BONK: From Meme Coin to Utility Flywheel

BONK has evolved from a holiday airdrop into one of the most influential native assets on Solana, demonstrating the power of community, a spirit of experimentation, and broad integration. Its fee-driven burn mechanism combined with strong cultural stickiness gives it a longer lifespan than most meme coins, while the adoption by traditional financial instruments marks a new chapter of legitimacy.

Original Source: BONK

Key Points

· Bonk was launched at the end of 2022, when Solana was in a slump following the FTX collapse. The project distributed 50% of its 100 trillion token supply, making it one of the largest airdrops in Solana’s history (about 50 trillion BONK distributed to around 297,000 wallets).

· Initially a meme token, Bonk quickly gained widespread adoption in the Solana ecosystem and is now integrated into 400+ applications, covering DeFi, NFT, gaming, and payment sectors. Nearly 1 million wallet addresses hold BONK, demonstrating strong community acceptance.

· The difference between BONK and traditional short-lived meme coins lies in its fee-driven burn mechanism and DAO-led burn events. Applications like BonkBot and Bonk.fun contribute the majority of burns, while Bonk Rewards staking and large events like BURNmas further reduce circulating supply. As a result, BONK’s total supply has dropped from 100 trillion to about 88 trillion.

· BONK has transformed from a grassroots meme coin into a financialized asset. Osprey Bonk Trust, the upcoming Bonk ETF, and Safety Shot’s rebranding as a Bonk treasury company show that traditional investors have increasing avenues for exposure. These tools reduce circulating supply but also introduce new risks related to capital flows, regulatory scrutiny, and market perception.

The Origin and Issuance of BONK

The idea for Bonk was born at the end of 2022, when the Solana ecosystem was in a downturn due to the FTX collapse. Solana’s price plunged from about $36 before the crisis to below $10, and its DeFi activity and TVL (total value locked) also dropped sharply. The broader crypto market was in a deep bear market, with both bitcoin and ethereum falling to multi-year lows. Meanwhile, meme coins like DOGE and SHIB, which had soared in 2021, gradually lost their appeal by the end of 2022, and the market became increasingly skeptical of the long-term value of most altcoins, especially meme coins.

Against this backdrop, the concept of Bonk emerged, aiming to be a community-driven Solana meme coin, uniting the community and revitalizing Solana’s morale.

Bonk officially launched on December 25, 2022, with the brand positioning of “the people’s dog coin on Solana.” There was no private sale or VC funding during issuance; instead, 50% of the 100 trillion token supply was airdropped to active Solana ecosystem users, covering nearly 300,000 wallet addresses. This airdrop was one of the largest in Solana’s history, targeting core community groups to maximize grassroots user participation.

The clear goal of this airdrop was to reward the active Solana community at the time, covering multiple groups within the ecosystem. Notably, core Solana developers also received a small BONK airdrop as a token of appreciation. The broad distribution quickly made BONK one of the most widely held tokens on Solana.

The majority of the token supply entered circulation immediately after issuance, with only 21% of the early contributors’ allocation subject to a linear vesting schedule, unlocking from the end of December 2022, with the remaining small locked portion to be gradually unlocked over the next few months until January 2026. Another major project-related token allocation is 16% to BonkDAO.

BonkDAO was initially managed by a committee of 11 community members and core contributors, who control the DAO treasury’s multisig account. The DAO has pledged to gradually decentralize, and in July 2024 will open community voting to propose burning BONK collected by BonkBot and eventually integrate with Solana’s governance platform Realms for community governance voting. Many BonkDAO proposals revolve around marketing incentives and various token burns (such as Burnmas, BonkBot burns, and November burns).

Bonk’s launch was accompanied by a surge in speculative interest, with the token immediately tradable on Solana DEXs. Several centralized exchanges also quickly listed BONK, including Coinbase, Binance, OKX, Huobi, MEXC, Bybit, Gate.io, all going live in the first week of January 2023. This exchange support helped BONK achieve a market cap of hundreds of millions of dollars within weeks.

However, the initial airdrop and listing hype gradually faded by mid-year, until the end of 2023 when Solana experienced a broader meme coin boom and new tokens like WIF gained attention. BONK still maintained its flagship meme coin status on Solana and rebounded significantly during this period. By the end of 2023, BONK had firmly established itself as a core asset in the Solana ecosystem, with its price often moving in sync with SOL but with higher volatility.

Integration and Applications

From the beginning, Bonk’s strategy has been to deeply embed itself in the Solana ecosystem, with two main objectives:

1. To capture and maintain community attention

2. To create diversified application scenarios and reduce BONK circulation through fees or burn mechanisms

The main integrations and applications of BONK are as follows:

Decentralized Exchanges and Liquidity Pools (January 2023): DEXs on Solana quickly embraced Bonk, with Orca and Raydium launching BONK liquidity pools and offering incentive yields. In addition, a Bonk-branded DEX—BonkSwap—also appeared in early 2023.

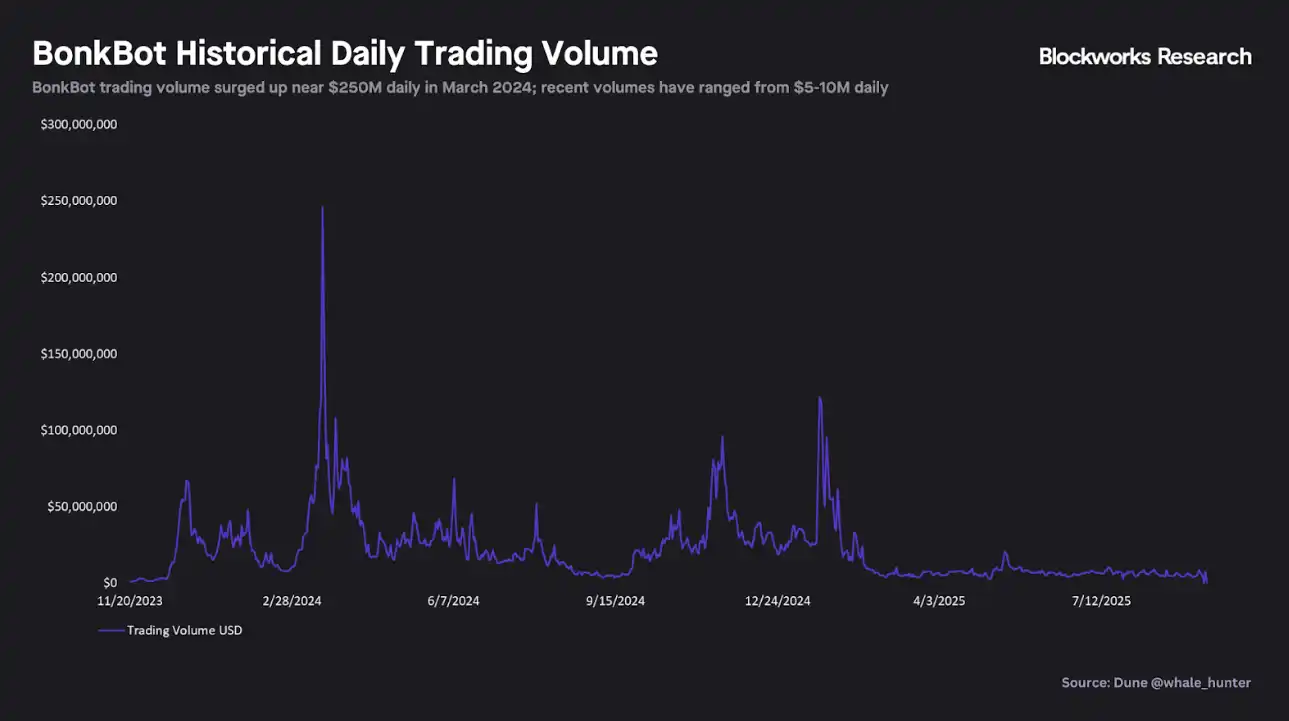

Trading Bot - BonkBot (Mid-2023): One of the most influential applications in the Bonk ecosystem is BonkBot, a Telegram trading bot previously mentioned in our trading bot industry report. BonkBot allows users to trade any Solana token via chat interface, charges a 1% fee on trading volume, and uses 10% of that to buy back and burn BONK. During the Solana meme coin boom in early 2024, BonkBot was the leading trading bot for several consecutive months. Although growth in the trading bot sector has since stagnated, its core users continue to generate stable fee income, supporting BONK burns.

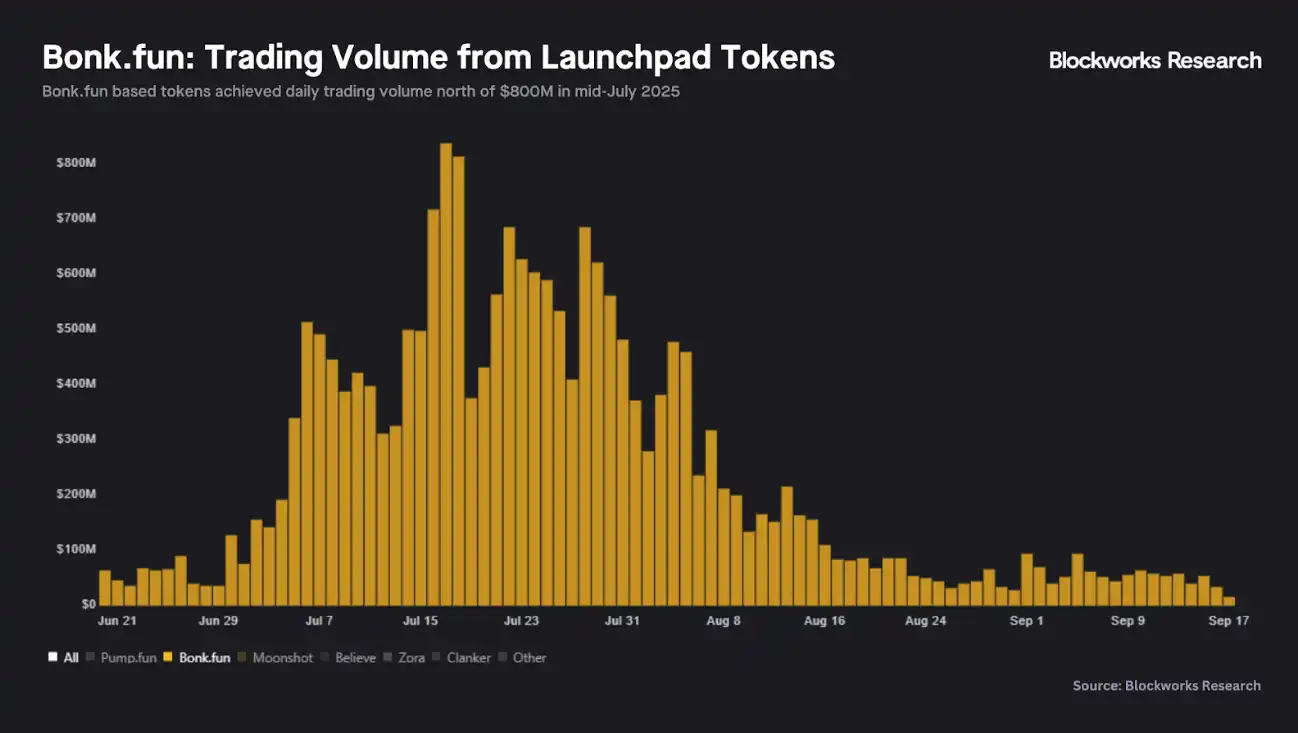

Token Launch Platform – Bonk.fun (Q2 2025): After Raydium launched the modular launch platform LaunchLab, Graphite Protocol partnered with BONK to launch Bonk.fun, a Bonk-themed launch platform built on LaunchLab. Similar to Pump.fun, Bonk.fun allows anyone to permissionlessly launch new SPL tokens and is highly oriented toward meme coin activity.

After launch, Bonk.fun quickly sparked a frenzy, with daily trading volume exceeding $400 million within weeks. Activity then cooled over the following months, until early July when Bonk.fun suddenly overtook Pump.fun, capturing over 60% of Solana launch platform trading volume at its peak.

Like BonkBot, Bonk.fun uses part of the platform’s fees to buy back and burn BONK. We will discuss the impact of these main burn drivers in more detail in the following sections.

Gaming – Bonk Arena (June 2025): Bonk entered the GameFi sector with Bonk Arena, a “kill-to-earn” arcade shooter developed by Bravo Ready. Bonk Arena launched in June 2025 as a web/browser game, requiring players to pay 10,000 BONK (about $0.15 at launch) to enter a deathmatch, with winners taking the BONK staked by defeated opponents. Of the BONK used in-game, 50% is allocated to token burns, BONK staking rewards, and charitable donations. Bonk Arena can be accessed directly via Phantom wallet and is planned for release on Solana’s Saga phone and PSG1 gaming handheld.

Fitness App – Moonwalk (2024–2025): Moonwalk is one of the first “real-world incentive (RWA-Fitness)” apps in the BONK ecosystem, gamifying fitness behaviors so users can earn on-chain rewards for daily activities like walking and running. Moonwalk’s long-term goal is to expand the Web3 fitness user base and convert the average user’s daily exercise into on-chain behavioral data, bringing more genuine user demand and healthy growth metrics to the entire BONK ecosystem. Through Moonwalk, Bonk moves beyond just social or trading apps and enters the realm of “real-world use cases,” further broadening BONK’s appeal outside Web3.

Digital Art – Exchange Art: Exchange Art is one of the largest digital art and NFT trading platforms on Solana. In 2025, BONK and Solana jointly launched the Crycol Gallery in New York, bringing all gallery works onto Exchange Art to achieve an “online + offline” art exhibition loop. Exchange Art allows artists to accept BONK as payment and integrates BONK-themed art into some events, making BONK part of Solana’s NFT culture.

Charity – Buddies for PAWS: Buddies for PAWS is BONK’s global animal charity initiative, supporting multiple animal protection organizations through “community donations + 1:1 BONK official matching.” This program reinforces BONK’s narrative of “from the community, for the community,” expands BONK’s international influence, and conveys positive brand values to the traditional world. While donations do not directly lead to burns, the enhancement of BONK culture and media exposure indirectly strengthen BONK’s social acceptance and long-term value stickiness.

Cross-chain Bridges: As Bonk has grown, it has expanded to other chains. Cross-chain bridges like Wormhole enable BONK to circulate on Ethereum, BNB Chain, Base, and more. By 2025, BONK is available on 13 blockchains via bridges or wrapped tokens, significantly improving accessibility. However, Solana remains the core chain for BONK activity.

Multi-chain Deployment: Bonk is also exploring launching DeFi products on different blockchain platforms. Recent plans include launching BONAD, a meme coin launch platform similar to Bonk.fun, on Monad. In the future, redeploying or expanding Bonk products to more blockchain ecosystems may further drive BONK buyback and burn pressure.

This broad integration demonstrates Bonk’s vision as more than just a meme coin. By embedding the token in diverse application scenarios, Bonk aims to create organic demand that goes beyond pure retail speculation.

Supply-side Evidence: “Deflationary Dog Coin”

Almost all meme coins gradually disappear after their initial hype fades, but the Bonk community chose to build a sustainable ecosystem. By 2024, a new narrative began to form: “BONK is more than just a meme coin,” with the core being fee income and token burn mechanisms.

Fee Generation and Distribution

As mentioned above, BonkBot and Bonk.fun are the most influential applications driving application fees to BONK buybacks and burns.

BonkBot charges a fixed 1% fee on each trade:

· 10% of which is used to buy back and burn BONK

· Another 10% goes to the BonkDAO multisig wallet

Therefore, 20% of all BonkBot fees directly benefit BONK holders—half through permanent burns, the other half through DAO accumulation (to date, these funds have also ultimately been used for burns via governance proposals).

To date, BonkBot has generated over $87M in trading fees, with about $8.7M used for BONK burns and $8.7M accumulated in the DAO. Although 2024 was BonkBot’s peak year, recent trading volume and fees have dropped significantly. Over the past 30 days, fees were about $667k, implying annualized BONK burns of about $810k (if the DAO’s 10% allocation is also used for burns, the total could reach $1.6M).

In addition to BonkBot, Bonk.fun became a major driver of BONK burns in mid-2025. The platform charges a 1% fee on bonding curve-based trading volume. As of August 11, Bonk.fun used 50% of trading fees to buy back and burn BONK, later adjusting the ratio to 35%, but Safety Shot pledged to reinvest 90% of its 10% revenue share into buying BONK, making the actual buyback and burn ratio 44%.

As shown, Bonk.fun’s trading volume surged in July, surpassing Pump.fun in market share and generating over $37M in revenue in July alone, with 50% used for BONK burns. However, since July, Bonk.fun’s activity and revenue have dropped by over 90%. In the past 30 days, revenue was about $812k, meaning at a 35% burn ratio, annualized BONK burns are about $3.5M (with Safety Shot’s reinvestment, actual burn pressure may be even higher).

Other applications in the Bonk ecosystem are relatively niche but generally follow the same model: using part of the fees to buy back and burn BONK. These include BonkSwap, Bonk Arena, Bonk Validator, and other Bonk-related apps or integrations.

The key conclusions are:

· Bonk’s burn pressure comes almost entirely from the success of BonkBot and Bonk.fun

· Various small applications have a negligible impact on the overall burn rate

Nevertheless, the Bonk core team and community continue to launch new Bonk-related apps, games, and integrations, which may create new sources of BONK supply reduction in the future.

Self-initiated Burns and Staking Mechanisms

In addition to the main Bonk-related applications, another major source of burns comes from DAO votes, events, and community/cultural decisions.

· Bonk DAO Burns: The DAO regularly proposes to burn tokens accumulated in the treasury through revenue sharing. For example, about 27.8 billion BONK were burned in April 2024 by committee vote, and about 8.4 billion BONK were burned in July 2024 by community vote (any holder could temporarily stake BONK to participate).

· Event Burns (such as BURNmas): BURNmas is an incentive marketing event where the DAO pledges to burn varying amounts of BONK based on tweets and other social interactions. From November 15 to December 24, 2024, the DAO and community burned tokens daily, targeting 1 trillion BONK and ultimately burning 1.69 trillion BONK.

· DeGods Allocation Burn: The entire DeGods airdrop allocation (500 billion BONK) was burned in January 2023. As a Solana NFT project, DeGods was initially included in the BONK airdrop, but after announcing a migration to Ethereum, the community and Bonk team unanimously decided to burn the allocation.

In addition to burn mechanisms, Bonk launched the Bonk Rewards staking mechanism in mid-2024 to encourage long-term holding. Users can choose lock-up periods from 1 month to 1 year, with longer terms earning higher reward multipliers. In return, stakers receive a share of the Bonk Rewards pool, funded by Bonk ecosystem income, with rewards mainly in USDC, supplemented by a small amount of BONK, and distributed periodically.

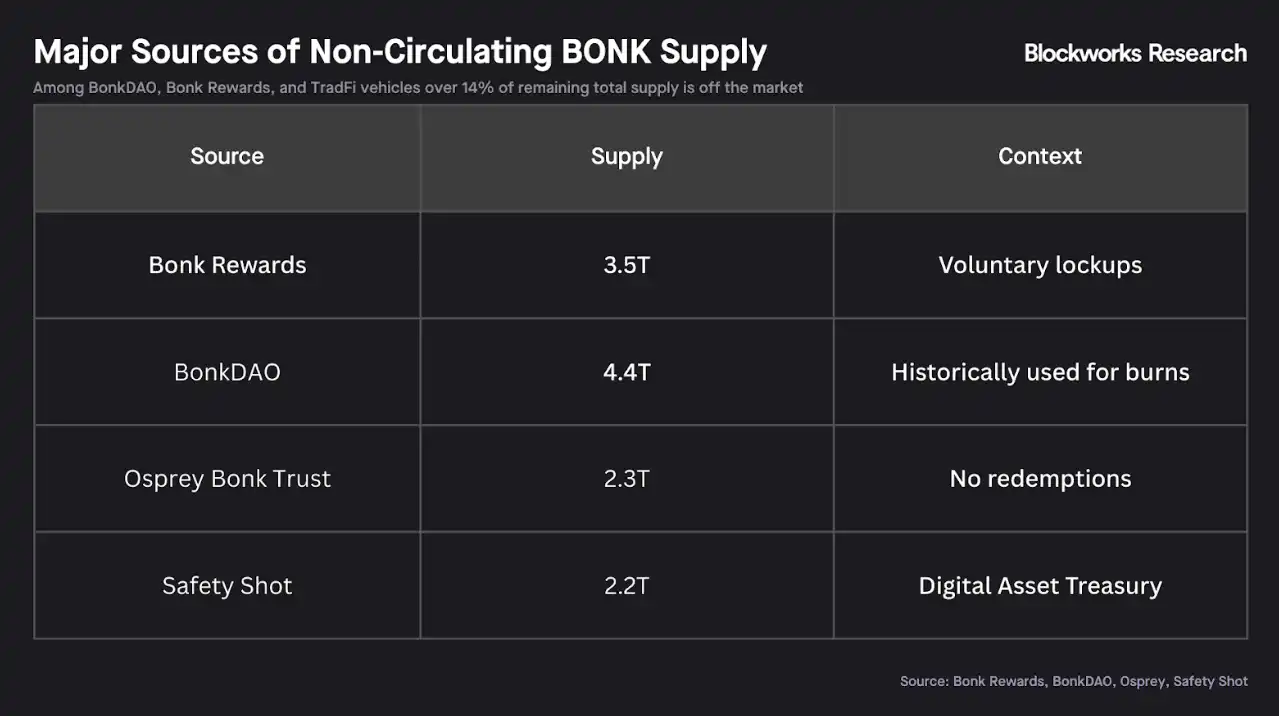

Currently, about 3.5 trillion BONK is staked, accounting for about 4% of the total supply.

Demand-side Drivers: Access and Traditional Financial Products

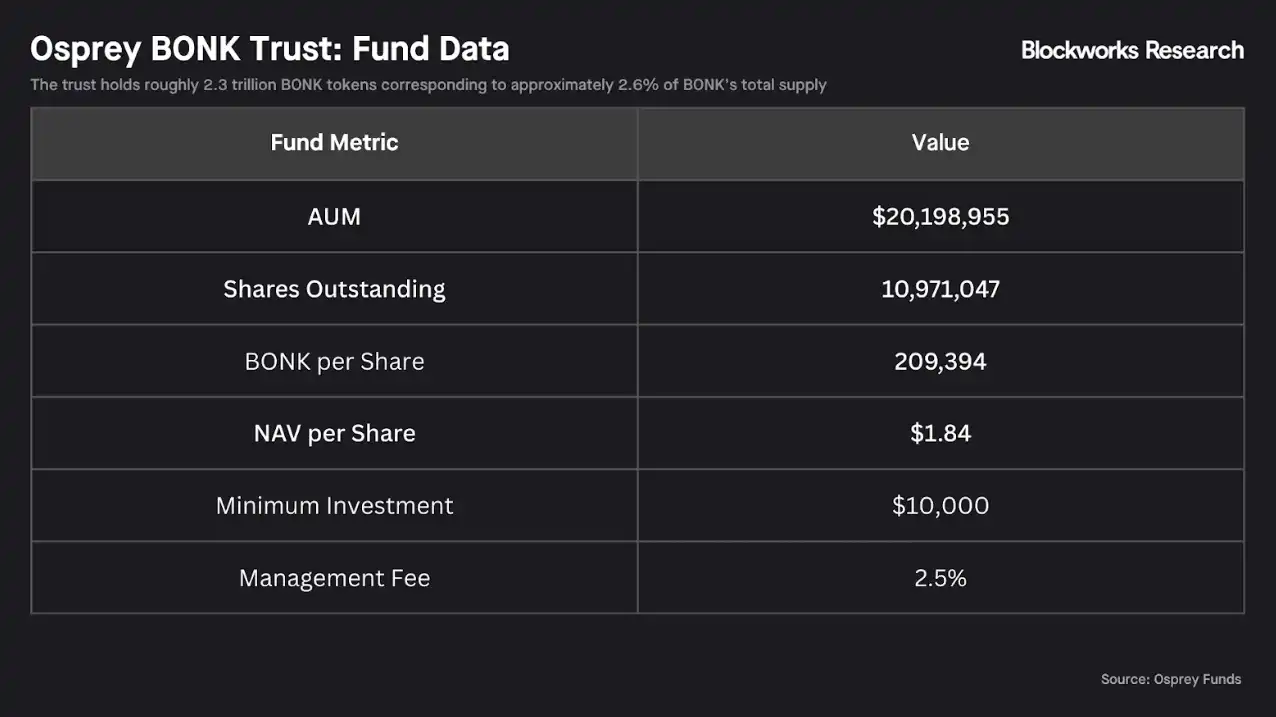

Osprey Bonk Trust was launched by Osprey Funds in October 2024 as a Delaware Grantor Trust designed to provide U.S. qualified investors with passive BONK exposure without directly holding tokens. The trust is issued as a 506(c) private placement with a minimum investment of $10,000, charges a 2.5% annual management fee, and uses a closed-end structure (no direct redemption of shares).

As of November 21, 2025, the trust holds about $20.2M in assets, corresponding to 10.97 million shares, each backed by about 209,000 BONK.

The trust currently holds about 2.3 trillion BONK, accounting for about 2.6% of the total supply, a significant portion locked up and removed from the market. Osprey says that once OTCQX listing time and asset requirements are met, it plans to list the trust for trading, offering public market investors a stock ticker trading method similar to Grayscale GBTC. However, before official listing, liquidity is only available through periodic private placements, and due to no redemption mechanism, the following risks exist:

1. No redemption, shares can only be traded on the secondary market

2. After listing, premium or discount trading may occur, a risk with historical precedent in closed-end funds like GBTC

In parallel with the trust, Osprey is applying for a Bonk ETF in partnership with REX Shares, which will directly hold BONK and offer daily creation/redemption on the primary market. Several Rex-Osprey meme coin ETFs, including BONK, TRUMP, DOGE, are expected to begin trading after the SEC’s 75-day review window on September 12.

Additionally, Tuttle Capital is advancing a 2x leveraged Bonk ETF and other leveraged crypto ETFs, but SEC approval remains uncertain. If approved, these ETFs would provide compliant, exchange-listed investment channels for BONK, potentially bringing marginal capital inflows. Notably, when news of the 2x Bonk ETF broke in July 2025, BONK’s price rose about 10% in a single day, showing that the market expects easier access to boost demand. Ultimately, the actual impact of these products will depend on trading launch and observed capital inflows.

In August 2025, Florida-based health beverage company Safety Shot rebranded as the first publicly listed BONK Digital Asset Treasury Company (DATCO), making BONK its core treasury asset. The company pledged to purchase up to $115M in BONK (about 4-5% of total supply), with the first $25M acquisition completed in partnership with BonkDAO, along with a 10% revenue share from Bonk.fun. The company then changed its name to Bonk, Inc. (NASDAQ: BNKK) to strengthen its association with the BONK ecosystem.

Bonk, Inc. raises funds through convertible preferred stock and ATM offerings to buy and hold BONK, and pledges to reinvest 90% of Bonk.fun revenue into BONK. Although BNKK nominally still operates a beverage business to maintain listing eligibility, its core strategy is to provide traditional investors with equity-like BONK exposure. This move caused significant volatility—on the day of the announcement, the stock price dropped nearly 50%, but before the Bonk ETF listing, it provided BONK with a public equity market investment channel and drove indiscriminate buying until the $115M acquisition commitment was completed.

BONK’s demand-side story is financialization: an originally grassroots meme coin now entering the traditional financial system through investment trusts, potential ETFs, public companies, and derivatives markets. If successful, these products could inject large amounts of capital into BONK, but also bring new risks such as capital flows, premiums/discounts, regulatory approval, making the originally retail-driven market more complex.

Tokenomics: Supply and Demand Accounting

BONK’s total supply has dropped from the initial 100 trillion to about 88 trillion, mainly due to various burn mechanisms.

Within these 88 trillion, there are several non-circulating sources:

· Bonk Rewards staking

· BonkDAO holdings

· Osprey Bonk Trust and Safety Shot holdings

Together, these account for over 14% of the remaining total supply, essentially removed from the market.

In addition, the original Bonk Contributors allocation still has about 2 trillion tokens pending unlock, expected to be fully unlocked in the coming months.

We can also project the income run rate of BonkBot and Bonk.fun onto token supply reduction to show their impact on supply. Based on the previously calculated 30-day annualized income, BonkBot and Bonk.fun are expected to burn about 84 billion and 370 billion BONK per year, respectively, together accounting for about 0.5% of total supply.

Essentially, Bonk’s story revolves around constrained supply and ongoing burns. Positive catalysts include:

· New staking tools to further reduce circulating supply

· Increased revenue from Bonk-related applications, accelerating burns

Conversely, if Osprey Bonk Trust introduces a redemption mechanism after the Bonk ETF goes live or BonkBot, Bonk.fun, and other applications lose further market share, we expect BONK’s price to face downward pressure.

Risk Factors

Operational Risk

BONK’s value is increasingly tied to the performance of applications like BonkBot and Bonk.fun, as they directly affect burn volume. Whether the Bonk team and community can continue to capture new narratives, launch fee-generating and burn-driving applications, and maintain relevance in the crypto market has become a key driver of success.

This model is highly cyclical: product hype is constructive when rising, but reflexive downturns occur when hype fades. We have already observed this with BonkBot and Bonk.fun—BONK soared when these apps dominated, but fell when competitors took market share.

Ecosystem Competition Risk

Solana’s meme coin ecosystem is not a monopoly. If a more topical meme coin emerges (such as TRUMP earlier this year), users may shift from BONK to other tokens. Likewise, Bonk products face competitive pressure within the Solana ecosystem:

· In 2024, BonkBot was the leader in the trading bot market but was later marginalized

· Bonk.fun briefly captured the majority of Solana Launchpad market share in July 2025, but Pump.fun soon regained dominance

If Bonk products continue to lose market share, the narrative of driving fees into burns will fail. Bonk must maintain cultural relevance while adapting to the increasingly competitive DeFi and trading app ecosystem on Solana.

Reputation and Ethical Risk

Bonk is inherently associated with speculative frenzy. If a major scam or rug pull occurs under the Bonk brand, it could affect the entire ecosystem. For example:

· If a malicious token launched on Bonk.fun rugs, users may blame the platform or Bonk

· If influencers promote BONK and the price crashes, the media may label it a “pump and dump”

The team tries to position Bonk as community-friendly, but there are negative cases in meme coin history, such as celebrity tokens leading to lawsuits and Crypto Twitter criticism of “celebrity coins.” In addition, Safety Shot’s announcement of the BONK treasury strategy led to a nearly 50% stock price drop, possibly indicating the market viewed the move as “not serious.” If this narrative spreads (with the media ridiculing the Bonk treasury as absurd), it could hinder further adoption, such as Bonk ETF products, or even trigger regulatory scrutiny of meme coin treasuries.

Conclusion

BONK has evolved from a holiday airdrop into one of the most influential native assets on Solana, embodying community power, experimental spirit, and broad integration. Its fee-driven burn + cultural stickiness model gives it a longer lifespan than most meme coins, while acceptance by traditional financial instruments marks a new chapter of legitimacy.

However, BONK’s future depends on whether the community can continue to innovate, defend its cultural moat, and maintain effective burn mechanisms amid competition and shifting narratives. If successful, BONK will become a typical case of how a meme coin transforms into a lasting ecosystem asset.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Russia Plans to Ease Digital Asset Investment Thresholds, Expanding Legal Participation of Citizens in the Crypto Market

Russia plans to relax the investment threshold for digital assets, Texas allocates $5 million to Bitcoin ETF, an Ethereum whale sells 20,000 ETH, Arca's Chief Investment Officer says MSTR does not need to sell BTC, and the S&P 500 Index may rise by 12% next year. Summary generated by Mars AI. The accuracy and completeness of this summary produced by the Mars AI model are still being iteratively updated.

x402 The most crucial piece of the puzzle? Switchboard aims to rebuild the "oracle layer" from scratch

Switchboard is an oracle project within the Solana ecosystem and proposes to provide a data service layer for the x402 protocol. It adopts a TEE technology architecture, is compatible with x402 protocol standards, supports a pay-per-call billing model, and removes the API Key mechanism, aiming to build a trusted data service layer. Summary generated by Mars AI. The accuracy and completeness of this content, generated by the Mars AI model, is still in an iterative update phase.

Who would be the most crypto-friendly Federal Reserve Chair? Analysis of the candidate list and key timeline

Global markets are closely watching the change of Federal Reserve Chair: Hassett leading the race could trigger a crypto Christmas rally, while the appointment of hawkish Waller may become the biggest bearish factor.