Key Notes

- DOGE open interest dropped 1.5% to $1.43 billion as traders closed $20 million in futures positions following Musk's announcement.

- The long-short ratio declined to 0.98, indicating new futures contracts are predominantly bearish bets against the memecoin.

- Technical indicators show DOGE trapped below three key moving averages with MACD signaling persistent downside momentum despite mild RSI recovery.

Dogecoin DOGE $0.15 24h volatility: 4.0% Market cap: $23.16 B Vol. 24h: $1.82 B price remained muted below $0.15 on Nov. 24, breaking its historical tendency to rally during bullish announcements from Elon Musk. The Tesla CEO revealed on Nov. 23 that a secret AI unit within the carmaking firm achieved a significant breakthrough in AI chip production.

Most people don’t know that Tesla has had an advanced AI chip and board engineering team for many years.

That team has already designed and deployed several million AI chips in our cars and data centers. These chips are what enable Tesla to be the leader in real-world AI.

The…

— Elon Musk (@elonmusk) November 23, 2025

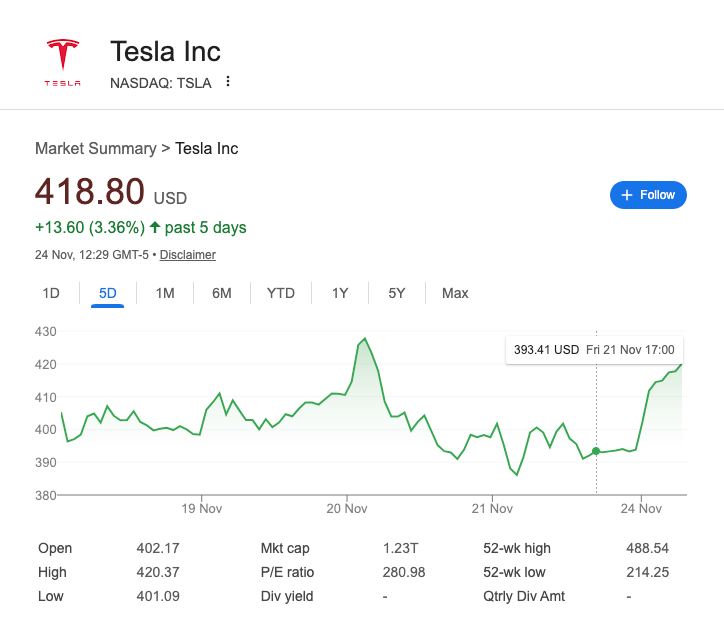

Musk notably raised eyebrows, emphasizing that Tesla is now positioned to surpass the combined output of existing players like NVIDIA and TSMC. The statement fueled aggressive bidding on Tesla shares. The TSLA stock jumped 7.5% on Nov. 24, trading at $420, lifting its market capitalization to $1.2 trillion, according to Yahoo Finance data .

Tesla (TSLA) Share price | Source: Yahoo

Tesla (TSLA) share price rose 7% on Nov. 24 after Elon Musk confirmed breakthrough in AI chips in manufacturing on Nov. 23.

However, bullish sentiment around Tesla failed to spill into Dogecoin markets. DOGE traded within a tight $0.14 to $0.15 zone as speculative traders reacted defensively to Musk’s announcement.

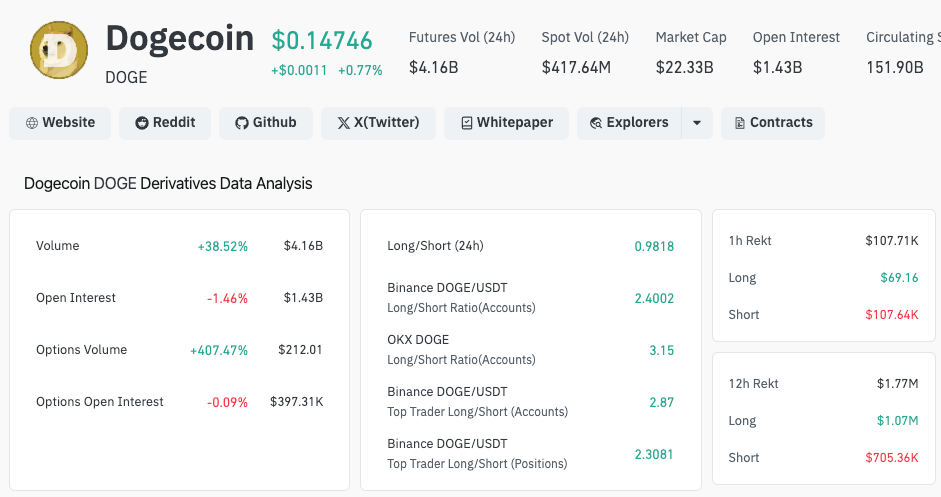

Dogecoin derivatives market analysis, Nov. 24, 2025 | Source: Coinglass

Coinglass data shows DOGE open interest fell 1.5% in the last 24 hours to $1.43 billion. Traders closed roughly $20 million in futures positions, signaling a clear sell-the-news pattern.

More critically, DOGE’s long-short ratio declined to 0.98. This confirms most new futures contracts placed after Musk’s update leaned bearish, posing more downside risks ahead.

Dogecoin Price Forecast: Bears Hold Momentum as Indicators Track a Weak Recovery Attempt

Dogecoin trades near $0.15 after a mild green candle on Nov. 24, yet the broader structure remains firmly bearish. DOGE price continues to hover below the 5-day and 8-day SMAs just above $0.15, showing strong overhead roadblocks, further reinforced by the 13-day SMA at $0.15.

The chart shows a failed recovery near Nov. 10, marked by the green arrow, followed by renewed selling pressure highlighted by the red arrow. With that death-cross in mid-November still in place since, Dogecoin’s price rebound prospects remain in doubt.

Dogecoin (DOGE) Technical Analysis | Nov. 24

The MACD line remains below the signal line, with both sliding deeper into negative territory. This signals persistent downside momentum, despite the small price uptick on Nov. 24.

The RSI at 41.22 shows Dogecoin hovering just above oversold conditions, indicating mild buyer interest but no confirmed reversal. The RSI’s slow upward turn suggests weakening bearish pressure, but not enough to shift market structure.

If bearish traders continue pressing, DOGE price risks revisiting support near $0.145. A break below this level exposes $0.138. For bulls to regain control, DOGE must close above $0.154 and reclaim all three SMAs overhead.

next