Bitcoin Price Climbs Over $90,000 After 7 Days, But Liquidity Concerns Linger

Bitcoin is beginning to recover from its recent decline, crossing above $90,000 for the first time in a week as market conditions slowly improve. However, despite the renewed optimism, one key group of investors continues to fuel concerns around liquidity. This lingering pressure is preventing Bitcoin from reestablishing a fully stable upward trend. Bitcoin Holders

Bitcoin is beginning to recover from its recent decline, crossing above $90,000 for the first time in a week as market conditions slowly improve.

However, despite the renewed optimism, one key group of investors continues to fuel concerns around liquidity. This lingering pressure is preventing Bitcoin from reestablishing a fully stable upward trend.

Bitcoin Holders Could Present A Threat

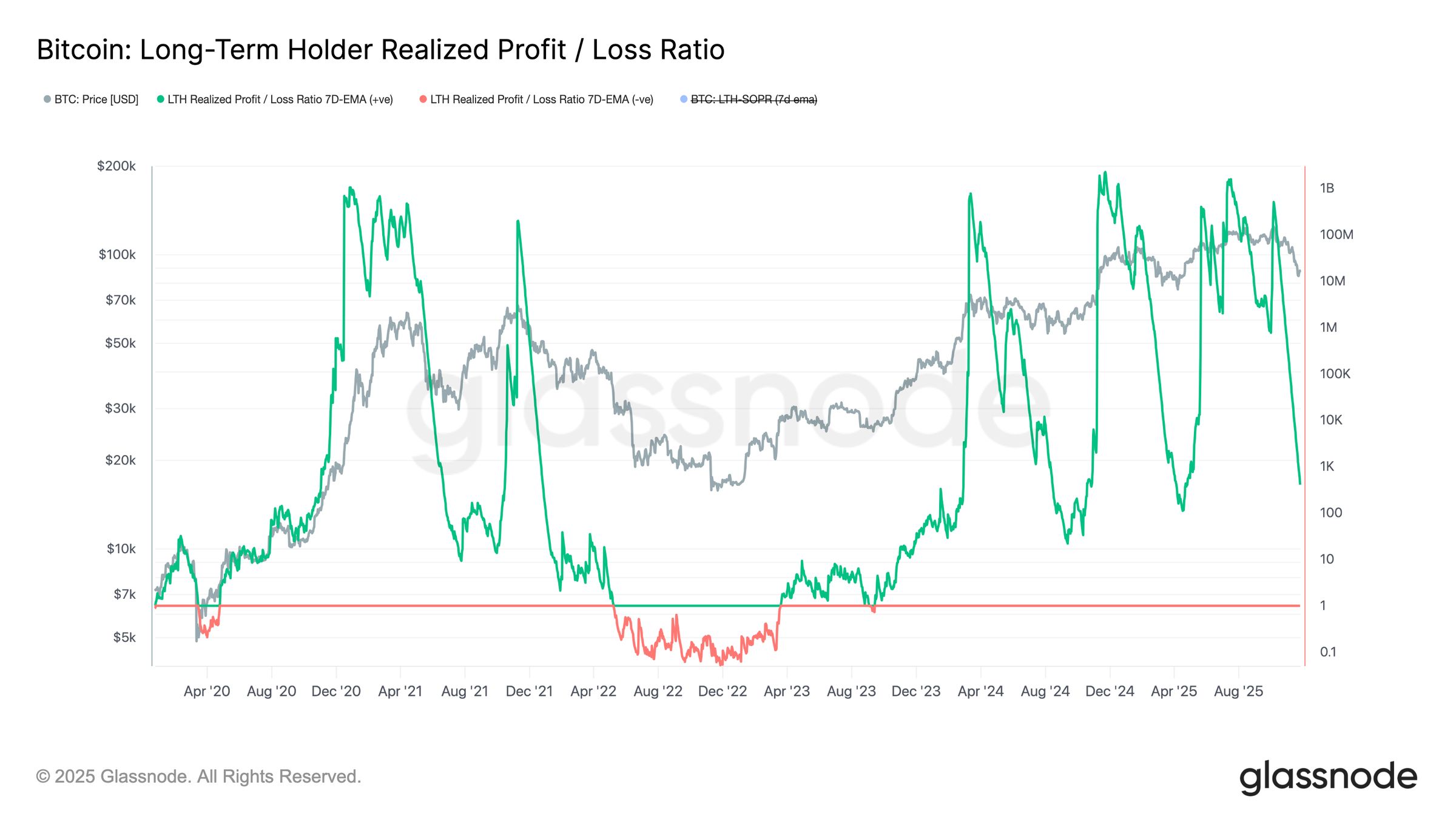

Liquidity trends measured through realized profit and loss provide important insight into longer-term market health. The Long-Term Holder (LTH) Realized Profit/Loss Ratio remains above 100x, indicating that long-term holders are still realizing profits rather than losses.

This suggests liquidity remains healthier than during major bottom formations or the stressed market conditions of Q1 2022. As long as LTHs continue to realize profits, Bitcoin retains a layer of structural support.

However, the picture could shift quickly. If liquidity fades and the ratio compresses toward 10x or lower, the risk of entering a deeper bear market becomes difficult to dismiss.

Historically, that threshold has aligned with moments of severe stress across long-term holders. Should LTHs begin realizing losses, it would signal a deterioration in market confidence and a potential reversal in price momentum.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Bitcoin LTH Realized P/L Ratio. Source:

Glassnode

Bitcoin LTH Realized P/L Ratio. Source:

Glassnode

Macro momentum indicators also show signs of cooling stress in the market. Recent patterns reflect clear mean reversion, suggesting that volatility sellers are returning. Even so, implied volatility remains elevated relative to actual market performance.

Glassnode data shows that one-month implied volatility has fallen—dropping roughly 20 vol points from last week’s peak and about 10 points from recent levels—indicating that some of the stress premium is now unwinding.

The decline in implied volatility, combined with easing put skew, signals reduced demand for immediate downside protection. This means short-term fear has cooled, though Bitcoin still remains vulnerable to sudden shifts.

Bitcoin Options Volatility. Source:

Glassnode

Bitcoin Options Volatility. Source:

Glassnode

BTC Price Still Needs To Test Crucial Support

Bitcoin is trading at $91,366, holding firmly above the $89,800 support level after crossing $90,000 for the first time in seven days. The crypto king now faces resistance at $91,521, a key barrier that will determine the next leg of its recovery.

Volatility may increase if long-term holders begin realizing losses, potentially derailing the rebound. This scenario could pull Bitcoin back below $90,000, exposing it to declines toward $86,822 or $85,204 in the short term.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

If long-term holders continue realizing profits and traders maintain a bullish tone, Bitcoin should remain protected from deeper downside.

This resilience could help reignite bullish momentum, allowing BTC to break above $91,521 and target $95,000. A move beyond this psychological zone would open the path toward $98,000 and potentially a push toward the $100,000 mark.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Balancer’s $8 Million Recovery Strategy Splits DeFi: Accuracy or Backing the Community

- Balancer DAO proposes $8M recovery plan to reimburse victims of a $116M exploit via proportional BPT-based returns to affected liquidity pools. - Attack exploited a rounding function vulnerability in Stable Pools, bypassing 11 smart contract audits and draining funds through manipulated swaps. - Non-socialized distribution prioritizes precision over community-wide sharing, sparking debates about fairness and governance in DeFi recovery. - Industry experts highlight the incident as a "wake-up call," urgin

Ethereum Updates Today: Bhutan's Strategic Adoption of Ethereum: Leveraging Blockchain for National Digital Identity

- Bhutan stakes 320 ETH ($970,820) via Figment.io, adding 10 Ethereum validators to boost blockchain participation and economic resilience. - The government migrates its National Digital Identity system to Ethereum by 2026, leveraging its security for 800,000 citizens' self-sovereign identity. - Crypto reserves (6,154 BTC, 336 ETH) support the Gelephu Mindfulness City project, aiming to integrate blockchain with sustainable urban development. - Challenges include digital asset volatility and regulatory gap

The Strategic Value of Industrial Properties Amid Upstate New York’s Changing Economic Environment

- New York State's FAST NY and POWER UP programs are driving industrial real estate growth in Upstate through infrastructure grants and power-ready site upgrades. - $283M+ in grants since 2022 has transformed underutilized sites into competitive assets for semiconductors and clean-tech industries. - Corporate campus redevelopments like STAMP Park demonstrate 10%+ property value increases through public-private infrastructure partnerships. - Strategic investments align with semiconductor "superhighway" goal

Balancer DAO Starts Discussing $8M Recovery Plan After $110M Exploit Cut TVL by Two-Thirds