Analyst Forecasts Major Solana Breakout in 2026, Updates Outlook on Bitcoin, Ethereum and BONK

A widely followed trader believes Solana ( SOL ) may be gearing up for massive rallies after retesting the $120 level.

The pseudonymous analyst Inmortal tells his 235,200 followers on X that Solana may experience a parabolic rally similar to what Ethereum ( ETH ) did earlier this year.

“Different structure, similar vibes.”

Source: Inmortal/X

Source: Inmortal/X

ETH went from about $1,550 in April to about $4,900 in September, a more than 216% gain.

The analyst also says that Solana’s $120 level has consistently acted as a support level during market corrections.

“This level has provided support for more than 600 days.”

Source: Inmorta/X

Source: Inmorta/X

Solana is trading for $138 at time of writing, up 1.2% on the day.

Next up, the trader says that Bitcoin ( BTC ) may chop around for months before having an explosive move to new all-time highs around $150,000.

“Imagine.”

Source: Inmortal/X

Source: Inmortal/X

Bitcoin is trading for $88,679 at time of writing, up 1.3% in the last 24 hours.

The trader also says that the meme token Bonk ( BONK ) may be forming a local bottom at a key level around $0.00000900, indicating a potential bullish reversal.

“You only see this type of charts one to two times per year.”

Source: Inmortal/X

Source: Inmortal/X

BONK is trading for $0.000009555 at time of writing, down 1.9% in the last 24 hours.

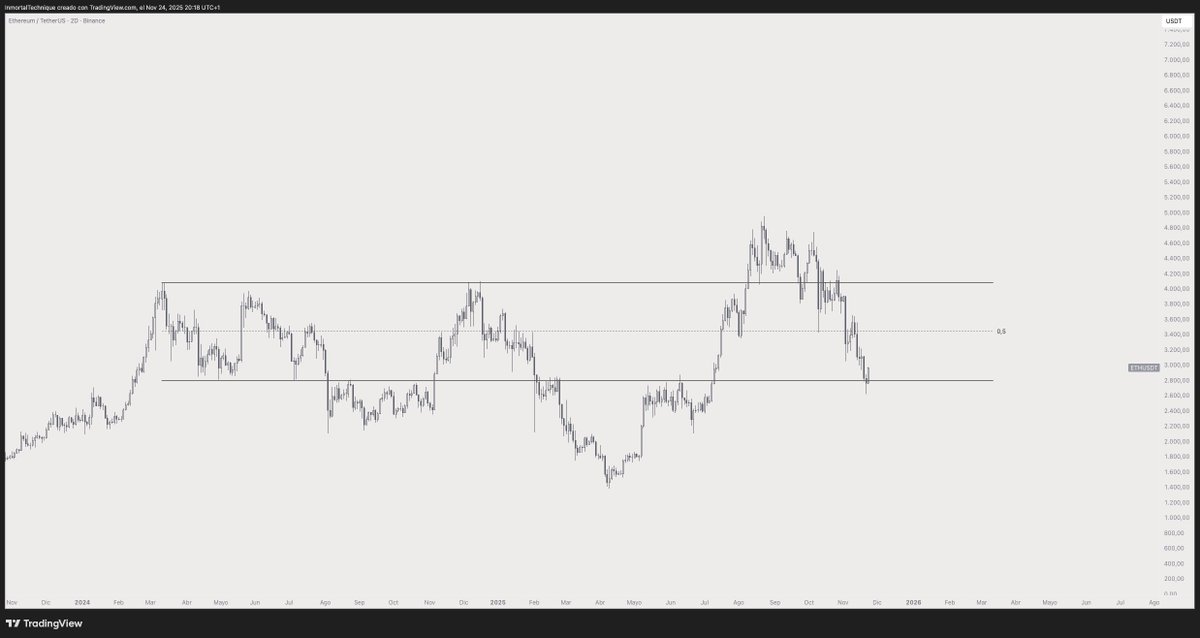

Lastly, the trader predicts that Ethereum ( ETH ) will soon surge more than 18% from its current value, after bouncing off the lower bound of a trading range at around $2,800.

“$3,500: ETH.”

Source: Inmortal/X

Source: Inmortal/X

ETH is trading at $2,963 at time of writing, up about 1% on the day.

Featured Image: Shutterstock/Vink Fan/Natalia Siiatovskaia

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin Holds Strong at $80K—Will This Support Ignite a Surge to $100K?

- Bitcoin stabilizes near $87,000 as Fed hints at 80% chance of December rate cut, fueling $100,000 optimism . - Projects like Bitcoin Munari ($0.22 presale) and Blazpay highlight innovation with fixed-supply models and AI-driven features. - Market remains volatile: ETF outflows threaten $94,000-$100,000 rebound, while $80,000 support is critical to avoid bearish shift. - Regulatory progress (Revolut's $75B valuation, KuCoin's MiCA license) signals maturing crypto infrastructure and institutional confidenc

Bitcoin Updates Today: Crypto ETF Fluctuations: Withdrawals and Deposits Reflect Market Evolution

- Crypto markets face $1.2T drawdown as Bitcoin drops to $80K, sparking debate over structural slowdown vs. macro shock. - Bitcoin ETF outflows hit $3.7B in November 2025, but experts argue this reflects tactical rebalancing, not lost institutional confidence. - Contrasting inflows of $128M for Bitcoin ETFs and $78M for Ethereum ETFs suggest institutions view dips as buying opportunities. - Analysts attribute selloff to liquidity shifts and Fed rate uncertainty, while noting market maturity through stabili

Bitcoin News Update: Balancing Institutional Trust and Market Volatility in Crypto’s High-Risk Arena

- Institutional investors and sovereign entities are intensifying crypto activity through Bitcoin accumulation, Ethereum staking, and leveraged altcoin trading, reflecting growing digital asset adoption. - Hilbert Group AB initiated a disciplined Bitcoin treasury strategy at $84,568, emphasizing long-term yield generation as institutional confidence in Bitcoin's utility expands. - Bhutan staked 320 ETH ($970k) via Figment.io and plans to migrate its NDI system to Ethereum, positioning itself as a blockchai

Bitcoin News Today: Nasdaq Pushes Bitcoin Further into the Mainstream with Quadrupled IBIT Options Availability

- Nasdaq proposes quadrupling IBIT options limits to 1 million contracts, aligning Bitcoin with major ETFs and boosting institutional access. - IBIT's $86.2B market cap and 44.6M daily volume justify higher limits, with 1M contracts posing minimal market disruption (7.5% float, 0.284% Bitcoin supply). - Visa expands stablecoin settlements via USDC partnerships, achieving $2.5B annualized volume, while JPMorgan launches IBIT-linked structured notes to address custody risks. - SEC-approved spot Bitcoin ETFs