Key Market Information Gap on November 26th - A Must-Read! | Alpha Morning Report

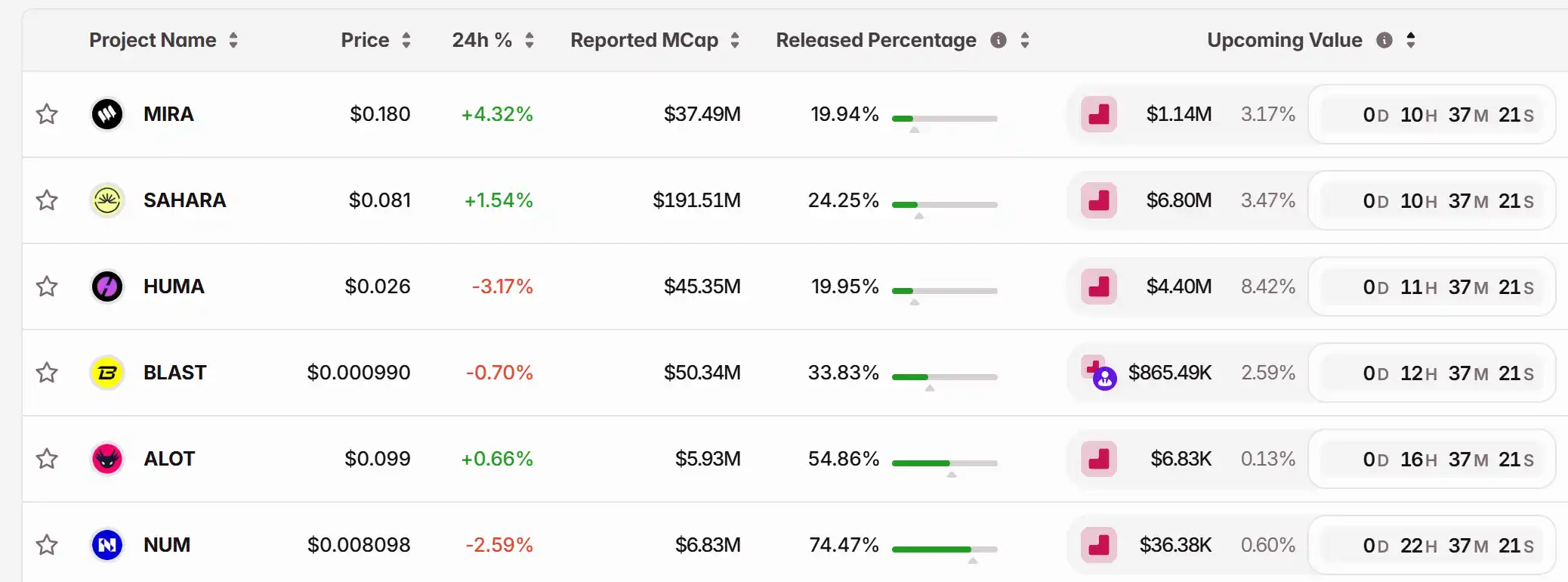

1. Top News: Fed Dovishness Outweighs Hawkishness, Rate Cut Expectations Surge in a Matter of Days 2. Token Unlocking: $MIRA, $SAHARA, $HUMA, $BLAST, $ALOT, $NUM

Featured News

1.Fed Dovishness Trumps Hawkishness, Rate Cut Expectations Soar in Days

2.MON Surges Above $0.046, Over 80% Rise from Public Sale Price

3.US Stock Market Opens Lower and Rises, Crypto Stocks Mostly Down, BMNR Down Over 7%

4.MegaETH Scaling Operation Error, Allegedly Front-Run by chud.eth, Total Capacity Now Revised to $5 Billion

5.JPMorgan "Blacklists" Strike CEO, Reignites US Crypto Industry Concerns Over Debanking Wave

Articles & Threads

1. "ChainOpera AI Interview: How Collective Intelligence Shapes Superintelligence"

By 2024, the AI Agent wave has swept through the worlds of tech and crypto. While everyone's attention is focused on how OpenAI's GPTs are making AI more "useful," a team led by Amazon AI scientist and USC professor Salman Avestimehr is using the power of Crypto to tackle a more disruptive issue: Who gets to own and control AGI (Artificial General Intelligence)?

2. "The Undissolved DOGE: What Is It Still Up To?"

Reuters reported that the news of the "US Government Efficiency Department DOGE Disbanded" was actually fake news. According to Reuters on November 23, a senior official in the Trump administration, U.S. Office of Personnel Management (USOPM) Director Scott Kupor, publicly confirmed this news. This news quickly caused a stir. In Reuters' description, DOGE's gradual decline today starkly contrasts with the government's full-scale promotion of its effectiveness over the past few months: Trump and his advisors, as well as cabinet members, early on promoted it on social media, with Musk even waving a chainsaw at one point to advocate for reducing government positions. However, a dramatic scene quickly unfolded as this seemingly explosive report sparked controversy and various clarifications.

Market Data

Daily Market Overall Funding Heat (reflected based on funding rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Europe Faces a Pivotal Moment in AI: Embrace Change or Trail Behind the US?

- The IMF outlines a strategic roadmap for Europe to harness AI's transformative power, aiming to boost productivity and economic growth through structural reforms. - AI could yield 1.1% cumulative productivity gains over five years, but disparities risk widening gaps unless adoption becomes more affordable and accessible. - Key recommendations include deepening the EU single market, strengthening financial markets, and aligning energy policies with green transition goals. - Long-term AI adoption could dri

Texas buys $5mn BTC ETF, pushes for Bitcoin reserve plan

Turning Time Into Computing Power: Redefining the Value of Consumption and Participation

Bitcoin Updates Today: Despite Bitcoin’s Drop, Positive Indicators Emerge—Could a Recovery Be Near?

- Bitcoin fell to $82,000, but a hidden bullish divergence on weekly charts suggests easing selling pressure and potential rebound. - Institutional outflows ($1.45B in ETFs) and surging on-chain losses ($523M/day) highlight deteriorating market conditions and panic selling. - Mid-sized investors (100-1,000 BTC) are accumulating while whales (1,000-10,000 BTC) distribute, signaling supply redistribution. - Key support at $80,000 and $85,389 could trigger stabilization, but sustained buying from institutions