Solana shows early signs of bounce: $131 support holds line

Solana price is flashing a daily bullish divergence while holding key support at $131, suggesting early signs of strength and the possibility of a short-term reversal toward higher resistance levels.

- Momentum shift emerges as Solana steadies at a long-tested support zone

- Market behavior reflects early accumulation after extended sell pressure

- Divergence hints that downside exhaustion may be forming beneath recent lows

Solana’s ( SOL ) latest price action is showing encouraging signals after an extended period of downside pressure. A clear bullish divergence has formed on the daily chart, hinting that momentum may be shifting back toward buyers.

With price holding a major support level and several indicators showing alignment, and with Wormhole’s new Sunrise DeFi platform launching on Solana and debuting Monad’s MON as its first listing, the current structure suggests that Solana may be preparing for a relief move.

Solana price key technical points

- Daily bullish divergence forming between price and RSI

- Major support at $131 continues to act as a reaction zone

- Key resistance lies at the value area low and later at $167

SOLUSDT (1D) Chart, Source: TradingView

SOLUSDT (1D) Chart, Source: TradingView

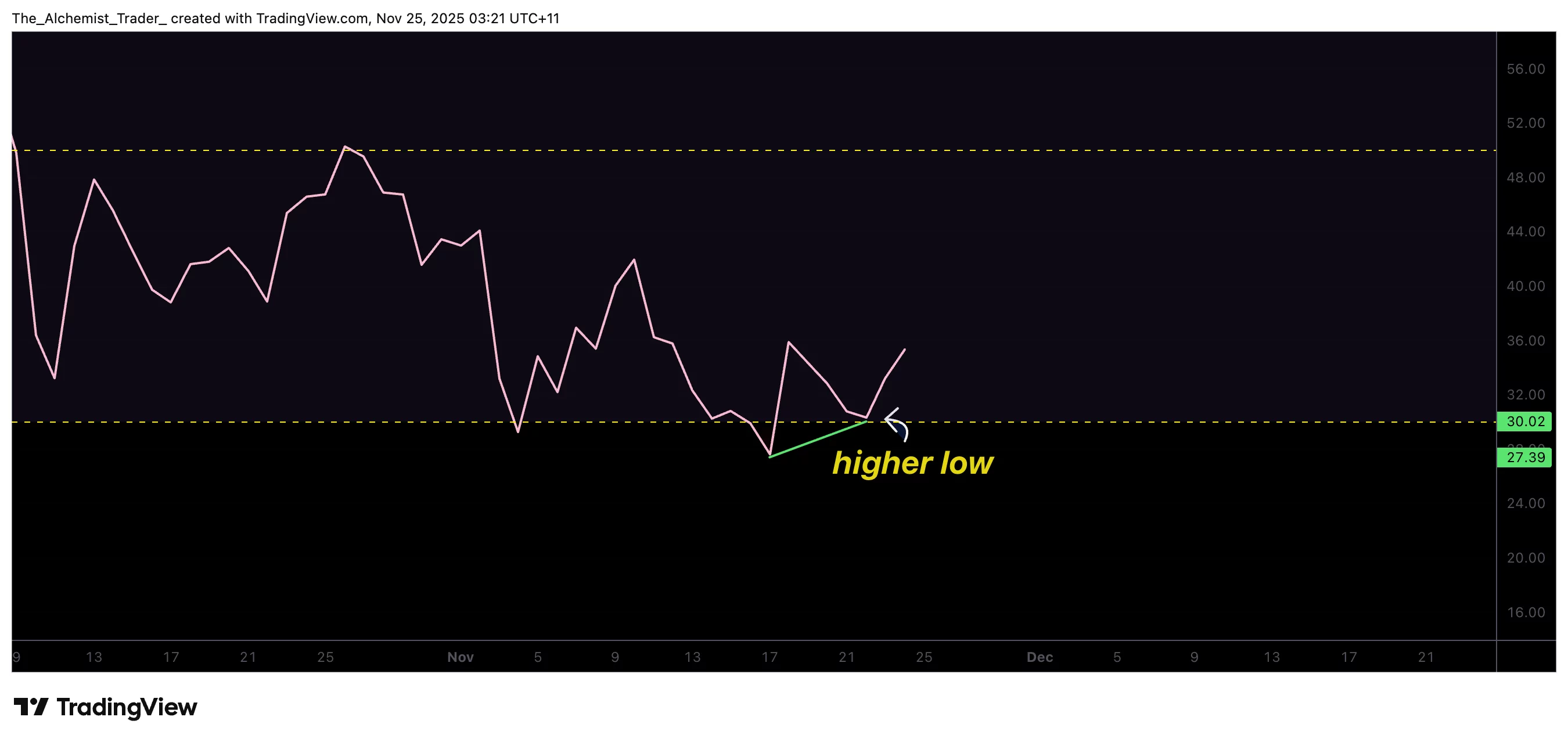

Solana is currently printing one of the most reliable early-reversal signals in technical analysis: a bullish divergence on the daily time frame. While price has recently formed a lower low, the RSI has created a higher low. This separation between momentum and price often suggests that sellers are losing strength even as price continues drifting downward.

Solana RSI, Source: TradingView

Solana RSI, Source: TradingView

The $131 region has become a focal point in recent sessions. This area has held as support multiple times, with price hovering above it for several days. Such behavior typically indicates the market is entering an accumulation phase where buyers absorb selling pressure before attempting a shift in direction.

If this support continues to hold, the next key level to watch is the value area low. Reclaiming this region would signal that buying pressure is returning, and that Solana may be preparing for a rotation toward the next significant resistance at $167. This level aligns with high-time-frame resistance and has historically acted as a significant decision point for trend continuation or rejection.

With new Solana ETFs from Grayscale and VanEck launching amid rising volatility, market flows may also help shape how the price reacts at this key level.

Price action and momentum indicators are now converging, suggesting a short-term reversal is becoming more likely. Bullish divergences often appear at the end of aggressive sell-offs, and Solana’s recent behavior fits this pattern. While confirmation is still pending, early signals suggest a potential shift in market sentiment.

Price action

If Solana maintains support at $131 and activates the bullish divergence, a move toward $167 may follow. A loss of support would delay the reversal and return the asset to a bearish continuation phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Senate Deadlock Over CLARITY Act Triggers Volatility in Crypto Markets

- Bitcoin fell below $82,000, losing $1 trillion in value due to macroeconomic risks and stalled U.S. crypto regulation (CLARITY Act). - Federal Reserve's delayed rate cuts and political gridlock over CLARITY Act deepened uncertainty, eroding market confidence. - Firms introduced leveraged tools and AI staking to navigate volatility, highlighting sector resilience amid leverage risks. - Deutsche Bank warned Bitcoin's 46% Nasdaq correlation weakens its value proposition, while political crypto advocacy grow

HYPE Token's Rapid Rise: Could This Be the Next Big Meme Coin or Just a Temporary Trend?

- Hyperliquid's HYPE token surged 51.8% in November but faced a 37.3% correction, highlighting crypto's volatile hype cycles. - Technical indicators show conflicting signals: neutral RSI (46.206) vs. bearish moving averages and a looming $327M token unlock on Nov 29, 2025. - Whale activity reveals divided market sentiment: $51.65M in short positions vs. $9.51M accumulation, with no clear social media-driven narrative to sustain momentum. - Analysts caution HYPE resembles a speculative fad rather than a mem

The Growing Buzz Around Hyperliquid: Is It Shaping the Future of DeFi Trading?

- Hyperliquid partners with Paxos and LayerZero to launch USDG0, an omnichain stablecoin bridging institutional-grade stability and DeFi liquidity across multiple blockchains. - The initiative enhances retail access to compliant, cross-chain trading while attracting institutional interest, but faces technical risks like HYPE's head-and-shoulders pattern and impending "death cross" indicators. - HYPE's 6.1% price rebound from tokenized equities and buybacks contrasts with broader market volatility, yet whal

AAVE rises by 0.88% as renewed whale accumulation and institutional purchases boost market confidence

- Aave (AAVE) rose 0.88% in 24 hours to $180.11, with a 9.35% weekly gain despite a 21.18% 30-day decline. - Whale activity surged, adding $45.5M in Aave holdings via 24,000 tokens at $165, signaling strategic accumulation amid price corrections. - Institutional buyer Multicoin added 61,637 AAVE ($10.94M) at $177, continuing its $49.52M accumulation strategy despite $13.9M unrealized losses. - Combined whale and institutional buying at multiple price points suggests Aave may be nearing a short-term floor a