Polymarket Trader Makes $1 Million on Google Search Bets, Sparking Insider Trading Fears

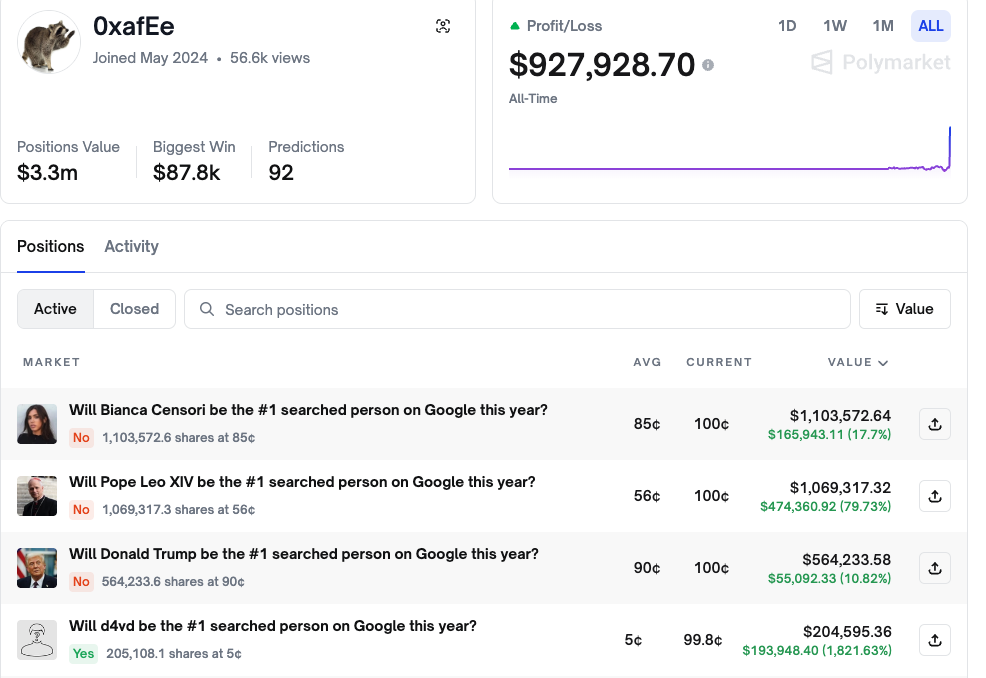

A Polymarket trader has earned nearly $1 million by placing suspiciously accurate bets on Google’s 2025 Year in Search rankings, sparking heated debate about insider trading on prediction markets. The wallet address “0xafEe” (previously “AlphaRaccoon”) netted nearly $1 million by correctly predicting nearly every outcome in Google search trend markets. Why Community is Suspicious of

A Polymarket trader has earned nearly $1 million by placing suspiciously accurate bets on Google’s 2025 Year in Search rankings, sparking heated debate about insider trading on prediction markets.

The wallet address “0xafEe” (previously “AlphaRaccoon”) netted nearly $1 million by correctly predicting nearly every outcome in Google search trend markets.

Why Community is Suspicious of AlphaRaccoon

The trader bought “Yes” shares on d4vd, a 20-year-old singer given just a 0.2% chance of being the most searched person of 2025, turning a $10,647 wager into nearly $200,000. The real money came from betting “No” on favorites like Pope Leo XIV, Bianca Censori, and Donald Trump.

According to Meta engineer Jeong Haeju, who exposed the situation on X, the trader achieved a 22-for-23 success rate on Google search predictions. Public blockchain data shows the wallet deposited $3 million into Polymarket last Friday and immediately began placing large bets. The same account previously won over $150,000 by correctly predicting the exact Gemini 3.0 Flash release date.

“This isn’t a lucky streak. He previously made $150K+ predicting the early release of Gemini 3.0 before results were out. At this point it’s obvious: He’s a Google insider milking Polymarket for quick money,” Haeju said.

However, there’s no confirmation that the trader is actually a Google insider. The allegations remain community speculation based on the unusual winning streak.

Insider Trading: Feature or Bug?

The incident has divided the crypto community. Some argue that prediction markets are designed specifically for insider trading, creating financial incentives to share privileged information with the market.

“The reason for prediction markets to exist is insider trading. In stocks it’s prohibited, with predictions it’s endorsed. It’s designed to be like this,” X user WiiMee said

The controversy arises as Polymarket officially relaunched in the United States this week after receiving CFTC approval. The platform announced Wednesday that its iOS app is now rolling out to waitlisted users, starting with sports markets.

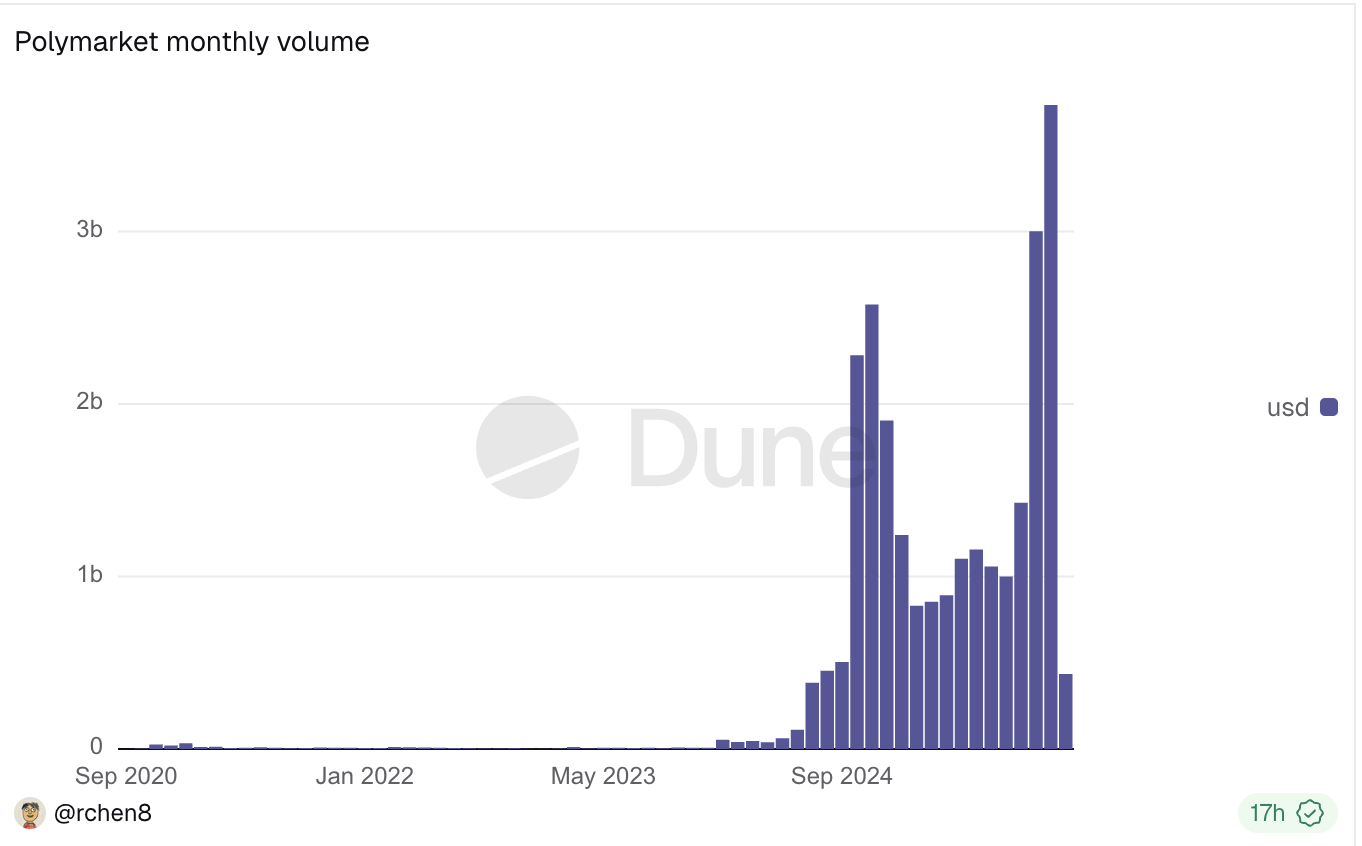

Polymarket processed over $3.7 billion in trading volume in November 2025. The platform received a massive boost when Intercontinental Exchange (ICE), parent company of the NYSE, invested up to $2 billion in October, valuing Polymarket at approximately $9 billion. Recent reports suggest the company is now seeking additional funding at a $12 billion valuation.

Polymarket Monthly Volume. Source:

Dune

Polymarket Monthly Volume. Source:

Dune

Chief Marketing Officer Matthew Modabber confirmed the platform will launch its native POLY token along with an airdrop for users, though not immediately.

“We could have launched a token whenever we wanted, but we want it to be with true utility, longevity, and to be around forever,” Modabber said.

The token launch is expected to occur in 2026, following the stabilization of the US platform.

For Polymarket, which faced scrutiny over alleged manipulation during the 2024 presidential election, how it handles insider information could define its regulatory future. The Google search markets saga serves as a test case for whether prediction markets are efficient information aggregators or insider profit machines.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Federal Reserve's Change in Policy and Its Unexpected Effect on Solana's Rise

- Federal Reserve's 2025 rate cut and QT end injected $72.35B liquidity, briefly boosting Solana by 3.01%. - October 2025's $19B liquidation and government shutdown exposed crypto liquidity fragility, eroding investor confidence. - Solana's 6.1% price drop and 4.7% TVL decline in November 2025 highlighted macroeconomic policy's volatile impact on crypto markets. - Upcoming December FOMC meeting (87% rate cut chance) could reignite risk appetite or trigger corrections, mirroring October's 20% price drop. -

Solana’s Latest Price Fluctuations and Institutional Involvement: Insights for Long-Term Investors

- Solana (SOL) faced 2025 price swings from $155 to $294, driven by macroeconomic pressures, on-chain weakness, and institutional adoption dynamics. - Institutional ETFs like Bitwise's BSOL attracted $2B AUM by mid-2025, with major holders staking SOL to deepen ecosystem integration despite short-term volatility. - Risks include network centralization, competition from Ethereum 2.0, and reliability concerns after the 2024 cluster outage amid Fed rate uncertainty. - Ecosystem resilience with 500+ dApps and

Timeless Strategies for Investing Amid Market Volatility

- In 2025, R.W. McNeel's 1927 value investing principles and Warren Buffett's strategies remain critical amid market volatility driven by tech disruption and geopolitical risks. - Both emphasize intrinsic value, emotional discipline, and long-term thinking to counter crypto and stock market swings fueled by speculation and social media hype. - Buffett's $340B cash reserves and focus on undervalued sectors like healthcare contrast with crypto's intangible promises, reinforcing tangible asset preferences. -

Saylor Strikes Again: Strategy Makes Its Biggest BTC Buy Since July