Bitcoin Updates: Tether's Unstable Backing and Bitcoin's Rally Intensify Liquidity Shortage

- Bitcoin's price surge triggered Tether (USDT) outflows, raising liquidity risks as reserves face S&P downgrade. - NYDIG reports $3.55B ETF outflows in November, linked to corporate trades and algorithmic stablecoin losses. - S&P cites 5.6% Bitcoin exposure in USDT reserves, exceeding overcollateralization buffers, risking undercollateralization. - Analysts warn of self-reinforcing cycles as Bitcoin rallies coincide with Tether redemptions, straining liquidity. - Tether's 24% high-risk assets in reserves

The latest surge in Bitcoin prices has sparked significant outflows of

The vulnerability of Tether’s reserves has worsened after S&P Global Ratings downgraded USDT’s stability score to “weak,” its lowest rating. The downgrade was attributed to Tether’s rising allocation to riskier assets, with Bitcoin now making up 5.6% of USDT’s reserves—surpassing the 3.9% overcollateralization margin.

Despite USDT maintaining its lead in the stablecoin sector with $184.4 billion in circulation, the agency suggested that greater transparency and a reduction in risky asset exposure could help restore its rating. Nevertheless, the current trends mark a pivotal moment for the crypto industry, where tightening liquidity and increased regulatory oversight may challenge the market’s durability in the near future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fluence-TON Agreement Eliminates "Cost Barrier" for Blockchain Entrepreneurs

- Fluence Energy joins TON's Grant Program to offer blockchain/AI developers high-performance compute credits, slashing infrastructure costs by up to 85% via AMD Zen5 and NVIDIA GPUs. - The initiative supports three credit tiers ($2k–$10k) with 6–12 month validity, targeting early-stage projects while Fluence reports $2.3B FY2025 revenue and 50% 2026 growth forecast. - Leveraging Fluence's enterprise-grade global infrastructure, the partnership optimizes compute-intensive tasks like TON node operations and

Top 5 Altcoins to Buy in December 2025

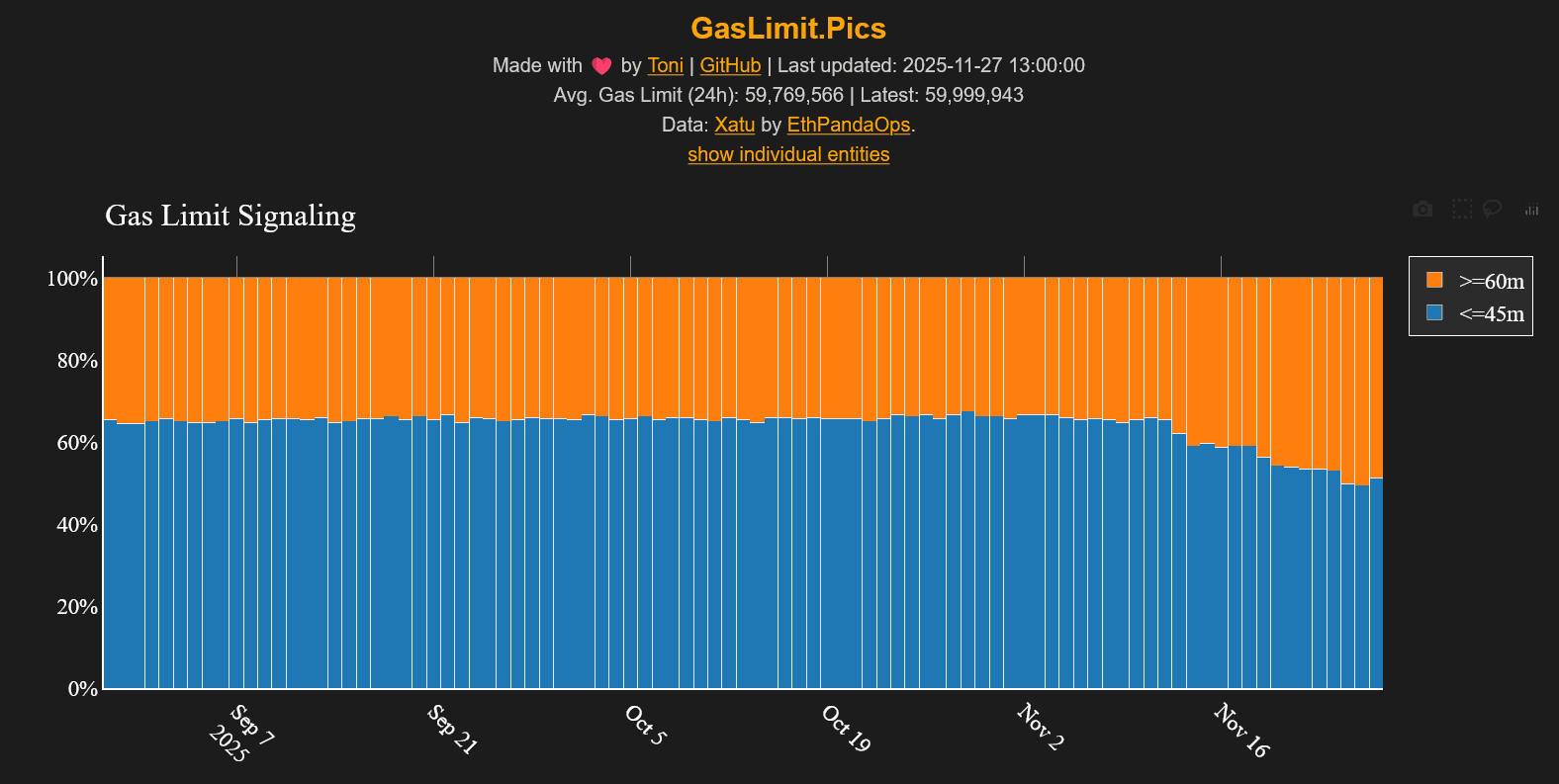

ETH Gas Limit Jumps to 60M and the Timing Is Wild

Animoca Receives ADGM Authorization, Opening a Regulated Avenue for Institutional Web3 Investments

- Animoca Brands secures in-principle approval from ADGM to operate as a regulated fund manager, advancing its institutional Web3 investment strategy in the Middle East. - The conditional approval enables compliance-focused expansion, aligning with UAE's blockchain innovation goals and institutional-grade investment pathways in gaming, NFTs, and tokenized assets. - With stakes in 600+ Web3 ventures, Animoca plans to integrate its ecosystem into regulated structures, complementing its $1B valuation target v