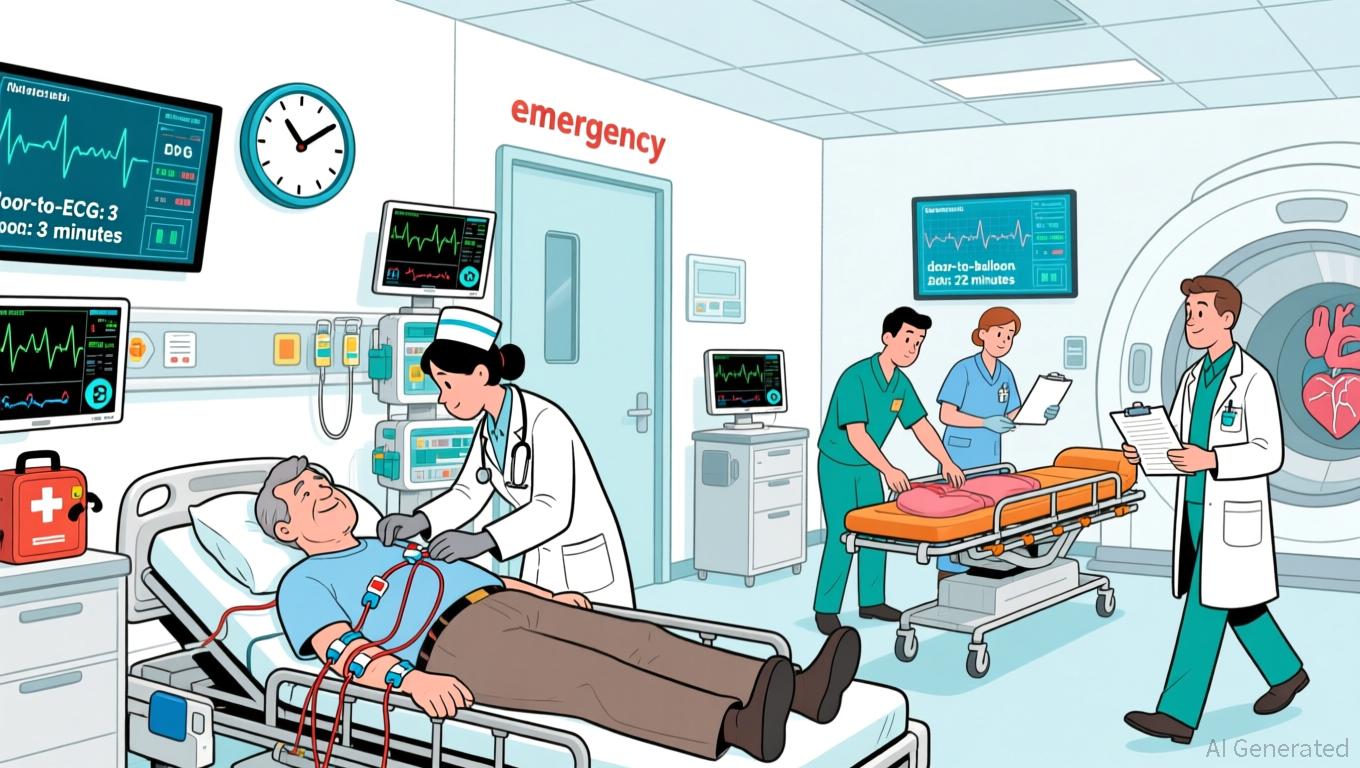

Accelerated Pathways Help Close the Gap Between ACS Guidelines and Actual Clinical Practice

- A Hunan hospital study found fast-track pathways for ACS patients reduced treatment delays and MACE without increased bleeding risk. - The protocol cut median door-to-ECG time by 50% and door-to-balloon time for STEMI patients to 68 minutes, improving guideline adherence. - In-hospital MACE rates dropped from 11.6% to 6.6%, with 30-day composite outcomes improving from 13.9% to 8.7% under fast-track care. - Researchers emphasized the pathway's applicability across all ACS subtypes and potential system ef

A recent prospective cohort investigation has found that implementing emergency fast-track protocols for acute coronary syndrome (ACS) patients leads to notably better clinical results, including shorter treatment times and fewer major adverse cardiovascular events (MACE), all without raising the risk of bleeding. The research, carried out at The Second People's Hospital of Hunan Province, assessed 870 individuals with ACS between January 2022 and December 2023. Of these, 438 were treated using a dedicated fast-track system, while 432 received standard care. The main outcomes showed that the fast-track model

The research,

The authors emphasized the study’s strong methodology, which used propensity score–based inverse probability of treatment weighting to address confounding factors. They also noted the protocol’s broad scope, as it covers all ACS types—including STEMI, NSTEMI, and unstable angina—rather than focusing solely on STEMI. This inclusive design enhances its relevance for emergency departments treating varied patient groups. Furthermore, the median length of hospital stay was

Although the findings strongly support the use of fast-track pathways, the study’s limitations include its single-center nature and insufficient sample size to detect small differences in mortality. The researchers recommend larger, multicenter studies to confirm these results and longer-term monitoring to evaluate sustained benefits. Still, the evidence offers practical guidance for healthcare leaders and providers, especially in Asia where cardiovascular disease rates are climbing. The authors suggest that structured fast-track protocols should become part of emergency care systems to help close the gap between clinical recommendations and everyday practice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Update: Market Downturn Fuels Altcoin Aspirations While Buybacks Hint at Crypto Revival

- Crypto markets face selling pressure amid macroeconomic uncertainty, with Solana (SOL) slipping below key levels despite ETF inflows. - Emerging altcoins like Apeing ($APEING) leverage whitelist programs to attract early adopters, promising high-conviction growth potential. - Institutional buybacks ($50M by Upexi , $10M by Antalpha) signal confidence in long-term crypto value despite short-term volatility. - Grayscale warns Q4 risks persist despite staking ETF optimism , as AI-driven trading experiments

South Korea's 'First-In, First-Out' Approach to Crypto Intensifies AML Enforcement

- South Korea's FIU intensifies crypto AML enforcement, sanctioning exchanges like Upbit, Korbit, and Bithumb for compliance failures. - A "first-in, first-out" penalty model targets inspected exchanges sequentially, with Dunamu fined $24.35M and operational restrictions in November 2025. - Fines could reach tens of billions of won per platform, aiming to standardize global AML standards while delaying a crypto tax regime until 2027. - The crackdown faces mixed reactions, balancing stricter oversight with

Bitcoin Updates Today: As Bitcoin Falters, AI Partnerships Highlight Changing Market Focus

- Bitcoin's 25% monthly drop tests $80,553 support as 11 U.S. ETFs report $3.79B outflows amid heightened gamma-driven selling and thinning liquidity. - Binance's Richard Teng frames volatility as "healthy consolidation," noting crypto's 100%+ 2024 gains despite macro risks and uncertain Fed policy. - Market makers face amplified swings below $85,000 due to short-gamma positions, while Deutsche Bank links selloff to regulatory stagnation and profit-taking. - Bitcoin Munari's $0.10 token presale and C3.ai's

Ethereum News Update: Ethereum Faces $2,900 Test as $531 Million in Liquidations Threaten $10,000 Ambitions

- Ethereum faces $2,900-$2,700 volatility threshold, with $531M short liquidation risk above and $988M long liquidation risk below. - Bearish momentum intensifies as Binance outflows and $350M daily liquidations accelerate downward pressure below $2,800 support. - Long-term forecasts project $10,000 by 2030 driven by Ethereum 2.0 upgrades, deflationary mechanics, and institutional adoption like BitMine's $11.2B ETH stake. - Aztec's decentralized L2 launch and GENIUS Act regulatory proposals highlight Ether

Trending news

MoreBitget Daily Digest (Nov 25) | Grayscale XRP ETF and Franklin XRP ETF go live; Public companies bought a net $13.4M BTC last week; U.S. September PCE rescheduled to December 5, and Q3 GDP advance report canceled

Solana Update: Market Downturn Fuels Altcoin Aspirations While Buybacks Hint at Crypto Revival