PIPPIN Defies the Market, Turning $180,000 Into Over $1.5 Million for a Trader

While the broader crypto market flashed red in early December, a Solana-based meme coin called PIPPIN delivered a remarkable countertrend rally. Its rapid price surge enabled several traders to achieve massive short-term profits. However, it also raised concerns about a potential sharp correction that could hurt latecomers. How One Trader Made More Than $1.3 Million

While the broader crypto market flashed red in early December, a Solana-based meme coin called PIPPIN delivered a remarkable countertrend rally.

Its rapid price surge enabled several traders to achieve massive short-term profits. However, it also raised concerns about a potential sharp correction that could hurt latecomers.

How One Trader Made More Than $1.3 Million With PIPPIN

PIPPIN originated from an AI-generated unicorn image (SVG). It later evolved into a meme coin on Solana.

Unlike many other meme tokens, the project’s developers promised to release open-source tools with potential applications for PIPPIN, including interactive tutoring systems, AI marketing assistants, and personality-driven DevOps bots capable of writing and deploying code.

Despite its high-risk meme-coin nature, PIPPIN has become one of the most talked-about names in Solana’s meme wave at the end of 2025.

PIPPIN Price Performance. Source:

PIPPIN Price Performance.

PIPPIN Price Performance. Source:

PIPPIN Price Performance.

According to data from BeInCrypto, the token has experienced a surge of over 400% in the past month and is currently trading at $0.139. When comparing the low in November ($0.02) to the recent high ($0.20), the token has increased tenfold. Additionally, the daily trading volume has surpassed $120 million, a significant rise from under $10 million in November.

This rally has put one early buyer on enormous unrealized profits. According to market-tracking account LookOnChain, a wallet named BxNU5a was created about a month ago. The wallet spent $179,800 to acquire 8.2 million PIPPIN tokens. The current value of this stash is approximately $1.51 million, resulting in an unrealized gain of more than $1.35 million.

A month ago, someone created a new wallet, BxNU5a, and spent $179.8K to buy 8.2M $pippin($1.51M now).This guy is now sitting on over $1.35M in unrealized profits.

— Lookonchain (@lookonchain) December 1, 2025

Nansen also reported strong whale accumulation and a sharp increase in the number of active wallets, signaling a wave of new investors pouring money into the token.

“PIPPIN didn’t just ‘go up,’ it detonated. 437% in 7 days with $43.9M volume is a different tempo. Whales added +6.6M, fresh wallets put in +11M, and exchanges saw sharp outflows,” — Nansen.

These bullish signals have fueled hopes that PIPPIN could become the next standout in the Solana meme-coin ecosystem. Recent reports also highlight potential reasons why the meme-coin wave may return in December.

Warning Signs Emerge

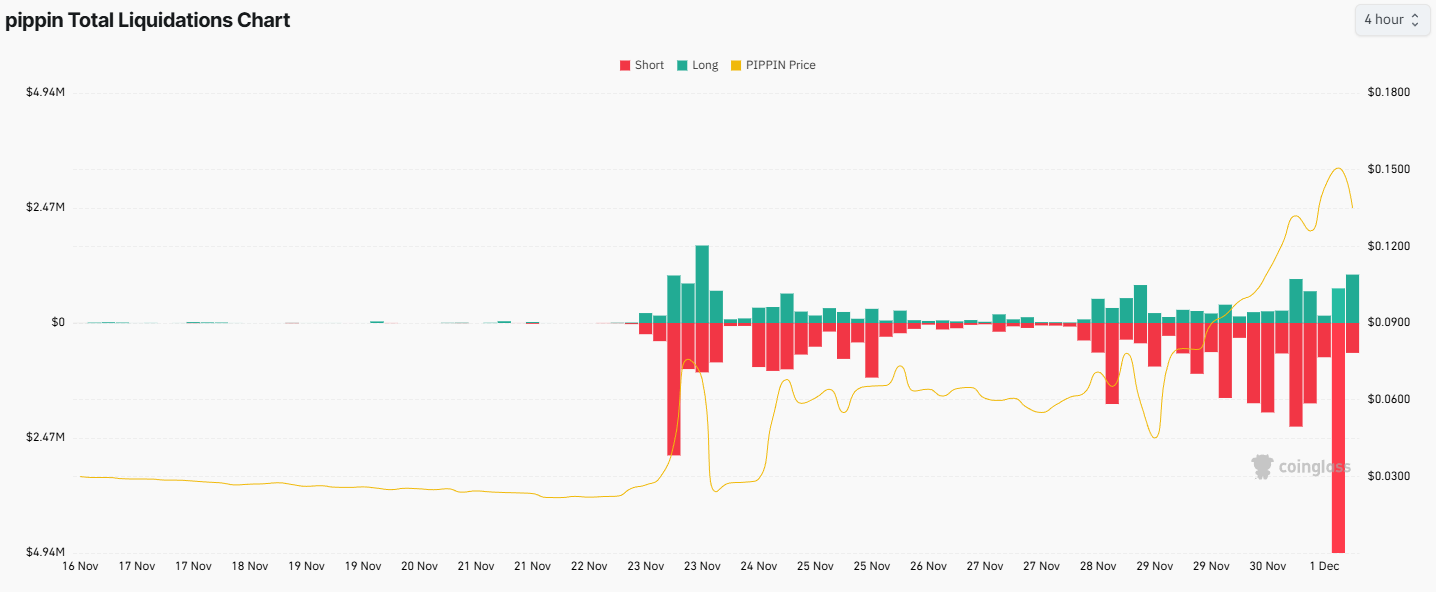

Despite the explosive rally, significant risks have also surfaced. The first warning concerns PIPPIN’s short positions suffering heavy liquidations.

Data from Coinglass shows a series of short positions being wiped out during the last week of November. The heaviest liquidation day occurred on December 1.

Pippin Total Liquidations. Source:

Pippin Total Liquidations.

Pippin Total Liquidations. Source:

Pippin Total Liquidations.

Coinglass reported more than $15 million in liquidations on December 1 alone, with over $11 million coming from short positions.

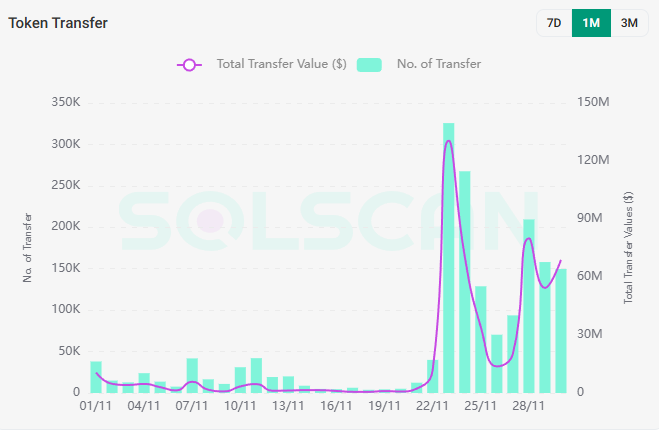

On-chain signals are also flashing caution. According to Solscan, even as the price soared, real on-chain trading volume decreased by 45% compared to the previous week.

PIPPIN Token Transder. Source:

PIPPIN Token Transder.

PIPPIN Token Transder. Source:

PIPPIN Token Transder.

Traders are executing fewer transactions on-chain and shifting more activity to exchanges. This divergence could signal a sharp decline if increasing amounts of PIPPIN are sold on centralized platforms.

Well-known analyst Altcoin Sherpa compared PIPPIN to other meme tokens, such as AVA, GRIFFAIN, and ACT, predicting that prices may drop significantly soon.

“With PIPPIN moving, some of these other AI shitters are also going. AVA, GRIFFAIN, ACT. Hard to honestly trade them though, and these are probably just 24-hour pump-and-dumps for most of them. Unlikely to be a sustained pump,”— Altcoin Sherpa.

PIPPIN’s market cap previously reached over $300 million late last year before collapsing to $8 million, which adds to investor skepticism about another potential steep dump.

Another analyst described PIPPIN’s rally as a familiar pattern: a small group accumulates heavily and withholds supply, creating buy pressure that pushes the price up. Short positions are then liquidated, the price drops afterward, and the cycle repeats.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid’s Growing Influence in Crypto Trading: Enhancing Investor Access and Entry Methods in an Evolving Market

- Hyperliquid dominates 2025 crypto market with 73% DEX perpetual trading share via fee cuts, stablecoin integration, and institutional partnerships. - USDH stablecoin (backed by USD/Treasury) and HyperEVM infrastructure position it as "AWS of liquidity" for on-chain finance developers. - 78% user growth and 1.75M HYPE token unlock resilience highlight its scalability, though stablecoin regulations and market volatility pose risks.

PENGU Token Price Rally: Examining Brief Upward Trends and Institutional Indicators Towards the End of 2025

- PENGU token surged past $0.0100 in late 2025, driven by Bitcoin's rebound and institutional inflows totaling $430,000. - Technical indicators show conflicting signals: overbought RSI (73.76) vs. positive MACD/OBV, with critical support at $0.009. - $66.6M team wallet outflows contrast with institutional accumulation, raising sustainability concerns despite short-term bullish momentum. - Macroeconomic factors like Fed policy and Bitcoin correlation amplify PENGU's volatility, complicating long-term price

LUNA Rises 1.13% Amid Progress on U.S. Lawmaker’s Stock Trading Ban

- LUNA rose 1.13% in 24 hours amid U.S. political pressure to ban congressional stock trading, despite an 82.66% annual decline. - Rep. Anna Paulina Luna advanced the bipartisan Restore Trust in Congress Act, which would prohibit lawmakers and families from trading individual stocks. - The bill faces bipartisan opposition over financial flexibility concerns but has 100+ supporters, including conservatives and progressives, seeking to close ethics loopholes. - Critics argue the 2012 STOCK Act lacks sufficie

BCH Rises 9.13% Over 24 Hours as Overall Market Trends Upward

- Bitcoin Cash (BCH) surged 9.13% in 24 hours, with 10.08% monthly and 37.01% annual gains, signaling sustained bullish momentum. - Analysts attribute the rise to BCH's utility in cross-border payments, low fees, and institutional interest as a Bitcoin layer-2 solution. - No immediate catalysts (regulatory shifts, partnerships) were identified, suggesting market sentiment and macro trends drive the rally. - Experts highlight BCH's structural strengths and active development, positioning it to outperform br