Why Monad Bears Could End Up Triggering a 40% C’up’ Move?

Monad price has dropped almost 40% from its recent peak, but the last 24 hours have turned active again. The MON token is up more than 27%, and the chart now hints at a classic pattern that often leads to sharp breakouts. At the same time, derivatives data show traders leaning heavily to the short

Monad price has dropped almost 40% from its recent peak, but the last 24 hours have turned active again. The MON token is up more than 27%, and the chart now hints at a classic pattern that often leads to sharp breakouts.

At the same time, derivatives data show traders leaning heavily to the short side. This mix creates an unusual setup where bearish positions could end up driving the next big move.

Possible Cup And Handle Setup Forms On The Chart

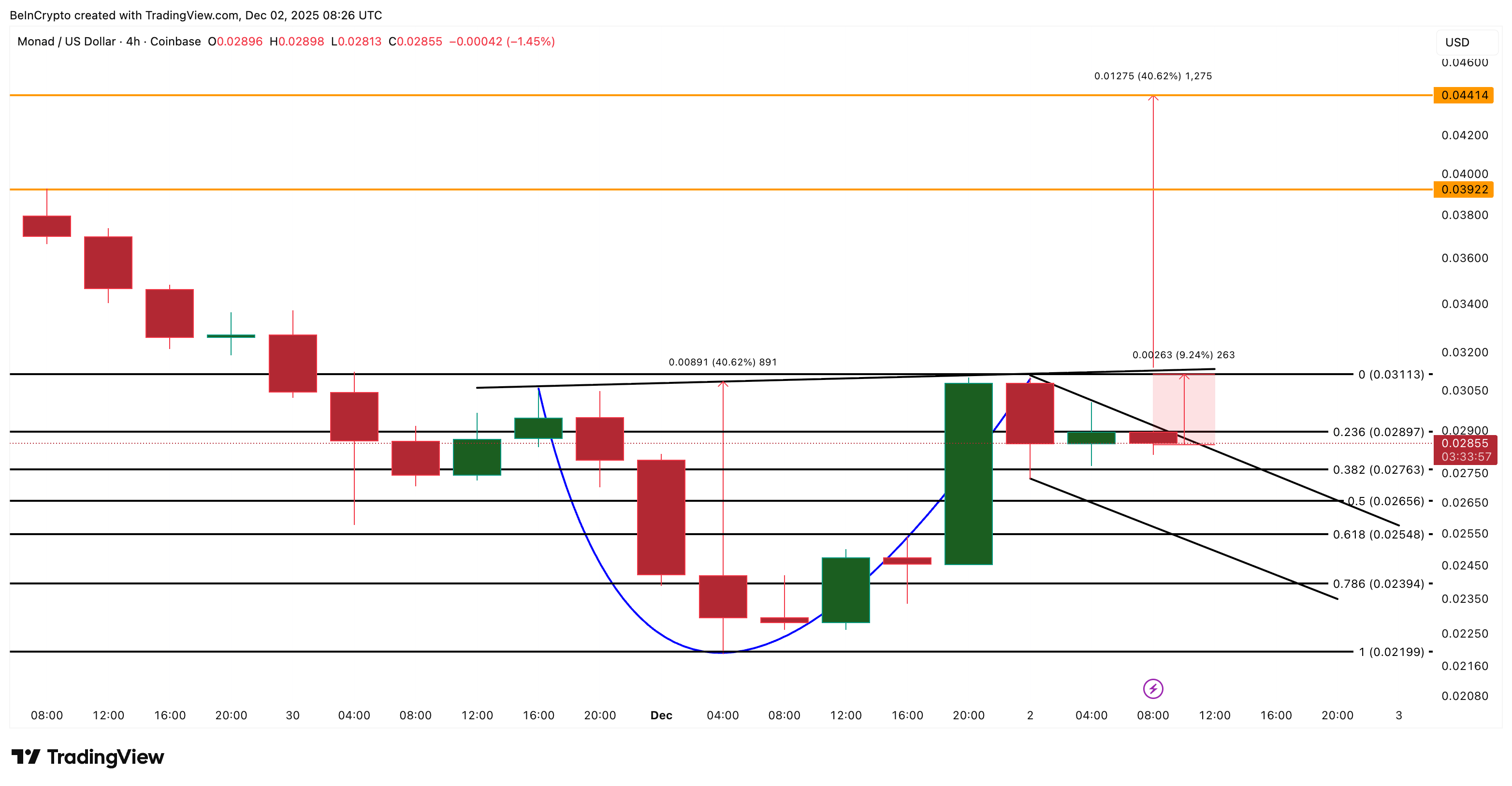

Monad trades inside a possible cup-and-handle pattern on the 4-hour chart. A cup-and-handle forms when the price rounds up, pauses, then builds a smaller pullback on the right side. This smaller pullback is called the handle. Breakouts from this pattern often lead to strong rallies.

CMF adds support to this idea. CMF (Chaikin Money Flow) tracks whether big money is entering or leaving. It has broken above its falling trend line, showing that large buyers may be returning. But CMF is still below zero. Until it moves above zero, Monad can stay inside the handle. A move above zero, while staying above the trend line, often triggers a clean breakout.

Monad Attempts Pattern Breakout:

Monad Attempts Pattern Breakout:

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

If the neckline breaks, the pattern points to a target near $0.044. This lines up with the recent high Monad set about a week ago.

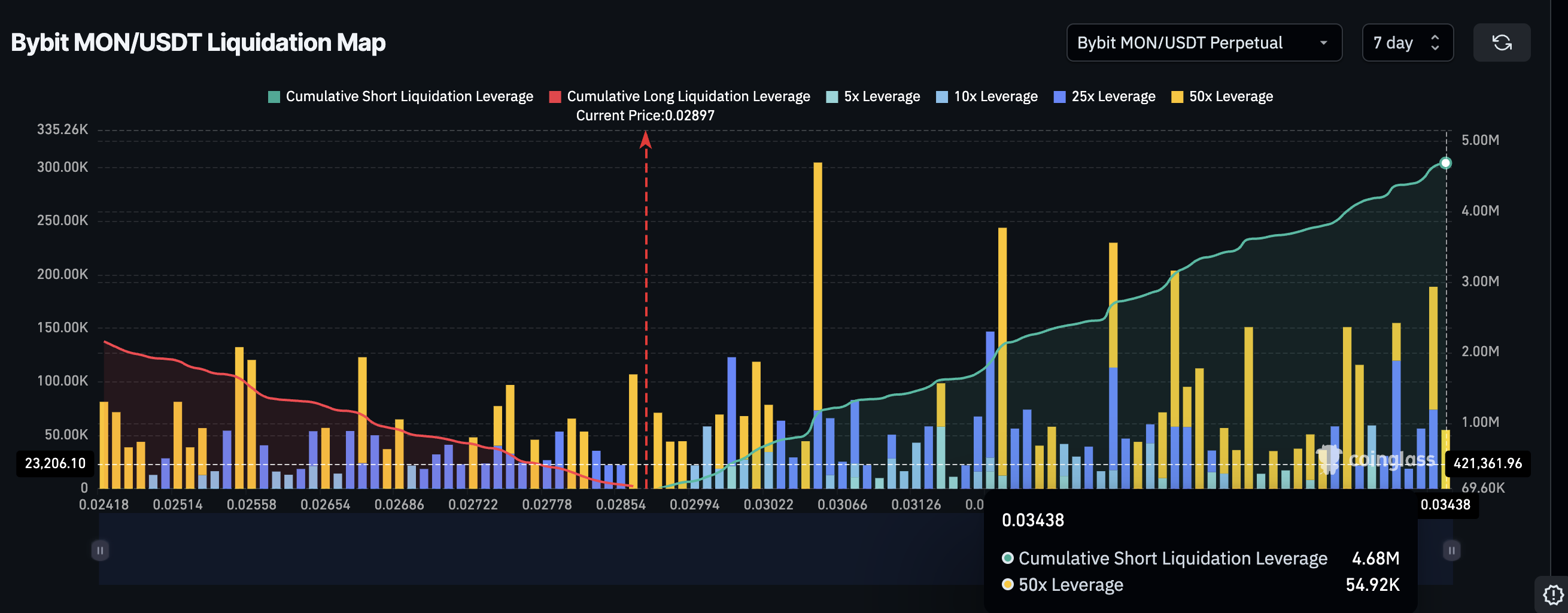

Short Squeeze Setup Builds As Traders Lean Bearish

A second catalyst sits in derivatives. The Bybit liquidation chart shows short liquidation leverage stacked far above long positions. Shorts total about $4.68 million MON, while longs sit near $2.16 million. That means short leverage is almost double the longs.

Liquidation Map Favors Bears:

Liquidation Map Favors Bears:

This is why Monad bears — traders betting against the price — could end up driving a breakout. When a price move pushes against heavy shorts, those traders are forced to close. That creates a short squeeze, which sends the price higher. Derivatives-led moves have been the feature of the current crypto market cycle.

Monad Price Levels: What Confirms And What Invalidates The Setup

The Monad price breakout path starts above $0.031, a 9% upmove from the current level. Do note that a break above $0.031 would continue to liquidate the shorts, per the liquidation map shared earlier. The handle breakout, however, happens with a 4-hour close above $0.028.

Clearing this level opens the move toward $0.039. If momentum stays strong, the final leg toward $0.044 can complete the full 40% cup move.

Monad Price Analysis:

Monad Price Analysis:

But invalidation sits close. A 4-hour close below $0.025 breaks the handle and weakens the structure. If the Monad price falls below $0.021, the trend turns fully bearish.

For now, pattern strength, rising CMF, and a crowded short side put Monad in a rare position: bears could create the fuel for the next big upmove.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Growing Significance of Financial Well-being in Investment Strategies

- Investors increasingly prioritize financial wellness, integrating emotional intelligence (EI), ESG principles, and fintech to align wealth strategies with holistic well-being and ethical values. - Research shows higher EI improves investment resilience, prompting advisors to address emotional biases like loss aversion through AI-driven tools and personalized guidance. - ESG-linked assets surpassed $50 trillion by 2025, with fintech platforms enabling tailored sustainable portfolios and AI-powered debt ma

COAI Experiences Significant Price Decline in Late November 2025: Is the Market Overreacting or Does This Present a Contrarian Investment Chance?

- ChainOpera AI (COAI) plummeted 90% in late 2025 due to CEO resignation, $116M losses, and regulatory ambiguity from the CLARITY Act. - Market panic and 88% supply concentration in top wallets amplified the selloff, while stablecoin collapses worsened liquidity risks. - Contrarians highlight C3 AI's 26% YoY revenue growth and potential 2026 regulatory clarity as signs of mispriced long-term AI/crypto opportunities. - Technical indicators suggest $22.44 as a critical resistance level, with analysts warning

Hyperliquid (HYPE) Price Rally: An In-Depth Look at Protocol Advancements and Liquidity Trends

- Hyperliquid's HYPE token surged 3.03% amid HIP-3 upgrades enabling permissionless perpetual markets and USDH stablecoin launch. - Protocol innovations boosted liquidity by 15% but failed to halt market share erosion to under 20% against competitors like Aster. - Structural challenges persist through token unstaking, unlocks, and OTC sales, yet HyENA's $50M 48-hour volume signaled renewed engagement. - Whale accumulation of $19.38M near $45-46 and HYPE buybacks aim to stabilize price, though long-term suc

ChainOpera AI Token Plummets Unexpectedly: Is This a Warning Sign for Crypto Investors Focused on AI?

- ChainOpera AI's 96% value collapse in late 2025 exposed critical risks in centralized, opaque AI-driven crypto projects. - 87.9% token concentration in ten wallets enabled manipulation, while untested AI algorithms and lack of audits eroded trust. - Regulatory ambiguity from delayed U.S. CLARITY Act and EU AI Act created fragmented frameworks, deterring institutional participation. - Post-crash trends prioritize decentralized governance, auditable smart contracts, and compliance with AML/KYC protocols fo