Solana ETFs Hit 20-Day Inflow Streak

Solana is doing something unusual in a shaky market: attracting uninterrupted institutional capital. While traders are still de-risking across the board, the U.S. spot Solana ETFs have just logged their twentieth consecutive day of net inflows, signalling that the deeper pockets are positioning for a longer-term payoff.

What’s driving Solana’s 20-day inflow streak?

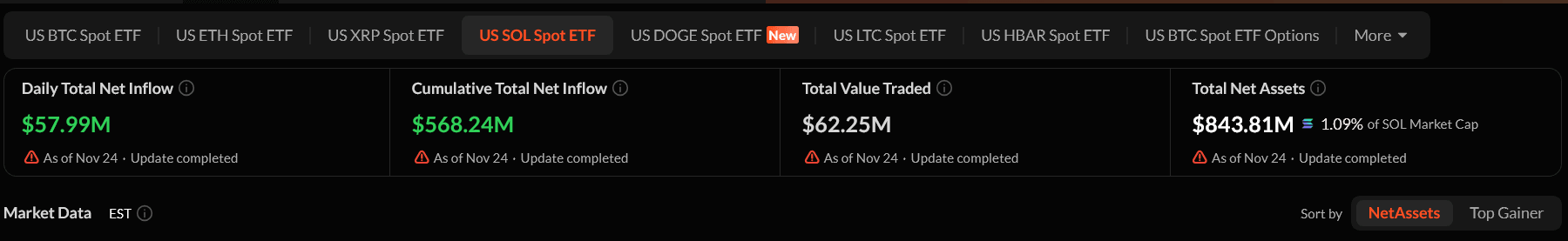

Spot Solana ETFs recorded $58 million in inflows on Monday, continuing a straight line of positive momentum since these funds launched in late October. Bitwise’s BSOL led the day with $39.5 million, marking its third-largest daily inflow since going live and the most impressive since November 3.

With this, Solana ETFs have now attracted $568.24 million in total inflows across six funds. Collectively, they hold $843.81 million in net assets, representing roughly 1.09 percent of Solana’s entire market cap. For a relatively new ETF class, that’s a serious show of confidence.

Nick Ruck from LVRG Research summed it up well: institutional investors expected a softer response, especially in a declining crypto market, but Solana’s ETFs beat those expectations. The consistency of these inflows points to Solana’s growing maturity as a blue-chip asset that can sit alongside Bitcoin and Ethereum in institutional portfolios.

Why are institutions choosing Solana right now?

What this really means is that Solana is carving out a practical role in the tokenization and DeFi infrastructure race. Jeff Mei from BTSE noted that traditional financial institutions are actively choosing Solana for tokenization use cases, including products like xStocks that bridge U.S. equities and digital asset rails.

That institutional vote of confidence matters. It reinforces the idea that Solana’s ecosystem isn’t just thriving on speculation; it’s being integrated into real-world financial products.

Will these inflows lift Solana’s price?

Solana’s token price is still falling in line with the wider market downturn. Selling pressure is visible across almost every layer of crypto, and ETFs are not immune to macro sentiment.

But these inflows do something important beneath the surface. They create a tightening effect on circulating supply and establish a reliable cushion of demand. Once the broader de-risking phase slows down, the ETF flows can play a crucial role in kick-starting a recovery.

Ruck believes this foundation sets up Solana for a rebound once the market stabilizes. And historically, persistent ETF inflows have been a reliable precursor to medium-term price strength.

XRP and Dogecoin ETFs also saw movement

While Solana captured the spotlight, $XRP ETFs logged $164 million in net inflows on Monday, their second-highest day ever after the November 14 record of $243 million. Both Grayscale and Franklin Templeton ETF products pulled over $60 million each.

On the other side, Grayscale launched the first spot Dogecoin ETF (GDOG) . Its opening day saw zero net flows, though trading volume hit $1.41 million. Markets are watching closely to see whether DOGE can build the same consistency as Solana or XRP.

Solana’s twenty-day streak sends a clear message: institutional investors haven’t lost confidence. In fact, they’re doubling down. The price may not show it right now, but ETF flows are often a leading indicator rather than a trailing one.

If the market shakes off its current risk-off mood, $SOL is positioned to be one of the earliest and strongest rebounders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

General-Purpose AI Versus Specialized Experts: The Pivotal Showdown in E-Commerce

- Perplexity AI and PayPal launch a free AI shopping tool enabling personalized searches and direct purchases from 5,000+ merchants via PayPal integration. - The tool challenges OpenAI's paid Instant Checkout by offering fee-free transactions, though Perplexity remains silent on monetization strategies. - Niche startups like Onton and Daydream argue vertical-specific AI models trained on curated datasets outperform generic tools in fashion and home goods markets. - Legal risks emerge as Perplexity faces Am

Bitcoin News Update: Bitcoin Drops 30% Amid ETF Withdrawals and Broader Economic Challenges

- Bitcoin fell nearly 30% from its October peak to $85,100 amid massive ETF outflows and macroeconomic pressures, with U.S. spot Bitcoin ETFs losing $3.79 billion in November alone. - BlackRock's iShares Bitcoin Trust (IBIT) led redemptions at $2.1 billion, while a stronger dollar and Fed policy uncertainty worsened selling pressure in risk-off markets. - Technical indicators show oversold conditions (RSI: 25.47), yet ARK Invest added $39 million to crypto-linked stocks, maintaining a long-term bullish sta

"Peaceful prospects push oil prices lower, yet Russia's firm position and ongoing attacks continue to unsettle markets"

- Oil prices fell sharply as U.S.-brokered peace talks between Ukraine and Russia raised hopes for lifting Western sanctions on Russian energy exports. - Zelenskiy's potential U.S. visit and revised peace plans contrast with Russia's unconfirmed acceptance and ongoing missile strikes on Kyiv. - Analysts warn of 2M bpd global oil surplus risks by 2026 if sanctions ease, with Russian oil stored in tankers threatening market rebalancing. - European gas prices dropped below €30/MWh while metals markets showed

Zcash News Today: Regulatory-Ready Privacy Fuels Zcash's Remarkable Surge

- Zcash (ZEC) surged to top Coinbase's November 2025 search rankings, outpacing Bitcoin and XRP amid a 10-fold price spike and $10B+ valuation. - The rise stems from 2024 halving-driven scarcity, 27% shielded transaction adoption, and NU6.1 governance upgrades allocating 20% block rewards to community development. - Regulatory clarity and optional privacy features (via view keys) positioned Zcash as a compliance-friendly alternative to fully opaque coins like Monero after its 2025 exploit. - Analysts debat