The highly anticipated DOGE ETF launch falls flat, with 100 more ETFs set to go public in the next six months—what challenges will the market face?

The lackluster performance of GDOG stands in sharp contrast to successful cases during the same period.

The lukewarm reception of GDOG stands in stark contrast to the success stories during the same period.

Written by: Blockchain Knight

On November 24, Grayscale's Dogecoin ETF (GDOG) was listed on the New York Stock Exchange Arca, but faced a "cold opening."

The first day's secondary market trading volume was only $1.41 million, far below the $12 million predicted by Bloomberg analysts, and net capital inflow was zero, meaning no new capital was injected into the ecosystem. This performance clearly reveals that the market demand for regulated products has been severely overestimated.

The lukewarm reception of GDOG stands in sharp contrast to the success stories during the same period. The Solana ETF (BSOL), launched in late October, attracted $200 million in capital inflows in its first week. The core reason is its practical attribute of offering staking yields, providing traditional investors with an investment mechanism that is difficult to access directly.

In contrast, GDOG only provides exposure to social sentiment. As a regular spot product, its underlying asset is already widely available on retail platforms such as Robinhood, lacking "access premium" and yield support, thus offering limited appeal to institutions.

Additionally, the inherent characteristics of MEME assets bring extra risks. Although Dogecoin's daily trading volume reaches $1.5 billion, it is highly susceptible to event-driven volatility.

At the same time, creating large positions requires purchasing massive amounts of DOGE, which could drive up spot prices; if the crypto market crashes during ETF market closure, the price may significantly deviate from net asset value when trading resumes. These risks cause traders to view GDOG as a short-term trading tool rather than a long-term allocation asset.

The lukewarm reception of GDOG is not an isolated incident, but rather a warning of industry oversupply. In the next six days, five spot crypto ETFs will go live (including Chainlink and XRP-related products), and over the next six months, more than 100 single-token ETFs are expected to be launched.

However, the current market environment is extremely unfavorable. As of the week ending November 24, digital asset investment products saw net outflows of $1.94 billion.

This supply-demand mismatch hides structural risks. If even high-profile MEME assets like Dogecoin cannot attract subscriptions, the outlook for "long-tail ETFs" with low liquidity is even bleaker.

A large number of low-scale "zombie ETFs" will disperse market liquidity, increase the difficulty of inventory management for market makers, and may lead to wider spreads and greater tracking errors during periods of volatility.

The performance of GDOG over the next two weeks will serve as a litmus test for the industry. If "zero new inflows" persist, it indicates that the product is merely cannibalizing existing demand rather than creating new inflows, which may force issuers to slow down the launch pace of 100 ETFs, or even trigger channel consolidation.

Although the infrastructure and regulatory approval for crypto ETFs are already in place, investors are choosing to exit in the current sluggish environment, and the previous frenzy of ETF issuance urgently needs to return to rationality.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Who would be the most crypto-friendly Federal Reserve Chair? Analysis of the candidate list and key timeline

Global markets are closely watching the change of Federal Reserve Chair: Hassett leading the race could trigger a crypto Christmas rally, while the appointment of hawkish Waller may become the biggest bearish factor.

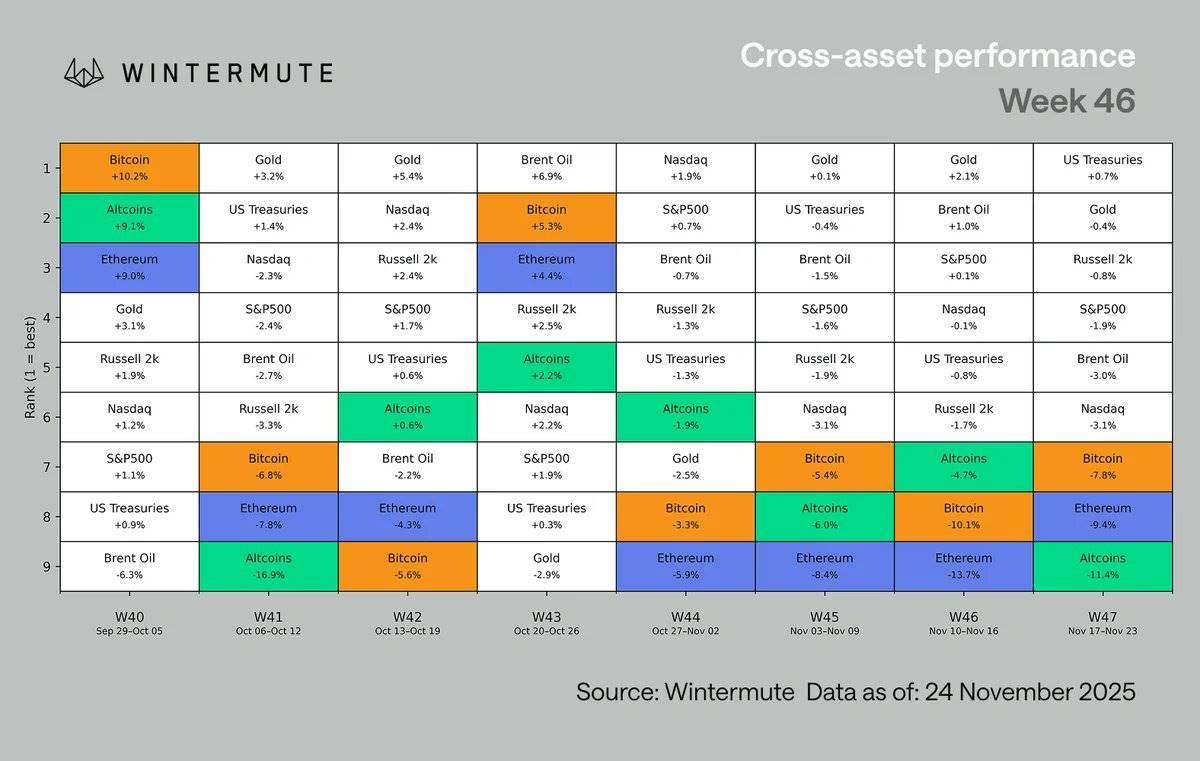

Wintermute Market Analysis: Cryptocurrency Falls Below $3 Trillion, Market Liquidity and Leverage Tend to Consolidate

This week, risk appetite deteriorated sharply, and the AI-driven stock market momentum finally stalled.

Former a16z Partner Releases Major Tech Report: How AI Is Eating the World

Former a16z partner Benedict Evans pointed out that generative AI is triggering another ten-to-fifteen-year platform migration in the tech industry, but its final form remains highly uncertain.