Brave Just Hit 101 Million Users — Is This the Spark Behind BAT’s Sudden Triple-Digit Surge?

Basic Attention Token (BAT) has surged more than 100% since October 11, reaching $0.2619 and approaching a new 2025 high. At the same time, Brave Browser surpassed 101 million monthly active users in September. The Brave browser is the platform for earning and using the BAT token. Users can earn BAT by viewing privacy-respecting Brave

Basic Attention Token (BAT) has surged more than 100% since October 11, reaching $0.2619 and approaching a new 2025 high. At the same time, Brave Browser surpassed 101 million monthly active users in September.

The Brave browser is the platform for earning and using the BAT token. Users can earn BAT by viewing privacy-respecting Brave Ads, which they can then use to tip content creators or exchange for other currencies.

BAT’s Price Rally Sets It Apart From Broader Altcoin Recovery

While altcoins continue recovering from the October 10 liquidation event, BAT stands out. The token trades at $0.2664, marking a 20% gain in 24 hours and 53.4% over the past week, according to CoinGecko data. In contrast, many assets remain below their pre-liquidation value.

Basic Attention Token (BAT) Price Performance. Source:

TradingView

Basic Attention Token (BAT) Price Performance. Source:

TradingView

The rally positions BAT’s Social token category as the second-best performing sector over the past month, trailing only Privacy Coins.

The growing adoption of privacy-focused platforms and sustained BAT accumulation reflect a trend toward privacy-first digital ecosystems.

Social Token Category Trails Privacy Coins. Source:

Artemis Analytics

Social Token Category Trails Privacy Coins. Source:

Artemis Analytics

Meanwhile, Brave’s platform now has 42 million daily active users, with on-chain data highlighting consistent interest from large holders over the past few months.

BAT’s market capitalization is over $397 million, with approximately 1.49 billion tokens circulating from a maximum supply of 1.5 billion.

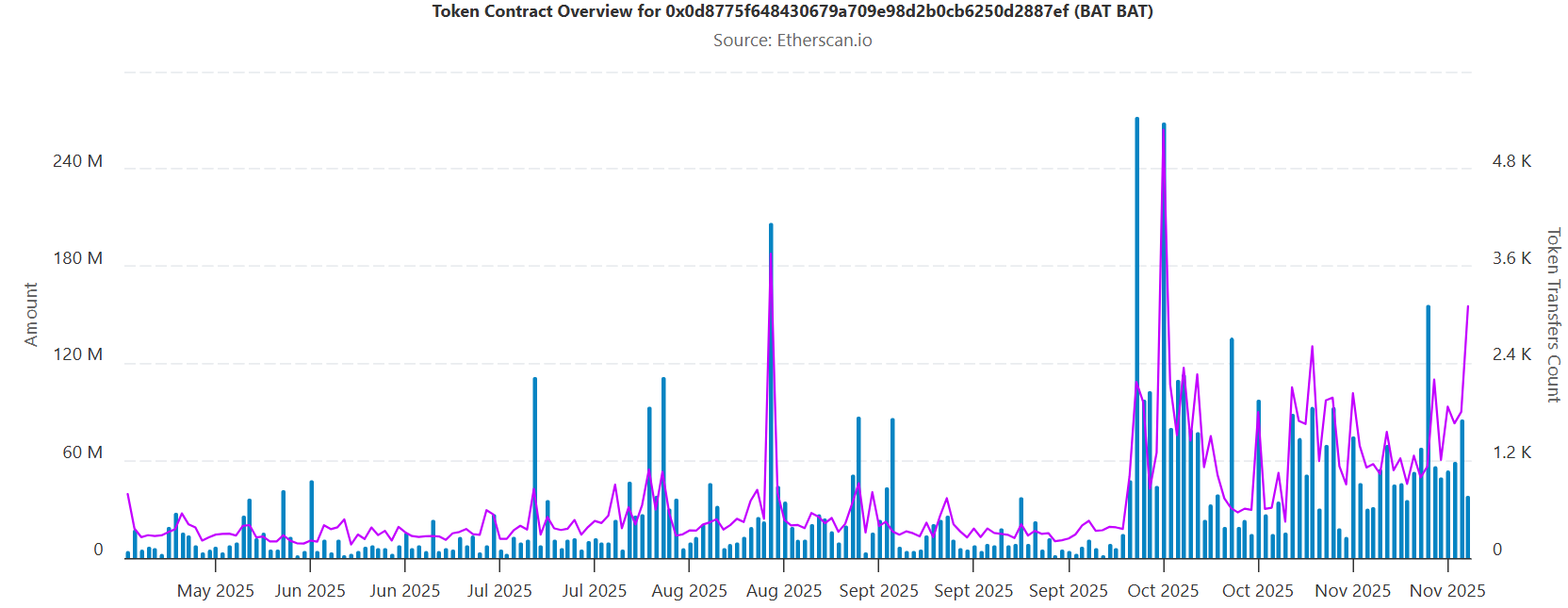

Its recent momentum has drawn the eyes of retail traders. Trade volume is up significantly, as Etherscan noted 3,107 transfers in the past 24 hours, representing a 72.32% increase from the previous period. On-chain analytics from Etherscan also shows BAT has 437,801 holders.

BAT Transfers. Source:

Etherscan

BAT Transfers. Source:

Etherscan

BAT’s role as both a privacy tool and a social rewards mechanism places it at the centre of two trends, social tokens and privacy coins.

Brave Browser User Growth Boosts BAT Utility

Brave reached 101 million monthly active users as of September 30, reflecting fast growth. The browser has added approximately 2.5 million net new users each month for two years. With 42 million daily users, the DAU/MAU ratio stands at 0.42, showing high engagement and retention.

Integrated with Brave, the Brave Search engine processes nearly 20 billion queries annually, including 1.6 billion monthly searches and more than 15 million daily AI-generated answers.

Brave’s transition from a privacy-focused tool to a broad digital ecosystem allows it to compete directly with mainstream browsers and search engines.

Privacy features on Brave include:

- Strong ad-blocking via Brave Shields,

- Tracker blocking,

- Storage partitioning,

- Global Privacy Control, and

- Bounce tracking prevention.

The platform also offers Leo, a privacy-centric AI assistant, plus a VPN with approximately 100,000 subscribers. Its integrated Brave Wallet supports shielded Zcash transactions and Web3, strengthening its decentralized offering.

BAT powers Brave’s rewards system. Users earn BAT for viewing privacy-respecting ads from major brands such as Amazon, Ford, and eBay.

Content creators are compensated through the Brave Creators program, bypassing traditional ad networks. BAT’s wide reach is reflected in its position as the 14th most distributed token on-chain.

However, it still faces strong competition from privacy-first browsers and must navigate changing regulatory challenges.

The next few weeks could determine whether heightened interest translates into lasting institutional involvement, especially as the crypto market faces year-end volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solar radiation reveals previously undetected software flaw in Airbus aircraft fleet

- Airbus issues emergency directive to update A320 fleet software/hardware after solar radiation-linked flight-control incident caused JetBlue's emergency landing. - EU Aviation Safety Agency mandates fixes for 6,000 aircraft, risking Thanksgiving travel chaos as airlines face weeks-long groundings for repairs. - Solar interference vulnerability, previously flagged by FAA in 2018, highlights growing software reliability challenges in modern avionics systems. - Analysts call issue "manageable" but warn of s

Khabib's NFTs Ignite Discussion: Honoring Culture or Taking Advantage?

- Khabib Nurmagomedov's $4.4M NFT collection, rooted in Dagestani heritage, sparked controversy over cultural symbolism and legacy claims. - The project sold 29,000 tokens rapidly but faced scrutiny for post-launch transparency gaps and parallels to failed celebrity NFT ventures. - NFT market recovery (2025 cap: $3.3B) highlights risks like "rug pulls" and volatility, despite celebrity-driven momentum. - Concurrent trends include crowdfunding innovations and sustainability-focused markets like OCC recyclin

Ethereum Updates Today: Fusaka Upgrade on Ethereum Triggers Structural Deflation Through L2 Collaboration

- Ethereum's Fusaka upgrade (Dec 3, 2025) introduces EIP-7918, linking L2 data costs to mainnet gas prices, boosting ETH burn rates and accelerating deflationary trajectory. - PeerDAS and BPO forks reduce validator demands while enabling scalable 100k TPS growth through modular upgrades, avoiding disruptive hard forks. - Analysts predict 40-60% lower L2 fees for DeFi/gaming, with institutional ETH accumulation and a 5% price rebound signaling confidence in post-upgrade value capture. - The upgrade creates

Bitcoin News Update: Stablecoin Growth Drives Cathie Wood's Updated Bullish Outlook on Bitcoin, Not Market Weakness

- ARK's Cathie Wood maintains $1.5M Bitcoin long-term target despite 30% price drop, adjusting 2030 forecast to $1.2M due to stablecoin competition. - She attributes market volatility to macroeconomic pressures, not crypto fundamentals, and highlights Bitcoin's historical liquidity-driven rebounds. - UK's "no gain, no loss" DeFi tax framework and firms like Hyperscale Data ($70.5M BTC treasury) reflect evolving regulatory and strategic dynamics. - Bitfarms' exit from Bitcoin mining to AI HPC by 2027 unders