JUST Price Prediction: Breakout Stalls As Sellers Test Support After Parabolic Rally

JUST price today trades near $0.0425, easing over 3% in the past 24 hours after a strong breakout that lifted price into a major multi-month resistance zone. The rally paused immediately at the upper boundary of a long-term triangle formation, leading to profit-taking as the market tests whether the breakout has real follow-through.

Price Hits Major Resistance After Strong Rally

The daily chart shows JUST breaking above a rising wedge base and driving into the horizontal ceiling near $0.0440, which has capped every major rally since April.

Price remains above all major EMAs, which now sit between $0.0348 and $0.0388, establishing a broad support zone beneath current levels. The reclaim of the EMA stack is structurally bullish, but the reaction at resistance determines whether the breakout transitions into trend expansion or stalls into consolidation.

RSI sits near 74, signaling overbought conditions and increasing risk of short-term cooling. The indicator also shows repeated bearish divergence signals on previous peaks, making the current stall notable as traders gauge whether momentum will fade again.

A failure to hold above the rising support line drawn from the late October low exposes a deeper pullback toward the EMA cluster.

Intraday Charts Show Initial Retest Of Support

On the 30-minute chart, JUST is testing the rising trendline that supported the breakout. Price briefly slipped below the line before reclaiming it, showing early signs of bid absorption.

Supertrend sits overhead at $0.0437, reinforcing that upside is encountering resistance. The Directional Movement Index shows a fading bullish impulse, with ADX flattening while +DI slips beneath related metrics. This supports the idea that momentum has cooled and the rally is transitioning into a retest phase.

A close below the trendline would shift focus toward the $0.0410 to $0.0395 region, where early support formed before the breakout acceleration.

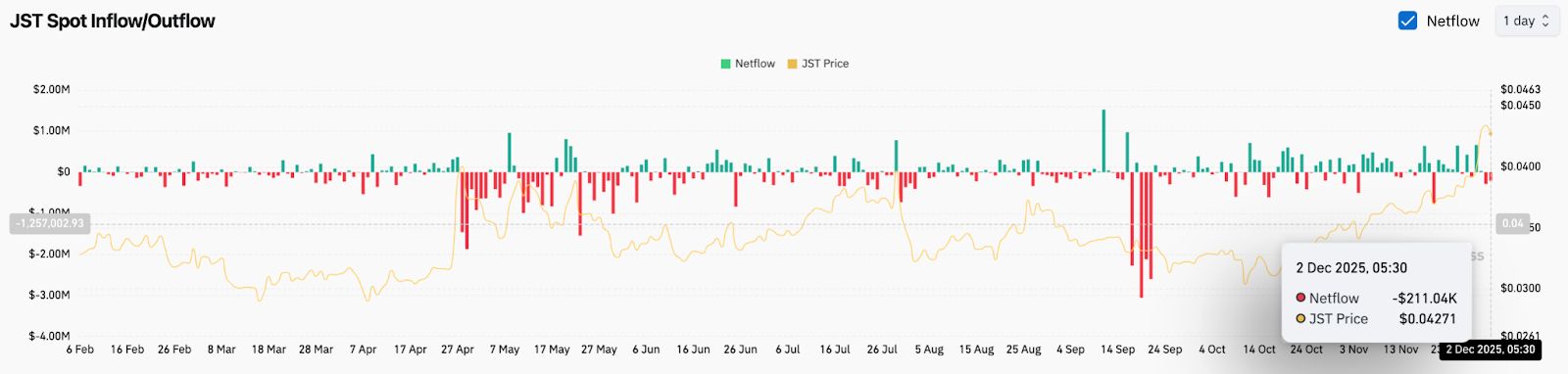

Spot Flows Show Light Distribution

Spot flow data shows a small $211,000 outflow on December 2, reflecting mild distribution after the breakout. Recent days show a mix of green and red prints, indicating balanced participation rather than heavy accumulation or aggressive profit-taking.

This flow profile matches price action. The rally was driven by technical breakout mechanics rather than large-scale inflow, and the current stall reflects traders managing risk rather than exiting en masse.

If spot flows turn positive again, the breakout could regain momentum. Sustained outflows would indicate further cooling.

Outlook. Will JUST Go Up?

JUST remains in a constructive higher timeframe structure after reclaiming the full EMA stack and breaking out from a multi-week base. The current pullback is a standard retest of resistance turned potential support. The next move depends on whether buyers defend that level.

- Bullish case: A bounce from $0.0410 followed by a close above $0.0440 signals continuation toward $0.0460 and $0.0500. Sustained higher lows confirm trend expansion.

- Bearish case: A break below $0.0410 turns the move into a deeper retracement toward $0.0395 and potentially $0.0380. Losing the EMA stack shifts structure back into range-bound behavior.

JUST must hold the rising support to maintain the breakout thesis. Reclaiming $0.0440 turns the pullback into trend continuation, while losing $0.0410 exposes a cooldown toward the mid-$0.03 area.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Surges in November 2025: Is This the Dawn of Widespread Institutional Investment?

- Bitcoin's 32% November 2025 drawdown occurred amid $732B in institutional inflows and record ETF adoption. - SEC-approved spot ETFs and the GENIUS Act provided regulatory clarity, boosting institutional confidence in crypto. - On-chain data showed institutional accumulation via P2WPKH addresses despite retail outflows and CDD spikes. - Macroeconomic factors like inflation and rate adjustments shaped Bitcoin's role as a hedge, with analysts viewing the correction as a mid-cycle reset. - Institutional allo

The Transformation of Education Through AI: Key Investment Prospects in EdTech and STEM Education

- AI in education market to surge from $7.05B in 2025 to $112.3B by 2034 at 36.02% CAGR, per Precedence Research. - Asia-Pacific leads growth at 46.12% CAGR; corporate e-learning to hit $44.6B by 2028 with 57% efficiency boost. - AI edtech startups raised $89.4B in Q3 2025 (34% of VC), with infrastructure investments at 51% of global deal value. - STEM institutions partner with tech giants to build AI talent pipelines, supported by $1B Google and $140M NSF investments. - Market risks include 66.4% revenue

ChainOpera AI Token Plummets 70%: A Stark Warning for AI-Based Cryptocurrencies

- ChainOpera AI (COAI) collapsed 99% in late 2025 due to hyper-centralization, governance failures, and technical vulnerabilities. - 88% token control by ten wallets, $116.8M losses at C3.ai, and minimal code updates exposed systemic risks in AI-driven crypto projects. - Regulatory uncertainty from U.S. CLARITY/GENIUS Acts and algorithmic stablecoin collapses accelerated panic, highlighting market fragility. - The crash underscores urgent need for frameworks like NIST AI RMF and EU AI Act to balance innova

The Increasing Expenses of Law School and the Expansion of Public Interest Scholarship Initiatives

- US law school tuition rose to $49,297/year by 2025, with debt averaging $140,870, driven by declining state funding and inflation. - The 2025 OBBB Act capped student loans at $50,000/year and $200,000 total, prompting schools like Santa Clara to adopt tuition moderation and scholarships. - Public interest scholarships (e.g., Berkeley, Stanford) and LRAPs now enable 85%+ retention in public service roles, reducing debt's influence on career choices. - PSLF has forgiven $4.2B for 6,100 lawyers since 2025,