Bitcoin drops below $89K, wiping over $100B from the crypto market

Key Takeaways

- Bitcoin fell below $89,000, causing over $100 billion to be wiped from the crypto market.

- US PCE inflation data largely matched expectations and indicated stable underlying inflation pressures.

Over $100 billion was wiped from the crypto market in the past 24 hours as Bitcoin slipped below $89,000.

According to CoinGecko data , the total market capitalization decreased from approximately $3.2 trillion to $3.1 trillion over the same period. Bitcoin was trading near $89,400 at the time of press, down about 3% on the day.

The pullback followed the release of the latest US Personal Consumption Expenditures (PCE) report, which largely matched expectations.

Headline PCE rose 2.8% year over year, slightly above last month’s 2.7%, while the monthly figure held steady at 0.3%.

Core PCE, the Federal Reserve’s preferred inflation gauge, increased 2.8% year over year, just below both forecasts and the prior reading. On a monthly basis, core PCE remained stable at 0.2%, indicating persistent but contained underlying inflation pressures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

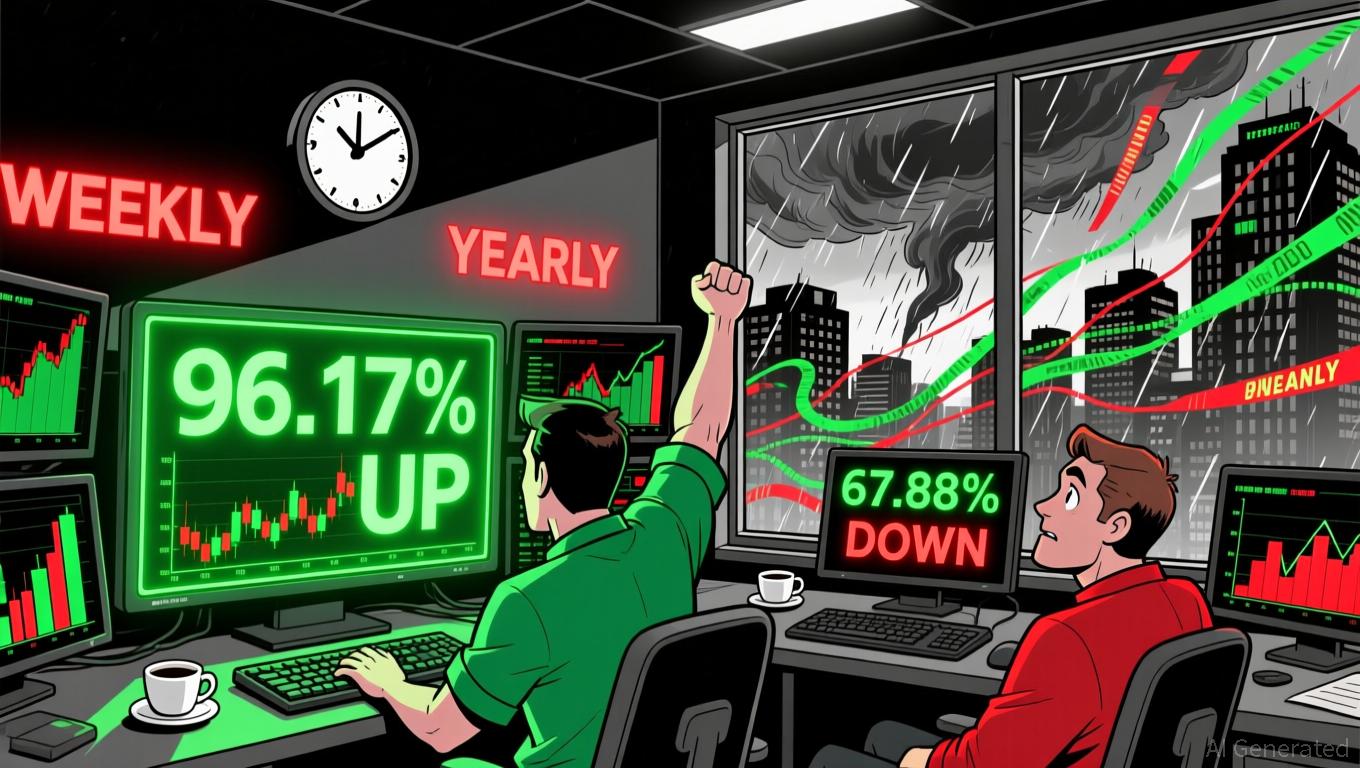

LUNA +96.17% 7D: Surge Attributed to Rumors of SBF Receiving a Pardon

- LUNA surged 96.17% in 7 days amid speculation about Sam Bankman-Fried's potential legal resolution. - The Terra 2.0 token (LUNA) trades at $0.1353, contrasting with LUNC's 70.3% 24-hour gain and $342M market cap. - Market optimism remains cautious as LUNA still faces a 67.88% annual decline and regulatory uncertainties. - SBF's legal developments could influence broader crypto sentiment, though Terra's recovery depends on technical performance.

Bitcoin’s Steep Drop: Uncovering the Triggers and What It Means for Investors

- Bitcoin's 2025 year-end 20% plunge highlights systemic risks and psychological volatility in crypto markets. - Trump's 100% China rare earth tariffs and Fed's 75-basis-point rate hike triggered initial 38% price collapse. - China's crypto ban erased 5% of Bitcoin's value, amplifying global regulatory risks for digital assets. - Algorithmic trading accelerated selloffs by detecting bearish signals faster than human traders could respond. - Investors must prioritize diversification and adapt strategies to

Bitcoin’s Latest Price Swings: Causes, Impacts, and Tactical Prospects

- Bitcoin's 2023-2025 volatility stemmed from macroeconomic uncertainty, delayed Fed rate cuts, and AI-driven credit strains, with prices swinging from $109,000 to $70,000 amid Bybit's security breach. - Regulatory shifts like U.S. Strategic Bitcoin Reserve and custody rules, plus offshore stablecoin risks, exacerbated systemic fragility as crypto financialized through ETFs and derivatives. - Growing equity correlations (e.g., Nasdaq 100) and institutional adoption (MicroStrategy, ETF inflows) highlight Bi

Dogecoin Could Reboot Soon: Rising Wallets Signal Accumulation Around Key Zones