The likelihood of a bitcoin short squeeze to $90,000 increases as funding rates turn negative

After dropping from $106,000 to $80,600, Bitcoin has stabilized and started to rebound, sparking discussions in the market about whether a local bottom has been reached. While whales and retail investors continue to sell, mid-sized holders are accumulating. Negative funding rates suggest a potential short squeeze. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Negative Bitcoin funding rates and large short liquidity zones may indicate that a short squeeze targeting $90,000 or even higher is brewing.

Bitcoin is showing signs of stabilization after last week's sharp correction, with the price rebounding towards the $87,000 to $90,000 range after dropping from $106,000 to $80,600 in just 10 days.

This rebound has reignited discussions about whether BTC has reached a local bottom, even as key whale groups continue to offload their holdings.

Key Takeaways:

- Both whale and retail BTC holders remain net sellers, but mid-sized holders continue to accumulate.

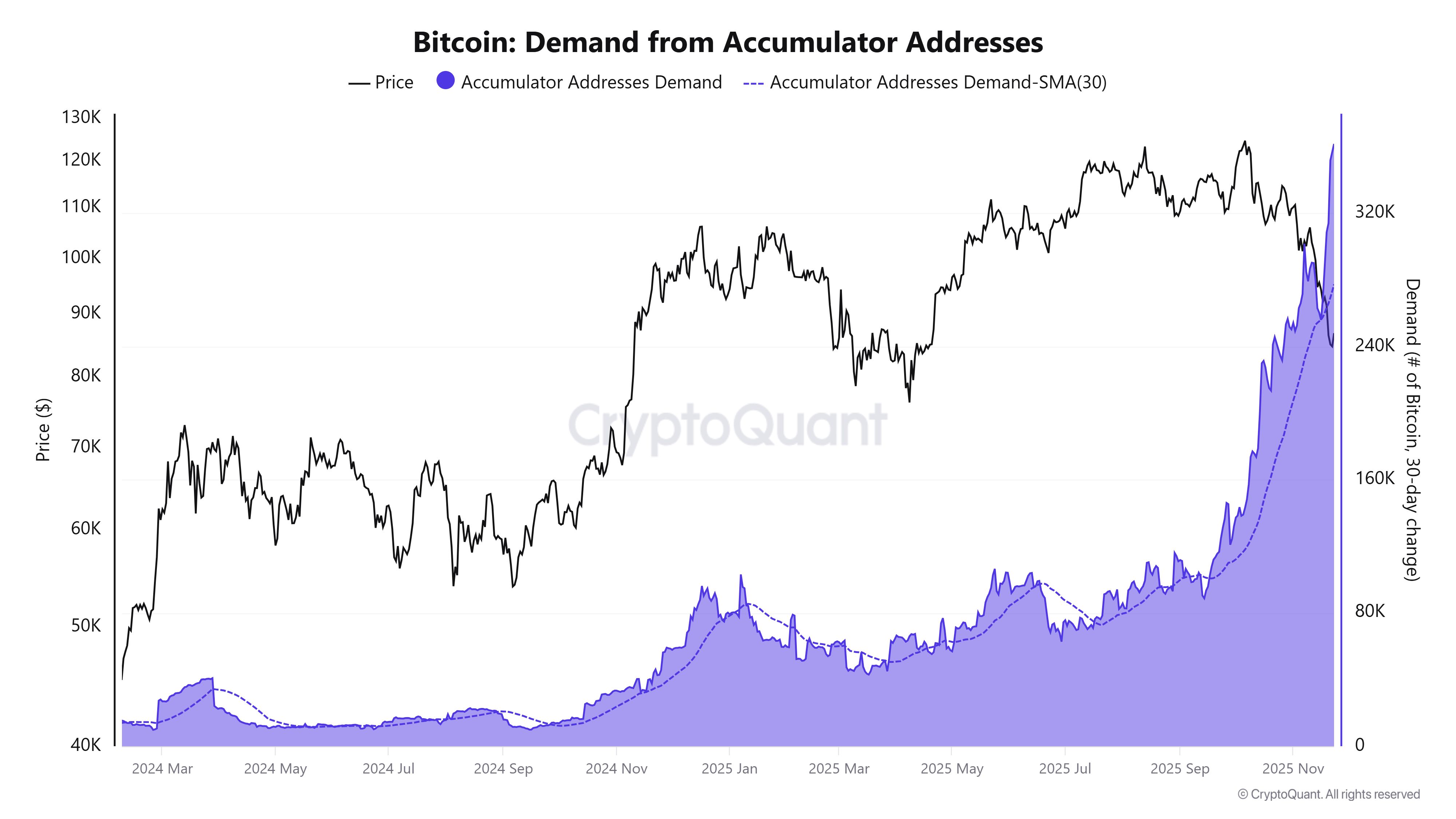

- Demand from "accumulation addresses" has reached a record 365,000 BTC, suggesting a return of long-term confidence.

- Negative funding rates indicate signs of trader capitulation and increase the likelihood of a short squeeze.

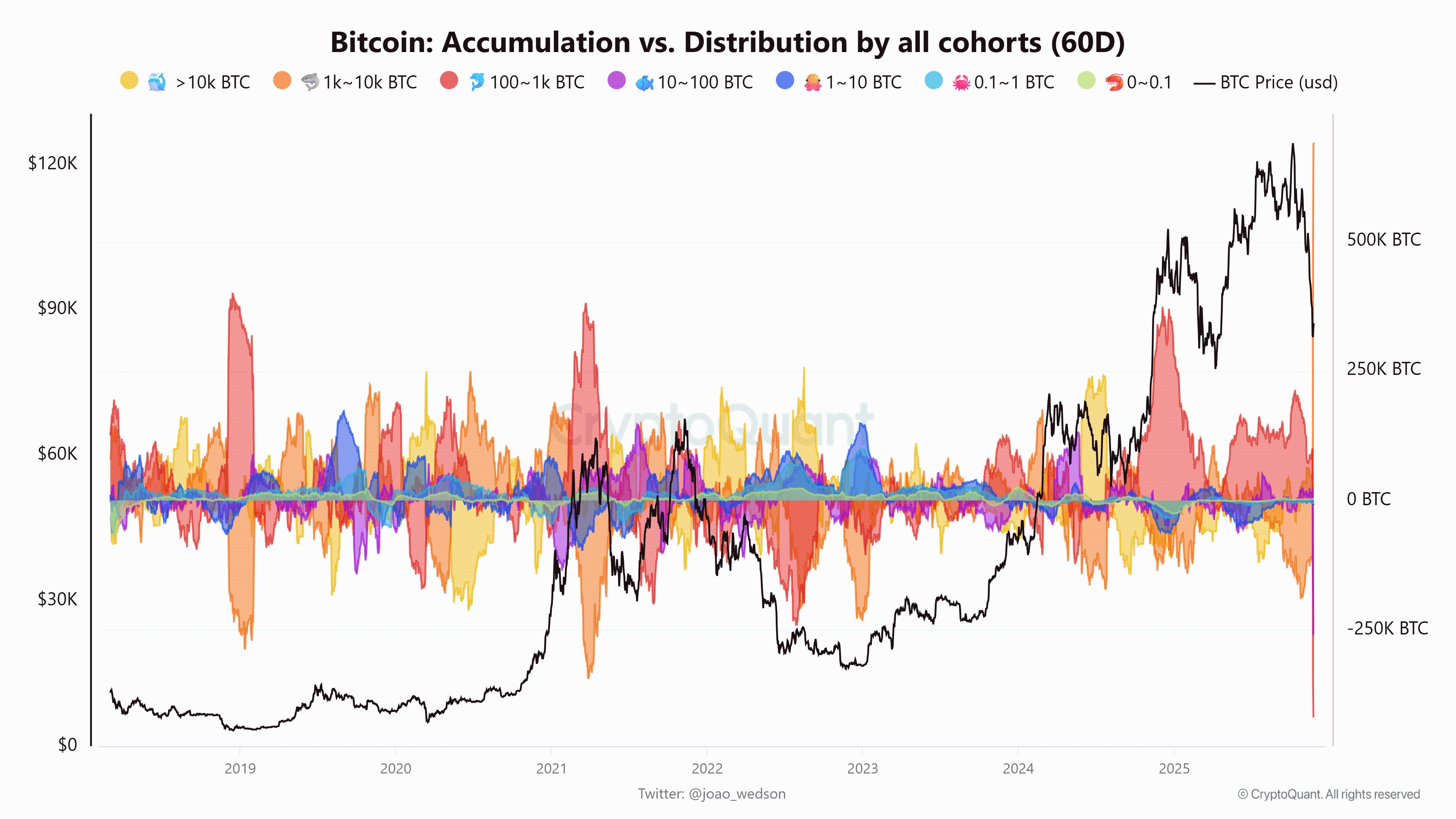

BTC Distribution Meets Slow-Growing Accumulation Trend

On-chain data indicates that this is a market defined by inconsistent behaviors among different holder groups.

Wallets holding more than 10,000 BTC, as well as institutional groups holding 1,000–10,000 BTC, have been consistently distributing throughout the downturn, exacerbating structural weakness.

Retail wallets (holding less than 10 BTC) have also been net sellers over the past 60 days, providing little support during the decline.

Bitcoin accumulation vs distribution by all cohorts. Source: CryptoQuant

In contrast, mid-sized holders with 10–100 BTC and 100–1,000 BTC have continued to accumulate throughout the correction phase, absorbing some of the selling pressure.

As demand from Bitcoin "accumulation addresses" surged to an all-time high of 365,000 BTC on November 23 (up from 254,000 BTC on November 1), these groups have become increasingly prominent, showing a significant increase in conviction-based demand.

The interaction between these groups may help stabilize BTC after the initial decline, laying the groundwork for a rebound towards $90,000.

Bitcoin demand from accumulator addresses. Source: CryptoQuant

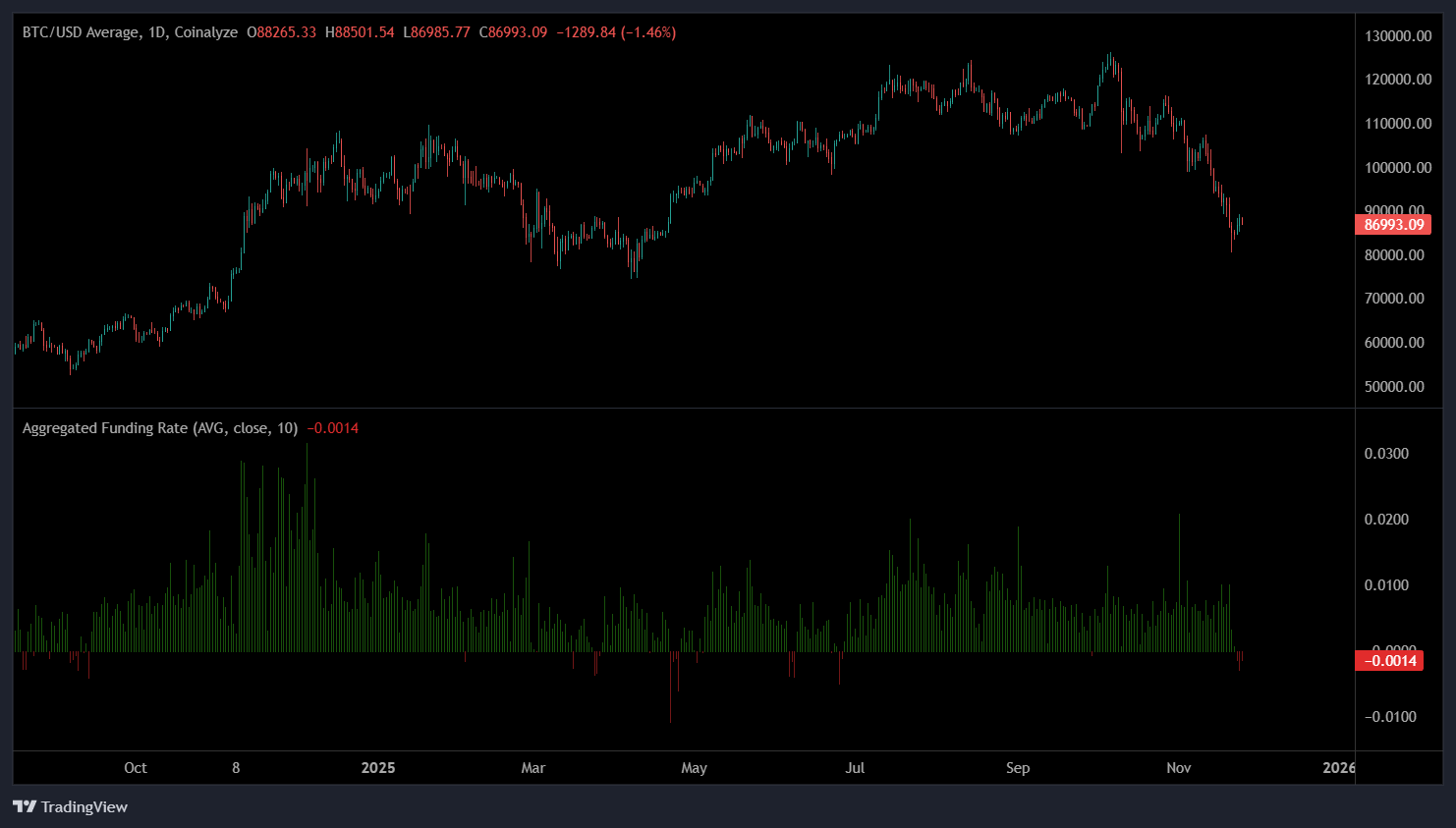

Negative Funding Rates Suggest a Short Squeeze

The futures market played a key role in the recent plunge: a cascade of long liquidations, forced selling, and margin calls drove BTC rapidly towards the $80,000 range. Now, futures data indicates that leveraged longs are showing signs of exhaustion.

Aggregated Bitcoin funding rate. Source: Coinalyze

According to CryptoQuant, traders who tried to go long during the correction "have ultimately been completely squeezed out," with daily funding rates cooling significantly and briefly turning negative.

With Binance's neutral funding rate hovering around 0.01%, any drop below this level indicates short dominance, which typically occurs when traders capitulate in the later stages of a correction.

Crypto analyst Darkfost warns that if shorts continue to add positions while BTC rises slowly, the market could enter a classic "disbelief phase," potentially triggering a powerful short squeeze.

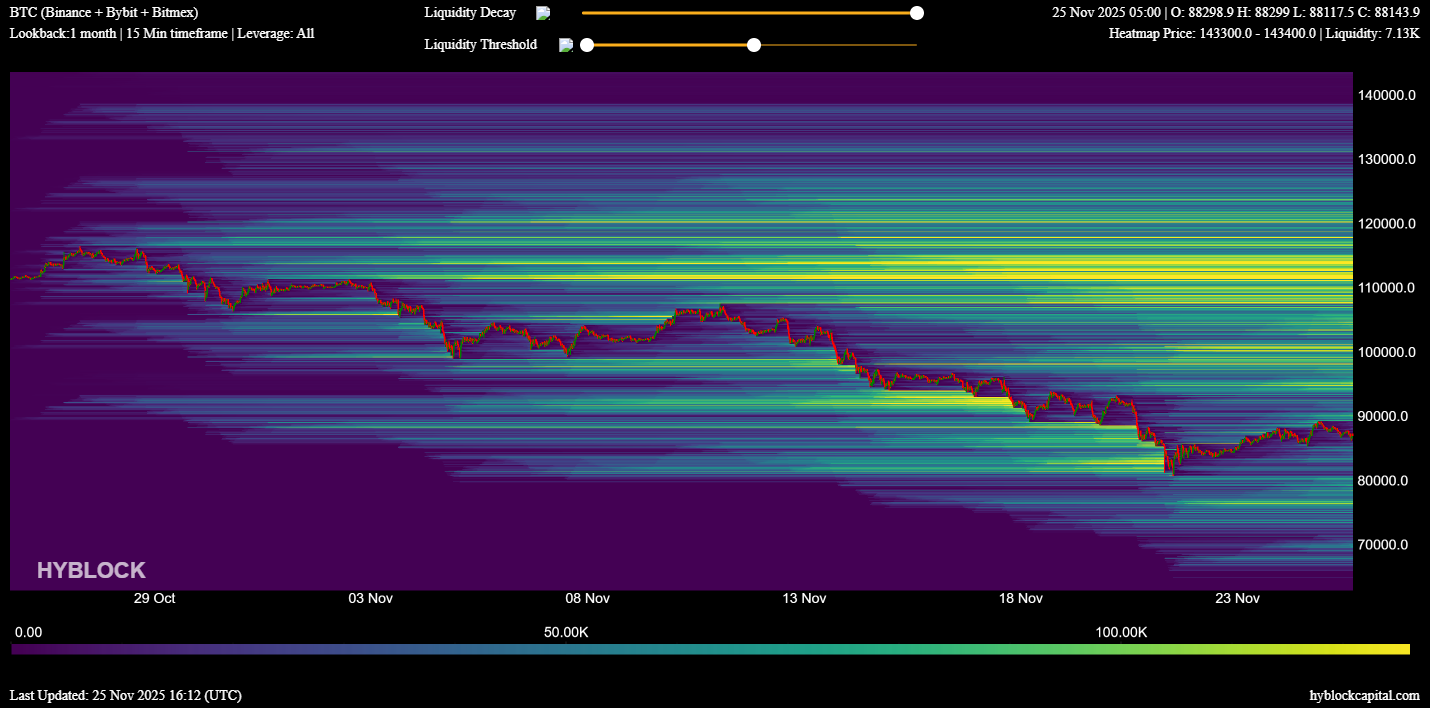

Liquidation heatmaps from Hyblock Capital also support this view: near $80,000, long liquidations have accumulated to $2.6 billion, while near $98,000, short liquidations have soared to over $8.4 billion. As shown in the chart, the dense liquidity zones at $94,000, $98,000, and $110,000 could become "magnet areas" for Bitcoin price action.

Liquidation heatmaps. Source: Hyblock Capital

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BNB Chain contract "Er Dang Jia" goes live on mainnet, but is it still worth participating in perp DEXs?

For StandX, the importance of DUSD appears to surpass that of the contract platform itself.

Powell's top candidate, Hassett, turns out to be a cryptocurrency enthusiast?

Trump is very likely to announce the new Federal Reserve Chairman before Christmas.

Trump Ally Kevin Hassett Tipped To Lead The Fed

Bitcoin : Are the conditions for a future bull run already met?