The Crypto Fed? Trump’s Chair Search Takes a Strange New Turn

Kevin Hassett, a former Coinbase advisor who holds over $1 million in COIN stock, leads the Federal Reserve Chair race with a 56% nomination probability on prediction markets. As Trump’s criticism of Jerome Powell grows, final interviews are underway through Treasury Secretary Scott Bessent. Hassett Emerges as Frontrunner Amid Volatile Prediction Markets Kalshi prediction markets

Kevin Hassett, a former Coinbase advisor who holds over $1 million in COIN stock, leads the Federal Reserve Chair race with a 56% nomination probability on prediction markets.

As Trump’s criticism of Jerome Powell grows, final interviews are underway through Treasury Secretary Scott Bessent.

Hassett Emerges as Frontrunner Amid Volatile Prediction Markets

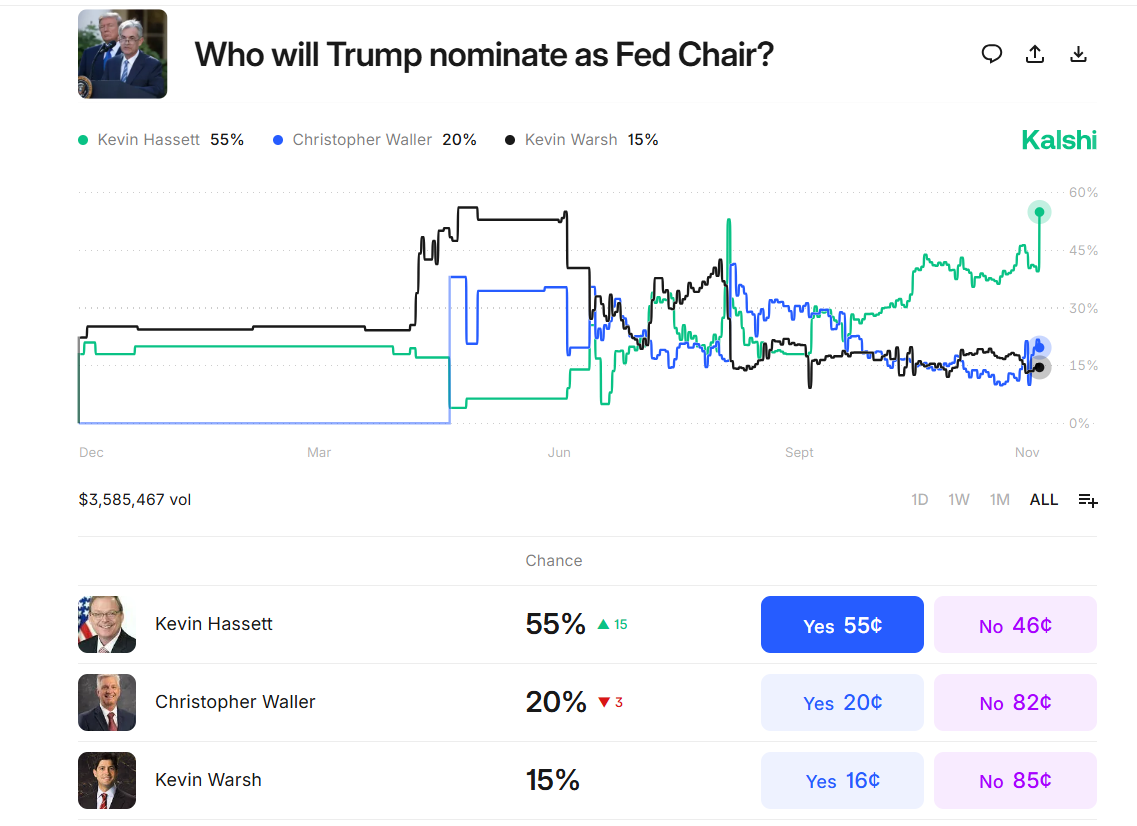

Kalshi prediction markets currently give Kevin Hassett a 55% chance of nomination for the role of Federal Reserve Chair. This represents a 15% increase in the last 24 hours, placing him well above Christopher Waller (20%) and Kevin Warsh (15%).

Fed Chair Predictions. Source:

Kalshi

Fed Chair Predictions. Source:

Kalshi

As the former chair of the Council of Economic Advisers, Hassett is known for advocating rate cuts and maintaining direct ties to the crypto industry.

Kevin Hassett is now the leading candidate for Fed chair, he has recently backed a 50 basis point cut in December. The 10-year Treasury yield is already below 4%, reflecting growing market confidence. Looking forward, I believe the 10-year could drop further, targeting the 3% to…

— Steve Grasso (@grassosteve) November 25, 2025

Coinbase officially announced its Global Advisory Council in late November 2025, confirming Hassett’s position.

The Council helps guide the company’s engagement with global regulators, illustrating the growing relationship between crypto firms and policymakers.

As a Distinguished Visiting Fellow at the Hoover Institution, Hassett has promoted a more accommodative monetary policy through 2024 and 2025. Therefore, his strong pro-rate cut approach sets him apart from the hawkish stance under current Fed Chair Jerome Powell.

However, Hassett’s experience as a Coinbase advisor and his substantial holdings of COIN stock create a direct link to the crypto sector.

This raises both concerns about potential conflicts of interest and hopes for a shift in the Fed’s approach to digital assets.

Meanwhile, President Trump has amplified his public criticism of Jerome Powell while the search for a new Fed chair continues. In a recent Oval Office session, Trump shared his frustrations with Powell’s leadership.

Reporter: “Have you started the interviews for the Fed chair?” President Trump: “Yes… I think I already know my choice. Well, I liked him. *Points to Secretary Scott Bessent* But he’s not going to take the job.”“We’re talking to various people… I’d love to get [Jerome… pic.twitter.com/yiFgP0l5aM

— RedWave Press (@RedWave_Press) November 18, 2025

Final interviews for the new Chair are ongoing, led by Treasury Secretary Scott Bessent. Trump hinted at having a preferred candidate but has kept details private, reportedly to gauge how markets respond to speculation.

Jerome Powell’s current term runs until May 2026, giving Trump limited time for change. While the team notes that Trump’s choices can be unpredictable, speculation continues to mount ahead of an expected announcement before Christmas 2025.

WATCH: Scott Bessent said “there is a very good chance President Trump announces the new Fed Chair before Christmas.” pic.twitter.com/b5gNmWsMbx

— BeInCrypto (@beincrypto) November 25, 2025

Implications for Crypto Policy and Market Dynamics

If appointed, Hassett could bring an unprecedented level of crypto support to the Federal Reserve. His role as a Coinbase advisor and investor places him in a unique position among contenders.

These connections could impact policy on digital asset regulation, central bank digital currencies (CBDCs), and integration of crypto into traditional finance (TradFi).

“If Kevin Hassett becomes Fed Chair, the implications for crypto are strongly bullish. 1. Aggressive “dove” who has publicly criticized current rates for being too high and advocated for deeper, faster cuts. 2. Led the White House digital asset working group to shape pro-crypto regulation. 3. Served on Coinbase’s advisory board and owns a large stake in COIN,” said Juan Leon, Senior Investment Strategist at Bitwise.

The market broadly expects that a dovish and crypto-experienced Chair could boost institutional acceptance and regulatory transparency.

Some critics worry that Hassett’s crypto holdings could create conflicts of interest in policies affecting digital assets.

The Fed holds significant influence over banking and regulations for cryptocurrency exchanges and stablecoin issuers. Therefore, scrutiny will be high if a Chair with personal investments in the industry takes office.

The contrast between Hassett and contender Christopher Waller signals two different paths for monetary policy and crypto regulation. Waller represents policy stability and caution regarding technology, while Hassett’s candidacy points to more support for innovation and cryptocurrency growth.

Who will be next Fed Chair?Christopher Waller’s odds have overtaken Kevin Hassett and Kevin Warsh. I’ve believed for months that Christopher Waller is the strongest candidate to become the next Fed Chair.Here are a few posts I’ve written on why I think so.… pic.twitter.com/RMcxpKu22r

— willy Lee (@willyLee) November 25, 2025

The decision will shape not only interest rates, but also the Fed’s stance on new technologies. As the December announcement nears, both financial and crypto markets are alert for changes in US monetary policy and digital asset regulation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South Africa's Growing Stablecoin Adoption Undermines National Monetary Authority

- South Africa's central bank warns stablecoin growth threatens foreign exchange controls and financial stability. - Stablecoin trading surged to 80B rand by 2024, bypassing regulations as USD-pegged tokens outpace Bitcoin in local adoption. - Global watchdogs highlight systemic risks from unregulated stablecoins, while SARB accelerates crypto regulation to address capital flight concerns. - Emerging market dilemma emerges: balancing crypto innovation with monetary sovereignty amid $314B global stablecoin

The Growing Investment Potential in Education: Addressing School Counselor Deficits and Policy-Led Revitalization

- U.S. schools face severe counselor shortages, with 60% of districts unable to meet student mental health needs despite rising demand. - Federal grants ($280M in 2025) and state initiatives like New York’s SBHCs aim to expand access through training, staffing, and regionalized resource-sharing models. - The 2025 Mental Health Excellence Act targets workforce gaps by subsidizing graduate training for counselors, aligning with ASCA’s 250:1 student-to-counselor ratio goals. - Investors see long-term opportun

Investing in Transforming Education: Tackling the Lack of School Counselors with Policy-Based Solutions in Educational Technology and Telehealth

- U.S. schools face severe counselor shortages in rural areas, with states like New Mexico (43% unmet demand) and Alabama (80% met) highlighting systemic underfunding and geographic barriers. - States implement policy solutions like Texas's $180k loan repayment caps and New Mexico's behavioral health legislation to address workforce gaps and mental health care deserts. - EdTech and telehealth startups (e.g., MagicSchool AI, GoStudent) attract $45M+ investments, leveraging AI and remote learning to mitigate

Navigating the Ups and Downs of Cryptocurrency: Does USDT Remain a Secure Refuge?

- Tether's USDT faces stability risks as S&P downgrades its rating to "weak" due to high-risk reserves like bitcoin and gold , now restricted by new U.S. regulations. - The 2025 crypto crash exposed systemic vulnerabilities, with algorithmic stablecoins depegging and triggering panic, despite USDT maintaining its $1 peg. - Regulatory frameworks like the EU's MiCAR and U.S. GENIUS Act mandate reserve transparency and liquidity standards, forcing Tether to launch a compliant alternative, USAT. - Investor beh