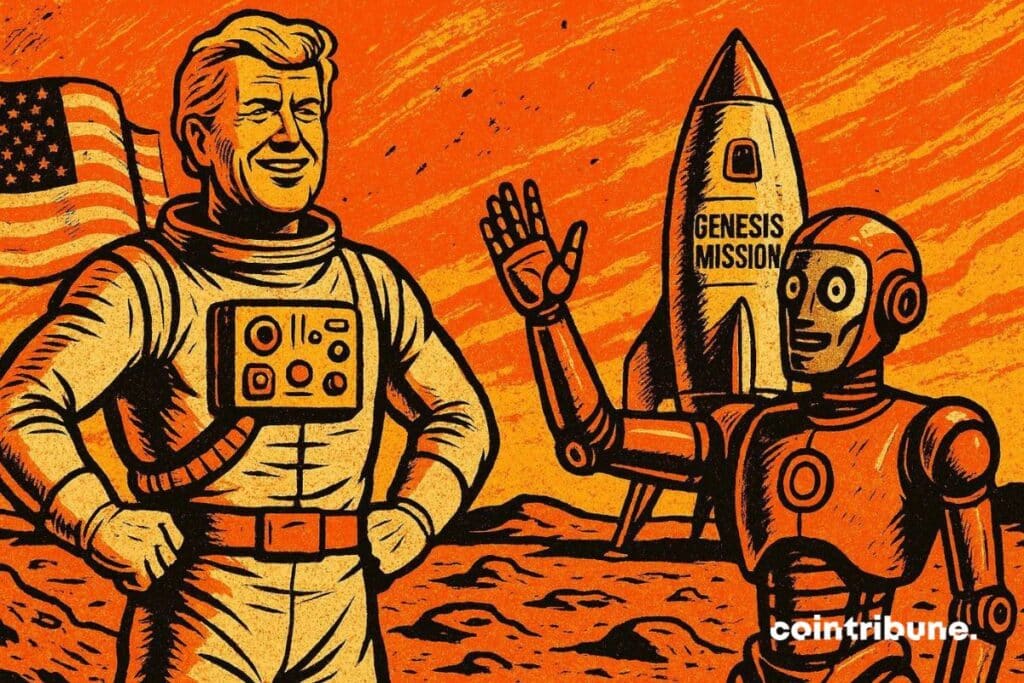

Trump Signs "Genesis Mission" Order to Boost AI Innovation in the United States

On November 24, 2025, Donald Trump signed an executive order launching the “Genesis Mission“, an ambitious federal project to accelerate research in artificial intelligence (AI). Compared to the Apollo program, this initiative aims to position the United States as the global leader in technological innovation. What are its objectives, key players, and implications for the future?

In brief

- Donald Trump signs the “Genesis Mission” executive order to accelerate AI research in the United States.

- The Genesis Mission relies on public-private partnerships with companies such as Nvidia, AMD, and AWS.

- The initiative could indirectly benefit AI-related cryptocurrencies, while creating new challenges for Bitcoin.

The “Genesis Mission“: a federal revolution for AI by Trump

The “Genesis Mission” is a federal initiative aiming to centralize American scientific resources to stimulate advances in artificial intelligence (AI). Led by the Department of Energy, the decree signed by Donald Trump foresees the creation of a digital platform integrating:

- supercomputers;

- federal data sets;

- research infrastructures.

The objective is clear: accelerate discoveries in strategic fields such as energy, national security, and semiconductors.

To achieve this, the Trump administration relies on partnerships with tech giants. Nvidia, AMD, and AWS have already announced massive investments, such as Amazon’s $50 billion commitment for AI-dedicated data centers. This public-private collaboration recalls great federal programs of the past, like the Manhattan Project or the space race.

The platform, named “American Science and Security Platform“, must demonstrate operational capability within nine months. It will allow researchers to access advanced modeling tools and unprecedented computing resources. All this while ensuring the protection of sensitive data.

AI and crypto: a winning duo for the US economy?

The alliance between AI and blockchain could become a pillar of technological innovation in the United States. Indeed, the “Genesis Mission” decree signed by Donald Trump emphasizes areas where blockchain can play a key role. Notably, data security and process automation. Smart contracts, for example, could optimize energy resource management, while decentralized ledgers would ensure research traceability.

For the crypto sector, this synergy represents an opportunity. Projects integrating AI tools, such as Fetch.ai or SingularityNET, could benefit from increased visibility and federal support. Growing AI adoption in government infrastructures could also encourage more favorable regulation for cryptocurrencies, strengthening their legitimacy. However, this dynamic will depend on the crypto players’ ability to meet federal requirements, especially regarding cybersecurity and compliance.

The dangers of the “Genesis Mission”: is Trump turning his back on bitcoin?

The “ Genesis Mission ” could propel AI cryptos to the forefront, relegating bitcoin to a secondary role. Projects combining blockchain and artificial intelligence align better with federal priorities than BTC, which is often seen as a simple store of value. Massive investments in AI, like those by AWS, could marginalize the crypto queen, less integrated into government initiatives.

However, bitcoin retains major assets: its status as a safe haven asset and increasing adoption by institutions (ETFs, state reserves) could limit its decline. Lastly, this initiative raises questions about the centralization of infrastructures, contrary to the decentralized ethos of cryptos, and about the environmental impact of data centers.

Donald Trump’s “Genesis Mission” could redefine technological and economic balances in the United States. While it offers unprecedented opportunities for AI cryptos, it also poses challenges in terms of regulation and environmental impact… A ticking time bomb for the climate . In your opinion, will this strategy manage to reconcile innovation and decentralized principles?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Texas Breaks New Ground as First U.S. State to Allocate $10M for Bitcoin Holdings

- Texas becomes first U.S. state to allocate $10M to a Bitcoin reserve via BlackRock's IBIT ETF, using surplus funds under Senate Bill 21. - The $5M purchase at $87,000/coin is temporary, with plans to transition to self-custody solutions by the Comptroller's office in coming months. - The move aligns with growing institutional Bitcoin adoption, mirroring Harvard and Abu Dhabi's investments, and positions Texas as a crypto-friendly policy leader. - Representing 0.0004% of Texas's biennial budget, the reser

MoonPay Sets New Benchmark in Bridging Crypto and Traditional Finance with NYDFS Charter

- MoonPay secures New York Trust Charter , joining Coinbase/PayPal in dual licensing (BitLicense + Trust) for crypto custody/OTC trading under NYDFS oversight. - The charter enables fiduciary services for institutions, aligning with NYDFS's rigorous standards and supporting MoonPay's institutional expansion goals. - Industry experts highlight the approval's significance, noting NYDFS's strict trust charter criteria and MoonPay's 30M-customer scale for accelerating crypto adoption. - Global regulatory compl

Ethereum News Update: MegaETH Halts $1 Billion Sale Amid Technical Issues Highlighting Scalability Problems

- MegaETH canceled its $1B fundraising after technical glitches caused premature deposits and KYC errors. - The protocol froze deposits at $500M, blaming spam traffic and misconfigured systems for exceeding the $250M cap. - Backed by Ethereum co-founders, MegaETH aims for 100,000 TPS with sub-millisecond latency but faces scaling challenges. - The incident highlights infrastructure risks in DeFi, with mixed reactions to the team's transparency and accountability. - MegaETH plans retroactive adjustments but

DeFi Faces Scalability Issues as MegaETH Withdraws from $1 Billion Fundraising

- MegaETH abandoned its $1B fundraising after technical failures disrupted the pre-deposit phase, including KYC errors and premature multisig execution. - The glitches allowed deposits to exceed $500M, with users exploiting website refresh spam to secure token allocations despite no asset risks. - Community reactions were mixed, praising transparency but criticizing inadequate testing, as the project now faces scrutiny over scaling capabilities. - MegaETH plans refunds and withdrawals after a prior oversub