Arthur Hayes Wagers on DeFi Returns Amid Rising Institutional Embrace of Crypto

- Arthur Hayes, ex-BitMEX CEO, acquired 2.01M ENA , 218K PENDLE, and 33K ETHFI tokens in 30 minutes, signaling strategic DeFi yield focus. - Recent ENA trades show Hayes bought $245K worth after selling $1.38M earlier, highlighting his liquidity provider role in volatile markets. - U.S. SEC's Bitcoin ETF approval and Abu Dhabi's Ripple stablecoin adoption reflect growing institutional crypto infrastructure and regulatory clarity. - Experts caution single-address activity may not represent broader trends, u

Arthur Hayes Increases Investments in DeFi Tokens

Arthur Hayes, previously the CEO of BitMEX, has recently ramped up his involvement in decentralized finance by acquiring substantial amounts of ENA, PENDLE, and ETHFI tokens.

On-chain analytics from LookIntoChain and Onchain Lens reveal that Hayes obtained 2.01 million ENA tokens (valued at roughly $571,600), 218,000 PENDLE tokens (worth about $589,800), and 33,099 ETHFI tokens (estimated at $257,400). These assets were transferred to him from the liquidity provider Cumberland within just half an hour. This activity highlights Hayes’ strategic shift toward DeFi protocols that offer yield opportunities, reflecting a broader trend of risk management as institutional infrastructure becomes more prominent in the crypto market.

These recent acquisitions follow a significant same-day trade in ENA, where Hayes bought 873,671 ENA tokens at an average price of $0.281, totaling $245,000. This purchase came just two weeks after he sold 5.02 million ENA tokens at $0.275, realizing $1.38 million, as reported by Coinotag. Such active trading positions Hayes as a notable liquidity provider in the market. While these large transactions can impact short-term price movements, analysts caution that the actions of a single wallet do not necessarily indicate a wider market trend, underscoring the importance of monitoring ongoing activity.

Institutional Momentum and Regulatory Developments

The cryptocurrency sector is undergoing rapid transformation, with regulatory advancements and institutional participation boosting market liquidity. The approval of Bitcoin spot ETFs by the U.S. SEC in January 2024 sparked a wave of institutional investment. Meanwhile, Abu Dhabi’s green light for Ripple’s RLUSD stablecoin for institutional use marks increasing regulatory certainty in major jurisdictions. These developments have strengthened the foundation for DeFi assets, which are now being incorporated into mainstream finance through partnerships such as Real X Holding’s alliance with Cobo, a provider of institutional-grade custody solutions.

DeFi Tokens Gain Traction in Diversified Portfolios

Hayes’ recent accumulation of ENA, PENDLE, and ETHFI reflects a growing perception of DeFi tokens as valuable additions to diversified investment strategies. The expansion of options limits for BlackRock’s Bitcoin ETF by Nasdaq further demonstrates the sector’s evolution, with crypto derivatives now being treated similarly to established equities like Apple and Microsoft. Market observers believe Hayes’ moves signal confidence in DeFi’s potential to generate returns, even as the sector navigates regulatory challenges and market fluctuations.

Looking Ahead: DeFi’s Role in the Next Phase of Crypto Growth

As the boundaries between traditional finance and digital assets continue to blur, Hayes’ strategic investments in DeFi may point to a broader trend of institutional adoption. With regulatory environments stabilizing and liquidity on the rise, the market seems set for a new era of expansion, where DeFi’s contributions to yield generation and risk management become increasingly significant.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Switzerland Postpones Crypto Tax Data Exchange to Meet Technological and International Requirements

- Switzerland delays crypto tax data sharing until 2027, aligning with global regulatory reevaluations amid evolving tech and market dynamics. - SGS acquires Australia's Information Quality to boost digital revenue, reflecting Swiss firms' expansion into tech-driven compliance solutions. - Canada's Alberta oil sands policy shift highlights governments prioritizing economic growth over strict climate regulations, mirroring Switzerland's approach. - BridgeBio's precision medicine and Aires' EMF solutions dem

Switzerland's Focus on Privacy Conflicts with International Efforts for Crypto Taxation

- Switzerland delays crypto tax data sharing with international partners until 2027, contrasting with global regulatory efforts to close offshore loopholes. - The U.S. advances implementation of the OECD's CARF framework, aiming to automate reporting on foreign crypto accounts by 2029. - CARF requires foreign exchanges to report U.S. account details, mirroring traditional tax standards and targeting crypto tax evasion. - Switzerland's privacy-focused stance highlights tensions between financial confidentia

Zcash News Update: Reliance Shifts Entirely to Zcash, Citing Privacy and Regulatory Alignment

- Reliance Global Group, a Nasdaq-listed fintech firm, shifted its entire crypto portfolio to Zcash (ZEC), divesting Bitcoin , Ethereum , and other major coins. - The strategic pivot, announced November 25, prioritizes Zcash's privacy-focused zk-SNARKs technology for institutional compliance and selective data disclosure. - Zcash's 1,200% 90-day price surge and Grayscale's ETF filing highlight growing institutional interest in privacy-centric assets. - The move reflects broader crypto industry trends towar

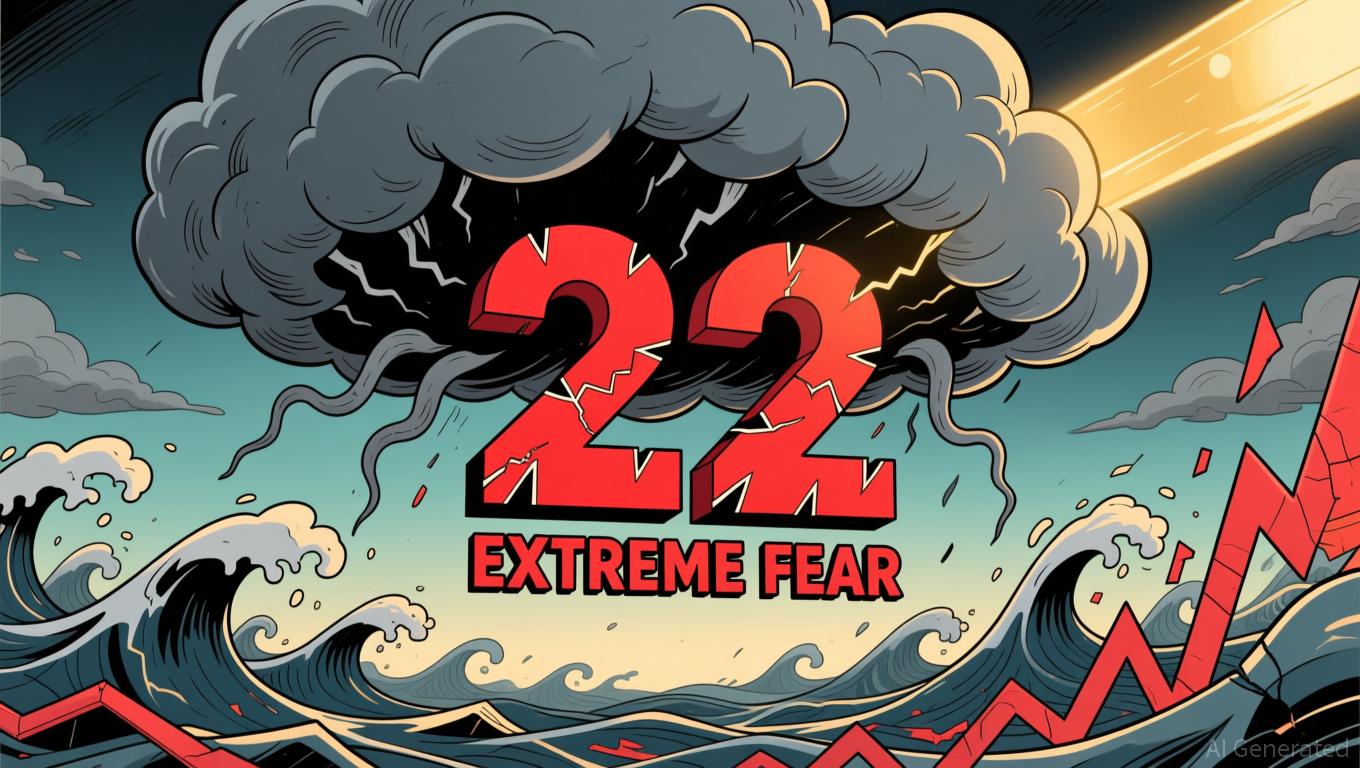

Bitcoin News Update: Bitcoin Fear Index Drops to 22 While Investors Look for Signs of Market Rebound

- Bitcoin Fear & Greed Index rose to 22 from 20, indicating slight easing of extreme fear but persistent bearish sentiment. - Bitcoin stabilized near $87,000 after hitting $80,553, yet remains below key resistance levels amid $3.5B ETF outflows. - Structural factors like leverage and liquidations drive selloffs, with ETF redemptions correlating to 3.4% price drops per $1B outflow. - Analysts note oversold technical indicators and waning retail capitulation as potential inflection points for near-term rebou