Global Exchanges Caution: Excluding Crypto May Undermine Market Fairness and Integrity

- Global exchanges urge SEC to reject broad crypto exemptions for tokenized stocks to prevent market integrity risks and unfair competition. - SEC considers sandbox framework for crypto pilots, but warned by WFE and SIFMA against creating parallel markets and eroding safeguards. - SIFMA highlights crypto market collapses, stressing that U.S. markets’ strength lies in regulated depth and liquidity, not speed. - Robinhood and Coinbase advance tokenized stock initiatives despite resistance from traditional ex

The U.S. Securities and Exchange Commission (SEC) is under increasing scrutiny from international financial organizations, which are urging the agency not to provide sweeping regulatory waivers to crypto platforms dealing in tokenized stocks, amid growing worries about market fairness and investor safety. On November 21, the World Federation of Exchanges (WFE)—which counts major exchanges such as Nasdaq, Cboe, and CME Group among its members—sent a letter to the SEC, pressing the agency to turn down requests for "

Tokenized stocks, which use blockchain to represent fractional shares of traditional equities, have sparked both enthusiasm and skepticism. Supporters believe these assets could make trading more efficient and accessible, but detractors point to dangers like fragmented markets and unstable pricing. The WFE pointed out that tokenized stocks are often "

SEC Chair Paul Atkins has indicated a willingness to explore a "sandbox" approach, which would grant temporary exemptions for crypto firms to test tokenized offerings under regulatory oversight

This ongoing debate highlights the fundamental conflict between fostering innovation and upholding regulatory standards. While the SEC’s Crypto Task Force considers custom exemptions, established exchanges and advocacy groups maintain that essential values—such as equal access, openness, and investor safeguards—must remain intact. For example, Robinhood’s move into tokenized stocks through European collaborations and Coinbase’s pending SEC filings demonstrate the rising demand for blockchain-based trading

The SEC’s forthcoming decisions will be pivotal for the evolution of tokenized assets. Should the agency move forward with its sandbox initiative, it will need to carefully balance encouraging innovation with maintaining market integrity. Detractors warn that even well-meaning exemptions could undermine the credibility of U.S. capital markets, which have long relied on robust regulatory protections to inspire investor trust. As SIFMA emphasized, "The strength of U.S. markets lies in their depth, liquidity, and reliability—qualities that cannot be sacrificed for the sake of speed or convenience".

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fluence-TON Agreement Eliminates "Cost Barrier" for Blockchain Entrepreneurs

- Fluence Energy joins TON's Grant Program to offer blockchain/AI developers high-performance compute credits, slashing infrastructure costs by up to 85% via AMD Zen5 and NVIDIA GPUs. - The initiative supports three credit tiers ($2k–$10k) with 6–12 month validity, targeting early-stage projects while Fluence reports $2.3B FY2025 revenue and 50% 2026 growth forecast. - Leveraging Fluence's enterprise-grade global infrastructure, the partnership optimizes compute-intensive tasks like TON node operations and

Top 5 Altcoins to Buy in December 2025

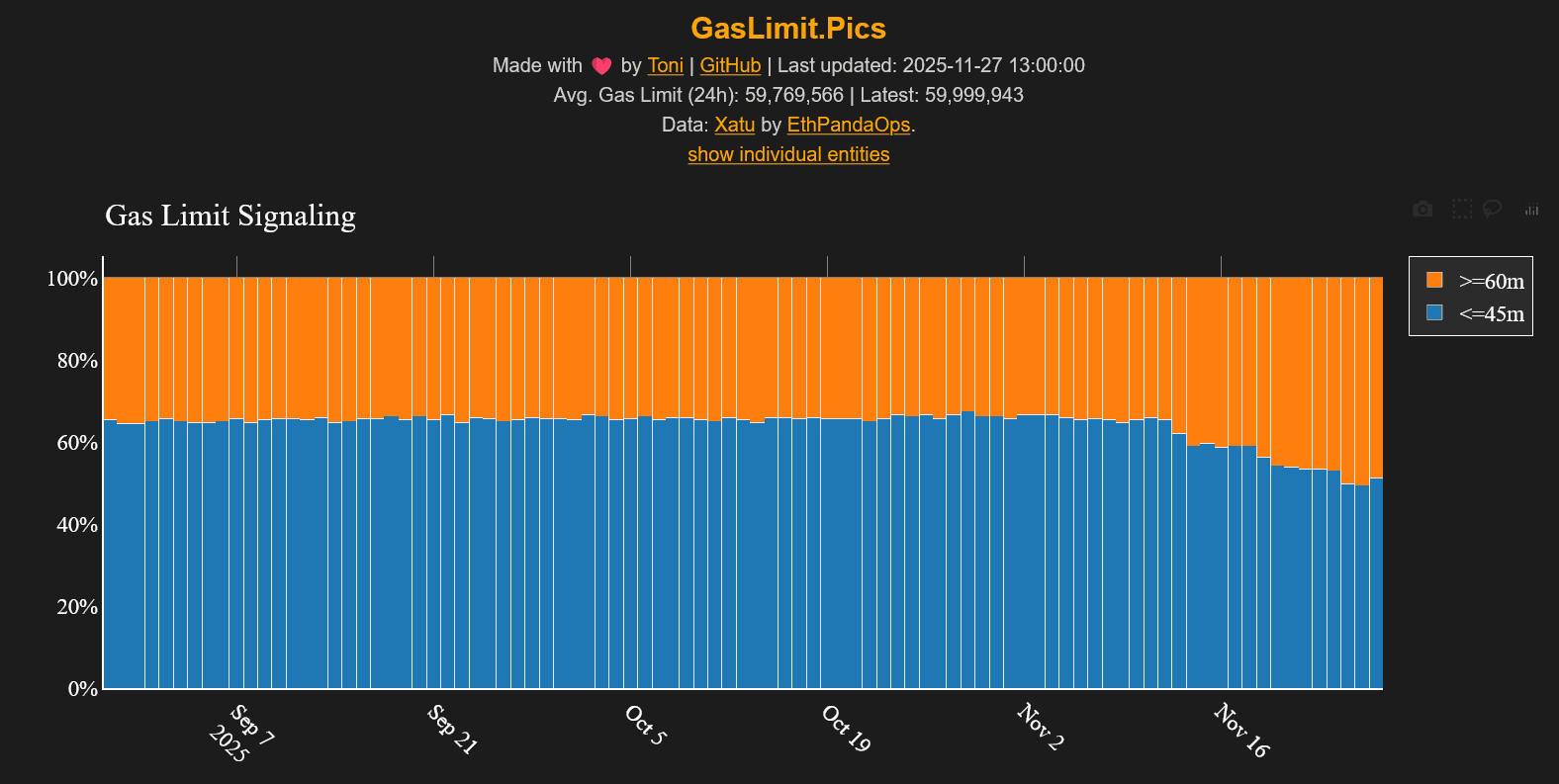

ETH Gas Limit Jumps to 60M and the Timing Is Wild

Animoca Receives ADGM Authorization, Opening a Regulated Avenue for Institutional Web3 Investments

- Animoca Brands secures in-principle approval from ADGM to operate as a regulated fund manager, advancing its institutional Web3 investment strategy in the Middle East. - The conditional approval enables compliance-focused expansion, aligning with UAE's blockchain innovation goals and institutional-grade investment pathways in gaming, NFTs, and tokenized assets. - With stakes in 600+ Web3 ventures, Animoca plans to integrate its ecosystem into regulated structures, complementing its $1B valuation target v