Date: Tue, Dec 02, 2025 | 03:40 PM GMT

The broader cryptocurrency market is showing signs of a relief bounce following yesterday’s heavy selloff. Both Bitcoin (BTC) and Ethereum (ETH) have posted strong 8% 24-hour gains, helping several beaten-down memecoins recover, including Fartcoin (FARTCOIN).

FARTCOIN has surged more than 30% today, but what makes this move particularly interesting is the emerging technical structure on its chart — one that could indicate a much larger upside move ahead.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Hints at Potential Upside

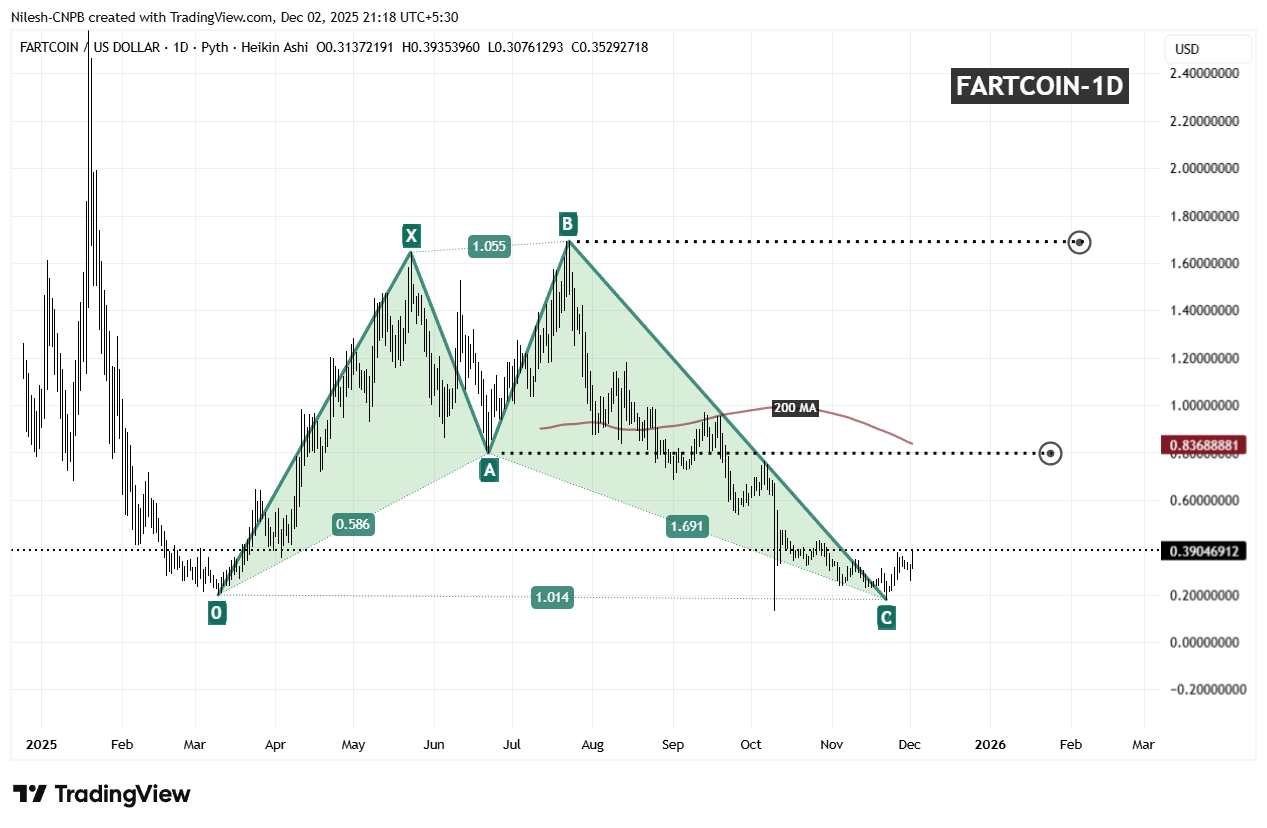

On the daily chart, FARTCOIN appears to be completing a Bullish Shark harmonic pattern, a formation often associated with strong reversal phases when price exhausts its downside momentum.

The pattern began with the initial O-X impulse around $0.1990, followed by a sharp rise to point X near $1.055. Price then retraced toward point A, climbed again to form point B around $1.691, and has since declined steadily into point C, forming near the $0.17–$0.18 range.

FARTCOIN Daily Chart/Coinsprobe (Source: Tradingview)

FARTCOIN Daily Chart/Coinsprobe (Source: Tradingview)

This C-leg completion is crucial, as it typically marks the reversal zone for a Shark pattern. And right on cue, buyers have stepped back in, pushing FARTCOIN higher and establishing early signs of recovery. The token now trades around $0.3904, showing renewed strength off its harmonic support zone.

What’s Next for FARTCOIN?

If this harmonic structure continues to play out as expected, FARTCOIN may be gearing up for a more extended upside move. The first major level to watch sits near $0.83, which aligns with a previous supply zone as well as the 200-day moving average. A breakout above this zone could open the doors for a larger upside target around the $1.69 region — the same area where the B-leg previously peaked.

However, failure to hold above the C-leg region could invalidate the harmonic setup and expose the price to a deeper pullback. For now, though, the pattern remains intact, and momentum is beginning to shift back in favor of the bulls.