Solana News Update: Speculative Investors Propel PIPPIN to a 600% Rally, Reflecting Trends Seen in Meme Coins

- PIPPIN AI token surged 600% to $0.18 in December 2025, driven by whale activity and speculation on Solana's Raydium platform. - The rally pushed its market cap above $200 million, with $154 million in 24-hour trading volume—50% of Raydium's total. - Analysts warn the surge lacks fundamental catalysts, mirroring meme coin dynamics and leaving the token vulnerable to large trades. - Despite outperforming the stagnant AI agent sector, PIPPIN's dominance on Raydium raises sustainability concerns amid broader

PIPPIN AI Token Soars Over 600% in December 2025

In December 2025, the PIPPIN AI token experienced an extraordinary rebound, climbing from a low of $0.023 to $0.18—a surge of more than 600%. This dramatic upswing was largely attributed to speculative trading and significant activity from large holders, or "whales," on the Solana-based Raydium platform.

As a result of this rally, PIPPIN's market capitalization surpassed $200 million, and its 24-hour trading volume exceeded $154 million, representing more than half of Raydium's total trading activity. This performance has set PIPPIN apart as a leading token within the AI agent sector, which as a whole remains below $3 billion in total market value.

Whale Activity Drives Volatility

The recent price jump has been fueled by both accumulation and profit-taking among major investors. Notably, one large holder built up a $1.2 million position over the course of a month, while another prominent whale recently liquidated their entire 29,527 SOL stake—turning an initial $90,000 investment into $3.74 million. Analysts have pointed out that these trading patterns are reminiscent of previous meme coin cycles, especially given the $7.4 million liquidity in PIPPIN's main trading pair, which leaves the token susceptible to large, market-moving trades.

Questions About Sustainability

Despite the impressive rally, industry experts warn that the surge is not backed by fundamental developments such as project updates or confirmed airdrops. The AI agent sector, which saw a boom earlier in 2025, has since cooled off, with most tokens losing over 99% of their value from previous highs. PIPPIN's dominance in trading volume on Raydium—outpacing other Solana-based tokens—may indicate strong on-chain interest, but its long-term prospects remain uncertain.

Mixed Signals Across the Crypto Market

The broader cryptocurrency landscape has shown signs of instability. Bitcoin recently fell below the $90,000 mark, sparking a wave of liquidations totaling nearly $1 billion in leveraged positions. Companies with significant Bitcoin exposure, such as Strategy, have revised their 2025 earnings forecasts in response to the downturn. Meanwhile, new projects like Mutuum Finance—a decentralized lending platform—continue to draw investor interest.

Volatility Remains High for AI-Driven Tokens

PIPPIN's recent performance highlights the unpredictable nature of AI-focused cryptocurrencies, where liquidity and the actions of large holders can rapidly shift market dynamics. As the sector faces ongoing macroeconomic challenges, investors are encouraged to closely track on-chain activity and whale movements to better anticipate future trends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vanguard Breaks Conservative Tradition, Opens to Crypto ETFs

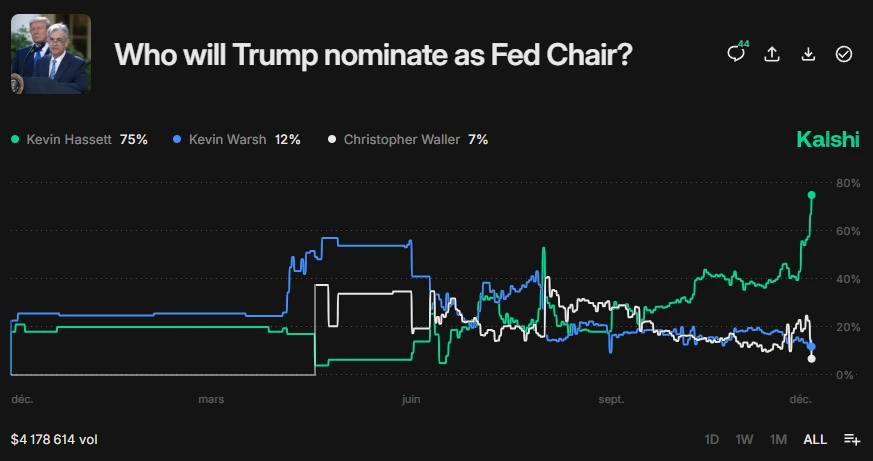

Trump’s Fed Chair Announcement Likely This Week: Is It the Needed Crypto Bullish Catalyst?

XRP Price News: Breakout or Breakdown?

Huione Pay Halts Withdrawals After Run on Banks, Users Fear Major Losses