JPMorgan: Mainstream cryptocurrencies shift from retail speculation to institutional dominance

ChainCatcher reported that JPMorgan stated in an article that cryptocurrencies are shifting from a "venture capital-style ecosystem" to a macro asset class "supported by institutional liquidity rather than driven by retail speculation."

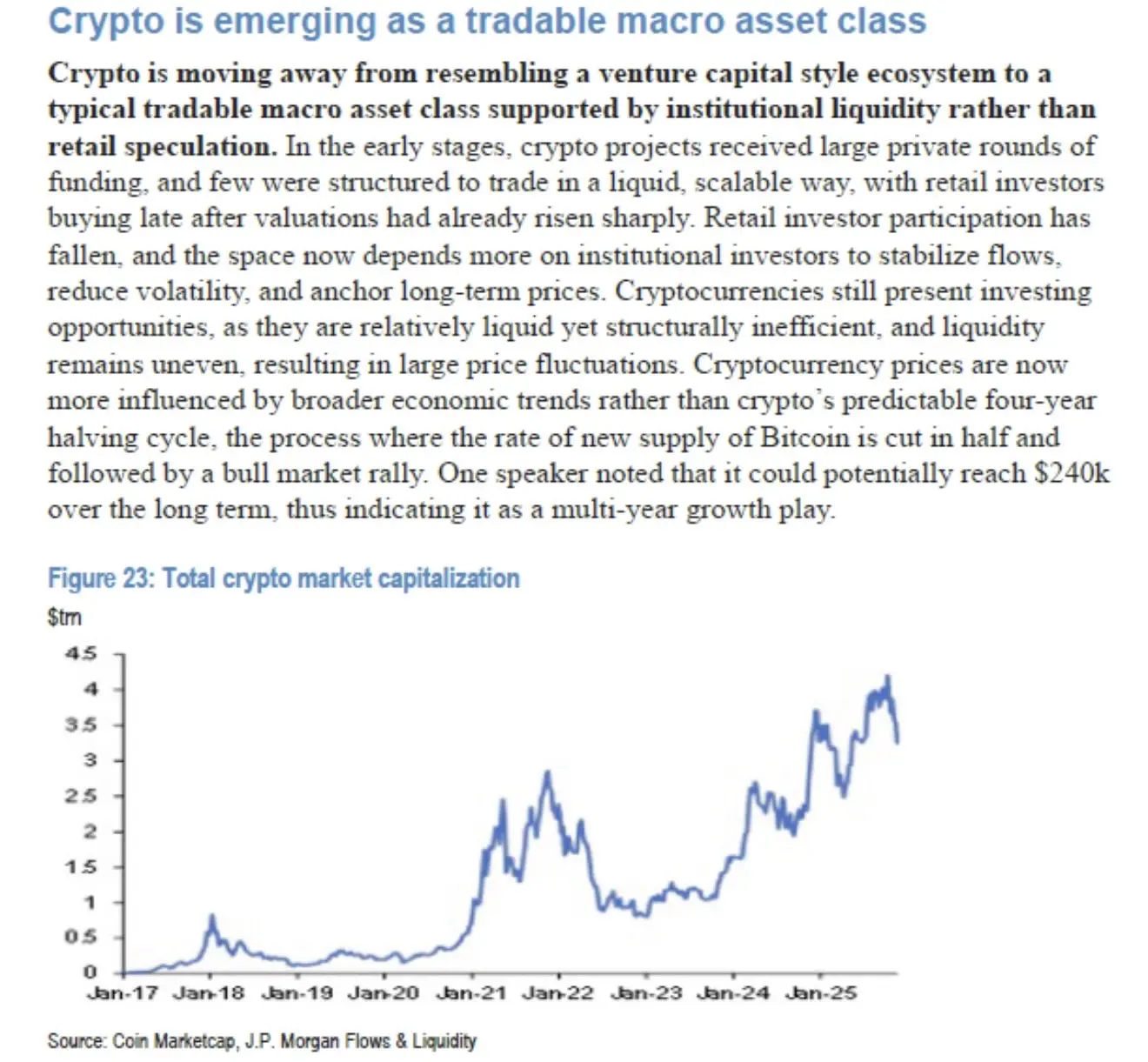

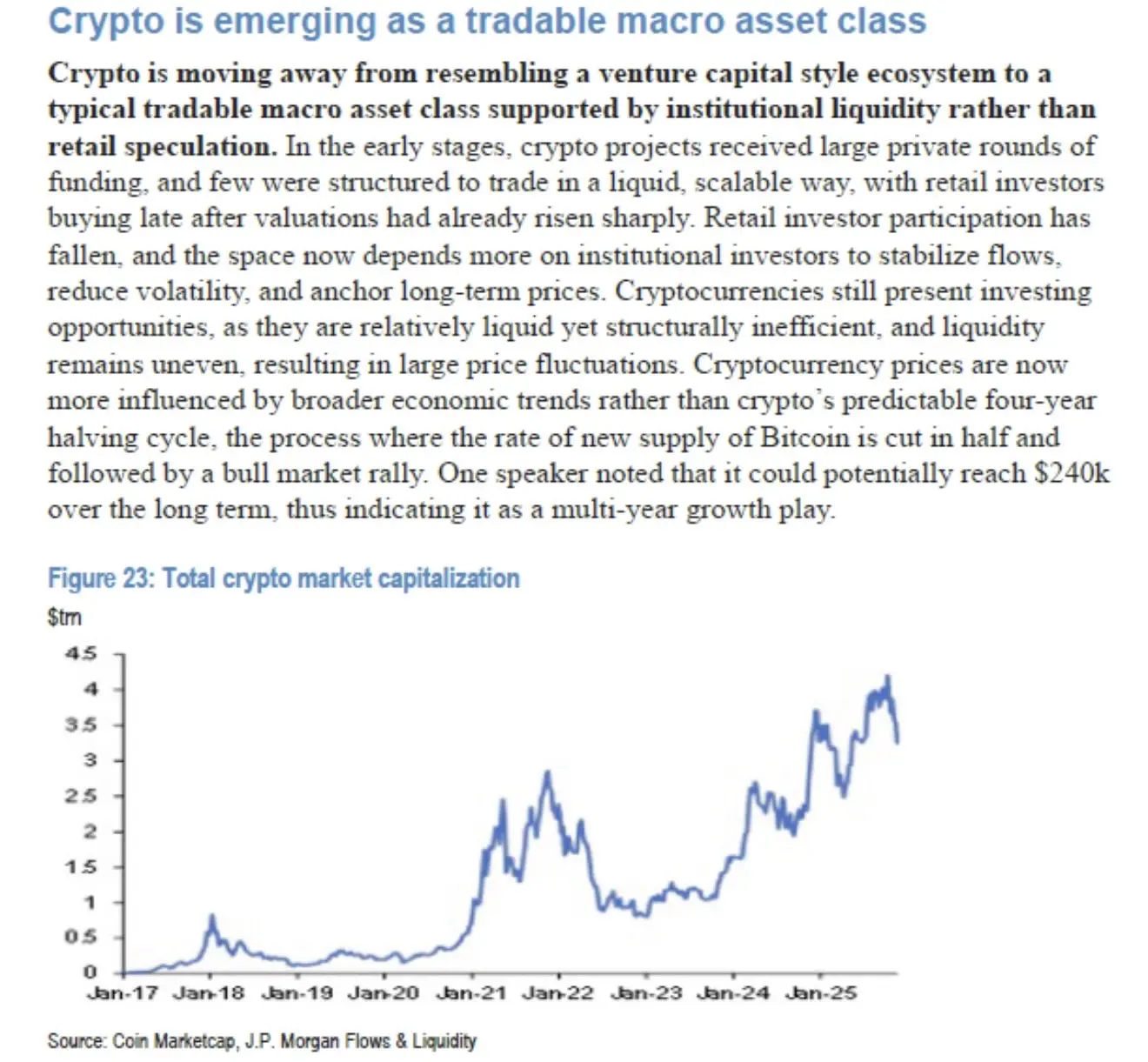

In the early stages, crypto projects relied on private fundraising and lacked liquid structures, with retail investors often entering after valuations were already high. Now, retail participation has significantly declined, and the market relies more on institutional investors to stabilize capital flows, reduce volatility, and anchor long-term prices.

Currently, cryptocurrencies still hold investment value, but structurally remain inefficient, with uneven liquidity distribution leading to significant price volatility. Price performance is now more influenced by macroeconomic factors rather than traditional halving cycles. An analyst pointed out that, in the long term, cryptocurrency prices could reach $240,000, making it a sector with multi-year growth potential.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Atlanta Fed's GDPNow model forecasts US third-quarter GDP growth at 3.9%.

BTC surpasses $89,000

Tether currently holds 116 tons of gold, a scale approaching that of the central banks of South Korea and Hungary.