XRP News Today: Ripple’s XRP-Based Device Seeks Banking License to Challenge Traditional Financial Systems

- Ripple's XRP-powered ecosystem, leveraging blockchain and stablecoins, is positioned to rival JPMorgan and SWIFT through real-time payments and institutional services. - The company has acquired six firms to expand custody, stablecoin, and treasury capabilities, transitioning XRP into institutional markets via DATS and ETFs. - Seeking a U.S. banking charter could make Ripple the first crypto-native entity to operate with bank-grade compliance, accelerating blockchain adoption in finance .

Ripple’s significant infrastructure enhancements and its calculated role within the global financial landscape have attracted the notice of industry experts, with Teucrium Trading CEO Sal Gilbertie identifying the company as a possible competitor to

According to Senior Executive Officer Reece Merrick, Ripple’s infrastructure plan is focused on integrating financial systems using blockchain. The firm utilizes XRP and its stablecoin Ripple USD (RLUSD) to facilitate smooth, low-fee transactions. In the last two years, Ripple has acquired six companies to strengthen its expertise in payments, custody, and stablecoins, while also moving into prime brokerage and treasury services. These initiatives support Ripple’s goal of evolving XRP from a payment tool to a foundational asset in institutional finance, including digital asset-backed treasury securities (DATS) and exchange-traded funds (ETFs)

Gilbertie’s support for Ripple highlights the increasing institutional interest in blockchain-powered finance. He emphasized that XRP is a key asset held within Ripple’s network, with its value likely to rise as network activity grows. The CEO also mentioned that Ripple’s application for a U.S. national banking charter from the Office of the Comptroller of the Currency (OCC)

The comparison to

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

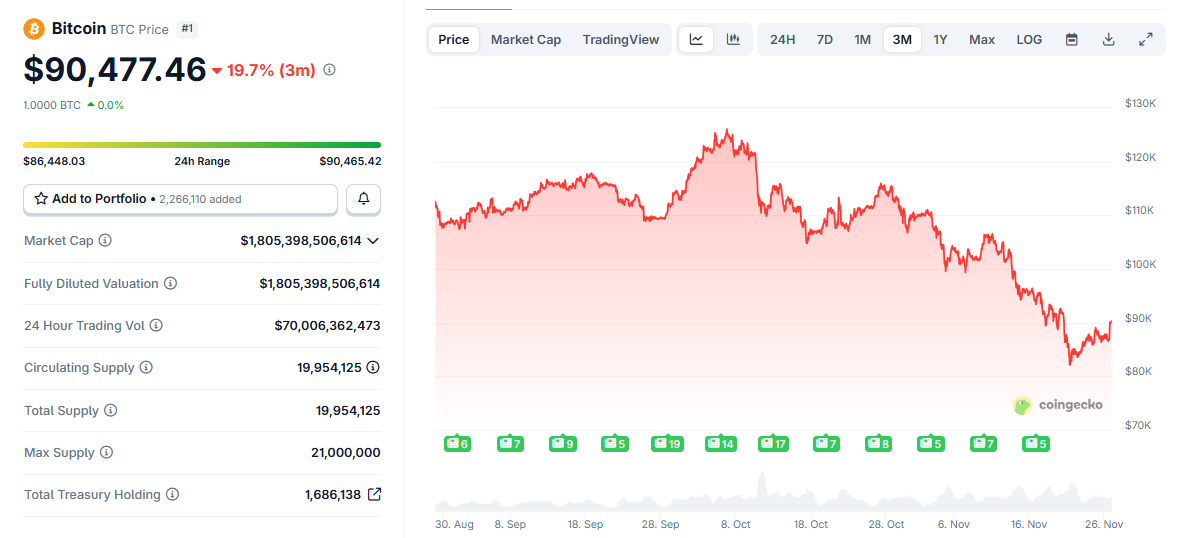

Bitcoin’s 2024 Cycle Mirrors Past Halvings as Price Climbs to $87K

Crypto Surge Alert: 5 Coins Poised to Explode in 2026

Are Digital Asset Treasuries (DATs) Just a Fading Fad?

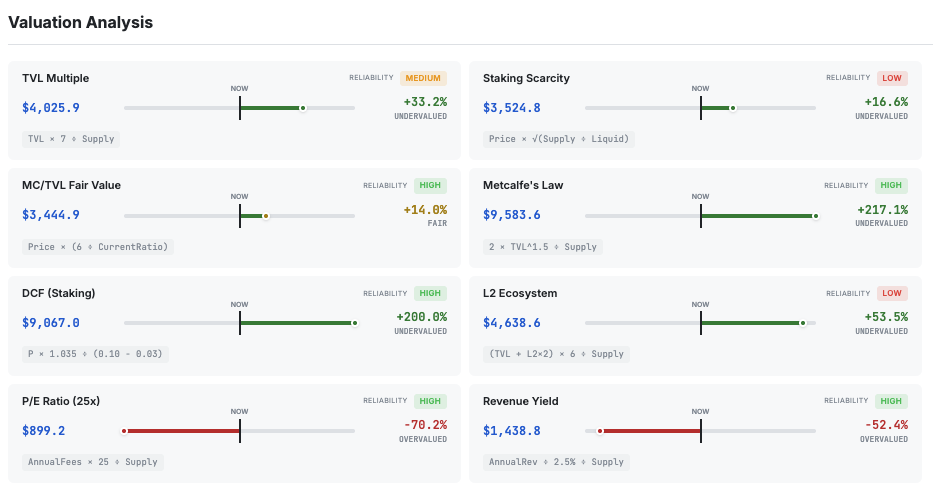

Hashed’s Simon Kim Says Ethereum Is 57% Undervalued