Bitcoin News Update: Bitcoin's Divergence from MAG7 Highlights a Shift Toward Scarcity-Focused Identity

- Bitcoin’s recent price drop and volatility warnings highlight market fragility amid diverging MAG7 correlations. - A historic $19B liquidation on October 10 marked Bitcoin’s decoupling from MAG7 tech stocks, reclassifying it as a scarcity-based hedge. - Low institutional adoption and 5% odds for MAG7 firms to hold Bitcoin in 2025 underscore limited macro support. - Trump’s growth forecasts lack Bitcoin tailwinds; CleanSpark’s AI pivot highlights crypto diversification. - Bitcoin’s future hinges on macroe

Bitcoin's latest price movements have prompted analysts to issue cautions, warning that the cryptocurrency's recent surge may not be sustainable in a market characterized by heightened volatility and shifting asset relationships. This alert comes as

The massive October 10 liquidation, the largest ever in crypto, marked a turning point in how Bitcoin moves relative to MAG7. Before this event, Bitcoin and the major tech stocks often moved together, but after the liquidation, Bitcoin

Still, confidence in Bitcoin's ability to withstand market shocks is dampened by overall market instability.

In the business sector, CleanSpark's move toward AI infrastructure reflects a wider industry shift.

Looking forward, analysts expect the gap between Bitcoin and MAG7 to persist. While Bitcoin's future is shaped by post-halving supply factors and possible ETF inflows,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top 5 Altcoins to Buy in December 2025

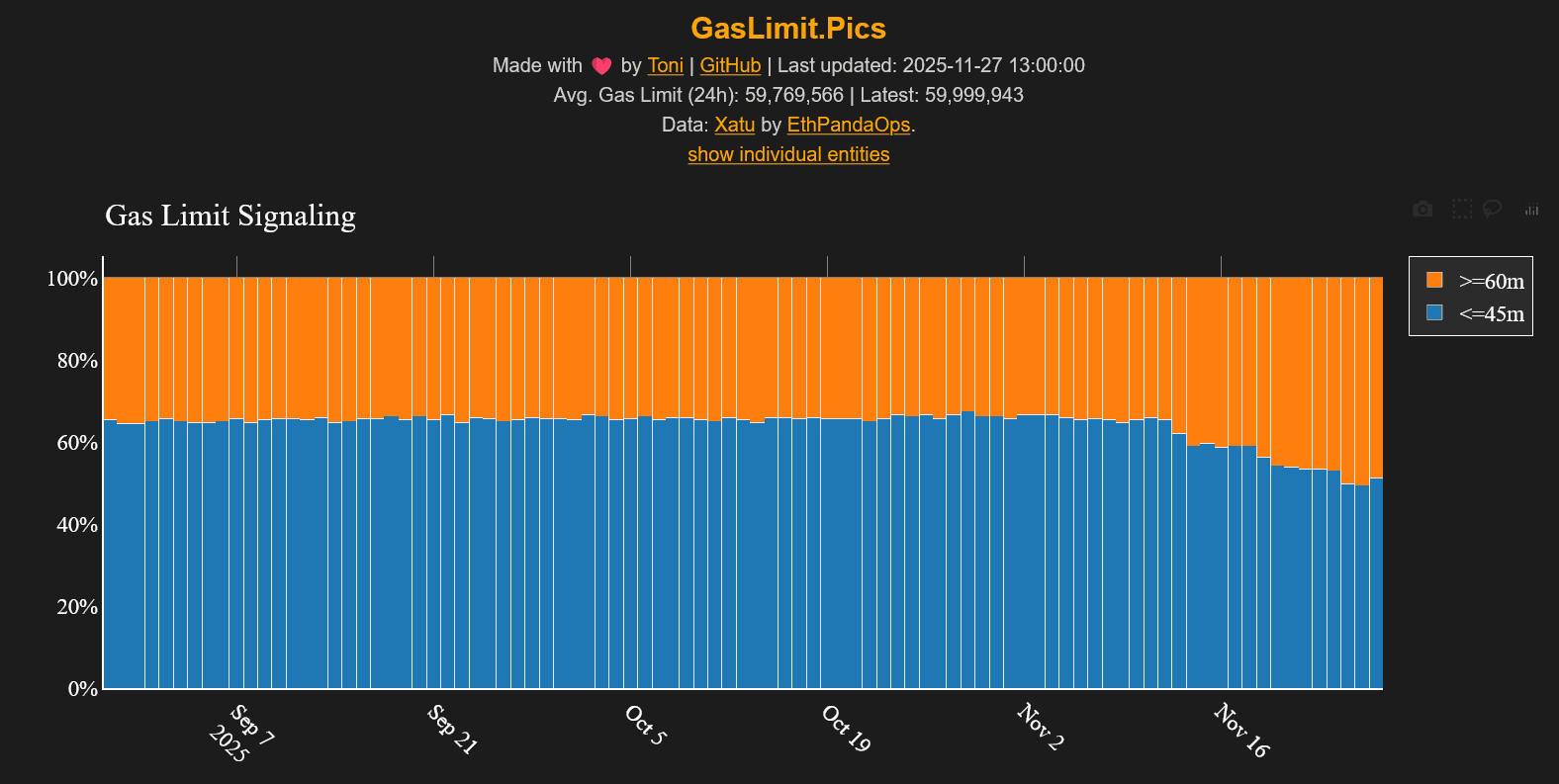

ETH Gas Limit Jumps to 60M and the Timing Is Wild

Animoca Receives ADGM Authorization, Opening a Regulated Avenue for Institutional Web3 Investments

- Animoca Brands secures in-principle approval from ADGM to operate as a regulated fund manager, advancing its institutional Web3 investment strategy in the Middle East. - The conditional approval enables compliance-focused expansion, aligning with UAE's blockchain innovation goals and institutional-grade investment pathways in gaming, NFTs, and tokenized assets. - With stakes in 600+ Web3 ventures, Animoca plans to integrate its ecosystem into regulated structures, complementing its $1B valuation target v

Dogecoin Latest Updates: Crypto Winter Challenges DOGE ETFs While Technical Indicators Suggest a Potential 80% Surge

- Dogecoin (DOGE) could surge 80-90% as ETF launches approach, driven by a falling wedge pattern and institutional interest in Grayscale's GDOG and 21Shares' products. - Technical analysts compare DOGE's potential to XRP's 2025 ETF-driven rally, though broader crypto weakness and high interest rates pose risks to sustained gains. - While DOGE trades below key moving averages and faces $0.1495 resistance, a breakout above the wedge's trendline could push prices toward $0.27–$0.29. - Long-term projections su