Tether's Staking Boom Drives Rumble's Ambitious AI Cloud Growth

- Tether's 1.06M-share purchase boosts Rumble's stock 14% to $6.51, expanding its stake to 104M shares ($680M). - Rumble acquires Northern Data AG for 22K Nvidia GPUs and global data centers, enhancing AI/cloud infrastructure. - Tether supports crypto integration: $150M GPU deal, $100M ad investment, and Lightning Network/USAT support. - Despite 50% YTD decline, Rumble reports improved Q3 losses and maintains "Hold" analyst rating at $14 target. - Tether's >10% stake and voting control via Giancarlo Devasi

On Monday, Rumble Inc. (NASDAQ:RUM) saw its stock price climb 14% to $6.51 after stablecoin leader

This investment comes as

Rumble has significantly expanded its crypto offerings in recent months. The platform introduced a non-custodial crypto wallet in late 2025, allowing users to tip creators with

Despite recent momentum, Rumble’s stock is still down nearly 50% for the year, mirroring wider market headwinds. The company

Tether’s influence over Rumble goes beyond its financial investment. The stablecoin company now owns more than 10% of Rumble, with Giancarlo Devasini, who holds over 50% of Tether Holdings’ voting rights,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Kingpin Biopic Speculation: Debate Surpasses Official Verification

- Unverified rumors suggest Jackie Chan could star in Netflix's "Crypto Kingpin," a biopic about Binance founder Changpeng Zhao, fueled by an anonymous X account's claim. - Zhao, who built Binance into the world's largest crypto exchange, faces scrutiny over 2023 money-laundering charges and a controversial 2025 Trump pardon. - The speculation gained traction after Chan's upcoming crypto-themed film "The Shadow's Edge" highlighted his interest in blockchain narratives. - Neither Netflix nor Chan's team has

Bitcoin Updates Today: Fed Sends Conflicting Messages as Bitcoin Struggles at $85k—Is This a Bear Market or Just a Temporary Setback?

- Bitcoin fell below $85k, triggering record ETF outflows as Fed policy uncertainty fuels volatility. - Mixed Fed signals from officials like John Williams and Beth Hammack deepen market jitters. - Analysts split between bearish cycles predicting $36k by 2026 and bullish targets up to $1.2M. - Investors use tax-loss harvesting, while Cramer criticizes crypto optimism amid 2018-like patterns. - Macroeconomic clarity on Fed rates and inflation will determine Bitcoin’s path in coming months.

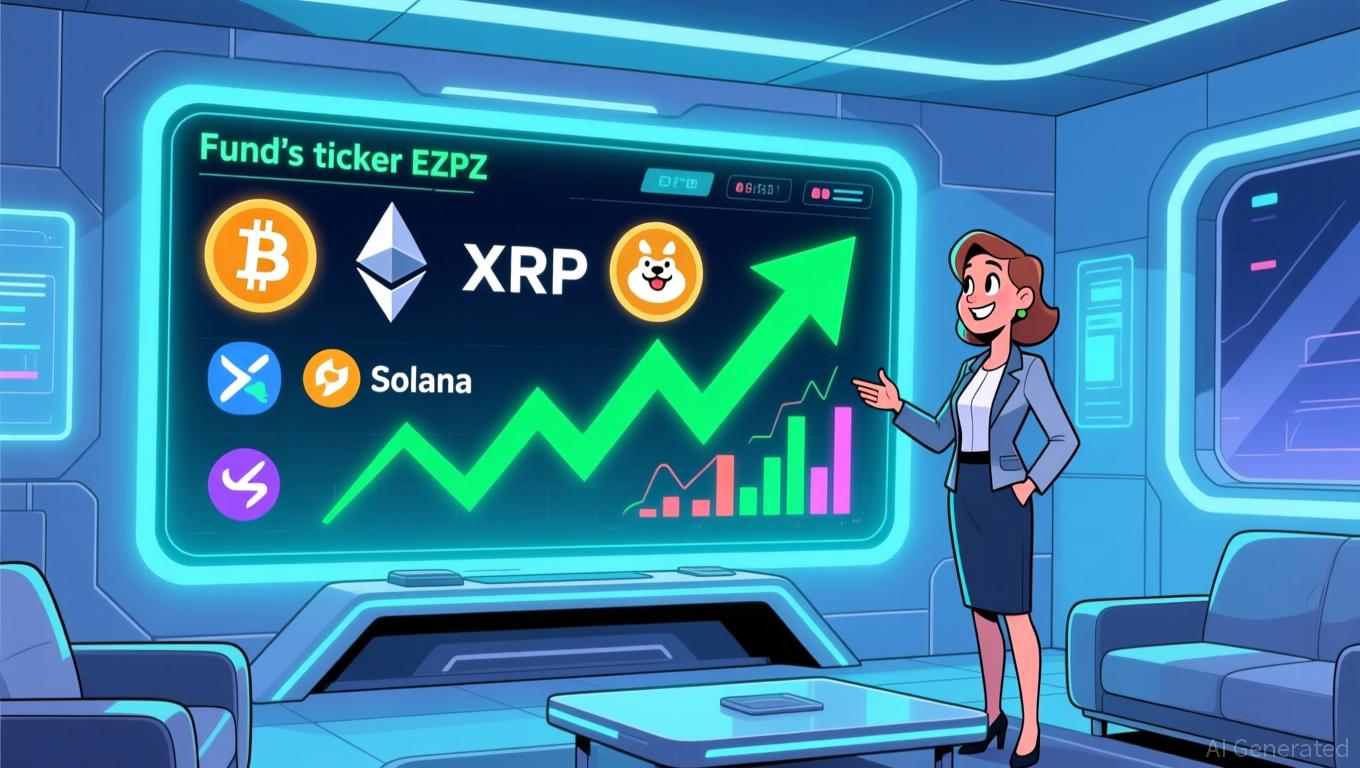

XRP News Today: SEC Approval Fuels Franklin's Broader Crypto ETF Growth

- Franklin Templeton expands its crypto ETF to include XRP , Solana , and Dogecoin from Dec 2025, reflecting rising demand for diversified digital assets. - The move follows Cboe BZX Exchange rules under SEC standards, enabling the fund to track a broader index with quarterly rebalancing and in-kind liquidity mechanisms. - Franklin also launched XRPZ ETF (a grantor trust) and joins Grayscale in offering spot altcoin exposure, coinciding with XRP's 2.3% price rally amid institutional interest. - Over 40 cry

South Korea’s $13.8B Fintech Consolidation Connects Conventional Finance with Crypto, Aiming for Worldwide Leadership

- South Korea's Dunamu merges with Naver to form a $13.8B fintech entity, combining blockchain and payments expertise for global crypto expansion. - The stock-swap deal reduces Naver's ownership to 17% while retaining operational control through voting rights, addressing shareholder concerns. - Regulators assess the merger's compliance with anti-money laundering rules and market competition risks amid South Korea's evolving crypto regulations. - A potential 2026 Nasdaq IPO could capitalize on strong earnin