The big market move is here! How Trump, the Federal Reserve, and trade are stirring up a market storm

Author: Capital Flows

Translation: TechFlow

Original Title: Macro Report: How Trump, the Fed, and Trade Could Trigger the Biggest Market Volatility in History

Macro Report: The Storm Is Coming

“What important truth do very few people agree with you on?”

This is a question I ask myself every day when researching the markets.

I have models for growth, inflation, liquidity, market positioning, and prices, but the ultimate core of macro analysis is the quality of ideas. Quant funds and emerging AI tools are eliminating every statistical inefficiency in the market, compressing the advantages that once existed. What remains is macro volatility that manifests over longer time cycles.

The Truth

Let me share with you a truth that very few people agree with:

I believe that in the next 12 months, we will see a significant increase in macro volatility, on a scale that will surpass 2022, the COVID-19 pandemic, and may even exceed the 2008 financial crisis.

But this time, the source of volatility will be a planned depreciation of the US dollar against major currencies. Most people believe that a falling dollar or "dollar depreciation" will drive risk assets higher, but the reality is quite the opposite. I think this is the biggest risk in today's market.

In the past, most investors believed that mortgages were too safe to trigger systemic panic, and also ignored credit default swaps (CDS) as too complex and irrelevant. Now, the market remains complacent about the potential sources of dollar depreciation. Almost no one delves into the mechanisms of this depreciation, which could shift from a mere indicator to a real risk for asset prices. You can spot this blind spot by discussing the issue with others. They insist that a weaker dollar is always good for risk assets and assume the Fed will intervene in any serious problem. It is precisely this mindset that makes a deliberately engineered dollar depreciation more likely to cause risk assets to fall rather than rise.

The Road Ahead

In this article, I will detail how this mechanism works, how to identify the signals when this risk emerges, and which assets will be most affected (both positively and negatively).

It all comes down to the convergence of three major factors, accelerating as we approach 2026:

Liquidity imbalances caused by global cross-border capital flows leading to systemic fragility;

The Trump administration's stance on currency, geopolitics, and trade;

The appointment of a new Fed Chair, whose monetary policy will align with Trump's negotiation strategy.

The Roots of Imbalance

For years, unbalanced cross-border capital flows have created a structural liquidity imbalance. The key issue is not the scale of global debt, but how these capital flows have shaped balance sheets to become inherently fragile. This dynamic is similar to the adjustable-rate mortgages before the Global Financial Crisis (GFC). Once this imbalance begins to reverse, the structure of the system itself accelerates the correction, liquidity dries up rapidly, and the whole process becomes hard to control. This is a mechanical fragility embedded in the system.

It all starts with the US acting as the world's only "buyer." Thanks to the dollar's strong position as a reserve currency, the US can import goods at prices far below domestic production costs. Whenever the US buys goods from the rest of the world, it pays in dollars. Most of the time, these dollars are reinvested by foreign holders into US assets to maintain trade relationships, and because the US market is almost the only choice. After all, where else but the US can you bet on the AI revolution, robotics, or people like Elon Musk?

This cycle repeats endlessly: the US buys goods → pays dollars to foreigners → foreigners use those dollars to buy US assets → the US can continue to buy more cheap goods because foreigners keep holding dollars and US assets.

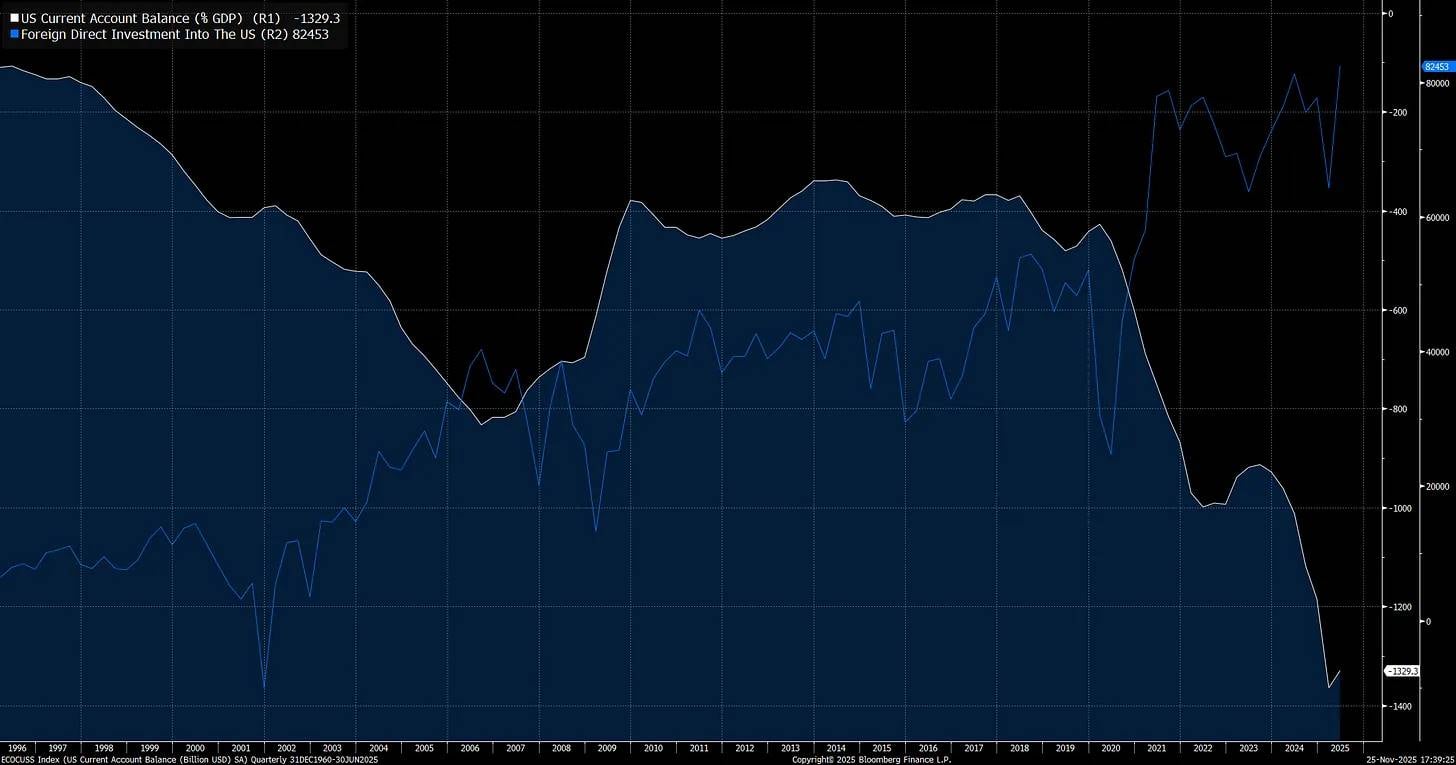

This cycle has led to severe imbalances, with the US current account (the difference between imports and exports, white line) at an extreme. On the other side, foreign investment in US assets (blue line) has also reached historic highs:

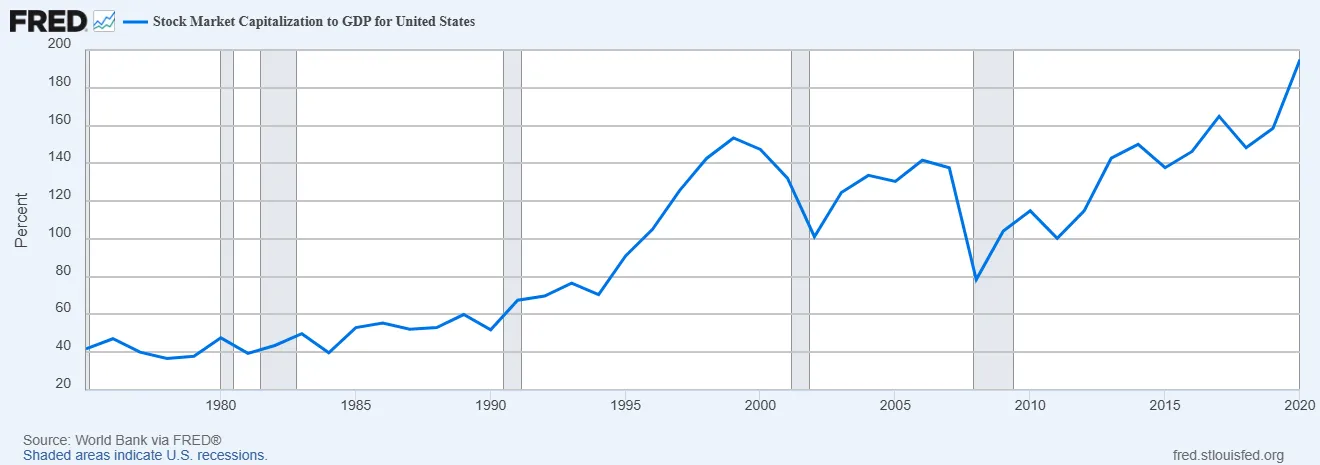

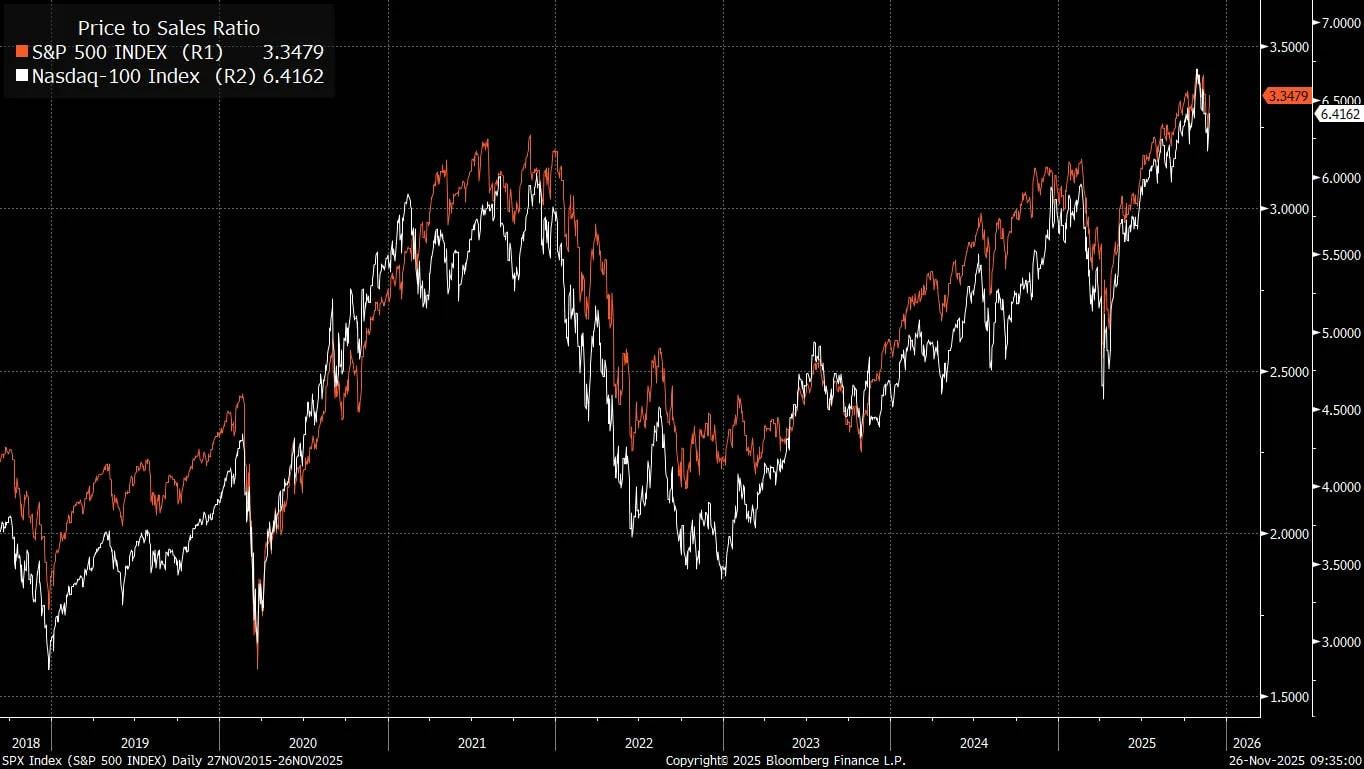

When foreign investors indiscriminately buy US assets to continue exporting goods and services to the US, this is why we see S&P 500 valuations (price-to-sales ratio) at record highs:

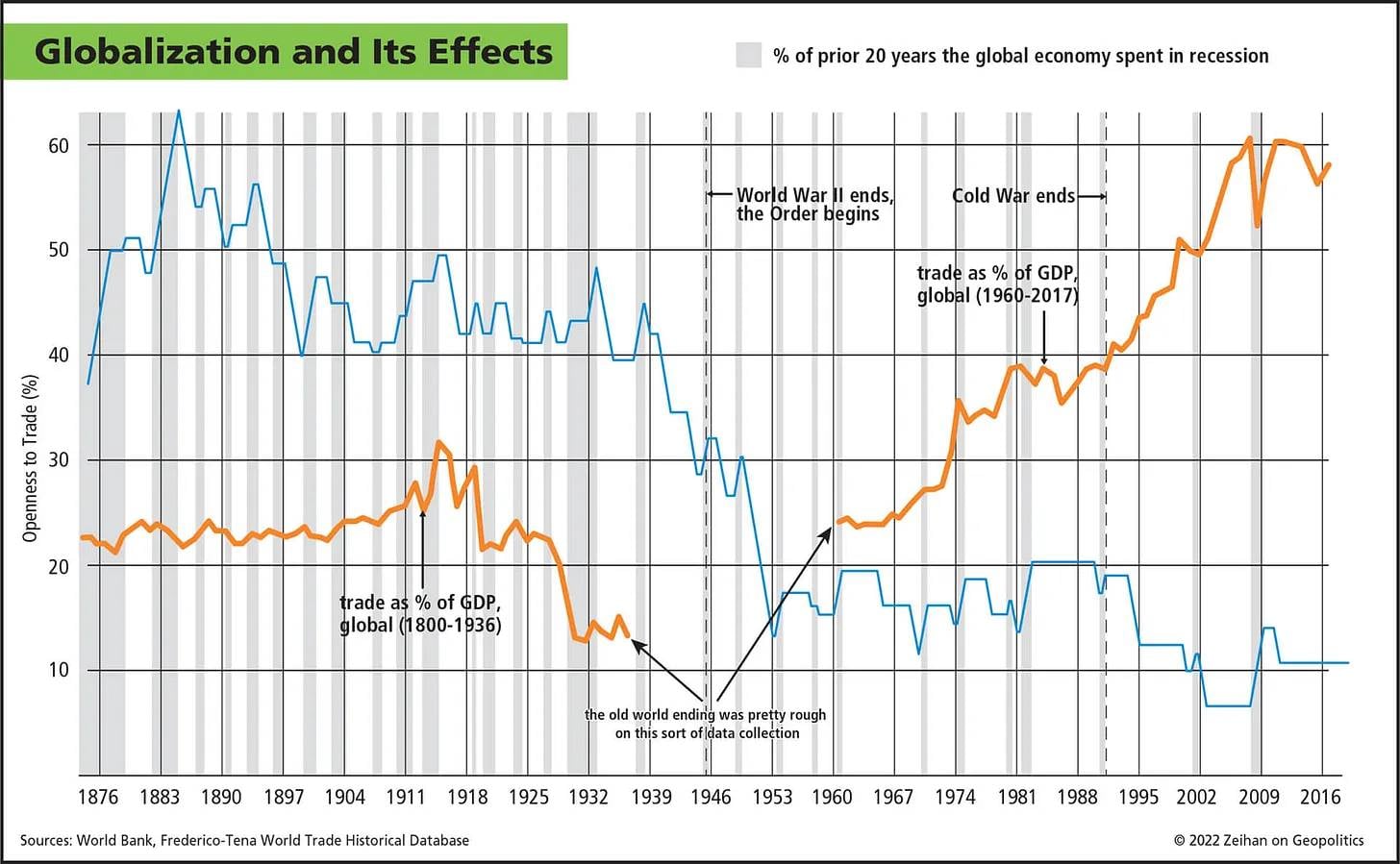

Traditional equity valuation frameworks stem from Warren Buffett's value investing philosophy. This approach worked well in times of limited global trade and less system-wide liquidity. However, what is often overlooked is that global trade itself expands liquidity. From an economic accounts perspective, one side of the current account corresponds to the other side of the capital account.

In practice, when two countries trade, their balance sheets guarantee each other, and these cross-border capital flows exert a powerful influence on asset prices.

For the US, as the world's largest importer of goods, capital flows massively into the US, which is why the US market cap-to-GDP ratio is significantly higher than in the 1980s—the era when Benjamin Graham and David Dodd laid the foundation for value investing in "Security Analysis." This is not to say valuations are unimportant, but from a total market cap perspective, these changes are more driven by macro liquidity shifts than by so-called "Mr. Market's irrational behavior."

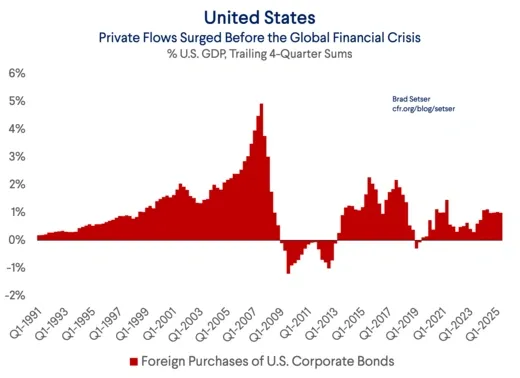

Before the Global Financial Crisis (GFC), one of the main sources driving the fragile capital structure of the mortgage market was foreign investors buying US private sector debt:

Michael Burry's "Big Short" bet during the GFC was based on insight into fragile capital structures, and liquidity was the key factor repriced as domestic and cross-border capital flows changed. This is why I believe there is a very interesting link between Burry's current analysis and my ongoing analysis of cross-border liquidity.

Foreign investors are injecting more and more capital into the US, and whether it's foreign inflows or passive investment inflows, they are increasingly concentrated in the top seven stocks of the S&P 500.

It is important to note the type of imbalance here. Brad Setser has done an excellent analysis explaining how carry trade dynamics in cross-border capital flows have structurally triggered extreme market complacency:

Why does all this matter? Because many financial models today (incorrectly, in my view) assume that in the event of future financial instability—such as a sell-off in US equities or credit markets—the dollar will rise. This assumption makes it easier for investors to continue holding unhedged dollar assets.

This logic can be simply summarized as: Yes, my fund is currently overweight US products because the US's "dominance" in global equity indices is unquestionable, but this risk is partially offset by the natural hedge provided by the dollar. Because the dollar usually rises when bad news hits. In major equity corrections (like 2008 or 2020, though for different reasons), the dollar may strengthen, and hedging dollar risk actually cancels out this natural hedge.

Conveniently, based on past correlations, the expectation that the dollar is a hedge for equities (or credit) also boosts current returns. This provides a reason not to hedge US market exposure when hedging costs are high.

However, the problem is that past correlations may not persist.

If the dollar's rise in 2008 was not due to its reserve currency status, but because funding currencies typically rise when carry trades are unwound (while destination currencies fall), then investors should not assume the dollar will continue to rise in future periods of instability.

One thing is certain: the US is currently the recipient of most carry trades.

Foreign Capital Did Not Exit the US During the GFC

This is the key reason why today's world is so different: foreign investors' returns on the S&P 500 depend not only on the index's returns but also on currency returns. If the S&P 500 rises 10% in a year, but the dollar depreciates by the same amount against the investor's local currency, this does not mean a positive return for foreign investors.

Below is a comparison of the S&P 500 (blue line) and the currency-hedged S&P 500. As you can see, accounting for currency changes significantly alters investment returns over the years. Now, imagine what happens if these years of changes are compressed into a short time frame. This huge risk driven by cross-border capital flows could be amplified.

This brings us to an accelerating catalyst—one that is putting global carry trades at risk: the Trump administration's stance on currency, geopolitics, and trade.

Trump, FX, and Economic Warfare

At the beginning of this year, two very specific macro changes emerged, accelerating the accumulation of potential risks in the global balance of payments system.

We saw the dollar depreciate and US equities fall simultaneously, a phenomenon driven by tariff policies and cross-border capital flows, not by domestic default issues. This stems from the type of imbalance I mentioned above. The real issue is that if the dollar depreciates while US equities fall, any Fed intervention will further suppress the dollar, which will almost certainly amplify the downward pressure on US equities (contrary to the traditional "Fed Put" view).

When the source of selling is external and currency-based, the Fed's position becomes even more difficult. This phenomenon shows that we have entered the "macro end game," where currency is becoming the key asymmetric pivot for everything.

Trump and Bessent are openly pushing for a weaker dollar and using tariffs as leverage to gain the upper hand in economic conflict with China.

The core view is: China is deliberately weakening other countries' industrial bases, creating dependence on China, and thus creating leverage to achieve broader strategic goals.

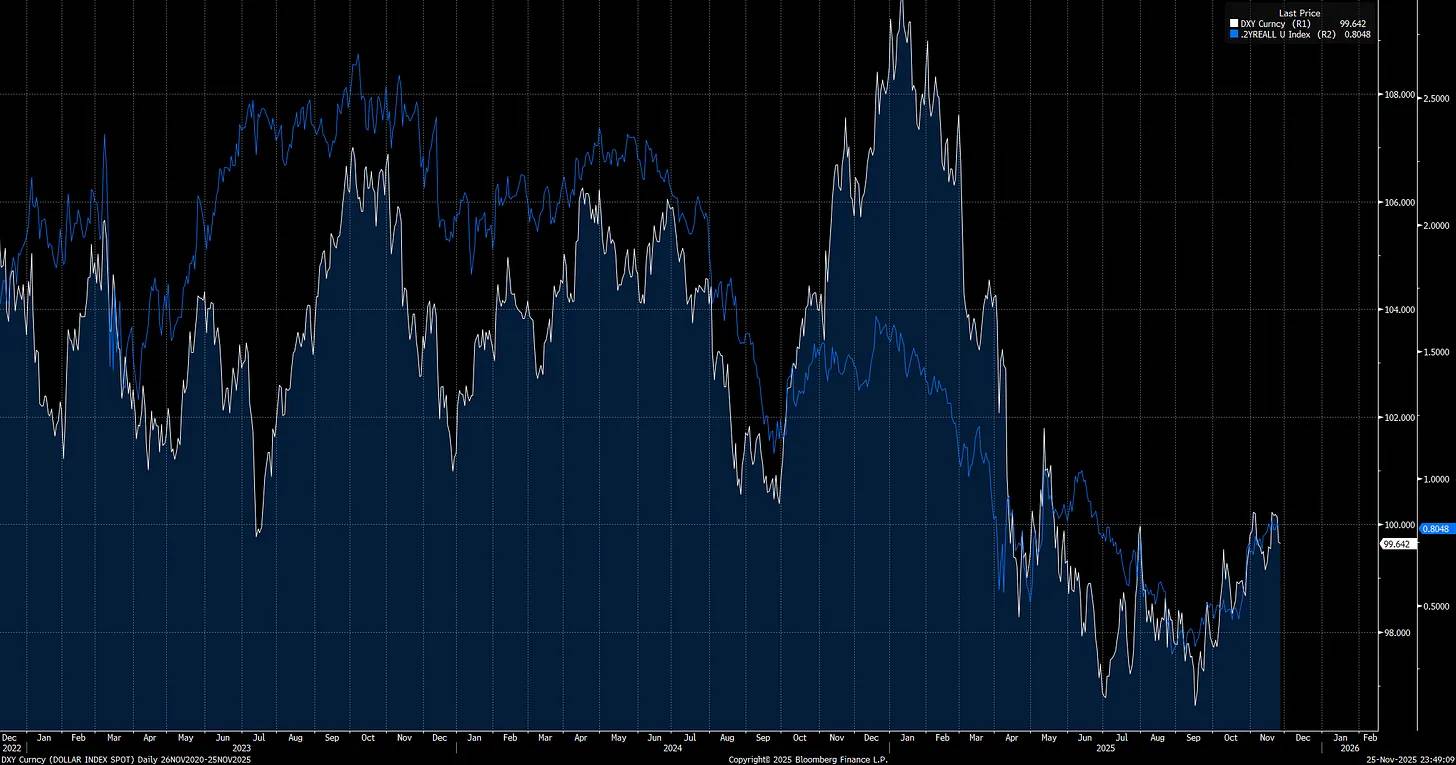

From the moment Trump took office (red arrow), the US Dollar Index (DXY) began to fall, and this is just the beginning.

Note that short-end real rates are one of the main drivers of the DXY, meaning monetary policy and Trump's tariff policy together are key drivers of this trend.

Trump needs the Fed to take a more dovish stance on monetary policy, not just to stimulate the economy but also to weaken the dollar. This is one reason he appointed Steven Miran to the Fed Board, as Miran has a deep understanding of how global trade works.

What was the first thing Miran did after taking office? He placed his dot plot projections a full 100 basis points below those of other FOMC members. This is a clear signal: he is extremely dovish and is trying to guide other members toward a more accommodative stance.

Core view:

There is a core dilemma here: the US is in a real economic conflict with China and must respond actively or risk losing strategic dominance. However, a weak dollar policy achieved through extremely loose monetary policy and aggressive trade negotiations is a double-edged sword. In the short term, it can boost domestic liquidity, but it also suppresses cross-border capital flows.

A weak dollar may cause foreign investors to reduce their exposure to US equities as the dollar depreciates, as they need to adjust to new trade conditions and a changing FX environment. This puts the US on the edge of a cliff: one path is to confront China's economic aggression head-on, the other is to risk a major repricing of US equities due to the dollar's depreciation against major currencies.

New Fed Chair, Midterm Elections, and Trump's "Grand Strategy"

We are witnessing the formation of a global imbalance directly tied to cross-border capital flows and currency. Since Trump took office, this imbalance has accelerated as he began to confront the biggest structural distortions in the system, including economic conflict with China. These dynamics are not theoretical—they are already reshaping markets and global trade. All of this is setting the stage for next year's catalyst: a new Fed Chair will take office during the midterm elections, and Trump will enter the final two years of his term, determined to leave a major mark on US history.

I believe Trump will push the Fed to adopt the most aggressive dovish monetary policy to achieve a weak dollar until inflation risks force a reversal. Most investors assume a dovish Fed is always good for equities, but this assumption only holds when the economy is resilient. Once dovish policy triggers cross-border position adjustments, this logic collapses.

If you have followed my research, you know that long-term rates always price in central bank policy mistakes. When the Fed cuts rates too aggressively, long-term yields rise, and the yield curve bear steepens to counter policy errors. The Fed's current advantage is that inflation expectations (see chart: 2-year inflation swaps) have been falling for a month, shifting the risk balance and allowing them to take a dovish stance in the short term without triggering significant inflation pressure.

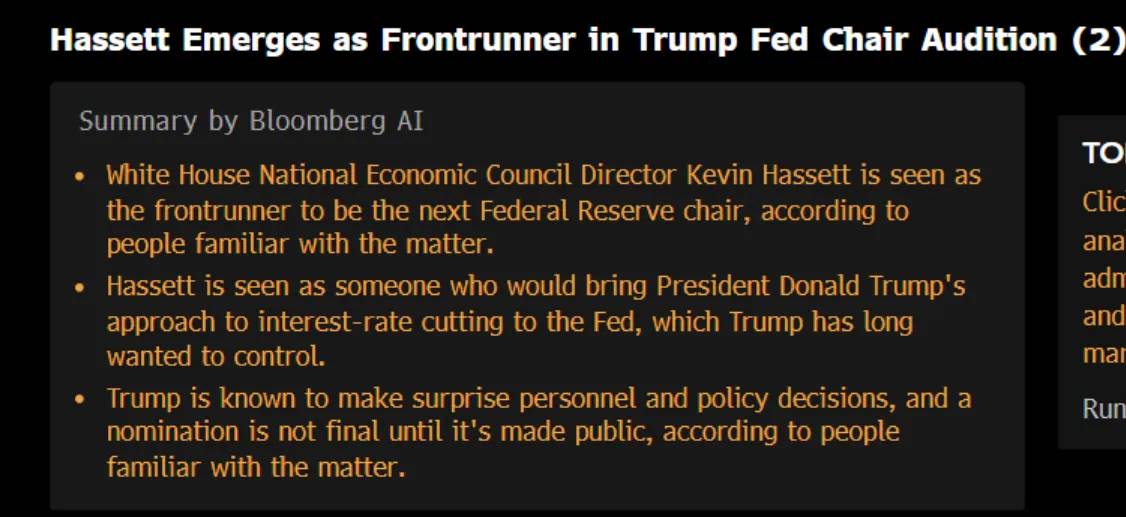

As inflation expectations fall, we get news of a new Fed Chair, who will take office next year and may be more aligned with Miran's stance than with other Fed governors:

If the Fed adjusts the terminal rate (currently reflected in the eighth SOFR contract) to better match changes in inflation expectations, this will start to lower real rates and further weaken the dollar (since inflation risk has just fallen, the Fed has room to do this).

We have already seen that the recent rise in real rates (white line) has slowed the dollar's (blue line) decline, but this is creating a bigger imbalance, paving the way for further rate cuts, which will likely push the dollar even lower.

If Trump wants to reverse global trade imbalances and confront China in economic conflict and the AI race, he needs a significantly weaker dollar. Tariffs give him negotiating leverage to reach trade deals consistent with a weak dollar strategy while maintaining US dominance.

The problem is that Trump and Bessent must balance multiple challenges: avoiding politically destructive outcomes before the midterms, managing a Fed with several less dovish members, and hoping the weak dollar strategy does not trigger foreign investors to sell US equities, widen credit spreads, and hit the fragile labor market. This combination could easily push the economy to the brink of recession.

The biggest risk is that current market valuations are at historic extremes, making equities more sensitive to liquidity changes than ever before. That's why I believe we are approaching a major inflection point in the next 12 months. The potential catalysts for an equity sell-off are increasing sharply.

“What important truth do very few people agree with you on?”

The market is sleepwalking into a structural risk that is almost completely unpriced: a deliberately engineered dollar depreciation, which will turn what investors see as tailwinds into the main source of volatility over the next year. The complacency around a weak dollar is just like the complacency around mortgages before 2008, which is why a deliberate dollar depreciation could hit risk assets harder than investors expect.

I firmly believe this is the most overlooked and misunderstood risk in global markets. I have been actively building models and strategies around this single tail event to short the market on a large scale when a structural collapse truly occurs.

Timing the Macro Inflection Point

What I want to do now is directly link these ideas to specific signals that can reveal when particular risks are rising, especially as cross-border capital flows begin to change the macro liquidity structure.

In the US equity market, positioning unwinds happen frequently, but understanding the drivers behind them determines the severity of selling pressure. If the adjustment is driven by cross-border capital flows, the market's fragility is greater, and vigilance must be significantly heightened.

The chart below shows the main periods when cross-border capital positions began to exert greater selling pressure on US equities. Monitoring this will be crucial:

Note that since the EURUSD rebound and call skew spike during the March market sell-off, the market has maintained a higher baseline level of call skew. This elevated baseline is almost certainly related to potential structural position risk in cross-border capital flows.

Any time cross-border capital flows become a source of liquidity expansion or contraction, this is directly related to net flows through FX. Understanding the specific locations of foreign investors' increases and decreases in US equities is crucial, as this will signal when risk is rising.

This is especially important for the AI theme, as more and more capital is disproportionately concentrated here:

To further explain the connections of these capital flows, I will release an interview with Jared Kubin, an authority in this field and a valuable resource in my learning journey, for subscribers in the first week of December.

Main Signals of Cross-Border Selling Include

The dollar depreciating against major currency pairs while cross-asset implied volatility rises.

Watching the skew of major currency pairs will be key to confirming signals,

The dollar falls while equities are also sold off.

Downward pressure in equities may be led by high beta stocks or thematic sectors, while low-quality stocks will suffer greater impact.

Cross-asset and cross-border correlations may approach 1.

Even a small adjustment in the world's largest imbalance could lead to high asset interlinkage. Monitoring other countries' equity markets and factor performance will be crucial.

Final signal: Fed liquidity injections instead cause the dollar to fall further and intensify equity selling pressure.

If policy-driven dollar depreciation triggers domestic stagflation pressure, this situation becomes even more dangerous.

Although gold and silver rose slightly during cross-border selling earlier this year, they still sold off in a true market crash because they are cross-collateralized with the whole system. While holding gold and silver may have upside potential, they will not provide diversified returns when the VIX truly explodes. The only way to profit is through active trading, holding hedged positions, shorting the dollar, and going long volatility.

The biggest problem is: we are at a stage in the economic cycle where the real return on holding cash is becoming increasingly low. This systematically forces capital to move up the risk curve to establish net long positions before the liquidity shift. Timing this shift is crucial, as the risk of not holding equities during the credit cycle is just as significant as not being hedged or holding cash during a bear market.

The Macro End Game

The core message is simple: global markets are ignoring the single most important risk of this cycle. The deliberate depreciation of the dollar, colliding with extreme cross-border imbalances and excessive valuations, is brewing a volatility event, and this complacency is reminiscent of what we saw before 2008. While you can't be certain about the future, you can analyze the present correctly. And current signals already show that pressure is gradually building beneath the surface.

Understanding these mechanisms is crucial because it tells you which signals to watch for, and as risk approaches, these signals will become more pronounced. Awareness itself is an advantage. Most investors still assume a weaker dollar will automatically benefit the market. This assumption is dangerous and wrong today, just as the belief that mortgages were "too safe" was in 2007. This is the silent beginning of the macro end game, where global liquidity structure and currency dynamics will become the decisive drivers for every major asset class.

Currently, I remain bullish on equities, gold, and silver. But the storm is brewing. When my models begin to show a gradual rise in this risk, I will turn bearish on equities and immediately notify subscribers of this shift.

If 2008 taught us anything, it's that warning signals can always be found if you know where to look. Monitor the right signals, understand the dynamics behind them, and when the tide turns, you'll be ready.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Staking Weekly Report December 1, 2025

🌟🌟Core Data on ETH Staking🌟🌟 1️⃣ Ebunker ETH staking yield: 3.27% 2️⃣ stETH...

The Blood and Tears Files of Crypto Veterans: Collapses, Hacks, and Insider Schemes—No One Can Escape

The article describes the loss experiences of several cryptocurrency investors, including exchange exits, failed insider information, hacker attacks, contract liquidations, and scams by acquaintances. It shares their lessons learned and investment strategies. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

Mars Morning News | Federal Reserve officials to advance stablecoin regulatory framework; US SEC Chairman to deliver a speech at the New York Stock Exchange tonight

Federal Reserve officials plan to advance the formulation of stablecoin regulatory rules. The SEC Chair will deliver a speech on the future vision of capital markets. Grayscale will launch the first Chainlink spot ETF. A Coinbase executive has been sued by shareholders for alleged insider trading. The cryptocurrency market fear index has dropped to 23. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.