Bitcoin plunged $5,000 this morning, breaking below $87,000 as the crypto market suffers a bleak start to December

The cryptocurrency market experienced a sharp decline on December 1, with bitcoin falling below $87,000 and ethereum losing the $2,900 mark. The total liquidation of contracts across the market reached $528 million. Market sentiment has turned cold, leverage is retreating, and increased uncertainty in Federal Reserve policies has intensified the sell-off. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still in the process of iterative improvement.

In the early morning of December 1, the cryptocurrency market once again staged a "mass exodus" drama.

Bitcoin plunged more than 5% during Asian morning trading, falling below the $87,000 mark; Ethereum was not spared either, dropping more than 5% and losing the psychological support of $2,900.

This wave of sell-offs swept across the entire crypto market. According to Coinglass data, in just 24 hours, the total liquidation volume of crypto contracts across the network reached $528 million, with more than 190,000 traders liquidated. This prolonged sell-off, which began in early October, has already wiped out over $1 trillion from the total market capitalization of cryptocurrencies. Bitcoin has fallen more than 30% from its historical high of $126,251 set on October 6.

Market Overview: Crypto Market Faces "Black Start" in December

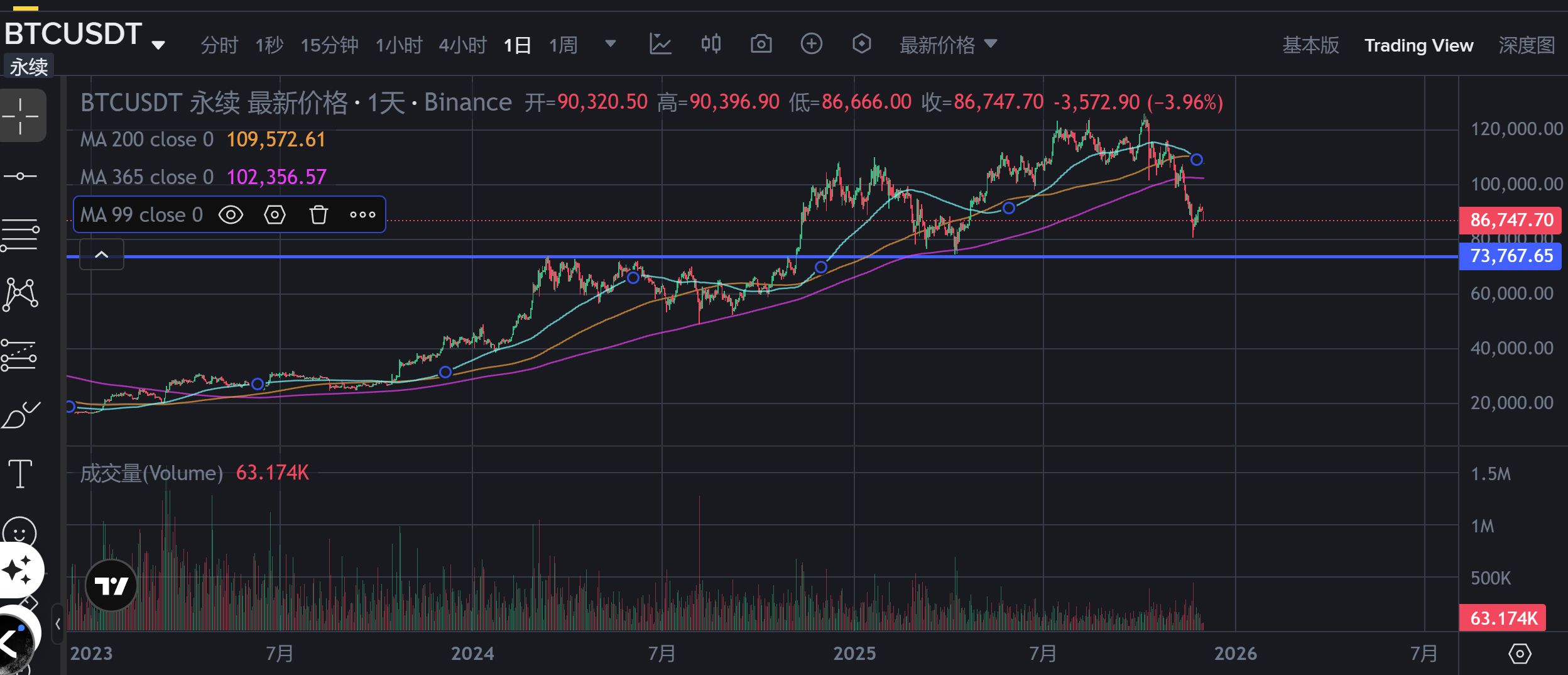

The sharp drop on Monday morning marked the toughest start to December for the cryptocurrency market. Bitcoin successively broke through all key support levels at $90,000, $89,000, and even $88,000, with technical indicators showing a clear bearish trend.

At press time, Bitcoin was trading near $87,100, with a daily decline of nearly 4%, while Ethereum performed even worse, falling below the key $2,900 support and currently trading around $2,850, with a 24-hour drop of 5%.

Not only did major cryptocurrencies suffer heavy losses, but the altcoin market was even more dismal. The Layer2 sector led the decline with nearly 8%, with Starknet (STRK) down 13.13% and zkSync (ZK) down 10.99%. XRP and Dogecoin fell more than 6%, Solana and ADA dropped nearly 6%, showing a broad-based decline. This crash is not an isolated event. Since early October, the cryptocurrency market has been under sustained selling pressure for several weeks.

This round of weeks-long sell-off began in early October, when leveraged positions worth about $19 billion were liquidated, just days after Bitcoin hit its all-time high of $126,251. After a brief rebound at the end of November, market sentiment had already turned cautious, but the black swan event at the start of December completely reversed market expectations.

Direct Cause: Powell Resignation Rumors and Uncertainty Over Fed Chairmanship

Behind Monday's plunge, market rumors played a significant role in fueling panic.

There were "unverified reports" claiming that "Powell will announce his resignation at an emergency meeting at 7 p.m. EST on December 1," which quickly triggered panic in the market.

Although this rumor is most likely false—so far, no major foreign media have reported on it—in an already fragile market, any negative rumor can be the last straw that breaks the camel's back.

More noteworthy is that U.S. President Trump stated on Sunday that he has already decided on the next Fed chair. Trump has previously made it clear that he hopes his nominee will push for rate cuts. Media reports suggest that Trump's chief economic adviser and White House National Economic Council Director Kevin Hassett is considered a possible successor to Powell.

In an interview with CBS on November 30, Hassett said: "We just had a successful Treasury auction, and interest rates have come down. I think Americans have reason to expect that Trump will nominate someone who can help everyone get lower-rate car loans and make it easier to apply for low-interest mortgages." The uncertainty in the Fed's leadership comes at an extremely sensitive time. Policymakers are evaluating the trajectory of interest rates heading into 2026, and economic data to be released in the coming week could affect market expectations about whether the Fed will continue its rate-cutting cycle.

Deeper Causes: Leverage Unwinding and Structural Vulnerabilities

Behind this cryptocurrency crash lies the inevitable eruption of internal structural contradictions in the market. Yu Jianing, director of the Hong Kong Registered Digital Asset Analyst Association, pointed out, "This decline is the result of cooling market sentiment combined with a sudden halt in leverage." The unwinding of leverage has created a vicious cycle.

During the flash crash on October 11, the market experienced the largest forced liquidation event in history, with over $19 billion in crypto assets liquidated across major global exchanges. According to CryptoQuant data, in the past month, long-term Bitcoin holders have cumulatively sold more than 320,000 BTC, reflecting weak market confidence and liquidity pressure.

Sean McNulty, Head of Derivatives Trading for Asia Pacific at FalconX, said: "The start of December is clearly a risk-off mode. The biggest concern is that inflows into Bitcoin ETFs are quite weak, and there is a lack of dip buying. We expect structural headwinds to persist this month." According to Bloomberg, investors withdrew more than $700 million from digital asset ETFs in just the past week, with BlackRock's Bitcoin fund seeing outflows of nearly $600 million. This phenomenon of capital outflows is not limited to the crypto market but also reflects the pressure faced by the entire high-risk asset sector.

The recent sharp volatility in the cryptocurrency market is not accidental, but rather the inevitable eruption of its internal structural contradictions. Behind this decline lies deep systemic difficulties, suggesting that cryptocurrencies may be entering a prolonged bear market.

Macro Environment: Fed Policy and Global Liquidity Tightening

The crash in the cryptocurrency market cannot be separated from changes in the macro environment. The aggressive monetary tightening cycles of major central banks worldwide have completely changed the previously abundant liquidity environment.

Wang Peng, associate researcher at the Beijing Academy of Social Sciences, said: "The sharp correction in Bitcoin prices, erasing gains for the year, is mainly due to the marginal tightening of dollar liquidity. The Fed's policy expectations have shifted, market expectations for rate cuts have cooled, and rising funding costs directly impact highly volatile assets. Institutional investors are forced to reduce leveraged positions, intensifying selling pressure." According to CME "FedWatch" data, as of the end of November, the probability of a 25 basis point rate cut by the Fed in December had risen to 84.9%.

However, there are still doubts in the market about whether the Fed will continue its rate-cutting cycle, and economic data to be released in the coming week will be a key influencing factor. The Trump administration's trade policies have also heightened market concerns. After taking office, Trump quickly announced increased tariffs and export controls on China, especially targeting industrial and strategic materials. This directly triggered global trade tensions, possible supply chain disruptions, and upward inflationary pressures. In this complex environment, Bitcoin's "digital gold" narrative faces severe challenges.

Technical Analysis: Key Supports Lost, Downside Risks Intensify

From a technical analysis perspective, Bitcoin's trend is worrying. The daily trend has clearly turned bearish, with the price breaking below the middle Bollinger Band support and moving towards the lower band, while the narrowing of the Bollinger Bands indicates reduced volatility. More notably, the 50-day and 200-day moving averages have formed a death cross, which is a medium- to long-term bearish signal. Bitcoin formed a "death cross" on November 16, when the 50-day moving average fell below the 200-day moving average, which historically often signals a deepening bear market.

Earlier this month, Bitcoin also fell below the 50-week moving average (around $103,000), and the loss of this key level prompted many technical traders to join the sell-off. Sean McNulty said: "We are watching the $80,000 mark for Bitcoin as the next key support level." This view is shared by most technical analysts.

If Bitcoin falls below $82,000, the next support will be around $70,000, while institutional support is at $85,000, which is the area of large ETF inflows. Ethereum's technicals also show a clear weak pattern. The TD Sequential indicator has issued a sell signal on the 1-hour perpetual futures chart, indicating that short-term upward momentum is exhausted. The RSI indicator has quickly retreated from the overbought area, showing that bearish momentum is strengthening. This decline has been accompanied by a moderate increase in trading volume, indicating some panic selling. Although the MACD indicator is still positive, the shortening histogram shows weakening upward momentum.

Outlook: Where Is the Market Bottom?

In the face of continued market sell-offs, the question investors care about most is: where is the market bottom? The $80,000 mark has become the next key support level.

If this support is broken, the market may fall further. The coming week will provide a key snapshot of U.S. economic momentum, as policymakers weigh the trajectory of interest rates through 2026. The data may affect market expectations about whether the Fed will continue its rate-cutting cycle.

In the long term, the fundamentals of the Bitcoin market still exist. The global trend toward asset diversification, the continuous increase of long-term capital, and the rising participation of institutions all lay the foundation for Bitcoin's potential future gains.

However, in the short term, the recovery of market confidence will require more positive signals. ETF funds turning net positive again, the profit-loss ratio of short-term holders returning above 1, the restoration of spot order book depth, and renewed growth in stablecoin supply,

when these indicators light up one by one, it may signal that the market is bottoming out and rebounding.

The sharp rises and falls of Bitcoin are a stress test for the financial market's decentralized currency system. Its price volatility not only reflects changes in liquidity but also reveals the fragility of the traditional financial system. If Bitcoin is to become a mainstream asset in the future, it will need to reconstruct its narrative, a process that may be accompanied by even more intense market volatility and regulatory battles.

For investors, the coming week will be crucial. The tug-of-war between U.S. economic data and Fed policy signals will determine whether the cryptocurrency market can hold the key support level near $80,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Staking Weekly Report December 1, 2025

🌟🌟Core Data on ETH Staking🌟🌟 1️⃣ Ebunker ETH staking yield: 3.27% 2️⃣ stETH...

The Blood and Tears Files of Crypto Veterans: Collapses, Hacks, and Insider Schemes—No One Can Escape

The article describes the loss experiences of several cryptocurrency investors, including exchange exits, failed insider information, hacker attacks, contract liquidations, and scams by acquaintances. It shares their lessons learned and investment strategies. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

Mars Morning News | Federal Reserve officials to advance stablecoin regulatory framework; US SEC Chairman to deliver a speech at the New York Stock Exchange tonight

Federal Reserve officials plan to advance the formulation of stablecoin regulatory rules. The SEC Chair will deliver a speech on the future vision of capital markets. Grayscale will launch the first Chainlink spot ETF. A Coinbase executive has been sued by shareholders for alleged insider trading. The cryptocurrency market fear index has dropped to 23. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.