Global Exchanges Urge SEC to Curb Broad Crypto Exemptions, Warn on Tokenized Stock Risks

A federation of stock exchanges has sent a letter to the U.S. Securities and Exchange Commission, urging the regulator to remove special exemptions given to crypto firms offering tokenized stocks.

In a letter sent last week to the SEC’s Crypto Task Force, the World Federation of Exchanges, whose members include the NYSE, Cboe, and CME Group, told the agency that exemptive relief should not be used to fast-track crypto trading platforms into roles that resemble national securities exchanges without requiring full compliance.

The federation stated that it is “alarmed” at “the plethora of brokers and crypto-trading platforms offering or intending to offer so-called tokenised US stocks,” citing a position paper it published in late August this year.

Such products are “marketed as stock tokens or the equivalent to stocks when they are not,” the letter signed by CEO Nandini Sukumar reads.

“While we are supportive of the principle of exemptive relief, we are concerned that the broad use of such relief presents risks to investors and market integrity,” the letter continued.

Exemptive relief is a regulatory mechanism that allows a company or platform to bypass specific legal requirements when the SEC determines that doing so is in the public interest and doesn't harm investor protection. It can be granted either temporarily or permanently.

The WFE said it supports the SEC’s right to use exemptive relief, but argued that it is appropriate only where “relief is reasonably necessary for a firm to provide a product or service on a level playing field” as well as if it is “found to be consistent with the interests of the public and the protection of investors.”

The federation’s stance comes as the SEC weighs a potential sandbox framework that could grant time-limited exemptive relief to crypto platforms offering tokenized stocks, part of a broader effort to explore how digital asset markets might operate under modified regulatory conditions.

In October, SEC Chair Paul Atkins said the agency had been exploring formal “innovation exemptions” that could give crypto firms temporary relief from existing rules.

The framework, estimated to arrive within the year, would allow platforms to pilot products like tokenized stocks under SEC supervision while regulators assess long-term policy needs.

Earlier efforts to launch tokenized stock products in the U.S. have drawn scrutiny, including Robinhood’s controversial move to offer blockchain-based equities through a Europe-based partner.

Decrypt has reached out to the SEC and the World Federation of Exchanges for comment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fluence-TON Agreement Eliminates "Cost Barrier" for Blockchain Entrepreneurs

- Fluence Energy joins TON's Grant Program to offer blockchain/AI developers high-performance compute credits, slashing infrastructure costs by up to 85% via AMD Zen5 and NVIDIA GPUs. - The initiative supports three credit tiers ($2k–$10k) with 6–12 month validity, targeting early-stage projects while Fluence reports $2.3B FY2025 revenue and 50% 2026 growth forecast. - Leveraging Fluence's enterprise-grade global infrastructure, the partnership optimizes compute-intensive tasks like TON node operations and

Top 5 Altcoins to Buy in December 2025

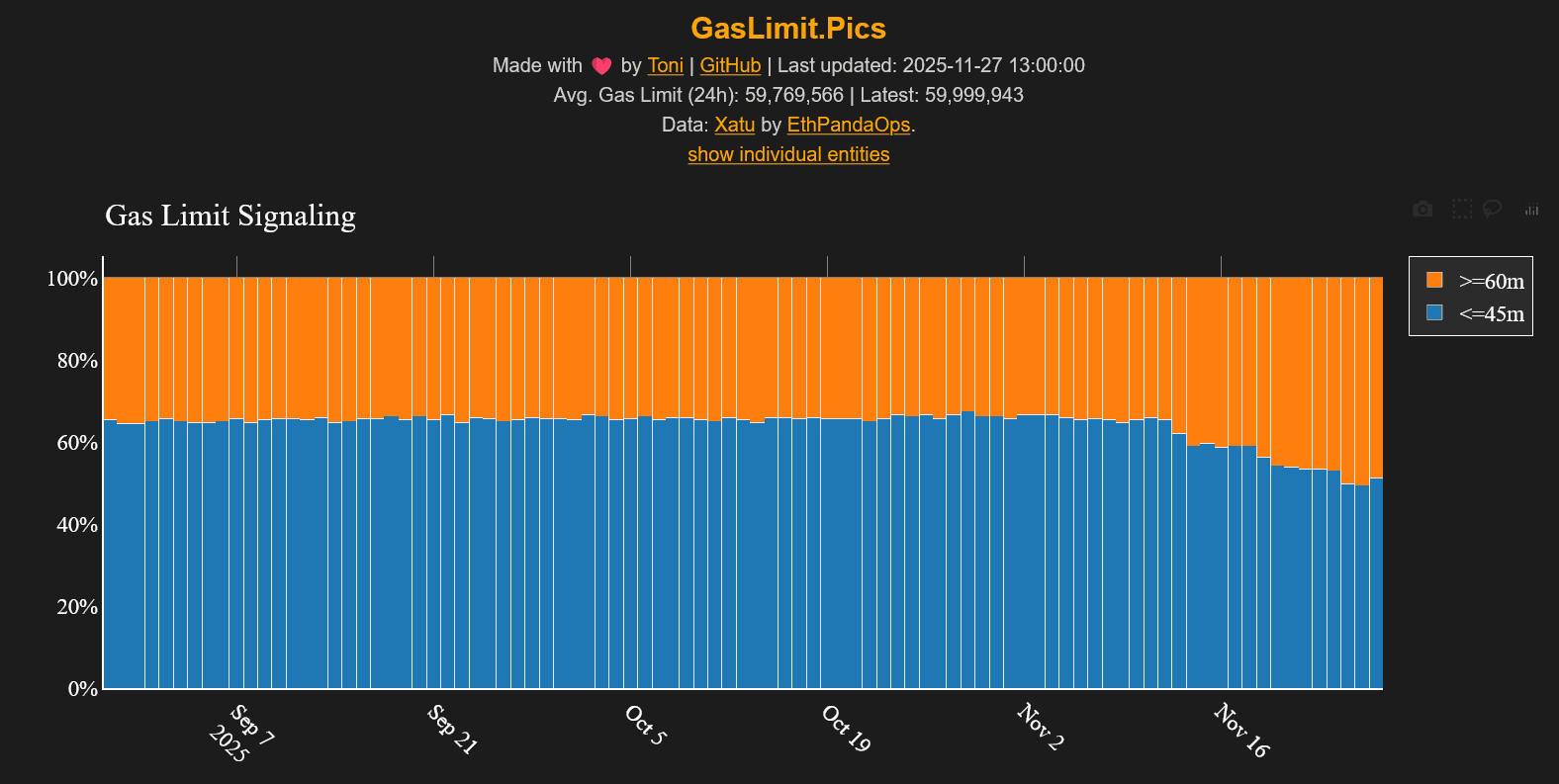

ETH Gas Limit Jumps to 60M and the Timing Is Wild

Animoca Receives ADGM Authorization, Opening a Regulated Avenue for Institutional Web3 Investments

- Animoca Brands secures in-principle approval from ADGM to operate as a regulated fund manager, advancing its institutional Web3 investment strategy in the Middle East. - The conditional approval enables compliance-focused expansion, aligning with UAE's blockchain innovation goals and institutional-grade investment pathways in gaming, NFTs, and tokenized assets. - With stakes in 600+ Web3 ventures, Animoca plans to integrate its ecosystem into regulated structures, complementing its $1B valuation target v