The transformation of the Xerox campus in Webster, NY: Driving Expansion in Industrial Real Estate and Infrastructure

- Webster’s Xerox Campus redevelopment transforms a 300-acre brownfield into a high-growth industrial hub by 2025 via $9.8M FAST NY grants and state funding. - Infrastructure upgrades (roads, sewer, power) position the site to compete with Sun Belt markets, attracting projects like a $650M dairy plant creating 250 jobs. - Low 2% industrial vacancy rates in Western NY and strategic proximity to Buffalo’s port highlight the region’s appeal for advanced manufacturing and logistics. - State-backed $283M Upstat

Strategic Infrastructure: Building a Competitive Edge

Upgrades at the Xerox Campus are carefully planned to resolve key challenges in today’s industrial development. Improvements to roads, expanded sewer capacity, and electrical infrastructure are positioning the site to rival top industrial regions like those in the Sun Belt and Midwest

The broader $283 million state commitment to Upstate New York’s industrial expansion further illustrates the magnitude of this initiative. By focusing on industries like semiconductors and renewable energy, Webster is establishing itself as a key link in the national supply chain, taking advantage of its access to Buffalo’s port and rail systems

Industrial Real Estate: Stability Amid a Challenging Market

Webster’s industrial property sector is already surpassing national averages. By 2025, warehouse and industrial vacancy rates in Western New York are around 2%, a sharp contrast to the 7.3% national figure

Demand for industrial properties is also being driven by "bluefield" projects, which combine advanced manufacturing with residential and commercial elements. This strategy not only broadens the local economy but also appeals to businesses looking to reduce employee commute times

Corporate Commitments and Economic Impact: Demonstrating Success

Although specific pre-leasing deals for the Xerox Campus have not been made public, projects like fairlife® serve as clear evidence of the site’s promise. The dairy plant alone is expected to contribute $650 million to the local economy and create well-paying jobs, helping the region diversify beyond its traditional manufacturing base

While recent searches do not provide detailed economic impact studies, broader trends offer insight. The Buffalo-Niagara area ranked as the 10th-largest U.S. exporter in 2023, reflecting its international reach, while the growth of cold storage and tech manufacturing signals a move toward higher-value industries

Risks and Considerations: Weighing Optimism with Realism

All investments carry some risk. The national industrial property market faces challenges such as increasing construction expenses and slower leasing activity due to higher interest rates

Furthermore, forecasts predict that national industrial leasing will recover by mid-2026, reaching 119.3 million square feet per year, suggesting that demand for high-quality industrial space will stay strong

Conclusion: Setting the Standard for Forward-Looking Investment

The redevelopment of the Xerox Campus demonstrates how focused infrastructure spending can drive growth in industrial real estate. By aligning with national shifts—like the move toward domestic manufacturing and sustainable logistics—Webster is creating a model for other Upstate communities. For investors, the mix of ready-to-build infrastructure, low vacancy rates, and strong corporate interest makes for a persuasive investment case. As 2025 approaches, the campus stands not only as a redevelopment project but as a symbol of economic renewal in the post-pandemic landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fluence-TON Agreement Eliminates "Cost Barrier" for Blockchain Entrepreneurs

- Fluence Energy joins TON's Grant Program to offer blockchain/AI developers high-performance compute credits, slashing infrastructure costs by up to 85% via AMD Zen5 and NVIDIA GPUs. - The initiative supports three credit tiers ($2k–$10k) with 6–12 month validity, targeting early-stage projects while Fluence reports $2.3B FY2025 revenue and 50% 2026 growth forecast. - Leveraging Fluence's enterprise-grade global infrastructure, the partnership optimizes compute-intensive tasks like TON node operations and

Top 5 Altcoins to Buy in December 2025

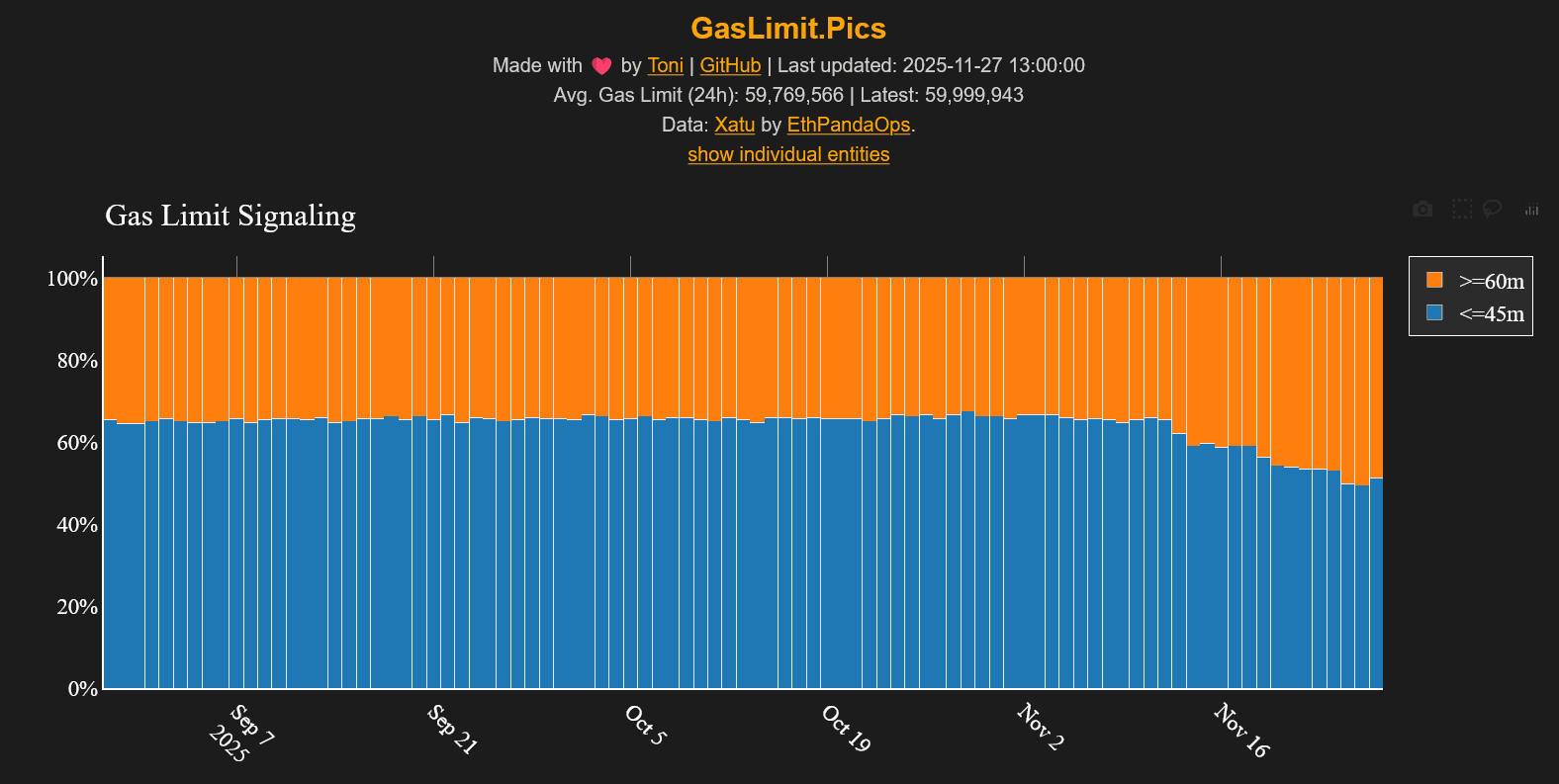

ETH Gas Limit Jumps to 60M and the Timing Is Wild

Animoca Receives ADGM Authorization, Opening a Regulated Avenue for Institutional Web3 Investments

- Animoca Brands secures in-principle approval from ADGM to operate as a regulated fund manager, advancing its institutional Web3 investment strategy in the Middle East. - The conditional approval enables compliance-focused expansion, aligning with UAE's blockchain innovation goals and institutional-grade investment pathways in gaming, NFTs, and tokenized assets. - With stakes in 600+ Web3 ventures, Animoca plans to integrate its ecosystem into regulated structures, complementing its $1B valuation target v