Conor McGregor and Khabib’s UFC Rivalry Erupts Again After NFT ‘Scam’ Accusation

Conor McGregor reignited his rivalry with Khabib by calling his NFT drop a scam, prompting Khabib’s denial and a sharp backlash led by investigator ZachXBT.

Conor McGregor and Khabib Nurmagomedov’s rivalry has returned to the spotlight, this time dominating Crypto Twitter after McGregor accused Khabib’s new Telegram-based NFT collection of scamming fans.

The claim triggered a swift response from Khabib and a sharp intervention from on-chain investigator ZachXBT, who redirected attention toward McGregor’s own controversial token launch.

Crypto Feud Ignites After Khabib’s NFT Launch

Khabib promoted a new digital collectibles drop on Telegram this week, themed around the Dagestani papakha hat he wore during UFC walkouts.

The collection sold out quickly, generating about $4.4 million in a single day.

The Now-Deleted Tweet From Conor McGregor

The Now-Deleted Tweet From Conor McGregor

The former UFC champion framed the NFTs as cultural digital gifts rather than speculative assets. He highlighted their link to Dagestani tradition and presented them as shareable items within Telegram’s ecosystem.

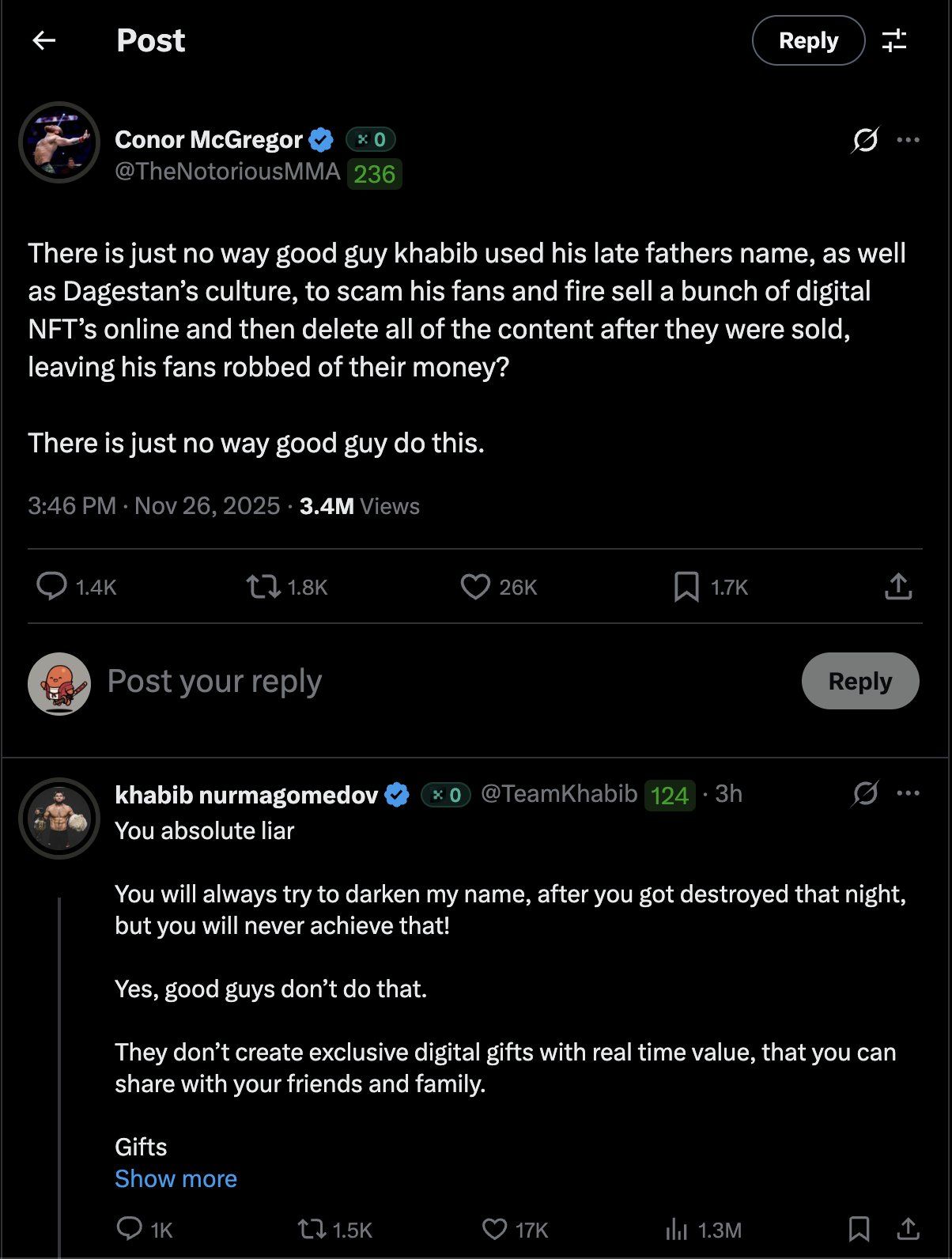

However, McGregor publicly rejected that narrative. He accused Khabib of running a “multi-million-dollar scam,” alleging that promotional posts were deleted after the sale.

His comments triggered immediate backlash from both MMA and crypto communities.

Can anybody find me a single person who bought the Khabib NFT who is claiming they have been scammed?Can anyone show me a single shred of evidence of Khabib misrepresenting what he was selling?The answer to both those questions are no. We get it you guys hate Muslims

— MMA Joey (@MMAJOEYC) November 26, 2025

McGregor Escalates Long-Running Rivalry

McGregor’s post revived the bitter rivalry born from UFC 229, where Khabib defeated him in 2018. The pair have exchanged barbs for years, often referencing family, legacy, and national pride.

This time, McGregor suggested Khabib used his father’s legacy and Dagestani cultural symbols to mislead fans. His message framed the drop as a “cash grab” disguised as heritage.

The accusation spread quickly, drawing strong reactions across social media.

Khabib responded within hours. He called McGregor an “absolute liar” and accused him of trying to “darken my name” since the UFC 229 loss.

He reiterated that the NFTs are cultural gifts and denied any wrongdoing.

ZachXBT’s Intervention Shifts the Narrative

The feud escalated further when on-chain investigator ZachXBT entered the conversation. He reposted McGregor’s comments but flipped the accusation back onto him.

There is just no way good guy McGregor used his reputation, as well as Irish culture, to scam his fans and fire sell a bunch of digital tokens’s online and then delete all of the posts after they were sold, leaving his fans robbed of their money? There is just no way good guy…

— ZachXBT (@zachxbt) November 26, 2025

ZachXBT pointed to McGregor’s failed REAL token earlier this year. The coin raised far less than its public target, fell sharply in price, and lost community support within weeks.

McGregor then deleted most promotional posts, leaving the project abandoned and investors frustrated.

Crypto Twitter quickly framed this as hypocrisy. Many noted that McGregor’s own token showed more red flags than Khabib’s Telegram collectibles.

After the backlash intensified, McGregor deleted his “scam” posts about Khabib.

Despite the allegations, no reports indicate that buyers lost access to their NFTs. The items still function as digital gifts inside Telegram, with no broken utilities or frozen assets.

Khabib has not marketed the drop as a financial investment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AI Grabs Headlines, Yet Gold Industry's Productivity Fuels Worth

- Two Gen Z entrepreneurs rejected Elon Musk's funding to develop a brain-inspired AI outperforming OpenAI and Anthropic models. - QGold Resources initiates economic assessment for its Oregon gold project with 1.543M oz reserves, signaling strategic expansion. - Galactic Gold appoints mining veteran Manley Guarducci to enhance operational efficiency amid industry consolidation. - Alamos Gold and B2Gold demonstrate resilience through record cash flow and production growth despite geopolitical risks. - Gold

Bitcoin News Update: As Major Crypto Firms Target Affluent Investors, Authorities Increase Scrutiny

- Binance launches "Prestige" to target high-net-worth clients, competing with Morgan Stanley and Fidelity through tailored crypto services. - KuCoin secures MiCA license in Austria, enabling EEA operations and emphasizing compliance with global regulatory standards. - Binance faces lawsuit alleging $50M+ in Hamas-related transactions, highlighting crypto's regulatory challenges amid expanded AML measures in South Korea. - Houdini Pay introduces privacy tools for freelancers, addressing wallet transparency

XRP News Today: Institutional ETFs May Exhaust XRP Reserves Earlier Than Expected

- XRP's institutional ETFs (e.g., Franklin Templeton's XRPZ) drive rapid supply depletion risks as inflows outpace expectations. - Analyst Zach Rector models potential $168 price targets if XRP ETF inflows mirror Bitcoin's $62B 2024–2025 surge pattern. - ETFs enhance XRP liquidity for SMEs and fintechs but expose risks from whale manipulation and unclear Asian regulations. - Market analysts warn XRP's limited 60.25B circulating supply faces accelerated institutional demand pressures amid growing ETF adopti

CME's Twofold Mission: Emergency Response and Advancing Cryptocurrency Innovation

- CME Group's November 2025 data center outage disrupted global trading, highlighting infrastructure vulnerabilities and prompting redundancy calls. - CME launched XRP and Solana spot futures on December 15, 2025, addressing surging institutional demand for altcoin exposure beyond Bitcoin and Ethereum . - Crypto derivatives trading hit record volumes, with 794,903 contracts traded on November 21, 2025, as year-to-date volume grew 132% compared to 2024. - CME plans 24/7 crypto trading in early 2026 but rema