Korean Retail Frenzy Triggers Harsh New Rules on US Leveraged ETFs

South Korea is tightening oversight of its most aggressive retail traders, introducing mandatory training for anyone who wants to trade foreign leveraged ETFs. The move follows a record surge of Korean money into high-risk US products—and growing concern that this speculative wave is distorting global markets. South Korea’s Regulators Step In After a $7 Billion

South Korea is tightening oversight of its most aggressive retail traders, introducing mandatory training for anyone who wants to trade foreign leveraged ETFs.

The move follows a record surge of Korean money into high-risk US products—and growing concern that this speculative wave is distorting global markets.

South Korea’s Regulators Step In After a $7 Billion Monthly Surge

South Korea’s Financial Supervisory Service (FSS) will require retail investors to complete a one-hour online course and a three-hour mock-trading exam before gaining access to foreign leveraged or inverse ETFs.

The policy takes effect on December 15, 2025, and aligns foreign-market rules with domestic standards.

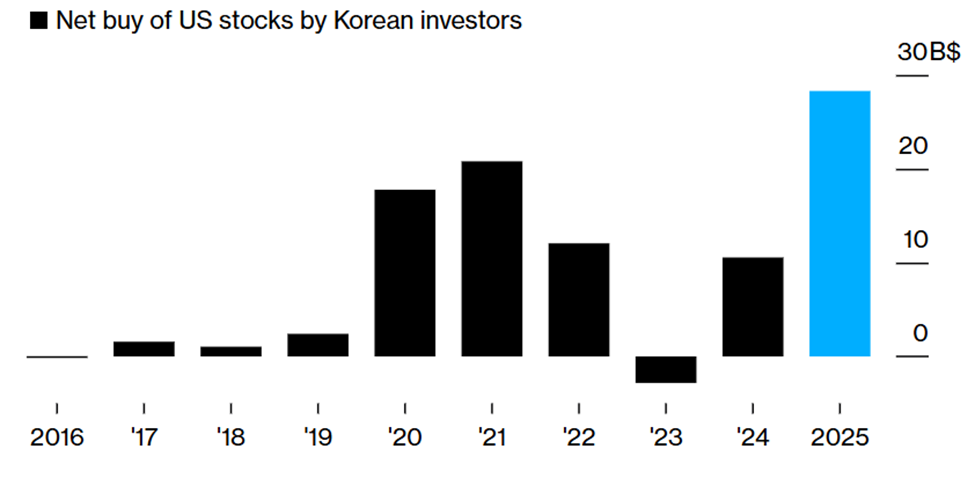

The decision follows an extraordinary influx into US leveraged ETFs. Korean retail traders invested $7 billion in these products in October alone and $30 billion year-to-date, according to data from depository and ETFGI.

Data compiled by Bloomberg shows October’s inflow was the highest monthly foreign ETF purchase on record.

Korean retail among purchases of overseas ETFs. Source:

Bloomberg data

Korean retail among purchases of overseas ETFs. Source:

Bloomberg data

Officials say the training is needed because many investors fundamentally misunderstand the mechanics of daily leveraged products. The FSS has warned that traders often treat 2× or inverse ETFs as simple linear exposures, without accounting for compounding effects and volatility decay.

According to the regulator, these factors can cause long-term returns to diverge sharply from those of the underlying asset.

“The new policy will help individual investors acknowledge some of the most basic aspects of investing,” Bloomberg reported, citing Bora Kim, head of APAC strategy at Leverage Shares.

Local Korean media further highlighted the extreme intensity of this trend, noting that individual investors, known domestically as “Seohak Ants,” have purchased 43 trillion won (about $29.3 billion) worth of US stocks this year, a record high.

October alone saw 10 trillion won ($6.8 billion) in net purchases, with another 8.3 trillion won ($5.6 billion) in November, making 2025 the largest year of outbound retail stock buying since data began.

The frenzy has also spilled into Korea’s dollar funding markets. Securities firms’ dollar repo balances have surged 15-fold since 2019 to 28.6 trillion won ($19.5 billion), driven by retail investors’ need to fund overseas stock purchases.

USD/KRW Price Performance. Source:

TradingView

USD/KRW Price Performance. Source:

TradingView

This nonstop demand for dollars has pushed the won-dollar exchange rate into the mid-to-high 1,400 range, with risks of future currency losses if the won reverses.

Korean Retail Now Moves the Needle on US Single Stocks

This regulatory shift comes amid a dramatic rise in Korean trading of US single-stock ETFs. Analysts, referencing market data, note that IONQ now trades more daily volume in Korea than Amazon, Microsoft, or Google, a remarkable contrast given the massive market-cap difference.

BREAKING (Bloomberg): People Don’t Understand What’s Happening With RETAIL Investors in South Korea $IONQ $RGTI $QBTS South Korean retail is so obsessed with US leveraged ETFs that regulators are now forcing mandatory DMV-style training just to buy them.Starting Dec 15,… pic.twitter.com/6liTz9nHIg

— Common Sense Investor (@commonsenseplay) November 24, 2025

Korean retail is heavily concentrated in leveraged single-stock ETFs tied to niche companies, not just broad tech funds.

Local media indicates that Two 2× IONQ ETFs (GraniteShares’ IONL and Defiance’s IONX) have seen outsized inflows from Korean investors seeking amplified exposure to quantum-computing stocks.

Local media reports also show that retail investors are heavily concentrated in AI, semiconductor, and big-tech bets. SOXL, the 3× leveraged semiconductor ETF, was the most purchased security by Korean retail investors this year, with net buying exceeding 1.12 trillion won ($765 million).

NVIDIA, Meta, and Alphabet followed, further confirming Korea’s intensifying concentration in US tech momentum trades.

Accordingly, the top 10 stocks purchased in November include SOXL, Nvidia, Meta, Alphabet, METU, IONQ, Palantir, TQQQ, BitMine, and QQQ.

TrackInsight data shows that leveraged single-stock ETFs experienced weekly swings of 40% or more in October, further attracting speculative traders.

This behavior marks a departure from earlier Korean trends, which favored mega-cap tech names such as Apple and Tesla.

As of August 2025, 28.7% of all Korean retail overseas ETF holdings were in leveraged or inverse funds, a concentration significantly higher than the global norm.

Why Regulators Fear a Blow-Up

The prevailing sentiment is that Korean investors are increasingly viewing foreign ETFs as a “quick and easy way to create wealth.” However, leveraged ETFs automatically rebalance daily, which means they can magnify both rallies and losses.

In stressed markets, this can lead to cascading liquidations and performance that deviates sharply from expectations.

This means that the current environment may end in tears if volatility spikes. The risk is magnified by some traders using margin, heightening the potential for forced unwinds.

While the new training aims to improve investor understanding, it is also worth probing whether a few hours of coursework can meaningfully reduce risk-taking in a market culture that embraces high leverage.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Monad's MON Shows Strength Despite Market Downturn, Experts Caution About Potential Threats

- Monad's MON token surged over 80% to $0.046, defying weak crypto markets driven by strong on-chain activity and stable holders. - $269M Coinbase sale and 4.73B airdrop anchored initial liquidity, with 7.5% supply unlocked at $0.025 setting $25B FDV. - Analysts warn 50%+ locked supply until 2029 risks medium-term selling pressure, while price forecasts range from $0.02 to $0.25 by 2027. - EVM compatibility and 2029 token locks differentiate Monad, but adoption and developer activity remain unproven despit

MoonPay’s New York License Strengthens the Connection Between Conventional and Digital Financial Systems

- MoonPay secures New York Trust Charter , joining Coinbase/PayPal in holding both BitLicense and trust authority for crypto custody/OTC trading. - The charter enables institutional-grade fiduciary services and potential stablecoin issuance under federal-compliant frameworks like GENIUS Act. - With 30M+ users and 500+ enterprise clients, MoonPay's dual licensing strengthens its role as a bridge between traditional finance and crypto infrastructure. - The move follows strategic acquisitions (Helio, Iron) an

Polymarket Receives CFTC Authorization, Paving the Way for Institutional Crypto Trading in the United States

- Polymarket secures CFTC approval to resume U.S. operations via intermediated trading through FCMs and traditional market infrastructure. - The $112M QCX acquisition provided regulatory compliance infrastructure, ending CFTC investigations and enabling direct brokerage onboarding. - Enhanced surveillance tools and regulatory reporting meet CFTC requirements, positioning Polymarket to compete with Kalshi and attract $2B ICE investment. - The approval aligns with Biden-era crypto openness, expanding institu

HYPE price rises as Paxos taps Hyperliquid, Plume, and Aptos for the USDGO stablecoin