MicroStrategy Admits a Bitcoin Sale Is Possible—Here’s When

MicroStrategy CEO Phong Le has, for the first time, acknowledged that the company could sell its 649,870 BTC holdings under specific crisis conditions. This marks a significant shift from Chairman Michael Saylor’s long-standing “never sell” philosophy and signals a new chapter for the world’s largest corporate Bitcoin holder. CEO Phong Le Reveals Hidden Kill-Switch in

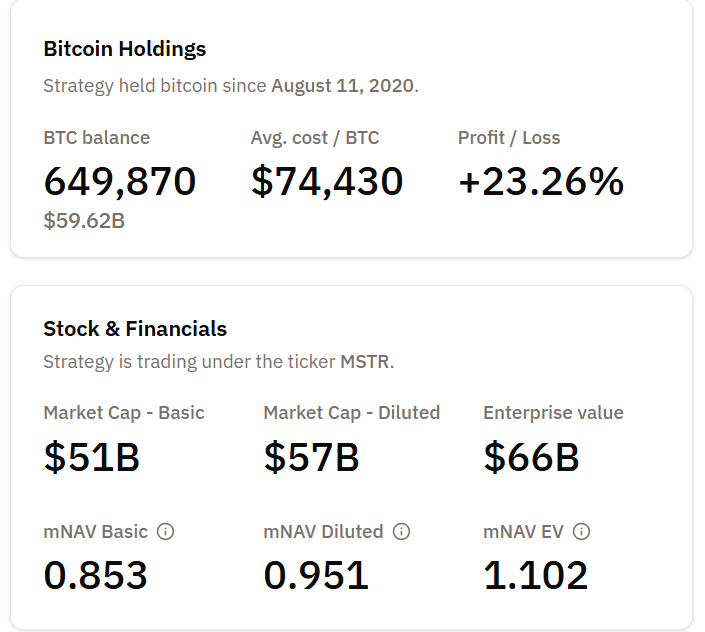

MicroStrategy CEO Phong Le has, for the first time, acknowledged that the company could sell its 649,870 BTC holdings under specific crisis conditions.

This marks a significant shift from Chairman Michael Saylor’s long-standing “never sell” philosophy and signals a new chapter for the world’s largest corporate Bitcoin holder.

CEO Phong Le Reveals Hidden Kill-Switch in MicroStrategy’s Bitcoin Strategy

MicroStrategy has confirmed a scenario : the potential to sell Bitcoin, its core treasury asset. Speaking on What Bitcoin Did, CEO Phong Le outlined the precise trigger that would force a Bitcoin sale:

- First, the company’s stock must trade below 1x mNAV, meaning the market capitalization falls below the value of its Bitcoin holdings.

- Second, MicroStrategy must be unable to raise new capital through equity or debt issuance. This would mean capital markets are closed or too expensive to access.

JUST IN: Strategy CEO Phong Le says $BTC would only be sold if the company’s stock falls below net asset value and funding options disappear, calling it a financial decision.

— Whale Insider (@WhaleInsider) November 30, 2025

Le clarified that the board has not planned near-term sales, but confirmed that this option “is in the toolkit” if financial conditions deteriorate.

This is the first explicit acknowledgement, after years of Michael Saylor’s absolutist claim that “we will never sell Bitcoin.” It shows that MicroStrategy does, in fact, have a kill-switch tied directly to liquidity pressure.

Why the 1x mNAV Threshold Matters

mNAV compares MicroStrategy’s market value to the value of its Bitcoin holdings. When mNAV drops below 1, the company becomes worth less than the Bitcoin it owns.

Several analysts, including AB Kuai Dong and Larry Lanzilli, note that the company is now facing a new constraint. The mNAV premium that powered its Bitcoin-accumulation flywheel has nearly vanished for the first time since early 2024.

As of November 30, mNAV hovers near 0.95x, edging uncomfortably close to the 0.9x “danger zone.”

MicroStrategy mNAV. Source:

Bitcoin Treasuries

MicroStrategy mNAV. Source:

Bitcoin Treasuries

If mNAV falls below 0.9x, MicroStrategy could be pushed toward BTC-funded dividend obligations. Under extreme conditions the firm would be compelled to sell portions of its treasury to maintain shareholder value.

🧵 MicroStrategy CEO Phong Le just confirmed on What Bitcoin Did (Nov 29, 2025):😯 “If MSTR stock trades <1x mNAV AND we can’t raise fresh capital → we would sell portions of our #Bitcoin as a last-resort move.”🤔 He called it “mathematically justified” to protect Bitcoin…

— Larry Lanzilli (@lanzilli) November 30, 2025

The pressure stems from $750–$800 million in annual preferred share dividend payments, issued during MicroStrategy’s Bitcoin expansion.

Previously, the company used new equity issuances to cover these costs. With the stock down more than 60% from its highs and market skepticism rising, that avenue is narrowing.

Strategy (MSTR) Stock Price Performance. Source:

Google Finance

Strategy (MSTR) Stock Price Performance. Source:

Google Finance

Analysts Warn of a Structural Shift

According to Astryx Research, MicroStrategy has effectively transformed into a “leveraged Bitcoin ETF with a software company attached.” That structure works when BTC rises, but amplifies stress when liquidity tightens or volatility spikes.

Michael Saylor’s Bitcoin Strategy: Genius or Hidden Risk?@saylor and MicroStrategy have done something no public company in history has ever done:They turned their balance sheet into a leveraged Bitcoin ETF with a software company attached — and it has paid off massively.…

— Astryx Research (@AstryxHQ) November 30, 2025

SEC filings have long warned about liquidity risk during a deep Bitcoin drawdown. While the firm maintains that it faces no forced liquidation risk due to its convertible debt structure, the CEO’s latest comments confirm a mathematically defined trigger for voluntary sales.

If $BTC drops to our $74K average cost basis, we still have 5.9x assets to convertible debt, which we refer to as the BTC Rating of our debt. At $25K BTC, it would be 2.0x.

— Strategy (@Strategy) November 25, 2025

Why This Matters for Bitcoin Investors

MicroStrategy is the largest corporate BTC holder in the world. Its “HODL forever” stance has been a symbolic pillar of the institutional Bitcoin thesis. Acknowledging a sell condition, even if distant, shifts that narrative toward realism:

- Liquidity can override ideology.

- Market structure matters as much as conviction.

- The Bitcoin cycle now has a new, and measurable, risk threshold: the 0.9x mNAV line.

Investors will watch Monday’s updates closely as analysts track whether mNAV stabilizes or continues slipping toward 0.9x.

Any further weakness in BTC or MSTR stock could intensify scrutiny of MicroStrategy’s balance sheet strategy heading into 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The HYPE Token Crypto Rally: Unveiling the Driving Force Behind Its Week-Long Surge

- HYPE Token's 7-day surge in late 2025, reaching $35.08, was driven by protocol upgrades, institutional backing, and retail FOMO. - Institutional investments like Paradigm’s $581M stake and retail-driven momentum mirrored the 2021 Dogecoin rally. - However, looming token unlocks and bearish indicators, including a $11B unlock of 237M tokens, raised sustainability concerns. - Technical analysis showed mixed signals, with consolidation near support levels and short-term volatility risks, while broader trend

How CFTC-Recognized Platforms Such as CleanTrade Are Transforming the Landscape of Clean Energy Investments

- CFTC-approved CleanTrade introduces a regulated SEF for clean energy derivatives, addressing market fragmentation and liquidity gaps. - The platform enables institutional-scale trading of vPPAs/RECs, achieving $16B notional volume in two months by aggregating demand/supply. - Integrated risk analytics (e.g., CleanSight) enhance transparency, allowing investors to hedge project-specific risks like grid congestion and curtailment. - Dual investment pathways attract hedge funds/pension funds through direct

The Rise of CFTC-Regulated Clean Energy Markets: Opening a New Chapter for Institutional Investors

- CFTC's 2025 approval of REsurety's CleanTrade as a SEF marks a landmark shift in clean energy markets by introducing standardized, transparent trading for VPPAs and RECs. - The platform attracted $16B in notional value within two months, enabling rapid institutional-grade transactions that previously took months to negotiate. - By addressing liquidity gaps and enabling precise risk modeling, CleanTrade is accelerating capital flows into decarbonization while bridging ESG investment gaps for institutional

The Increasing Overlap Between Health and Financial Wellbeing in Managing Personal Finances

- Global wellness economy to hit $9 trillion by 2028, driven by holistic well-being trends. - Millennials/Gen Z prioritize wellness as lifestyle, with 55% spending over $100/month on health. - Employers integrate financial wellness into health programs to reduce burnout and boost productivity. - Investors target wellness-driven SaaS, healthcare tech , and financial literacy platforms for holistic solutions.