Will Solana’s Price Trajectory Be Defined By Losses?

Solana is in a critical phase as its recent decline continues to validate a channel pattern that has shaped its price action over the past week. The downward movement highlights growing uncertainty, with investors now playing a key role in determining whether SOL continues slipping or finds support for a reversal. Solana Investors Remain Bearish

Solana is in a critical phase as its recent decline continues to validate a channel pattern that has shaped its price action over the past week.

The downward movement highlights growing uncertainty, with investors now playing a key role in determining whether SOL continues slipping or finds support for a reversal.

Solana Investors Remain Bearish

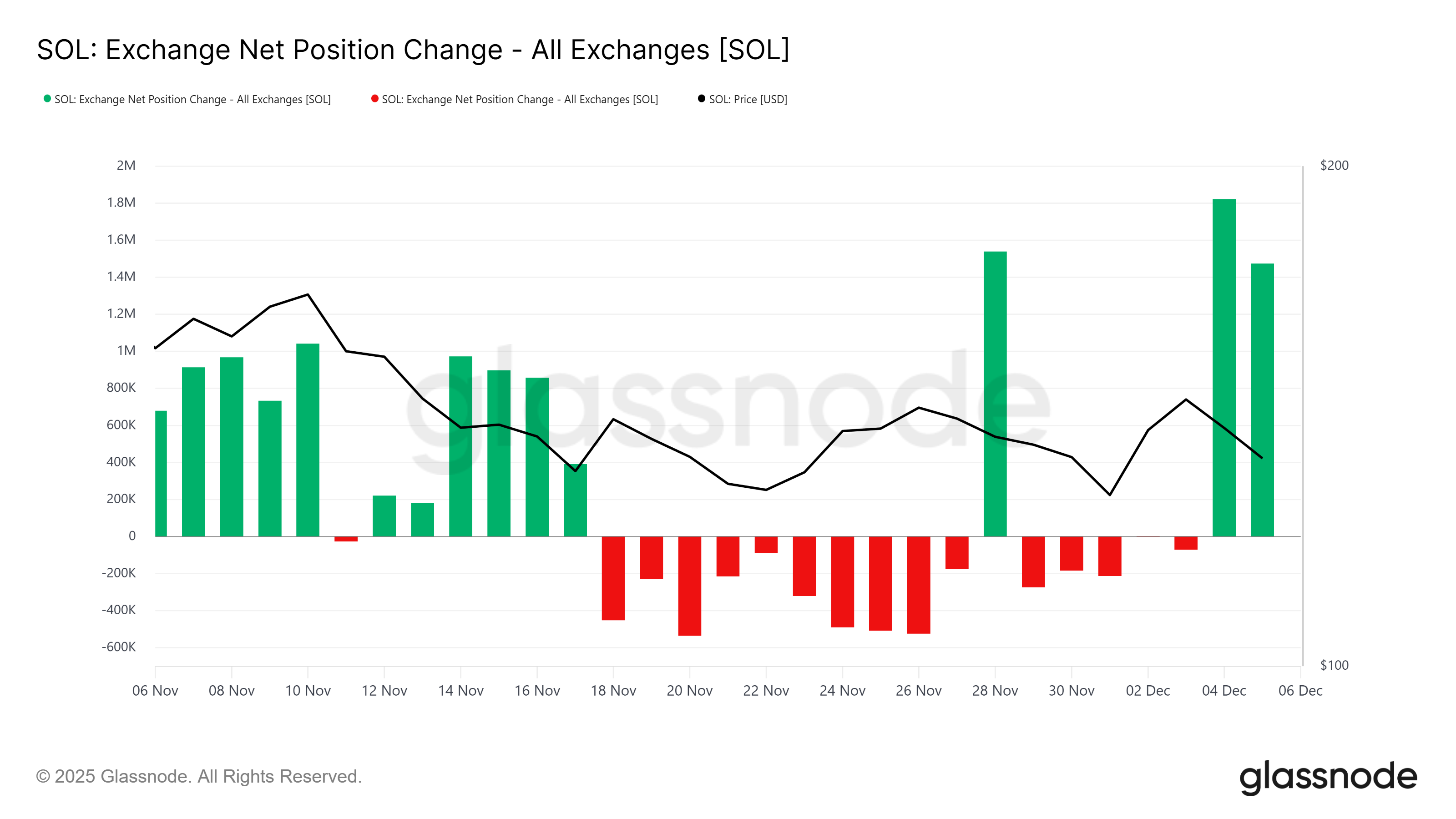

The exchange net position change reflects conflicting signals from Solana holders. Throughout the past week, SOL wallets have oscillated between accumulation and distribution, creating an unstable backdrop.

Notably, the last 48 hours recorded a dominance of green bars, indicating heavier outflows from exchanges.

Such inconsistent behavior points to uncertainty among holders rather than strong conviction. The repeated switches between buying and selling reflect a market struggling to find direction.

With selling currently outweighing accumulation, Solana’s short-term outlook remains vulnerable.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Solana Exchange Net Position. Source:

Glassnode

Solana Exchange Net Position. Source:

Glassnode

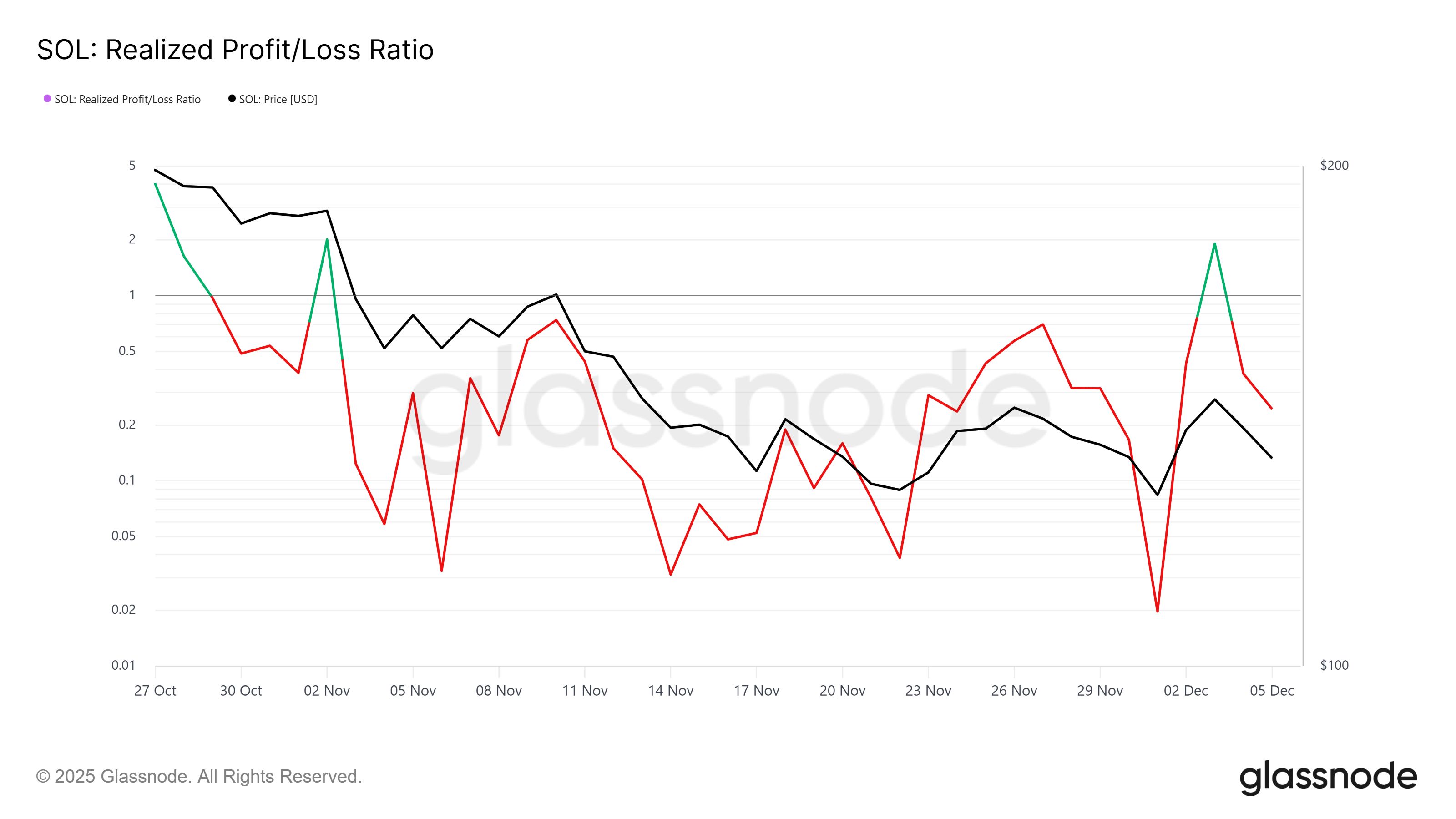

The Realized Profit/Loss Ratio further reinforces this bearish sentiment. The indicator shows that losses are dominating Solana as holders increasingly sell at lower prices to avoid deeper drawdowns. Panic-driven exits, even on a smaller scale, point to fading confidence.

When losses dominate, price tends to face additional downward pressure unless broader sentiment shifts. At present, the macro environment suggests investors are bracing for potential declines rather than preparing for accumulation.

Solana Realized Profit/Loss. Source:

Glassnode

Solana Realized Profit/Loss. Source:

Glassnode

SOL Price Needs To Find Direction

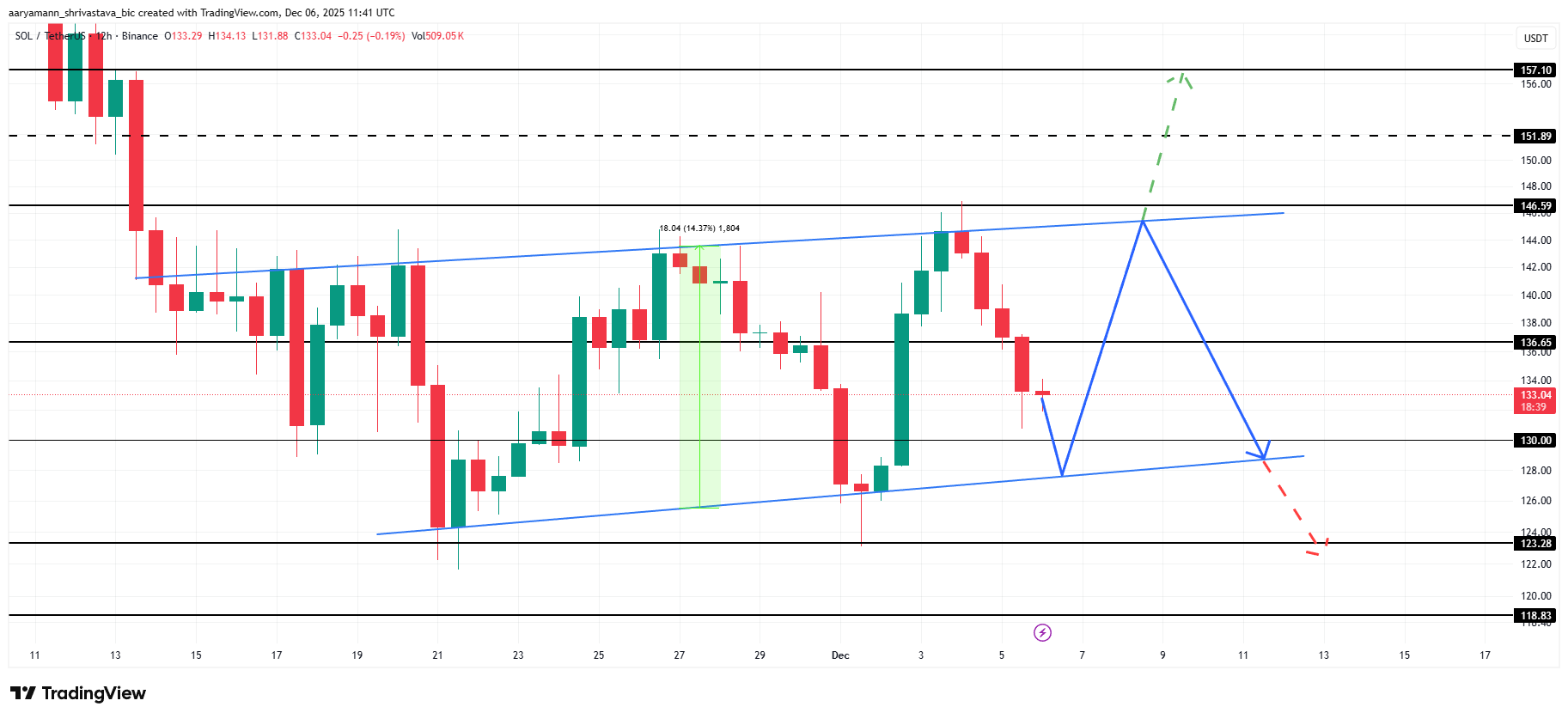

Solana’s price continues to trend within a descending channel after failing to break past the $146 resistance earlier this week. This structure leaves two potential paths depending on upcoming market cues and investor behavior.

If the channel remains intact and bearish sentiment persists, SOL risks falling below the lower trend line. Such a breakdown could drag the price toward $123 or even $118 if selling pressure continues to build.

Solana Price Analysis. Source:

TradingView

Solana Price Analysis. Source:

TradingView

Alternatively, a successful bounce off the channel support could spark a recovery attempt. If SOL regains strength and challenges the $146 resistance once more, a breakout could push the price toward $151 and eventually $157.

However, this outcome requires a renewed shift to bullish market conditions to invalidate the current bearish thesis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Surges in November 2025: Is This the Dawn of Widespread Institutional Investment?

- Bitcoin's 32% November 2025 drawdown occurred amid $732B in institutional inflows and record ETF adoption. - SEC-approved spot ETFs and the GENIUS Act provided regulatory clarity, boosting institutional confidence in crypto. - On-chain data showed institutional accumulation via P2WPKH addresses despite retail outflows and CDD spikes. - Macroeconomic factors like inflation and rate adjustments shaped Bitcoin's role as a hedge, with analysts viewing the correction as a mid-cycle reset. - Institutional allo

The Transformation of Education Through AI: Key Investment Prospects in EdTech and STEM Education

- AI in education market to surge from $7.05B in 2025 to $112.3B by 2034 at 36.02% CAGR, per Precedence Research. - Asia-Pacific leads growth at 46.12% CAGR; corporate e-learning to hit $44.6B by 2028 with 57% efficiency boost. - AI edtech startups raised $89.4B in Q3 2025 (34% of VC), with infrastructure investments at 51% of global deal value. - STEM institutions partner with tech giants to build AI talent pipelines, supported by $1B Google and $140M NSF investments. - Market risks include 66.4% revenue

ChainOpera AI Token Plummets 70%: A Stark Warning for AI-Based Cryptocurrencies

- ChainOpera AI (COAI) collapsed 99% in late 2025 due to hyper-centralization, governance failures, and technical vulnerabilities. - 88% token control by ten wallets, $116.8M losses at C3.ai, and minimal code updates exposed systemic risks in AI-driven crypto projects. - Regulatory uncertainty from U.S. CLARITY/GENIUS Acts and algorithmic stablecoin collapses accelerated panic, highlighting market fragility. - The crash underscores urgent need for frameworks like NIST AI RMF and EU AI Act to balance innova

The Increasing Expenses of Law School and the Expansion of Public Interest Scholarship Initiatives

- US law school tuition rose to $49,297/year by 2025, with debt averaging $140,870, driven by declining state funding and inflation. - The 2025 OBBB Act capped student loans at $50,000/year and $200,000 total, prompting schools like Santa Clara to adopt tuition moderation and scholarships. - Public interest scholarships (e.g., Berkeley, Stanford) and LRAPs now enable 85%+ retention in public service roles, reducing debt's influence on career choices. - PSLF has forgiven $4.2B for 6,100 lawyers since 2025,