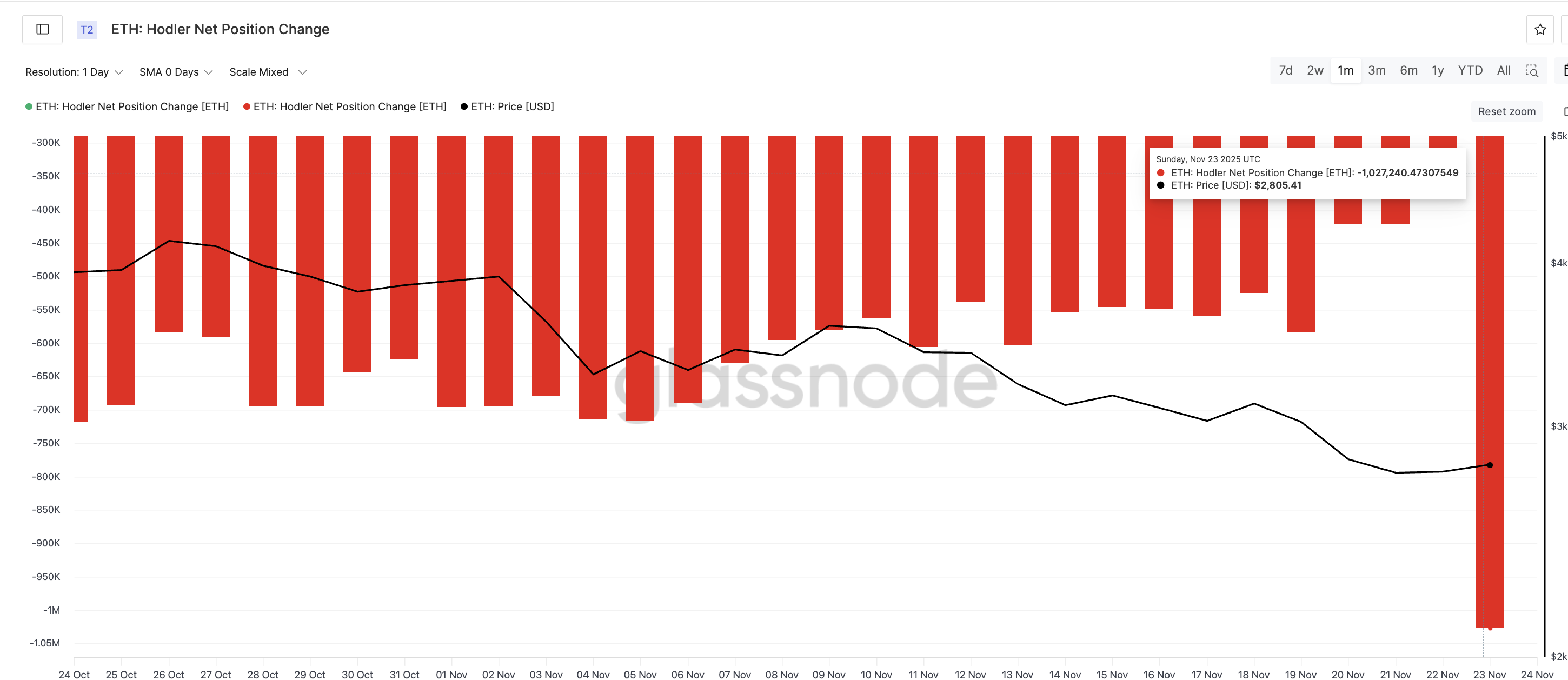

The first comes from long-term investors, often called hodlers. These are wallets that usually hold ETH for more than 155 days. When hodlers increase their selling, it usually shows fear or a shift in long-term belief.

On November 22, net selling from these wallets was about 334,600 ETH. On November 23, it jumped to 1,027,240 ETH — a 300% spike in one day. This is a major exit from long-term holders and adds heavy supply at a time when ETH already trades in a broader downtrend.

ETH Sellers Have The Upper Hand:

Glassnode

ETH Sellers Have The Upper Hand:

Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

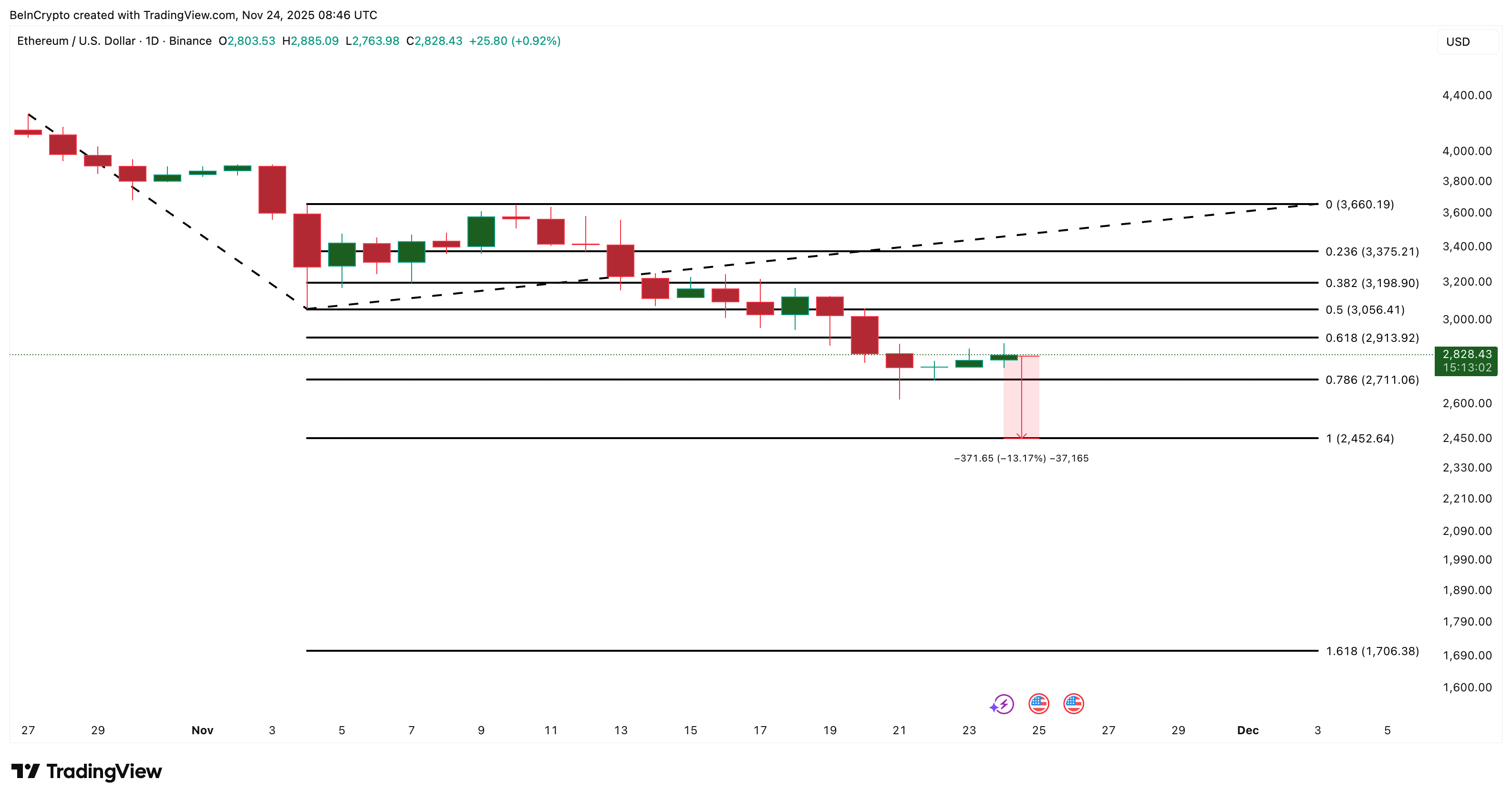

At the same time, a death cross has almost formed. A death cross appears when the 50-day exponential moving average (EMA) drops under the 200-day EMA. An EMA gives more weight to recent prices, so it reacts faster than a simple moving average.

When the 50-day EMA crosses below the 200-day, it signals strong downward momentum. That could hit the ETH prices significantly if the selling pressure continues to rise.

Bearish Risks Build:

TradingView

Bearish Risks Build:

TradingView

Here is the key connection:

Hodler selling is rising sharply at the exact moment the EMA structure is turning bearish. That means the selling pressure is reinforcing the death-cross signal instead of slowing it down. When these two appear together, recoveries usually fail and prices retest lower supports.

Ethereum Price Action: Downside Risk Still Outweighs the Bounce

Ethereum now trades near $2,820, but the chart shows more pressure above than support below.

The first level ETH must defend is $2,710, the 0.786 Fibonacci zone. Losing this level opens a drop toward $2,450, which marks roughly a 13% downside from current levels. If the death cross completes while hodler selling continues, ETH can fall directly toward this level and even under it if the market conditions weaken.

Ethereum Price Analysis:

TradingView

Ethereum Price Analysis:

TradingView

Below $2,452, the next deeper support sits near $1,700 — the broader extension from the descending structure. This only activates if the trend accelerates and sellers remain dominant.

Upside remains limited unless the ETH price can reclaim:

- $3,190, the first meaningful resistance

- $3,660, the stronger ceiling that signals an early trend shift

Under current conditions, hitting these levels looks difficult because both bearish signals — the surge in hodler selling and the death-cross setup — remain active.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trademark Dispute: OpenAI's 'Cameo' Restriction Sheds Light on Legal Challenges in AI

- U.S. Judge Eumi K. Lee temporarily banned OpenAI from using "Cameo" in its Sora app until December 22, citing trademark infringement by Chicago-based Cameo. - Cameo argued the term caused consumer confusion, with users contacting them about Sora's feature, highlighting brand overlap since 2017. - OpenAI contested the ruling, claiming "cameo" is generic, mirroring its legal strategy in India and facing broader IP lawsuits from authors and publishers. - The case underscores AI companies' legal risks, with

Fed Officials Divided on Rate Cut Despite Pressure from Trump

- The Fed faces internal division over December rate cuts, complicating Trump's push for lower borrowing costs amid conflicting economic signals. - New York Fed's Williams supports near-term rate adjustments, while Boston's Collins dismisses urgency, reflecting broader policy disagreements. - Trump's potential influence is limited by Fed dissent, with delayed inflation data and mixed labor market trends adding to decision-making uncertainty. - Global markets and geopolitical developments will shape investo

Hyperliquid News Today: DeFi Faces a Crucial Challenge: Hyperliquid Releases $314M in Tokens

- Hyperliquid will unlock 2.66% of HYPE tokens ($314M) on Nov 29, triggering debates over market stability and sell pressure. - Community and experts warn of risks from cliff unlocks, citing past price crashes and lack of binding sell restrictions for core contributors. - Despite $259B monthly trading volume, HYPE trades at $31 (-46% from peak), with technical indicators showing bearish signals. - Pre-unlock unstaking of $85.8M tokens and conflicting unlock timeline claims have intensified liquidity concer

Tech Leaders Join Forces to Close the AI Infrastructure Divide

- Tech giants form a "mega tech union" to accelerate AI, cloud, and data center infrastructure, driven by a projected $48.3B global AI agents market by 2030. - Rumble's $22,000 Nvidia-chip acquisition, backed by Tether , positions it as a key high-performance computing player amid surging AI demand. - France's AI-ready data center campus (1,400 MW) and $3.57B market growth by 2030 highlight Europe's role in global infrastructure expansion. - Agilent and Keysight's strong 2025 financials underscore the sect