Bitcoin ( BTC ) is on course for its worst November since 2018, but a new forecast sees a BTC price bottom this week.

Key points:

Bitcoin is on track to seal its weakest November performance since the 2018 bear market.

December has historically produced identical price action after “red” November months.

AI predicts that BTC/USD will form a local bottom this week.

November echoes 2018 Bitcoin bear market

Bitcoin remains in bear market territory ahead of the November monthly close, its drawdown versus October’s all-time highs hitting up to 36%.

Data from monitoring resource CoinGlass shows that at $87,500, Bitcoin is still down 20% this month.

CoinGlass confirmed that such bearish performance has been absent from the charts since 2018, the year following another bull run that peaked at $20,000.

“Every time Bitcoin has had a red November, December has also ended red,” Sumit Kapoor, founder of crypto trading community WiseAdvice, commented on the data in a post on X.

BTC/USD monthly returns (screenshot). Source: CoinGlass

BTC/USD monthly returns (screenshot). Source: CoinGlass

Since 2013, the average November gains for BTC/USD have been in excess of 40%, while December has been much more muted, resulting in a 5% average upside.

BTC is due for a “slow recovery” into 2026

On the topic of BTC price seasonality, network economist Timothy Peterson shared some more optimistic views on how Bitcoin might conclude 2025.

Related: Bitcoin price’s $80K low was bottom, Arthur Hayes says

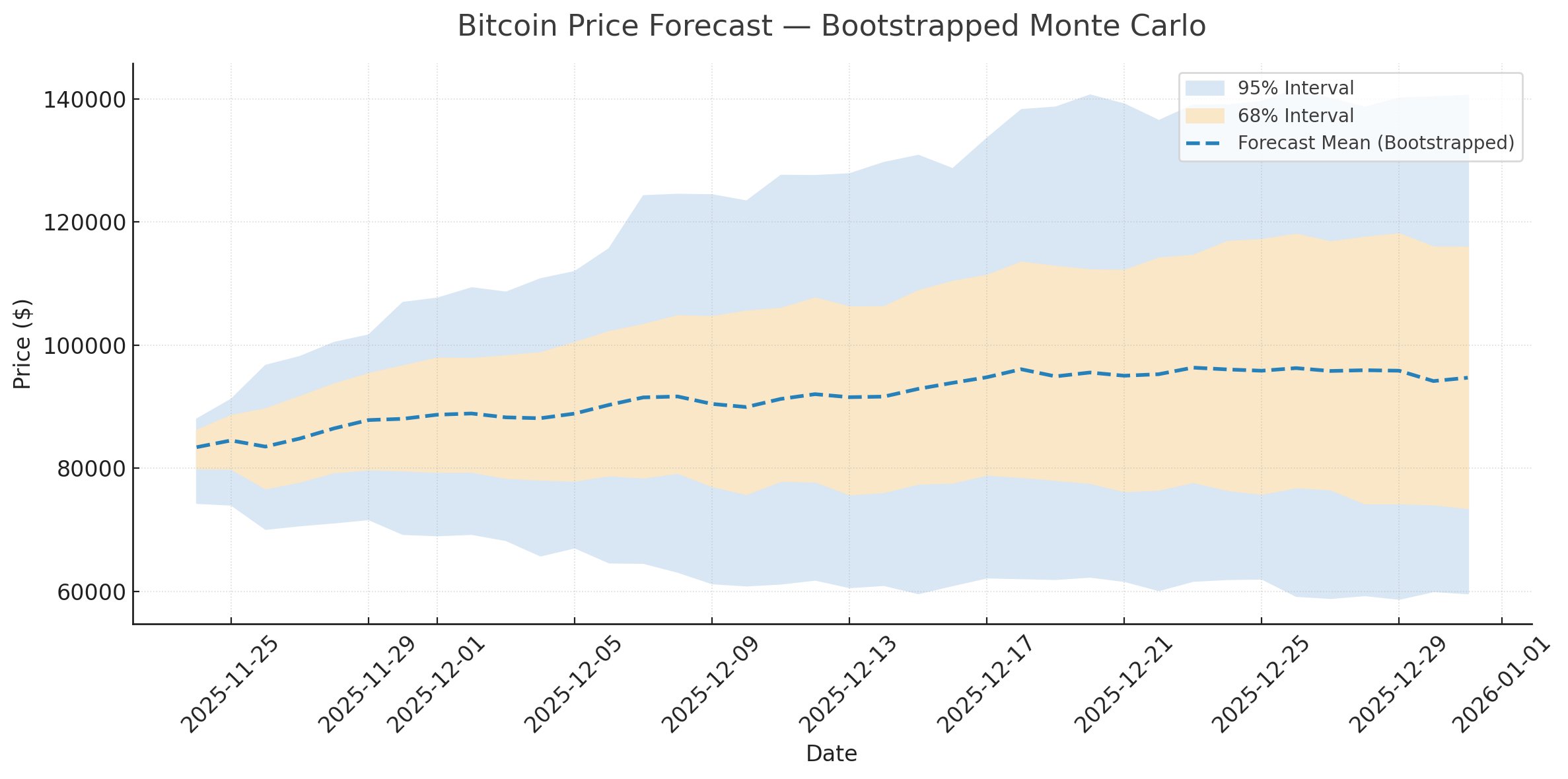

A dedicated AI-based prediction tool suggested that Bitcoin’s latest local bottom is either already in or due this week.

“AI-driven Bitcoin simulation estimates the bottom is in or occurs this week, with a slow recovery through the end of the year,” Peterson reported on X Monday.

“There is less than 50% chance Bitcoin reclaims $100,000 by December 31. There is at least a 15% chance Bitcoin finishes lower from here ($84,500) and an 85% chance it finishes higher.”

Bitcoin AI price model. Source: Timothy Peterson/X

Bitcoin AI price model. Source: Timothy Peterson/X

He noted that the model does not account for external volatility catalysts, such as macroeconomic events.

Previous findings, which overlaid BTC price action this year onto 2015, likewise hinted that a major rebound may come by the end of the year.

Peterson nonetheless described the concept as “hopium.”

Want some hopium?

— Timothy Peterson (@nsquaredvalue) November 16, 2025

Bitcoin was at this exact same point at this exact same time in 2015.

It then shot up 45% and finished the year up 33%. pic.twitter.com/dTC53llkYX