GameFi Push Ignites Pi Network Hype, So What’s Behind the Rising Sell Wall?

Pi Network is expanding its presence in Web3 gaming through a new partnership with CiDi Games. It aims to enhance Pi Coin’s real-world utility ahead of its first regulated trading debut in the European Union (EU). Yet, despite the strategic move and recent regulatory progress, exchange holdings of Pi coin continue to climb, indicating persistent

Pi Network is expanding its presence in Web3 gaming through a new partnership with CiDi Games. It aims to enhance Pi Coin’s real-world utility ahead of its first regulated trading debut in the European Union (EU).

Yet, despite the strategic move and recent regulatory progress, exchange holdings of Pi coin continue to climb, indicating persistent sell pressure in the market.

Pi Network’s GameFi Gamble Deepens, but Why Are Exchange Balances Surging?

The partnership, announced on November 26, 2025, positions CiDi Games as a core developer within Pi’s ecosystem. According to Pi Network, the collaboration:

- Expands Pi’s real-world use cases,

- Signals commitment to gaming at scale, and

- Creates new opportunities for its tens of millions of users, known as Pioneers, to transact with Pi daily.

By combining Pi’s global reach with CiDi’s development capabilities, the two parties aim to anchor Pi at the center of Web3 gaming.

CiDi Games is building a suite of Pi-integrated titles, including a lightweight HTML5 game platform scheduled for testing in Q1 2026.

The company is also developing APIs and infrastructure to facilitate easier integration with Pi for third-party game studios. This mirrors models used by established blockchain gaming platforms.

Pi Network Ventures, the project’s investment arm, has taken an equity stake in CiDi, signaling internal confidence despite the developer’s limited public track record. CiDi’s website contains little more than a logo, raising questions about transparency.

Still, Pi argues that gaming is a “natural fit” for its social, interactive, crypto-enabled community. Analysts say the strategy appears pragmatic, with casual gameplay known to drive transaction growth in emerging blockchain ecosystems.

Why did the @PiCoreTeam partner with CiDi Games?Because simple, accessible games attract massive audiences & the easiest way to scale on-chain activity, utility, and global adoption for $Pi 🔥🚀Simple games → Big traffic → More transactions → Stronger ecosystem.Now you… pic.twitter.com/rdQ4vNcwoN

— MAHIDHAR CRYPTO (@Mahidhar_Crypto) November 27, 2025

The push into GameFi comes just as Pi Network moves toward formal market entry in Europe. In October, the project published a MiCA-compliant white paper. This fulfills regulatory requirements ahead of trading on Malta-licensed exchanges, such as OKX and OKCoin, beginning November 28.

The 27-page document:

- Outlines security standards, consumer protections, and compliance procedures for the EU.

- Reaffirms that Pi was never issued via an ICO but earned through community mining.

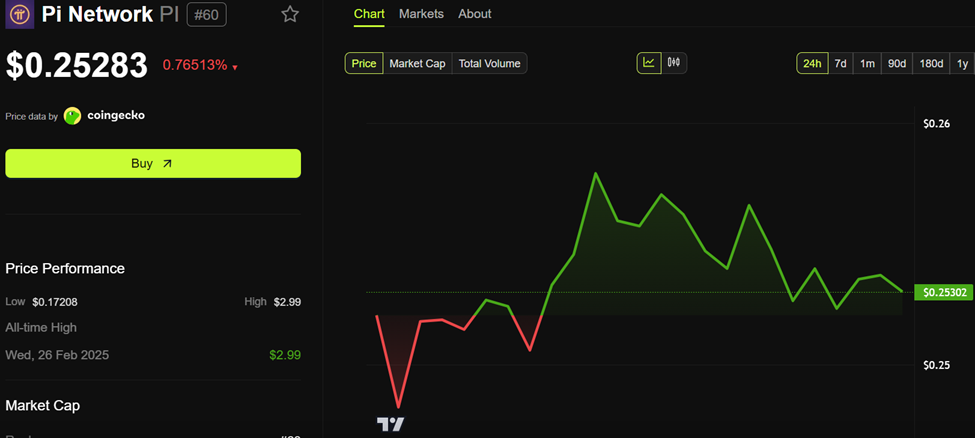

The news lifted Pi’s price by 10%, while also reinforcing its shift from a closed mobile mining platform to a regulated digital asset. Pi previously gained institutional exposure through the Valour Pi ETP listed in Sweden.

Rising Exchange Balances Threaten to Outpace Pi’s Ecosystem Growth

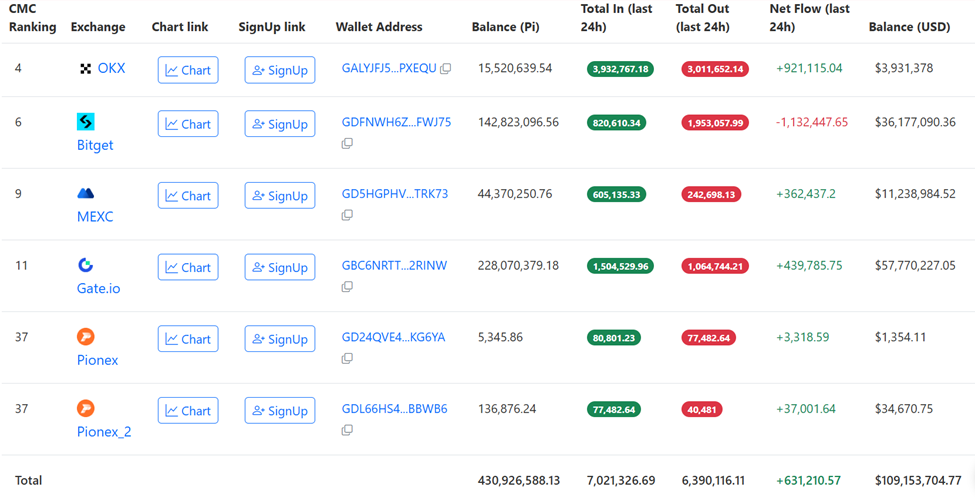

However, despite the positive momentum, supply dynamics continue to pose a challenge. Exchange balances reached 430.8 million Pi as of November 27, equivalent to approximately $109 million at current prices.

Gate.io holds the largest share at 228 million, followed by Bitget and the MEXC exchange. Net inflows added more than 631,200 Pi in the past 24 hours, suggesting more holders are preparing to sell.

Pi Coin Exchange Balances. Source:

Pi Coin Exchange Balances. Source:

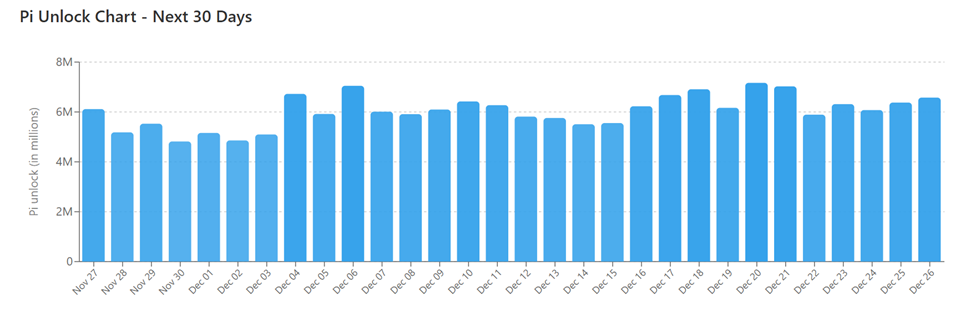

The surge in supply coincides with Pi’s aggressive unlock schedule. November unlock totalled 145 million Pi, while December is set to release 173 million, the largest monthly unlock until late 2027.

Pi Unlock Schedule. Source:

Pi Unlock Schedule. Source:

Meanwhile, daily trading volume remains modest at around $30 million. Pi Core Team wallets, which collectively hold more than 71 billion tokens, have shown no significant movement and do not appear to be contributing to the selling pressure.

However, with only an estimated 3 billion Pi circulating in practice, the rising exchange balances place continued downward pressure on price.

Pi Network (PI) Price Performance. Source:

Pi Network (PI) Price Performance. Source:

Whether GameFi adoption and EU trading access can absorb this supply remains an open question, even as Pi Network’s ecosystem growth accelerates in the face of the market’s sell-side liquidity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Investors Move Away from Bitcoin and Ethereum ETFs While Solana and XRP See Increased Interest

- U.S. Bitcoin and Ethereum ETFs faced $5.58B in November outflows as investors shifted to Solana and XRP funds amid market selloffs. - BlackRock's IBIT led BTC outflows with $355.5M single-day withdrawals, while Fidelity's FETH attracted $95.4M ETH inflows. - Solana ETFs gained $476M since October debut, contrasting BTC/ETH declines, as analysts cite institutional profit-taking and risk-off positioning. - Recent stabilization saw $129M BTC and $78M ETH ETF inflows by Nov 25, though long-term structural ch

AI Industry's Profit Boom Fails to Ease Doubts Over High Valuations Amid Intensifying Sell-Off

- AI sector faces valuation skepticism despite strong earnings, with Nasdaq down 2.2% as investors shift to defensive stocks. - C3.ai's 26% monthly decline highlights challenges: 19% revenue drop, leadership changes, and uncertain Microsoft partnership monetization. - Decentralized GPU platforms like CUDOS Intercloud gain traction by offering cost-effective alternatives to cloud giants through smart contracts. - Palantir contrasts with 62.8% revenue growth and 40.3% net margin, leveraging NVIDIA partnershi

XRP News Today: Abu Dhabi’s Green Light Establishes UAE as a Pioneer in Stablecoin Development

- Ripple's RLUSD stablecoin gains Abu Dhabi regulatory approval as UAE advances digital finance leadership. - ADGM's "Accepted Fiat-Referenced Token" designation enables institutional use for lending and cross-border payments. - RLUSD's $1.2B market cap growth reflects institutional demand, backed by USD reserves and dual blockchain operations. - UAE's ADGM-DIFC regulatory synergy attracts global fintechs , with Ripple expanding partnerships across Africa and Asia. - Regulatory milestones position RLUSD to

Ethereum Updates: Ethereum Drops to $2,800, Prompting Surge in Demand for ZKP's Hardware-Based Presale

- Ethereum's price fell below $2,800, triggering $6.5M liquidations and testing critical support levels amid declining on-chain demand metrics. - Institutional players like BitMine accumulated 3.62M ETH (~$10.4B) despite the selloff, signaling long-term bullish conviction. - ZKP's hardware-driven presale gained traction with $17M in ready-to-ship Proof Pods and Miami Dolphins partnership for privacy-focused sports analytics. - Mutuum Finance's $19M DeFi presale and ZKP's auction model with $50K wallet caps