Bitcoin Bounces Back to $91,000: Can It Break Out of the Continued Rally?

Amid a combination of factors such as the macroeconomic environment and expectations of a Fed rate cut, the cryptocurrency market has temporarily halted its downward trend.

Original Title: "Crypto Market Takes a Breather, Bitcoin Rebounds above $91,000 - Can It Continue?"

Original Author: Shaw, Golden Finance

In the early morning of November 27, after weeks of sluggishness, the crypto market saw a turning point. Bitcoin experienced a rapid rebound, quickly surpassing $91,500, momentarily touching $91,950, with a more than 4% increase in 24 hours; Ethereum returned above the $3,000 mark, briefly reaching $3,071.37, with a more than 3.5% increase in 24 hours. Data shows that within the past 24 hours, there were liquidations worth $323 million across the network, with long liquidations totaling $77.083 million and short liquidations totaling $246 million.

Recently, there has been a shift in the market direction. Under the combined influence of macroeconomic factors and the expectation of a Fed rate cut, the crypto market has temporarily halted its decline. Can this recent rise indicate that the market has bottomed out for a rebound and can it continue?

1. Crypto Market Halts Decline and Rebounds, Panic Eases Slightly

Early today, the crypto market saw a turning point after weeks of sluggishness, with Bitcoin experiencing a rapid rebound, quickly surpassing $91,500, momentarily touching $91,950, with a more than 4% increase in 24 hours; Ethereum returned above the $3,000 mark, briefly reaching $3,071.37, with a more than 3.5% increase in 24 hours.

Coinglass data shows that within the past 24 hours, there were liquidations worth $323 million across the network, with long liquidations totaling $77.083 million and short liquidations totaling $246 million. BTC liquidations amounted to $133 million, ETH liquidations to $52.3725 million, SOL liquidations to $16.2007 million. In the past 24 hours, a total of 112,363 people were liquidated, with the largest single liquidation occurring on Hyperliquid-BTC-USD, valued at $14.5787 million.

The recent persistent decline in cryptocurrencies, coupled with this significant rebound, has given the market a brief respite, easing the deepening panic to some extent. Positive macroeconomic trends, growing expectations of a Fed rate cut, ETF funds, and other factors may be the main drivers of this cryptocurrency rebound.

2. Improved Macro Economic Data Stimulates Major Asset Markets

The latest data shows that the U.S. initial jobless claims last week recorded 216,000, estimated at 225,000, with a previous value of 220,000, hitting the lowest level since mid-April, significantly boosting investor confidence. Although the PPI report showed a slight increase in wholesale prices due to rising energy and food costs, the core PPI increase (2.6%) was the smallest since July 2024.

In the U.S., recent macroeconomic data has been positive, and retail stocks related to Thanksgiving holiday consumption have received a boost. Optimism has supported the continued strength of tech stocks and small-cap stocks. The S&P and Nasdaq hit two-week highs. Dell closed up nearly 6%. NVIDIA rebounded in the chip sector, rising over 1%, while Coreweave rose over 4%; Google fell by 1%.

The improvement in macroeconomic data has stimulated investors' confidence in the market, and the rise of major assets such as U.S. stocks has also impacted the rebound in the cryptocurrency market.

III. Fed Signals a Shift, Rate Cut Expectations Rise Again

The latest Fed Beige Book shows that in recent weeks economic activity in the U.S. has remained largely unchanged, with overall consumer spending further declining except among high-end consumers. The Beige Book noted that the U.S. labor market has softened slightly, and price levels have seen moderate increases. The Fed stated in the report: "The overall economic outlook remains stable, with some surveyed businesses warning of risks of economic slowdown in the coming months, while the manufacturing sector demonstrates cautious optimism." Due to the recent longest-ever U.S. government shutdown lasting until November 12, key economic data collection was disrupted, and field surveys reflecting the actual conditions of businesses and consumers in recent months have been closely watched. Fed officials will be unable to access complete labor market and inflation data for October and November before the December policy meeting.

Following the report, JPMorgan economists revised their forecast, believing that the Fed will start cutting rates in December, reversing the bank's judgment a week ago that policymakers would delay the rate cut until January next year. JPMorgan's research team stated that several heavyweight Fed officials (especially New York Fed President Williams) have expressed support for a near-term rate cut, prompting them to reassess the situation. Currently, JPMorgan expects the Fed to cut rates by 25 basis points in December and another 25 basis points in January next year.

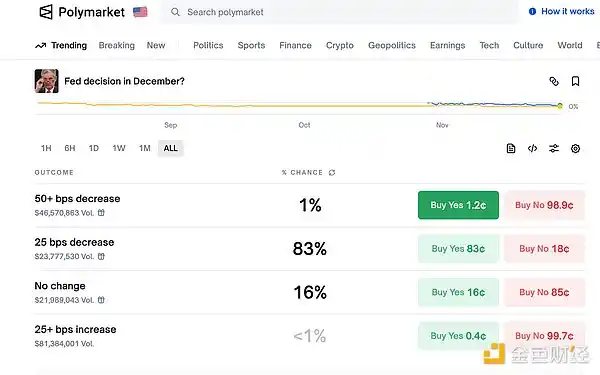

CME's "FedWatch" data shows that the probability of a 25-basis-point rate cut by the Fed in December is 84.9%, with a probability of maintaining the rate at 15.1%. The cumulative probability of a 25-basis-point rate cut by January next year is 66.4%, with a probability of keeping the rate unchanged at 11.1%, and a cumulative probability of a 50-basis-point cut at 22.6%. In addition, Polymarket data shows that the "probability of the Fed cutting rates by 25 basis points in December has risen to 83%," with a decrease to 16% in the probability of maintaining the rate unchanged, and the trading volume for this prediction event has reached $173 million.

Recent Federal Reserve reports and statements from several officials have continuously raised market expectations of a rate cut in December, with investors regaining confidence in risk assets as liquidity re-enters the market.

IV. ETF Fund Flows Rebound Slightly; New Coin ETFs Launched

Trader T monitoring data shows that the U.S. Bitcoin Spot ETF has seen net inflows for two consecutive days, totaling $149 million; the U.S. Ethereum Spot ETF has also seen net inflows for two consecutive days, totaling $139 million. In addition, several institutions have successively launched ETFs for other mainstream coins. Grayscale has now launched XRP and Dogecoin ETFs. Bitwise has officially launched the Bitwise Dogecoin ETF on the New York Stock Exchange, with the code BWOW. Franklin Templeton, VanEck, and others have also applied to launch new ETF products.

The temporary recovery in ETF fund inflows, along with the introduction of related cryptocurrency asset ETFs by other institutions, indicates that institutional investor funds have not completely exited and will re-enter after the readjustment.

V. Market Analysis and Interpretation

Can this recent cryptocurrency rebound signal that the market has bottomed out, that the deep correction has come to an end, and that the upward trend can continue? Let's take a look at some recent market analysis and interpretations.

1. 4E Lab observations indicate that the return of ancient whales, the relaxation of ETF derivatives, a trend towards structured regulation, and continuous institutional buying together constitute a moderately bullish signal. Bitcoin's "expectation gap" has shifted from extreme optimism to rational optimism, while Ethereum is regaining attention from on-chain whales. Improvement in funding and regulatory environments has led the market into a phase of resonance with the three factors of "warm policy, stable funding, and rising sentiment."

2. Matrixport's chart release states, "Based on federal funds futures implied pricing, the market expects an 84% probability of a Fed rate cut on December 10th, with a 65% probability of holding rates steady in January next year. Under such interest rate path expectations, even if a rate cut is implemented in December, the overall monetary policy easing will still be limited. Compared to Bitcoin, gold has a higher correlation with the U.S. fiscal deficit and debt issuance pace, and is more directly related to hedging fiscal expansion and rate cut expectations. Bitcoin relies more on actual incremental fund inflows, and given the current limited incremental liquidity, divergence in the short term between gold and Bitcoin trends is likely to continue."

3. Galaxy Digital Founder Mike Novogratz stated that he still believes Bitcoin can return to $100,000 by the end of the year, but there will be significant selling pressure by then. The "1011" flash crash had a mid-term psychological impact on the market. Additionally, Novogratz mentioned that with clearer crypto policies and the involvement of traditional financial giants, the market will see deep fragmentation in the future, favoring tokens that can provide value.

4. Bitwise Advisor Jeff Park believes that the previous four-year Bitcoin halving cycle has ended and has now been replaced by a two-year cycle, driven by the economic behavior of institutional fund managers and ETF fund flows.

5. CryptoQuant analyst Abramchart pointed out that the market has just experienced a deep "leverage washout," with the total open interest dropping from $45 billion to $28 billion, marking the largest decline in this cycle. This is not a bearish signal but more like a market bloodletting, clearing out overleveraged speculative positions and setting the stage for a healthier upward momentum.

6. BitMine Chairman Tom Lee believes that Bitcoin could potentially revisit its October all-time high of $125,100 before the end of the year. In an interview on Wednesday, Lee stated, "I think it's very likely that Bitcoin could surpass $100,000 by the end of the year, and maybe even set a new high."

7. Wintermute Trading Strategist Jasper De Maere pointed out that the options market indicates traders generally expect Bitcoin to fluctuate in the $85,000-$90,000 range, betting that the market will maintain the status quo rather than experience a breakthrough trend. Whether this rebound can truly translate into a sustainable uptrend will ultimately depend on whether macro policies and funding can provide lasting and robust support.

8. Delphi Digital analysts published an analysis of the bullish and bearish structures currently forming in BTC. The bullish scenario interprets the current trend as an ABC correction, which needs to be completed and break above $103,500 to confirm. The bearish scenario involves the current rebound forming a lower high below $103,500 at any point, which would trigger the next leg down to complete a full 5-wave impulse decline before seeing a larger-scale sustained rebound.

9. LiquidCapital (formerly LDCapital) Founder Elaine Yi posted stating: ETH Returns to 3000, extreme panic sentiment has passed, and she continues to be optimistic about the follow-up market trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A New Paradigm for AI Data Economy: Exploring DIN's Ambitions and Node Sales through Modular Data Preprocessing

AI is undoubtedly one of the hottest sectors globally today. From Silicon Valley's OpenAI to domestic players like Moonshot and Zhipu Qingyan, both emerging entrepreneurs and traditional tech giants are joining this AI revolution.

Solana analysis: SOL price unlikely to break $150 for now

Bitcoin has a 75% chance of short-term rally, says trader Alessio Rastani

Bitcoin trades above $90K: Here’s what bulls must do to extend the rally