PENGU Token Jumps 30% on NHL Deal, But $108 Million Sell-Off Sparks Fear

PENGU rallied over 30% in early December 2025 following news of a major collaboration between Pudgy Penguins and the National Hockey League (NHL) for the 2026 Discover NHL Winter Classic. Despite the price jump, on-chain data shows persistent transfers of PENGU from the project’s deployment address to centralized exchanges. This trend has sparked debate about

PENGU rallied over 30% in early December 2025 following news of a major collaboration between Pudgy Penguins and the National Hockey League (NHL) for the 2026 Discover NHL Winter Classic.

Despite the price jump, on-chain data shows persistent transfers of PENGU from the project’s deployment address to centralized exchanges. This trend has sparked debate about the sustainability of PENGU’s recovery.

NHL Partnership Sparks PENGU Rally

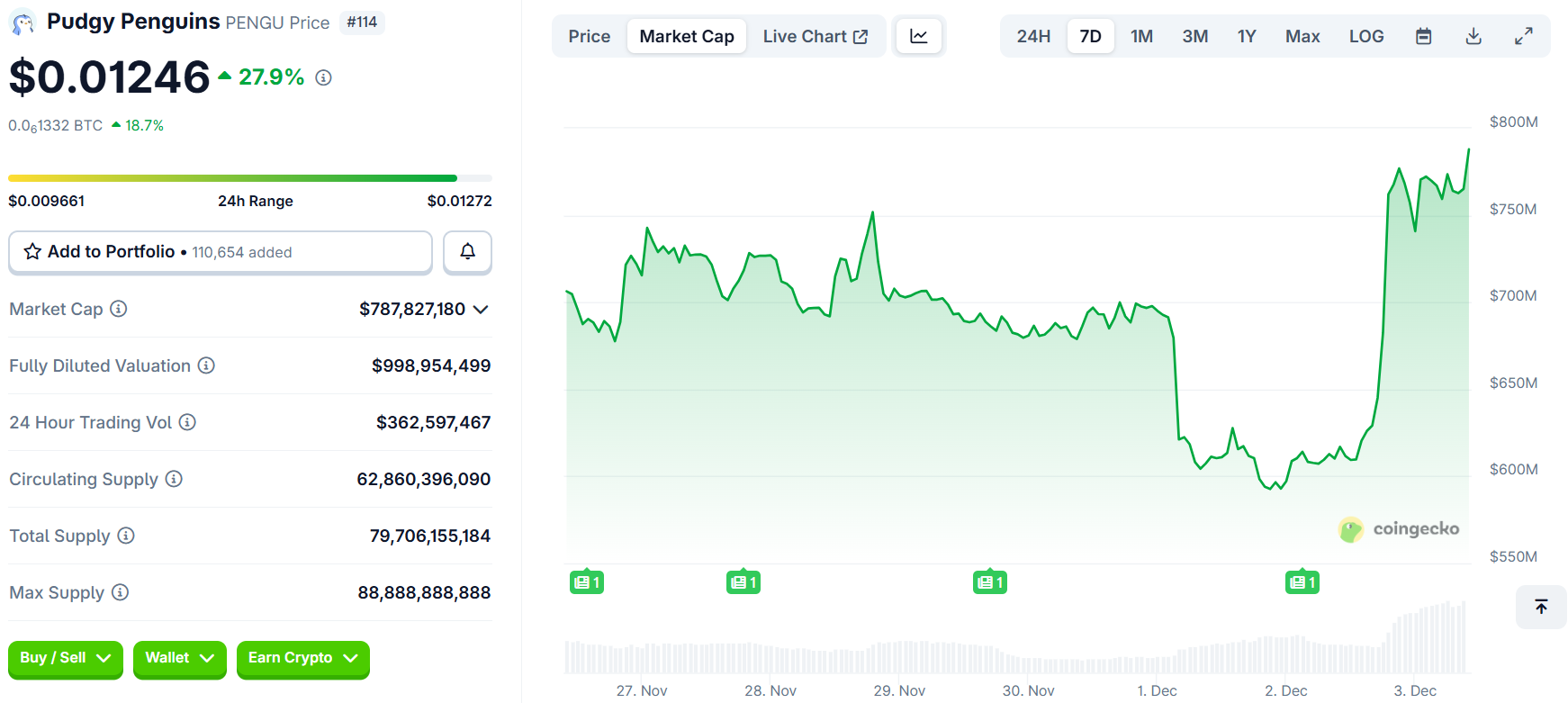

PENGU, the Pudgy Penguins community token, experienced a notable surge during the first week of December. It has increased by almost 30% in the last 24 hours, trading at $0.01246 as of this writing.

Pudgy Penguins (PENGU) Price Performance. Source:

Pudgy Penguins (PENGU) Price Performance. Source:

This price increase aligned with Pudgy Penguins’ announcement of an NHL partnership lasting from December to January.

The collaboration launched at Art Week Miami, highlighted by activations, giveaways, and live appearances at NHL events.

Pudgy Penguins X @NHLWe will be collaborating with the NHL for the 2026 Discover NHL Winter Classic from December to January, starting this week at Art Week Miami. From giveaways to Pengu meeting NHL fans and more, these activations will bring Pengu into the world of the NHL. pic.twitter.com/rcnIAT6fet

— Pudgy Penguins (@pudgypenguins) December 2, 2025

The partnership spans December through January, beginning with activations at Art Week Miami. The campaign, supported by an animated video of cartoon penguins skating across an ice rink, reflects the brand’s broader push into mainstream entertainment.

Once known primarily as an NFT collection, Pudgy Penguins has expanded into toys, physical events, and global licensing, now aiming to “own winter” through sports tie-ins.

The partnership reignited enthusiasm in the token. DEX trading volume for PENGU reached its monthly high in early December, as noted by Solscan. This surge reflected increased activity from traders responding to the partnership news.

Bullish sentiment received further support from whale accumulation. In late November, large investors acquired about $273,000 in PENGU, buying at nearly three times their average volume. Smart money inflows tracked $1.3 million from new addresses in early November.

At the same time, Bitso Exchange, the leading Latin American crypto exchange, announced a Q1 2026 launch of a perpetuals aggregator, featuring PENGU as a primary asset. This move targets the region’s $1.37 trillion remittance market.

$PENGU is there still hope ? after experiencing a pump of +35% blueprint of pengu with a potential increase of +359% to ATH$PENGU is the official community token of Pudgy Penguins, a web3 entertainment brand based on 8,888 unique NFTs launched on Ethereum in 2021 Acquired by… pic.twitter.com/kBIb0JPgtH

— Vespamatic.hl (@vespamatic96) December 3, 2025

However, with hype building around Pudgy Penguins’ new NHL partnership, traders now face a sharp contrast between bullish momentum and uneasy sell-pressure signals.

On-Chain Analysis: Selling Pressure Persists

Although price action turned positive, blockchain data identified ongoing token transfers. The PENGU deployment address has routinely moved about $3 million in tokens to centralized exchanges every few days.

On-chain analyst EmberCN reported that these transfers have continued, with the latest seen in early December.

“The most recent transfer was in the early hours of this morning,” they wrote.

Since mid-July, the address moved 3.881 billion PENGU tokens, worth $108 million, to centralized exchanges. This activity tracked directly with the decline in PENGU’s price, which fell from its $0.04 second peak to roughly $0.01.

Regular outflows from the project’s core wallet suggest ongoing selling or strategic distribution, challenging recent price gains.

PENGU price decline correlates with on-chain transfers to exchanges / EmberCN

PENGU price decline correlates with on-chain transfers to exchanges / EmberCN

Such token movements often prepare for sales or liquidity. In the PENGU ecosystem, however, the scale and sustained pace suggests ongoing distribution rather than routine liquidity management.

This dynamic creates tension between positive news, such as the NHL partnership, and continued selling from unlocked team or ecosystem tokens.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Clean Energy Market Dynamics and Investment Prospects: The Role of CFTC-Approved Platforms in Facilitating Institutional Participation

- CFTC-approved platforms like CleanTrade are transforming clean energy markets by standardizing derivatives and centralizing trading infrastructure, boosting institutional liquidity and transparency. - CleanTrade’s SEF designation in September 2025 enabled $16B in notional trades within two months, converting illiquid assets like RECs into tradable commodities with ESG-aligned risk management tools. - Institutional demand surged as 70% of large asset owners integrated climate goals, with IRA-driven clean

The Growing Significance of Financial Well-Being in Planning for Lasting Wealth

- Financial wellness is redefining long-term wealth planning by integrating personal well-being with financial outcomes. - Intentional habits and AI-driven tools boost resilience, reducing behavioral underperformance by 2.5% annually. - Debt management via sustainable finance mitigates risks, especially in developing economies with robust policies. - Early financial education and four-quadrant frameworks balance objective metrics with subjective well-being. - Technology and financial therapy bridge gaps, e

The Rise of Liquid Clean Energy Markets and Their Impact on Investment Opportunities

- Global energy transition accelerates liquid clean energy markets, reshaping institutional investment strategies with ESG-aligned assets. - U.S. DOE and private firms advance infrastructure, including fusion and hydrogen projects, addressing scalability and reliability. - RESurety’s CFTC-approved CleanTrade platform boosts transparency and liquidity in clean energy derivatives, enabling $16B in trading. - Institutional investors diversify portfolios with clean energy derivatives, leveraging ESG compliance

Anthropology-Inspired Advancements in Higher Education: The Impact of Cross-Disciplinary Research on Student Success and Institutional Worth

- Farmingdale State College integrates anthropology with STEM/edtech to cultivate critical thinking and cross-disciplinary skills, aligning with evolving workforce demands. - Its Anthropology Minor (15 credits) and STS program emphasize cultural context, societal implications of technology, and data-driven problem-solving for STEM-aligned careers. - Partnerships like the $1.75M Estée Lauder collaboration and $75M Computer Sciences Center demonstrate how interdisciplinary approaches attract investment and a